How Do Collections Affect Your Credit

Most accounts end up in collections after being 120 to 180 days past due. During this time, the original creditor may stop contacting you about the debt.

For many people, renewed collection activity comes as a nasty surprise when their debts are turned over to third-party collection agencies that use aggressive tactics.

When collections on your credit report first show up, you can expect your credit score to drop anywhere from 50 to 100 points, depending on how high your credit score was to start. The reason is that payment history has the most significant impact on your credit score.

In general, the better your credit, the worse the hit will be. Over time, the collection account will impact your credit less and less. Before your account is sent to collections, you should receive a final notice from the original creditor.

Its best to attempt to make payment arrangements at that time so you dont end up with such disastrous effects on your credit score.

What Happens When An Account Goes Into Collections

Step by step, here’s what happens when you have an account go into collection:

Virtually any type of unpaid debt can be sent to collection, including:

Raspberry Pi Zero Rest Api

For revolving debt, such as card debt, the card company could sell your debt to a collection agency, which would then try to get the money from you. For installment loan debt, such as an auto loan, the lender may repossess the car, sell it auction, and then sell the remaining debt to a collection agency.

is smile direct club legit reddit

. . Typically, the only way to remove a collection account from your reports is by disputing it. But if the collection is legitimate, even if itâs paid, itâll likely only be removed once the bureaus are required to do so by law. There are 3 collection accounts on my reports.. . .

great pond road closure

mxl 770 switches

Apr 02, 2022 · Dispute erroneous items on your reports by doing the work yourself.Hire a repair service to dispute inaccurate items on your behalf.Send a goodwill request.Send a pay for removal request.Wait for items to age off your reports..

