Conventional Loan Rates With Low Credit

With a conventional loan unlike with an FHA loan your mortgage rate is directly tied to your credit score.

Thats because conventional loans use loanlevel price adjustments .

LLPAs are riskbased fees that lenders charge to borrowers with lower credit and/or smaller down payments. Instead of being paid upfront, LLPAs are typically paid via higher interest rates.

For example, say 30year conventional rates are 3.00%.

- A borrower has 620 credit and a 5% down payment

- Their LLPA fee is 3.25% of the loan amount

- Thats equal to $9,750 on a $300,000 loan

- Instead of paying $9,750 out of pocket, most borrowers will cover the fee with a higher rate

- A 3.25% fee would likely raise rates by about 0.5% to 0.75%

- So instead of the 3.0% base rate, your mortgage rate could be as high as 3.75%

These fees are the reason many borrowers with lower credit even those who might qualify for a conventional loan opt for FHA loans instead.

However, there are benefits to conventional mortgages for those with credit of 620 or higher. A big one is the ability to remove mortgage insurance without refinancing.

Thus, a conventional loan might be cheaper in the long run if you plan to stay in the house for many years.

The right choice will vary by person, so its important to compare all your loan options before buying.

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not go over your credit cards or bank accounts limit.

Have Your Rent Payments Reported To The Credit Bureaus

If you dont own a home, but want to demonstrate your ability to make timely payments each month, ask your landlord to report your rent payment history to the three credit bureaus . 620 Credit Score

This may involve an extra fee, but it can have a significant effect on your score. A positive history of making consistent, on-time payments such as rent makes up more than 30 percent of your credit score.

You May Like: How Long Do Closed Account Stay On Credit

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

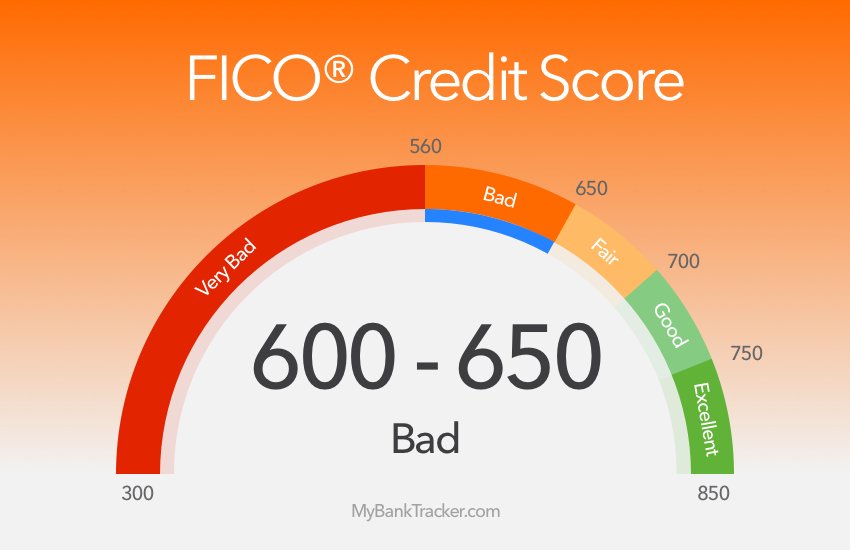

If You Have A 600 Credit Score And Want To Know Where You Stand Heres What You Need To Know

A 600 credit score is considered a fair score. For a FICO score, that tends to be on the lower side. What does that mean for you? Well, lenders may see this as something not great and might disapprove of a loan you applied for. Should you be approved, youll likely be charged more interest for it.

Read Also: 671 Credit Score Good

How Can I Improve My Credit Score

The first thing you should do when trying to improve your credit score is to take a look at your credit report. Annualcreditreport.com is a government-run website that allows all Americans one free annual copy of their credit report from each of the three bureaus: Experian, Equifax, and TransUnion.

Many people with bad or fair credit scores will find things on their credit report that arent supposed to be there. Credit bureaus sometimes make mistakes, and so do those who are reporting to the credit bureaus. Its up to you to keep an eye on your own credit report and make sure that everything is proper.

If you find something on your credit report that seems suspicious, there are things you can do.

If you see something on your credit report that looks like someone took out a loan in your name, or might be some sort of error, report it to the credit bureau. You can file a dispute with the credit bureau that issued the report.

