Can Credit Repair Companies Remove Late Payments

Consumer credit reports contain a wealth of information about how you’ve managed your relationships with lenders and other service providers. If you’ve always paid your bills on time, you probably have no late payments on your credit reportsand your credit scores will likely reflect that responsible credit behavior.

A record of late payments, however, can have a serious negative effect on your credit. That’s why some consumers hire credit repair companies and pay them hefty fees to dispute their late payments in an attempt to have them removed. What you should know, however, is that accurate late payments cannot be removed from credit reports.

The good news? If you find inaccurate late payments on your credit reports, you can dispute those late payments on your own at no cost. Read on to find out how to dispute inaccurate late payments.

Pay For Delete Letter

If you donât have an established history of timely payments with a creditor, or if your account has already been transferred to a collection agency, a pay for delete letter may be an option. A pay for delete request is when you offer to pay a debt in exchange for the creditor removing the negative information from your credit report.

A pay for delete letter should identify the account and clearly express the terms of what you are offering in exchange for removing the item from your credit report. You can offer full or partial payment. You can also offer to enroll in automatic payments so you avoid late payments in the future.

Like goodwill letters, creditors are not obligated to respond to or comply with pay for delete requests. There are also several other reasons why a pay for delete letter should be used only as a last resort:

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Also Check: Free Credit Report Usaa

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

File A Complaint With The Cfpb

The CFPB, Consumer Financial Protection Bureau, accepts credit reporting complaints as of September 22nd, 2012. Now consumers have the chance to file complaints against bands and lenders about inaccurate credit reporting on a Federal level.

You can file a complaint against the creditor directly or against the credit bureaus here.

Read Also: How Long Can Eviction Stay On Your Credit

File A Credit Dispute

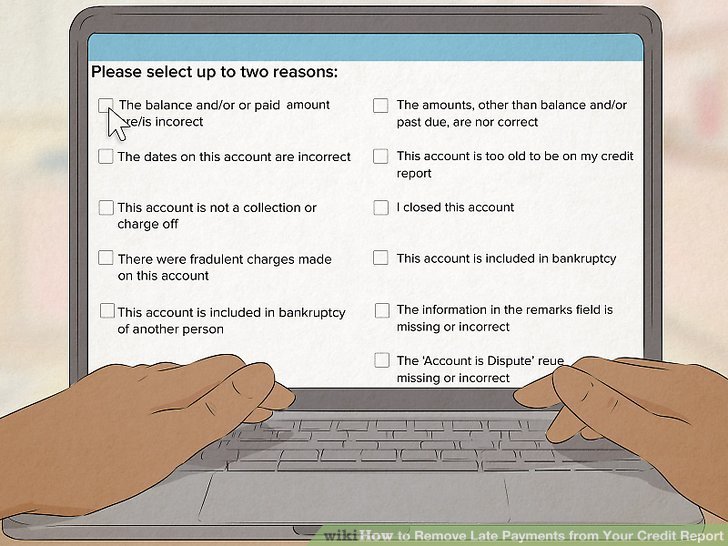

If you find any errors on your credit report, you can file a dispute with the credit bureau that generated the report. You can also dispute the mistake with the creditor.

You can start this process by sending a dispute letter to each credit bureau that reported the mistake. The dispute letter should clearly state the negative information youre disputing, include any documentation of the inaccurate information, and request that the item is corrected or removed.

After receiving your dispute letter, the creditor or credit bureau has 30-45 days after receiving your dispute to investigate the claim. You should be notified of the results after the creditor or credit bureau has finished their investigation.

If the creditor or credit bureau has proof that the information they are reporting is correct, it will stay on your credit report. However, if they agree that the information is incorrect, they must remove it from your credit report.

How Long Does A Goodwill Letter Take

A goodwill letter is an unofficial letter sent to thecreditor. As such, theres no timeline requirement or even an obligation on thecreditor to respond to the letter. How long the letter takes to generate aresponseor if any response is generatedvaries.

A goodwill letter is not an official . When someone finds an inaccurate item on their credit report, they can send a or verification letter to the credit bureau. This prompts the credit bureau to launch an investigation, which comes with specific timelines that must be followed by the credit bureau and any creditor that is asked to provide documentation for the negative item.

