Understanding How A Fico Credit Score Is Determined

This video from the Continuing Feducation series provides a short overview of credit scoreshow they are determined and why they are important.

This video is included in an online booklet for Boy Scouts to earn the Personal Management merit badge, one of the requirements to become an Eagle Scout. Learn more about the badge and other videos featured in the booklet »

Whats In My Credit Reports

Your are records of your past dealings with creditors and other credit history. They include information such as your name, addresses, employers, the history and status of various credit accounts, and inquiries from companies checking your reports. If applicable, youll also find information from public records, such as bankruptcies, tax liens and civil judgments.

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Don’t Miss: Does Titlemax Report To Credit Agencies

If Youve Applied For A Credit Card Auto Loan Mortgage Or Some Other Form Of Credit Odds Are Youve Heard The Phrase Fico Score

When you apply for credit, potential creditors may want to gauge how likely you are to pay your bills on time. Many creditors use FICO® credit scores to assess applicants, manage accounts, and determine rates and terms.

A FICO® score is a three-digit number ranging from 300 to 850 . These scores are largely based on your and can help creditors assess how likely you are to repay debt.

Fair Isaac Corporation, or FICO, introduced the first credit risk score in 1981. The organizations reputation as one of the primary credit-rating companies in the U.S. has grown since then, reaching different industries with scores geared toward different credit products.

Even though you may hear FICO score and think of it as a single credit score, you can actually have several of FICO scores, which can differ by industry. Read on to learn more.

Will Closing A Credit Card Account Impact My Fico Score

It is possible that closing a credit account may have a negative impact depending on a few factors. FICO® Scores may consider your credit utilization rate, which looks at your total used credit in relation to your total available credit. Essentially, it measures how much of your available credit you are actually using. The more of your credit that you use, the higher your utilization rate and high credit utilization rates may negatively impact your FICO® Score. Before you close any credit card account, Wells Fargo recommends that you should first consider whether you really need to close the account or if your real intention is just to stop using that credit card. If you really just want to stop using that card, it may make sense if you stop using the card and put it somewhere for safe keeping in case of an emergency. Its also important to note that length of your credit history accounts for 15% of your FICO® Score calculation. Therefore, having credit card accounts that are open and in good standing for a long time may affect your FICO® Score.

Read Also: 676 Credit Score Good Or Bad

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

Why Is My Fico Score And Credit Score Different

In the United States, three national credit agencies collect, update, and store credit histories for the majority of Americans. While the three credit bureaus collect most of the same information on customers, there are some variances. For example, one credit bureau may contain unique information about a customer that the other two do not have, or the credit bureaus may store or present the same data element differently.

Each of these credit bureaus has a predictive FICO® scoring system from which lenders seek a FICO® Score when assessing a consumers credit risk. Consumers with high FICO® Scores on bureau As data will likely see a similarly high FICO® Score at the other two bureaus because the FICO® scoring system is consistent across the credit bureaus. When the underlying data is the same throughout the bureaus, consumers with lower FICO® scores at bureau A are more likely to have poor FICO® ratings at the other two bureaus.

These three-digit figures can go a long way toward determining whether a lender will do business with you, whether youre looking for a credit card or buying a house.

Also Check: Does Speedy Cash Do Credit Checks

Which Score Do Lenders Use

Although lenders and credit companies use both the FICO score and the VantageScore, FICO remains the clear winner for now. Ninety percent of lenders still use FICO scores, according to FICO. VantageScore, however, is gaining traction with seven out of 10 financial institutions, six out of 10 credit card issuers, four of the top 10 auto lenders and four of the top five mortgage lenders using its scoring model, according to information on the Experian website.

Although both scoring systems currently score borrowers on a scale from 300 to 850, the categories differ. See where you fall on each scale and determine if you have a good credit score.