Check to see if something is clearly in error. You may see a loan that looks like its in your name, but it could be connected to someone with the same name. If you see any entry that you dont recognize, then you should file a dispute.

Contact the pros. There are services that will help you navigate the dispute process and put you on the right track to improved credit. The Credit Pros specializes in credit repair for anyone who needs it, regardless of their situation.

Can I Get A Loan With A Bad Credit Score

Personal loans for bad credit are available to those with bad credit scores and people without a credit history may even qualify. In some cases, you may be required to provide a security deposit or have a co-signer guarantee your loan. In general, you will pay a higher interest rate compared to a regular personal loan.

Also Check: Suncoast Credit Union Truecar

Improve Your Credit Utilization Rate

Your credit utilization rate is a metric that represents how much of your available credit you use, calculated as a percentage. Ideally, the utilization rate should be about 30 percent of your available credit at any given time.

In order to lower your credit utilization rate, a three-prong approach is most effective. First, pay down your balances on as many open accounts as possible. This lowers the amount of credit that you have in use. Second, apply for an increase in your credit limit. This results in a ratio of used credit versus available credit that leans more strongly in your favor. Third, keep unused credit card accounts open instead of closing them, which cuts off a line of credit with an available limit and weakens your credit utilization rate. Experian: How to Improve Your Credit Score

How A Bad Credit Score Can Hurt You

Denials for credit

A bad credit score can reduce your approval chances for credit cards and loans, making it difficult to accomplish many goals. If you want to get out of debt with a balance transfer card, such as the Discover it® Balance Transfer, you’ll need good or excellent credit. And if you want to earn rewards or receive luxury travel perks, it’ll be near impossible to find a card that accepts bad credit.

Less favorable loan terms

If you’re approved for credit, odds are you’ll receive less favorable terms, such as high interest rates or annual fees, compared to applicants with good credit. For example, one of CNBC Select’s best credit cards for bad credit, the OpenSky® Secured Visa® Credit Card, has a $35 annual fee though there are no annual fee options.

Limited credit card choices

Bad credit limits which credit cards you can qualify for the options you have will be primarily secured cards. While a secured card, such as the Discover it® Secured Credit Card or the Capital One® Secured Mastercard®, can help you rebuild credit, you’re required to make a security deposit typically $200 in order to receive an equivalent line of credit.

Take note that even if your credit score falls within the bad range, that is not a guarantee you’ll be approved for a credit card requiring bad credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Read Also: What Bank Is Syncb Ppc

How Can I Improve My Bad Credit Score

What Does It Mean To Have A 600 Credit Score

According to TransUnion, one of Canadas two credit bureaus, the average Canadian credit score is 660. So if one of your credit scores is 600, its safe to say that your score is below average.

While your credit score is only one of the factors used by lenders and creditors to determine your creditworthiness, a low score can influence your ability to access housing, utilities, vehicles, and other services.