Also Check: Brandon Weaver Credit Repair Reviews

Contact Your Creditor For Assistance

If you believe a creditor incorrectly reported the late payment, you may want to start by submitting a dispute directly to them. Include any documentation you havesuch as copies of a canceled check or payment verification email.

If the creditor investigates and agrees that there was an error, it will send an update to all the credit bureaus it reports to and have the late payment corrected or deleted. You can monitor your credit reports for the changes, which may take several billing cycles to appear.

Do Goodwill Letters Work

Unfortunately, there are not any specific studies that show how often goodwill letters work only anecdotal evidence. Further, many banks state specifically that they will not act in your favor if you send a goodwill letter. Bank of America is one of them. Per the banks website, theyre required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments.

Instead, Bank of America notes that the best way to address negative credit history is to rebuild your credit by moving forward and establishing a solid history of on-time payments.

Be aware that goodwill letters are more likely to work for late payment removal not for more serious credit offenses. If youve been wondering how to get an account in collections removed from your credit report, for example, a goodwill letter is unlikely to help.

Regardless of your banks stance on goodwill letters , you cannot lose anything by asking for this type of assistance. The goal of a goodwill letter is to try to remove negative information from your credit reports, knowing fully well you may or may not achieve the results you want.

Also Check: How Do I Check My Credit Score Chase

When Are Late Payments Added To Your Credit Report

Usually, your creditor or lender will report a payment as late to the credit reporting bureaus after 30 or more days have passed since you missed the payment. If you make the payment within 30 days of missing it, the payment is unlikely going to be reported as late on your credit report. However, if more than 30 days pass since youve missed your payment, the payment will be added as late on your credit report.

If you continue to fail to make payments on your credit card, personal loan, car loan, or any other type of debt, first a 30-day late mark is added, then a 60-day late mark, and then a 90-day late mark, causing several late payment marks to be added to your credit report.

A single missed payment can lower your credit score by over 100 points. This is so because your payment history accounts for 35% of your credit score. Making your payments on time will improve your credit, and missing even a single payment can cause significant damage to your credit score. So, you should strive to make all of your credit card and loan payments on time to maintain the best credit score possible.

Dispute The Late Payment With The Creditor

Disputing a late payment with the bank or creditor directly is often the most effective. If the late payment is, in fact, an error. You can explain the situation to customer service to investigate. Usually, they will need some time to have a department look into the error and respond.

In most cases, if the error is on the creditors behalf, they will refund the late fee and have the late payment removed from your credit report. However, this is not always the case. If they refuse to remove the late payment, you can move on to the next step.

Don’t Miss: Repo On Credit Report

Ways To Remove Inaccurate Late Payments

Its not uncommon to find inaccurate information on your credit report. If you find do find a mistakenly reported late payment, youre entitled by the Fair Credit Reporting Act to request the credit bureaus to substantiate it, and if found to be an error, remove it. There are a few different ways to do this.

How To Remove Late Payments From Credit Report

As weve just outlined, late payments can have a big impact on your overall credit. Your score will likely drop as a result, and it will affect your ability to access credit in the future.

Therefore, its important to do everything in your power to remove late payments as quickly as possible. Lets get into how you can accomplish late payment removal.

You May Like: Speedy Cash Card Balance

You Paid The Bill On Time But It Was Reported As Late Anyway

If you see a late payment but you think you paid on time, it could be a mistake. In this case, try to verify that you did, in fact, pay the bill on time. You could do this by reviewing statements from the account you used to pay the bill and the account thats showing a late payment or by checking if you received a payment confirmation.

What Happens If I Miss Payments Because Of Coronavirus Anyway

If you aren’t able to work out an agreement with a creditor and you fall behind in payments on a debt, that creditor may report the delinquency to the credit reporting bureaus. As a concession, some creditors have said they’ll use a special code, one for natural disasters that adds a comment to the report, for delinquent debts during the pandemic.

This code might make a difference if a potential creditor actually reads the full report when making a lending decision. But any debt reported as delinquent still shows up as negative on reports and can hurt your FICO credit score. FICO doesn’t factor this kind of code in when calculating credit scores, although VantageScore will disregard late payments for accounts with a disaster code.