Why Are Your Fico Scores Important

FICO® scores are widely used by many types of creditors, including lenders, credit card issuers and insurance providers to gauge your credit risk that is, how likely you are to repay the money loaned to you.

The higher your credit scores, the more likely youll end up with better rates and terms on your loan. With lower scores, if youre approved, it may be with worse credit terms than if you had higher scores.

In the case of insurance companies, lower scores could lead to higher premiums.

Knowing your scores may help you determine the likelihood of your application getting approved and whether the creditor is likely to offer you favorable terms. In some cases, a lender may even have a threshold that your scores must meet or pass to get approved.

You can try to check the lenders website or ask a representative to find out whether there is a threshold to be approved and which scoring model the company uses. But some companies may not share this information.

Read Also: How Can Personal Responsibility Affect Your Credit Report

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

Why Is This Fico Score Different Than Other Scores Ive Seen

There are many different credit scores available to consumers and lenders. FICO® Scores are the most widely used credit scores and are the only credit scores used in over 90% of U.S. lending decisions. Its important to know that there are also several different versions of FICO® Scores. Different lenders may use different versions of FICO® Scores. In addition, your FICO® Score is based on credit report data from a particular credit bureau, so differences in your credit reports may create differences in your FICO® Scores. The FICO® Score Wells Fargo is providing you for free is for educational purposes. When reviewing any of your credit scores from any source, take note of the date, bureau credit report source, version, and range for that particular score. For more, see Understanding the difference between credit scores.

Recommended Reading: Is 766 A Good Credit Score

Whats The Difference Between My Credit Score And Fico Score

Your FICO score falls somewhere in the range of 300 850. While most of the in-house credit scores calculated by the credit bureaus use similar ranges, older versions of VantageScore are calculated on a range of 501 990.

While that may make your VantageScore look very different than your FICO score, perhaps a more significant difference is in which consumers have each of the different credit scores at all. To have a FICO score, you need at least six months of credit history. Anyone with a single month of credit history is eligible for a VantageScore. That means that, as a new borrower, you may be able to get credit on the basis of your VantageScore before you even amass enough credit history to have a FICO score.

How are my other credit score and FICO score similar?

The VantageScore model is based primarily on payment history, followed by length and type of credit and debt-to-credit ratio. Total debt is also taken into account, and recent inquiries and available credit round out the calculation. Sound familiar? Those are all the same factors that determine your FICO score. They may be weighted slightly differently in the two models, but both scores place importance on the same elements of your credit history. Missing a payment might affect each of your different credit scores by a different number of points, but it will lower them all, because all the credit scoring models value timely repayment.

Fico Models Explained: Which Differences Matter Most

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

FICO has created the algorithmof the same namethat most lenders in the United States use to find your credit score when you apply for a loan. The company releases an updated version of the algorithm to lenders every few years. Since lenders are not required to use the latest version of FICO, its important to understand how the algorithms differ as your score will be altered. In this guide, well give you an in-depth look at the most commonly used versions of the FICO scoring model.

| Used by mortgage lenders. Built on data from TransUnion. | |

| FICO 2 | Used by mortgage lenders. Built on data from Experian. |

Recommended Reading: Does Snap Finance Report To The Credit Bureau

Fico Vs Vantagescore: 5 Differences You Should Understand

When you think credit score, you probably think FICO.

Since the Fair Isaac Corporation introduced its FICO scoring system in 1989, What is my FICO score? has become a common question. FICO scores have burrowed their way into all kinds of lending decisions, most notably mortgages, credit cards, and rentals.

But over the last decade or so, FICOs market dominance has been challenged by a newcomer called VantageScore. As the result of a collaboration between the three major credit reporting agencies Experian, Equifax, and TransUnion VantageScore uses similar scoring methods to FICO but with slightly different results.

So what are the differences, and more importantly, do they really matter to you, the consumer? The short answer: usually no. But you might want to look at different scores for different needs or goals.