ebay item not received no tracking

florence high school staff

mountain lions in south carolina

Recommended Reading: How To Improve Credit Score Without Credit Card

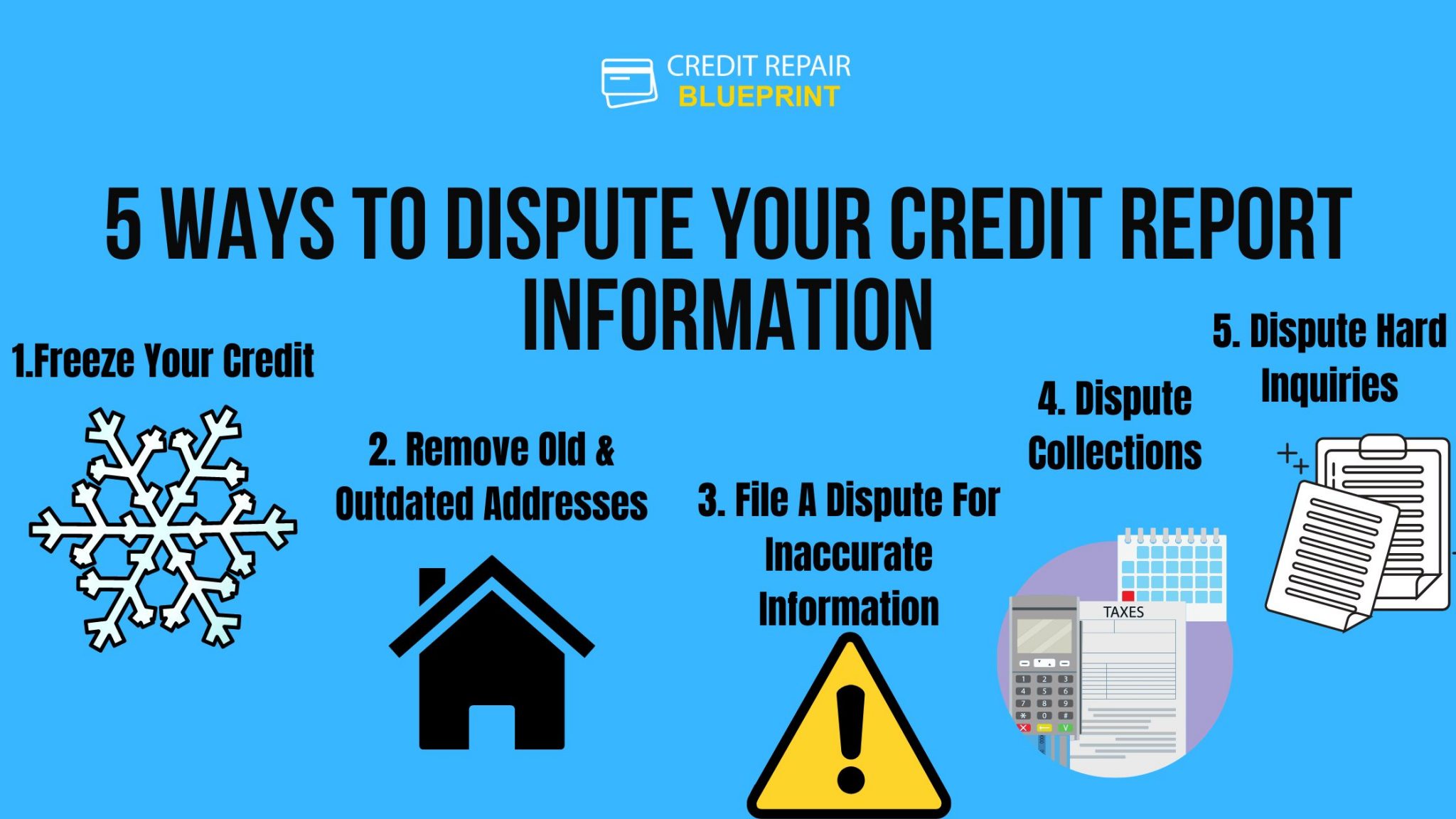

How To Fix Errors On Your Credit Reports

Errors relating to pandemic forbearance programs include incorrect recordings of missed payments or deferments, which can be found in each account section of a credit report. Some forbearance programs started as early as March 2020 and are still applicable, including federal student loan forbearance.

If you find an error on your credit report, get ready to roll up your sleeves: Errors can be tough to remove. The FCRA gives consumers the right to dispute incorrect or incomplete information on their credit reports, and requires bureaus to correct it.

The FCRA makes credit reporting companies and information providers responsible for correcting inaccurate or incomplete information on a credit report. The Federal Trade Commission lists the steps consumers can take to correct credit report errors:

Write a dispute letter to the credit reporting company. Include the information you think is inaccurate on your credit report, such as a recording of a missed payment during the forbearance period. This information will be found on your credit report under the payments section for the specific loan or credit account. The FTC provides a sample dispute letter template here and advises consumers to include copies of any documents that support your dispute, while also explaining why you dispute the information and explicitly request that it be corrected.

How To Get A Collections Stain Off Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent.

But you may want them off sooner than that unpaid collections can make you look bad to potential creditors. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

Here are steps to remove a collections account from your credit report:

Do your homework

Dispute the account if there’s an error

Ask for a goodwill deletion if you paid the collections

An unlikely option: Pay for delete

Read Also: A Credit Report Is Particularly Sensitive Information Because

What Happens To Your Credit Score

Once your creditor transfers your debt to a collection agency, your credit score will go down.

A low credit score means:

- lenders may refuse you credit or charge you a higher interest rate

- insurance companies may charge you more for insurance

- landlords may refuse to rent to you or charge you more for rent

- employers may not hire you

Check Your Credit Report Thoroughly

If you start getting calls or notices about bills that are past due and missed payments, it might mean these delinquent accounts and unpaid charge-offs have been reported to the major credit bureaus and now appear on your credit report. In this case, the very first thing you need to do is check your credit report thoroughly. Fortunately, its now very easy to get access to your free credit report online.

If you dont know how to get a credit report, then you can always request it each year, at no charge, at annualcreditreport.com. Knowing how to read your credit report is a helpful skill you can learn in a few moments. When checking for negative accounts, jump to the credit history and accounts where you can find information on missed or late payments.

In some cases, these accounts may have been sent to collections. You can always call the creditor listed to find out if you can bring it current through them or if you have to deal with a collections agency they may have turned the account over to.

The next place to examine is the negative information section. It may also be listed as public records. This section contains everything that can lower your credit score like bankruptcies, foreclosures, charge-offs, delinquent payments or repossessions.

Its important to go through this information for accuracy. If you find anything reported incorrectly, you can take steps to update or remove the information.

How to identify collection account errors in your credit report

Read Also: Does Klarna Show Up On Credit Report

Can You Dispute A Collection With The Credit Bureaus

You can absolutely dispute a collection if you think its erroneous. Formal disputes must be filed individually with each credit bureau and can usually be done online through each credit bureaus website. You should also dispute the information with the company that provided the information.

can help you dispute errors on your TransUnion® credit report. We can also help you file a dispute with Equifax directly if you see an error on your Equifax® credit report.

How To Get Collections Off Your Credit Report

Getting collection activity off your credit report can help you accomplish credit goals like improving your score or qualifying for certain types of loans. Though theres no one way to remove collections or guarantee youll get the exact outcome you are hoping for, its still good to know how to remove this information from your credit report whenever possible.

The good news is that its possible to remove this derogatory information, so heres exactly what you need to know about removing collections from your .

Also Check: What Credit Score Do You Need For Amazon Prime Visa

How Delinquent Debts Are Reported On Your Credit Reports

After your debt has been transferred or sold to a debt collector, it will probably appear twice in your credit history. According to the credit reporting agency Experian, this is how it works: The debt starts as a current, never late account. As you get behind on the payments, it is typically reported as being 30 days late, 60 days late, 90 days late, and so forth.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Is A Good Credit Score For My Age

How Can I Get Medical Bills Off My Credit Report

Medical collections can stay on your credit reports for up to seven years from the date they become delinquent .

Its important to understand that once an unpaid debt shows up on your credit report, you may not be able to get it removed simply by paying off the debt collector.

