Signing Away Your Data

Before you can create an account on any of these apps, you have to agree to a terms of service agreement, which is lengthy and confusing. Theyre written in legalese that many consumers wont be able to understand, Fitzgerald says.

And by accepting those agreements, you grant the companies a lot of power. Buried in those agreements are broad statements giving the companies permission to collect your personal data not just from your use of the app but also from other sources.

The goal is to build a kind of digital dossier about you. Such digital profiles, Fitzgerald says, are not just filled with details about your credit history but also may include information about where you live, work, socialize, and shop.

For example, Credit Karmas policy allows it to gather information about you from local business reviews or social media posts, which implies it could engage in some form of data scraping or collection of business reviews and social media sites, Fitzgerald says.

The policy also states that it can receive your employment or income data, vehicle, or driver information from third parties.

MyFICOs agreement says it could dip into census data or real estate records when putting together its file on you.

TransUnions privacy policy takes it further. It might collect your family members names, and your home and billing addresses, email addresses, phone and Social Security numbers, birth date, employment information, and drivers license and passport numbers.

Comparing Nates Credit Scores On Credit Karma Vs Wells Fargo

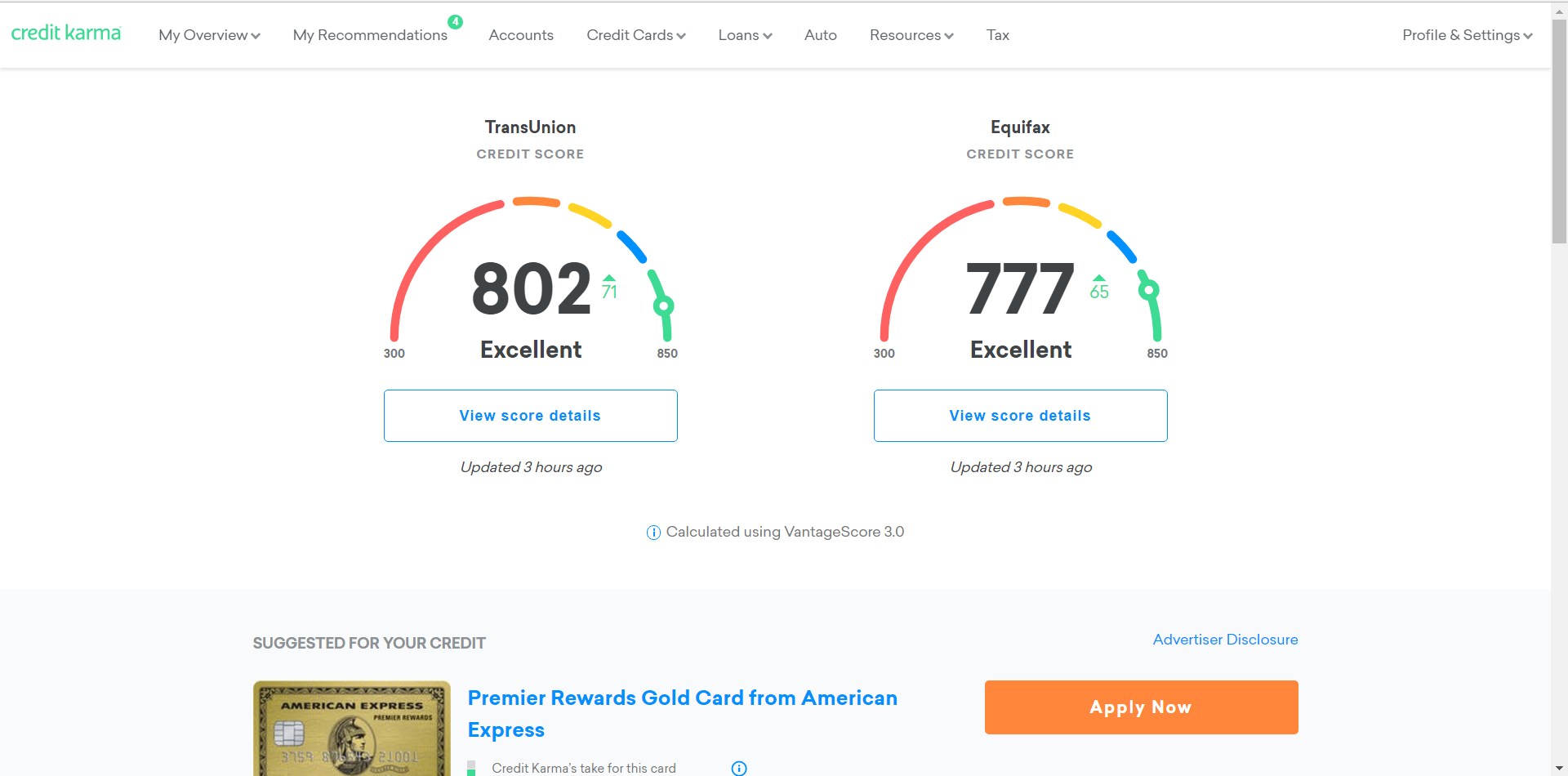

As an example, we experimented to see how accurate Credit Karmas scores were for our Co-founder, Nate Matherson. Here is a screenshot from Nates Credit Karma account:

Also on July 9th, 2019, Nate applied for a personal line of credit from Wells Fargo. Here is a screenshot from Nates Wells Fargo loan application:

As you can see in the examples above, Nates Experian FICO Score 9 was 25 points higher than his VantageScore from Transunion and 20 points higher than his VantageScore from Equifax.

In Nates case, Credit Karma was accurate enough to say that he had an excellent credit score, but wasnt perfect.

Interested in viewing your free credit score with Credit Karma?

- Receive alerts when changes to your reports occur

- View a breakdown of factors that are currently affecting your score

- Make better decisions with personalized recommendations

A Response To Criticism About Credit Karma Having An Accurate Credit Score

Its important to keep in mind that no one credit score is the end-all, be-all. There are dozens of different FICO® scoring models alone. Even if youre confident in a specific FICO® credit score, it may not necessarily match the scores a lender pulls when you apply for a loan.