Some Servicers Are Reporting Mortgages in Forbearance as Current But Adding a Comment

Again, under the CARES Act, a loan in forbearance must be reported as current on credit reports, so long as the borrower wasn’t already delinquent on payments at the time of the agreement. But mortgage servicers are finding a way to let the credit reporting agencies know about a home-loan forbearance while still complying with this requirement: they’re reporting the debt as current and then adding a comment to the borrower’s credit reports as well. While a notation that a loan is in forbearance won’t hurt your , you might have a problem getting another mortgage or refinancing the loan later on.

Also Check: Remove Credit Inquiries In 24 Hours

Analyze Your Late Payments

In addition to keeping track of your daily charges and overall balance, you should analyze your credit history at least once a year. Each of the allows one free credit report copy every year. By requesting your free report from one of the credit bureaus every few months, you can ensure your credit is in good standing throughout the entire year without spending a penny.

When analyzing your report, any late payment you come across should be under seven years old. Although its rare, sometimes older delinquencies can remain on your report after their expiration period. If you do find an older late payment on your report, make sure to call the bureau and file a claim to get it removed.

Remove Inaccurate Late Payments W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today

Don’t Miss: Carmax With Bad Credit

Faqs On How To Remove Late Payment Records Of Credit Card From Credit Report

Yes, late payment records lower your credit score making it harder to get approvals for loans.

A late payment record will remain for seven years on your credit report from the date it was reported.

A late payment is reported if you fail to pay your outstanding balance within 30 days after the due date.

Your credit score can reduce by up to 100 points due to a late payment record.

If an incorrect late payment has been reported even if you made the payment on time, you will have to file a dispute with the credit bureau. The credit bureau, after investigation, will remove the late payment record if your dispute has been proved right.

Request A Removal On The Grounds Of Goodwill

Sometimes, you could have actually made a late payment. It happens.

Where this is the case, you can write a goodwill letter to your creditor politely requesting that they delete the derogatory information from your report. In this instance, youre asking the creditor to do you a favor, and youre not promising anything in return.

Keep in mind you have to be respectful and nice the creditor is under no obligation to grant your request. However, if you have a record of making timely payments, you stand a higher chance of your request being granted.

Writing a goodwill letter best helps when you have a solid excuse for the late payment. Examples of valid excuses are:

- A drop in finances temporarily affected your ability to pay

- You moved to a new location and the bill didnt get to your new location

- You thought you enabled automatic payments but you didnt

You May Like: How Long Does Carmax Pre Approval Take

Getting My Credit Back On Track

Several years ago, I went through some tough times financially. I became unemployed when my company went out of business. I simply wasnt able to pay my bills on time.

After I told a friend of mine about my issues, he suggested I check out Lexington Law. So, I called them for a free consultation at 800-220-0084. I spoke to a credit professional who told me they believed they could help me.

I decided to sign up and give it a shot. After all, if it didnt work, I could cancel at any time. Then, after only a few weeks, I started getting letters from credit reporting agencies saying negative accounts were being removed from my credit reports.

Since then, my credit score has been improving steadily, and I have been getting much better interest rates on credit cards and loans. So it turned out to be a great decision for me .

Will Creditors Delete My Late Payment History If I Submit A Goodwill Letter

Now that weve explored late payment disputes, lets talk about goodwill letters.

If youre familiar with the subject, you may know that goodwill letters used to work to some extent to remove late payments from your credit record. However, that was 10-15 years ago.

However, at this point in time, the bottom line isgoodwill letters do not work. In fact, many bank websites say so explicitly.

Whats more, submitting a goodwill letter may actually decrease the chances of removing a late payment from your record .

But the sad part is, every self-proclaimed credit expert still claims you will achieve forgiveness on a late payment with a goodwill letter.

Signs to lookout for

As a result, many folks end up wasting their time sending courtesy removal requests to creditors. Lots of other people have wasted money with ineffective credit repair companies, including the likes of and Lexington Law Firm, whove been known to prey on customers and have been sued by one of the governments regulating agencies.

Want more proof that goodwill letters are a waste of time? Check this out: Here is Bank of Americas own website stating that goodwill letters will not work. Bank of America says the following:

Were required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments.

Also Check: Does Hsn Report To Credit Bureaus