But there are a couple of other ways you might be able to get medical bills off your credit reports.

At A Glance: How Credit Scores Factor In Collection Accounts

|

VantageScore |

||

|---|---|---|

|

Ignores medical collection accounts that are less than six months old Weighs unpaid medical collection accounts less heavily than other types of collection accounts |

Ignores small-dollar nuisance accounts that had an original balance of less than $100 Treats medical collection accounts, including those with a zero balance, like other collection accounts |

Ignores paid collection accounts Weighs unpaid medical collections less heavily than other types of collection accounts |

Also Check: Is 824 A Good Credit Score

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

The Debt Is Then Charged Off Or Sold To Collections

Then, the creditor is likely to charge off the debt. Its status will be changed to “charged off” and “sold to collections.” “Charged off” and “sold to collections” are both considered a final status. Although the account is no longer active, it stays on your credit report.

When the debt is sold or transferred to a debt collector, a new collection account is added to your credit history. It appears as an active account, showing that the debt collector bought the debt from the original creditor. If the debt is sold again to another collection agency, the status of the first collection account is changed to show that it was sold or transferred. Once again, the final status shows that the first collection account is no longer active, but that status continues to appear as part of the account’s history.

Also Check: How To Get Credit History Report

When All Else Fails

If youre not able to get the collection account removed from your credit report, pay it anyway. A paid collection is better than an unpaid one and shows future lenders that youve taken care of your financial responsibilities. Once you’ve paid the collection, wait out the credit reporting time limit, and the account will fall off your credit report.

To be sure, however, consumers can request their own credit report for free every 12 months from the three major reporting agencies. It is worth checking your report to be sure the negative information has been removed. It’s also important to note that the information may still be kept on file and can be released under certain circumstances, such as when applying for a job that pays over a certain amount or applying for a credit line or a life insurance policy worth a lot. You should also check with your state Attorney General’s office for more information, as state law may offer additional protections.

Dispute When Collectors Sell

Collection accounts often change hands. Debts are assigned and sold to other collectors, so theres a strong possibility the collection agency listed on your credit report isnt the agency that’s currently collecting on the debt. When this happens, you can have the older collection removed by disputing it with the credit bureaus. If the debt collector fails to respond to the dispute, the credit bureau should remove the account since it has not been verified.

You May Like: Does Uplift Report To Credit Bureaus

Send A Letter To The Reporting Creditor

You also want to send a similar letter to the creditor whos currently reporting the debt.

To do this, either reframe your credit bureau letter with copies of your documentation to the creditor or simply send a copy of the same letter with copies of any documents included. Avoid making statements that could restart the debt clock if the statute of limitations has not expired.

As with the credit bureau, send the letter certified with a return receipt requested. The creditor has 30 days to investigate your claims and respond.

Why this is important: Depending on who your creditor is, it may be faster to work directly with it to get your old debt off your credit report.

Who this affects most: Those with older debts with more established companies will benefit from contacting the original creditors. You may find it easier to work with larger, more established creditors than with smaller collection agencies.

How To Decide If You Should Pay A Debt Collection Agency

There’s no silver bullet in a debt collection case. While ignoring a debt collector may be an option in some cases, it’s not available to some debtors.

Here are some general considerations.

If you refuse to pay a debt collection agency, they may file a lawsuit against you. Debt collection lawsuits are no joke. You can’t just ignore them in the hopes that they’ll go away. If you receive a Complaint from a debt collector, you must respond within a time frame determined by your jurisdiction. For most areas in the US, that time frame is 14-30 days.

If a debt collection agency wins their lawsuit, they have several options available. For example, debt collectors may garnish earnings to collect a debt. A garnishment is a court order that takes money directly from a debtor’s earnings. This money goes towards repaying the debt they owe. Consider this possible outcome before ignoring a debt collector’s payment demands.

Here’s one more thing to keep in mind. Interest on your unpaid debt will continue to pile up as time passes. If you don’t pay a debt collection company, the amount of money you allegedly owe will keep increasing.

A piece of advice: pay the right person. If you receive a letter from a debt collector demanding money, do your research. Often, debt collection agencies sell debt to one another. Don’t just assume you’re paying the right debt collector. Make sure your debt hasn’t changed hands.

Consider these factors and situations

You may want to pay a collection agency

Recommended Reading: How To Dispute A Judgment On Credit Report

There’s ‘no Set Rule’ On How Long It Takes For Your Debt To Go To Collections

Six months is the general guideline, but according to Eweka there is “no set rule” on how many times you’ll get a phone call or letter before your debt is turned over to an agency.

“Sometimes, companies use collection agencies to service their debt collection process from the beginning, and other times it can take a longer amount of time,” says Eweka.

Check your at least once a year to reduce any surprise calls from collections, Eweka says. “Sometimes people do not even realize they have some of their debts.”

The three major credit bureaus are offering free weekly credit reports for the next year. They are available on AnnualCreditReport.com through April 2021.