At Credit Karma, we believe that because you can have so many different scores, the exact number you get at a given time isnt of foremost importance. Whats more important are the changes you observe over time in a single score and where that number puts you concerning other consumers.

The take-home message here is that when someone asks how accurate Credit Karma is, dont always believe the negative news you see on social media from those attacking the company like Twitter users.

The company uses VantageScore credit scores which are different than FICO credit scoring. They are just different scoring models which does not make them any less accurate.

The VantageScore model is a respected alternative. Just because they provide different credit scores doesnt mean the information isnt useful.

Don’t Miss: Freeannualcreditreport Com Official Site

Does Credit Karma Offer Free Fico Scores

You may have read reviews that say the credit scores you see on Credit Karma are useless because theyre not FICO® scores. Though Credit Karma does not currently offer FICO® scores, the scores you see on Credit Karma provide valuable insight into your financial health.

Its important to keep in mind that no one credit score is the end-all, be-all. There are dozens of different FICO® scoring models alone. Even if youre confident in a specific FICO® score, it may not necessarily match the scores a lender pulls when you apply for a loan.

At Credit Karma, we believe that because you can have so many different scores, the exact number you get at a given time isnt of foremost importance. Whats more important are the changes you observe over time in a single score, and where that number puts you in relation to other consumers.

Need More Credit Offerings

I LOVE Credit Karma! I only wish they had more diverse credit card option. As my credit score gets better, I keep getting offers from Capital One. I have two cards already and when I accepted an offer they recently sent me, I was declined based on having too many Capital One cards. I have no problems with my Capital One cards, the app makes it so easy to manage and pay my balances. The in app reviews seem to be spot on so make sure you take the time to read them before accepting offers. They seem to be partnered with a company that offers credit but the reviews are pretty much consumer beware Im glad to have Capital One in my wallet so if your looking for a go to card with awesome reviews on rebuilding your credit, they are a good place to start. I recently also started receiving auto financing offers from a company that basically sells their cars via a vending machine concept. The reviews are absolutely horrible and the cars are severely overpriced. It is my opinion that some partnerships are just not a good fit for Credit Karma. Someone with bad credit would have a better chance of getting a better deal at a lemon lot or car auction. Credit Karma has helped me set reachable credit goals. I just wish there were better in app credit offerings as ones scores improve.