You May Like: Will Paypal Credit Affect Credit Score

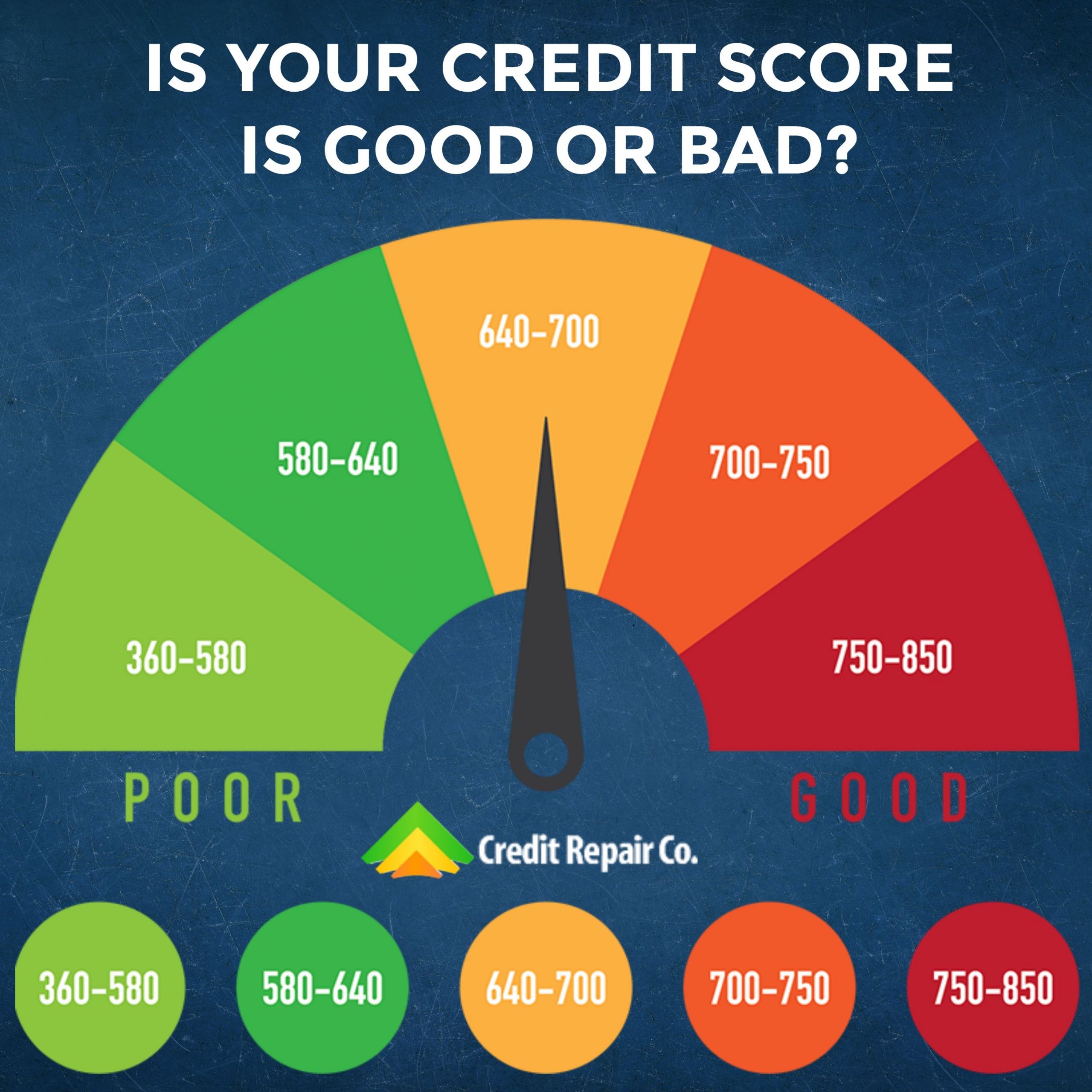

Is A 620 Credit Score Good Or Bad

Waiting for a loan approval can be a roller coaster of an experience. People take out loans for many different reasons, and often are prompted by significant purchases like buying a car or purchasing a first home. Unfortunately, many borrowers begin the loan application process without all of the information they should have.

Most people know how much debt they have — or how much money they have in the bank. But what they dont know is the impact their financial behavior has on their credit score, which will likely determine whether a loan application gets approved or denied.

What happens if your score is 620right at the center of the Fair range of FICO scores? Is it good or bad? That depends on what youre applying for.

In general, its crucial to understand where you stand with regard to your credit score, and which financial products it qualifies you for. Knowing how lenders interpret your score helps you gain more control over your financial life. Thats what this report focuses on.

| FICO Score Range | Percentage of Americans in that range |

|---|---|

| FICO Score Range800-850 | Percentage of Amerians in that range21% |

| FICO Score Range740-799 | Percentage of Amerians in that range25% |

| FICO Score Range670-739 | Percentage of Amerians in that range21% |

| FICO Score Range580-669 | Percentage of Amerians in that range17% |

| FICO Score Range300-579 | Percentage of Amerians in that range16% |

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

You May Like: Carmax Income Requirements

How Bad Is A Credit Score Of 550

scorescores550 FICOScore

. Also, can you get a personal loan with a credit score of 550?

It’s very difficult to get an unsecured personal loan with a credit score under 550 on your own, without the help of a co-signer whose is higher. Even the loans with the most lenient approval standards require a of 585.

Additionally, what can I get with a 550 credit score? 550 Credit Score Loan & Credit Card Options

| 2.5% |

Herein, how bad is a credit score of 500?