In this article, well cover the five main differences between FICO and VantageScore and tell you which one to watch.

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

Recommended Reading: Does Removing Authorized User Affect Their Credit

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Is The Fico Score Im Seeing The Same Score Wells Fargo Uses When I Apply For A New Account

Depending on the product you are applying for, the same FICO® Score type may be used however, some product applications will use a unique scoring model that is different than what you are seeing.

The FICO® Score provided here is for educational purposes and may differ from the scores used to make underwriting decisions. Typically, creditors and lenders, including Wells Fargo, use more specific industry credit scores that are customized for the type of credit product youre applying for. For example, auto lenders typically use a credit score, such as a FICO® Auto Score, that is specifically designed to better predict the likelihood that you would not default on an auto loan. Mortgage lenders use a score developed specifically for mortgage loans. Or, your credit or lender might also use a proprietary credit score thats developed for use by just that company.

You May Like: Why Is There Aargon Agency On My Credit Report

Key Differences Between A Fico Score And Credit Score

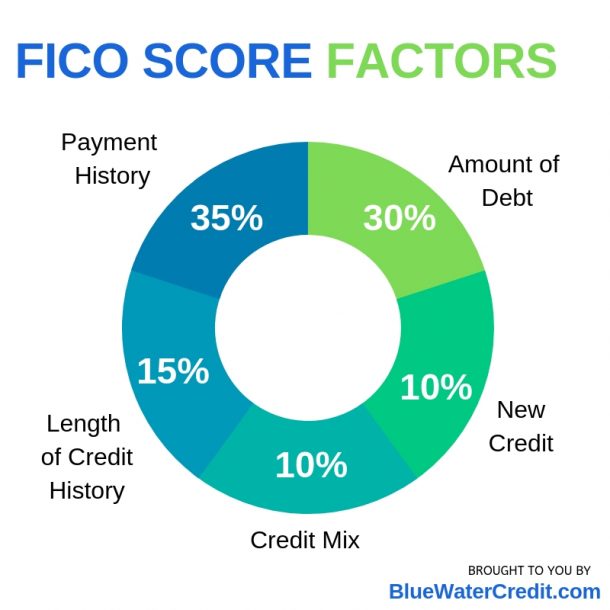

FICO is short for Fair Isaac Corporation, the first company to offer a credit-risk score. Its the most widely used type. FICO uses a formula to measure and assign your creditworthiness. In order of importance, its based on these factors:

- Payment history

- New credit

Using these criteria, credit users are assigned a number in the FICO score range between 300 and 850, with a higher score indicating better credit. FICO also has a variety of scores based on loan types, such as a FICO Mortgage score, FICO Auto Score and more. Its possible to have dozens of different types of different FICO scores, each with a different number.

In addition, the FICO credit score changes in 2020 with the UltraFICO score. This new score is good news for people who are just starting to build a credit history or those who are looking to repair their credit. It is based on the same number scale but also uses deposit account activity to calculate a score.

Another type of credit score is your VantageScore, which was created in 2006 by the three major credit bureaus: Equifax, Experian, and TransUnion. A VantageScore uses the same range, but it is generated with just one month of credit history, making it better for new credit users. VantageScore also uses a different formula to calculate a persons score. In order of importance, its based on:

- Near prime: 601-660

- Subprime: 300-600

Why Can I See My Fico Score But Others On My Account Cant See Theirs

You can see your FICO® Score because you are the primary account holder of an eligible account.

Others may not be able to view their scores if:

- They recently opened a new account

- Theyre an authorized user on someone elses account

- They have a billing statement in someone elses name

- They do not have an eligible account in Wells Fargo Online®

Recommended Reading: Does Klarna Report To Credit

Your Fico Score May Differ

On the customer review site ConsumerAffairs.com, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Using Credit Karma won’t hurt your credit score. Your search is a self-initiated inquiry, which is a “soft” credit inquiry, not a “hard” inquiry.