Read Also: What Credit Score Is Needed For Carecredit

Who Is In Charge Of Credit Karma

Kenneth Lin, Ryan Marciano, and Nichole Mustard launched Credit Karma, an international firm, in 2007. Lin is now the companys CEO, Marciano is the chief technology officer, and Mustard is in charge of revenue.Intuit, the business behind TurboTax, completed the acquisition of Credit Karma for $8.1 billion in cash and equity in December 2020.Credit Karma claims to have over 100 million users globally.

How Many Points Is Credit Karma Off

Many people ask ‘how many points is credit karma off?’ and the answer varies for each individual case. Credit Karma receives information from two of the top three credit reporting agencies. This indicates that Credit Karma is likely off by the number of points as the lack of information they have from Experian, the third provider that does not report to Credit Karma. If you can figure out your Experian credit score you will be able to generate an accurate detailing of how many points Credit Karma is off as it relates to your actual score.

Read Also: Does Uplift Do A Hard Credit Check

Why Is Credit Karma Not Accurate

Asked by: Cordell Toy

The credit scores and credit reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. They should accurately reflect your credit information as reported by those bureaus but they may not match other reports and scores out there.

Whether You Use A Free Credit Service Or Not Contact A Local Lender As Soon As Possible

We are a bit bias on this point, but the best way to prepare to buy a home is to first talk with a local lender. Credit Karma is a great tool, but you need a local professional to guide you through the process. Besides having a bit of expertise in knowing what will improve your credit scores and history, we have contacts that can council you if needed or help you remove incorrect items from your report. The amount of money you will save in upfront cost and monthly interest with a great credit score will be worth the time and effort needed to get your scores up.

Is the credit score on Credit Karma accurate? No, but it can be a great tool for you and your local mortgage lender.

Then contact us to create a plan of action.

Read Also: Does Affirm Report To Credit

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

Is Experian Better Than Credit Karma

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Think of it this way Credit Karma is like a newspaper that writes about the credit scores other companies give you. But we have no influence over your scores.

Recommended Reading: When Do Late Payments Fall Off Credit Report

Fico Vs Vantagescore: Which Is Better

VantageScore and FICO are both software programs that calculate credit ratings based on consumers’ spending and payment history. FICO is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer credit agencies, Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most frequently used base model and which of its many versions is used.

The key point is that your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

How Accurate Is Your Credit Karma Score

Your Credit Karma score, which is generated using the VantageScore model and data from TransUnion and Equifax, is updated every week, so it should be accurate. Keep in mind, though, that your scores accuracy is affected by whether your credit report is correct. To make sure your credit report is current, you should check your credit report with Experian, TransUnion and Equifax at least once a year. You can do this for free at AnnualCreditReport.com. If you find anything inaccurate, you should file a dispute with the credit bureau.

Read Also: Itin Credit Report

Is Your Credit Karma Score Accurate

Investopedia reached out to Credit Karma to ask why consumers should trust Credit Karma to provide them with a score that is an accurate representation of their creditworthiness.

Bethy Hardeman, the former chief consumer advocate at Credit Karma, responded: The scores and credit report information on Credit Karma comes from TransUnion and Equifax, two of the three major credit bureaus.

“We provide VantageScore credit scores independently from both credit bureaus. Credit Karma chose VantageScore because its a collaboration among all three major credit bureaus and is a transparent scoring model, which can help consumers better understand changes to their credit score.

Work With The Right Mortgage Company

One of the most significant decisions when purchasing a home for the first time will be picking the right lender. Numerous homebuyers dont put in enough effort to choose the right mortgage company.

The mistake that is often made is just focusing on the interest rate offered and not the loans total cost.

Lenders can make a particular loan product look enticing by the advertised rate they are offering. Sometimes the cost, however, when compared to other loan programs, is not the best.

At the initial stages of procuring financing, make sure you ask the lenders lots of questions. Getting the answers you desire will go a long way towards being happy in the long term.

As a first-timer, there are a plethora of exceptional first-time buyer loan products available to choose from. Whether you are looking for a low or no down payment loan, youll have plenty of outstanding choices.

Just as essential as finding the right fit with a mortgage company is finding a real estate agent you find dependable and trustworthy.

An excellent agent can be a valuable resource in finding a loan specialist. It is one of the many services a real estate agent provides to their buyer clients.