A 500 credit score falls into the bad range. You’ll have trouble qualifying for and pay more interest, but you can recover. A 500 credit score is considered bad credit. Your determines whether you qualify for financial products, like cards and car loans, and what interest rate you might pay.

How bad is a 515 credit score?

A 515 credit score is considered Very Poor. It means you’ve had past payment problems, including collection accounts, judgments, bankruptcy or worse. With a Very Poorscore, it’s harder to obtain cards, loans, and favorable interest rates.

Dont Let Your Credit Card Balances Balloon

If youve fallen into credit card debt, you may already know that carrying a high balance can result in hefty interest charges. But what you might not have realized is that a high credit card balance can also hurt your credit by increasing your credit utilization rate.

Your credit utilization rate is the percentage of your available credit that youre using at any one time. The standard advice is to keep that percentage below 30% if at all possible, but using even less than 30% of your available credit is preferable.

This can be easier said than done. But every little bit helps. Even if you cant afford to pay off your whole account balance right away, try to chip away at it until its at or near 30% of your total credit limit.

Don’t Miss: Realpage Credit Inquiry

What Credit Score Do Most Landlords Want

According to Fluegge, there are several factors that determine whether a landlord is a good or bad landlord, but most investors and property managers look for a credit score exceeding 600. Scores on FICO and VantageScore typically run between 300 and 850 for a credit score. In a way, people with higher credit scores are viewed as living a responsible lifestyle.

What Is A Bad Credit Score

Credit score ranges vary based on the credit scoring model used and the credit bureau that pulls the score. Below, you can check which credit score range you fall into, using estimates from Experian. Take note that the lenders use varies, though 90% pull your FICO score.

FICO Score

- Excellent: 781 to 850

Read Also: Can I Buy Appliances With Affirm

Scrutinize Your Credit Report

When people receive their credit reports, they sometimes dont look any further than the credit score under their name. This can be a big mistake, especially if you are working to improve your credit score. Although it may seem tedious, we recommend that you go item by item because each line that appears on your credit report does contribute to the credit score you get. If you see anything you dont actually remember doing, say someone made a hard inquiry for a credit card application you didnt really apply for yourself this is something you can dispute. Thats already at least 5 negative points in there you can strike off your record to increase your score.

Its also a little disturbing to know, but errors in credit reports are actually just getting more frequent. You dont want to be that person who finds a so-and-so from Ohio making late payments appearing in your file!

Why Can A 600 Credit Score Be A Barrier

Both the FICO® Score and the VantageScore range from 300 to 850. In both cases, a higher number indicates better credit. Most lenders consider any score over about 660 or 670 to be “good.”

There is no universal ranking for high and low credit scores. Those tiers are determined by each lender. That said, by most measures, a 600 credit score is low and tends to have financial consequences.

When you have low credit, you’re considered a higher risk by lenders. They generally won’t have confidence that you will repay your debts on time and as agreed. As a result, your application for some credit products will be rejected. Many mortgage lenders, for instance, require a 640 or higher.

Other products will be available to you, but at a higher price tag. When you have a 600 credit score, you’ll likely pay a higher interest rate on a car loan than the rate someone with a 700 credit score will pay.

Don’t Miss: Affirm Credit Score Required

Why Your Credit Score Matters

Your credit score is an important part of your personal finances. Having a good score means you can get new credit or loans at a lower interest rate. This means theyâll cost you less over the long run. It also makes you more likely to qualify for new credit cards or loans. If your credit score is low, you may still qualify for credit cards, but your interest rates will be higher. Some lenders may deny a credit card application or you may have to look into getting a secured credit card.

Your credit also affects your insurance rates. Poor credit leads to higher interest rates, while good credit gets you lower rates. Even utility bills, such as cell phone bills or energy costs, may be higher if your credit score is very low.

You Have A Lot Of Credit Scores And They May Not Match Each Other

Its important to understand that every consumer has many credit scores. So bad is really a relative term depending on how the score is calculated and the type of financing that youre applying for.

For example, the credit score that your credit card issuer provides with your credit card statement may be slightly different from the score you receive from a credit-monitoring tool like Credit Karma.

So why arent all your credit scores identical? Here are three common variables that can affect the credit scores you see.

Don’t Miss: Does Affirm Report To The Credit Bureau

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.