You May Like: What Bank Does Carmax Use

Which Of These Should You Check On A Regular Basis

Hardeman advised choosing one and sticking to it. Knowing that there could be hundreds of credit ratings can be startling, she remarked. Credit scores, on the other hand, are highly correlated. That is, if you scored good in one scoring model, you are most likely to score good in all others. Whether youre starting from nothing, trying to recover from a setback, or just keeping your credit in good shape, I recommend keeping track of one score over time.

The 6 Best Free Credit Reports Of 2022

- Best for Credit Monitoring:

- Best for Single Bureau Access:

- Best for Improving Credit:

- Best for Daily Updates: WalletHub

In 2003, a Federal law passed granting every consumer the right to a free report from all credit reporting agencies each year. AnnualCreditReport.com is the centralized site that allows every consumer to access their free credit report granted by Federal law.

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus Equifax, Experian, and TransUnion at no cost. You can obtain one free credit report every 12 months through AnnualCreditReport.com, without signing up, creating an account, or entering your credit card information. Alternatively, you can call 1-877-322-8228 to order your legally free credit report.

Credit reports are available as a PDF download or you can request to have your credit reports mailed to you. The downside is that you receive your full credit report, which hasnt been formatted for user-friendliness. Depending on the length of your credit history and the number of accounts youve had, your credit reports can be dozens of pages each. You wont receive a credit score with your credit report from AnnualCreditReport.com.

Don’t Miss: What Credit Bureau Does Carmax Use

Does Checking My Credit Scores Hurt My Credit

Checking your free credit scores on Credit Karma doesnt hurt your credit. These credit score checks are known as soft inquiries, which dont affect your credit at all.

Hard inquiries generally happen when a lender checks your credit while reviewing your application for a financial product. This kind of check can negatively affect your credit.

Read more about the difference between hard and soft credit inquiries.

Why Is Credit Karma Inaccurate

There are two big reasons the scores on Credit Karma and your actual scores will vary. First Credit Karma is not actually pulling your credit scores. They are using Vantage Credit to take impressions of your credit. Your actual credit scores will come from Trans Union, Equifax, and Experian. Vantage and FICO are systems that look at the data from these credit bureaus to estimate your credit scores.

The second reason the scores are different is there are many different credit reports. Credit cards, auto loans, and mortgage lenders pull their own type of credit report from Trans Union, Equifax, and Experian. Depending on what type of debt you are taking out, your scores will be different.

Read Also: 728 Fico Score

Good Way To Track Credit Changes With Caveats

Ive been using Credit Karma for at least 7-8 years now, and overall Im very happy with how it shows my scores and keeps info up to date on my report. I was able to dispute a negative item through CK and have it removed, which gave my score a remarkable jump. I started with about a 580, and CK now shows me at 720. Now, the only downside is that CK uses the Vantagescore 3.0 model, while no lenders do. They all use FICO modeling, some are still using FICO 3 even though that model is from many years ago. This can make your score significantly different, sometimes higher, but usually lower. For example, when I bought my house back in 2016, CK showed me to be around 680. My actual FICO score used was closer to 620. That put me in a different interest rate bracket, so my payments were a little higher than expected. Fast forward to present day and while CK shows my score at 720, a recent Amex platinum card approval shows my score at 758. So, dont go into Credit Karma thinking its the same score you will get from a lender that pulls your report, but use it as a tool to monitor your credit and manage your debt. Its helped me in that regard, and I take the scores with a grain of salt understanding scoring models are different.

Learn More About Loans Credit And How To Fund Your Education

The team at CollegeFinance.com is here to help you figure out the best way to pay for your college education, whether through scholarships, grants, or loans. While most federal student loans do not require a credit check, private student loans and some federal PLUS loans do. Learn more by visiting the resources on our website or signing up for our newsletter.

You May Like: Voluntary Repossession Drivetime

How Can I View My Credit Score

You can request your credit report from each of the Big Three credit reporting agencies, Experian, Equifax, and TransUnion. By law, each of them is required to give you one free credit report per year. Viewing these reports is very beneficial. For example, if you find inaccurate information, you can take steps to have it corrected.

However, a credit report is not the same as a credit score, and your credit score wont be found on your credit report. You would have to purchase that separately, often at a steep price, although they occasionally offer it for free.

This is where Credit Karma comes in.