When Are Credit Tradelines Removed

Credit bureaus, namely Experian, Equifax, and Transunion, will report any information that is accurate, complete, and within the credit reporting time limit. It also includes the negative and delinquent accounts you have.

Open tradelines with positive information will remain on your credit report. Closed tradelines and positive information will be on your credit report for a time determined by credit bureaus. Negative information, like delinquencies or bankruptcies, will fall off your credit report within 7-10 years.

Why Are Tradelines Important

Business tradelines can be important because they can help other businesses and organizations determine your companys creditworthiness.

Your business credit reports may have overviews of your companys history of paying its bills and trade credit accounts.

They also often have details about the business, such as how old it is, the industry, whether there are outstanding liens or judgments, and information about the owners.

Someone may review your businesss credit reports when you apply for a loan, line of credit, lease, insurance, or trade credit. Or, when you try to get a contract with a major corporation or government agency.

Many business credit reports also come with business credit scores or creditworthiness ratings, and your tradelines can directly impact these.

For example, the D& B Paydex Score ranges from 1 to 100. You need to make on-time payments on your trade accounts to get a score of 80. If you want a higher score, you need to pay earlier than your trade credit accounts require.

Dont Miss: Does Zzounds Report To Credit Bureau

How To Add Business Tradelines To Your Credit Report

Building business credit is essential to grow your business. You can do that by adding business tradelines. In order to add business tradeline to your credit report you will need to open new business credit accounts. Not every business tradeline will report to every business credit bureau.

Some business credit accounts can take several months before it reports to your business credit report.

It is important to note that the vendor name will not appear on your credit report. Instead the business type will be reported.

Find out which company reports to each business credit bureau.

You May Like: How To Report Rent Payments To Credit Bureau

Be Careful With Your New Credit

If you get a new car, you tend to drive a heck of a lot slower than you did in your old clunker. New tradelines work the same way. That is, especially if youre getting a new tradeline to pump up your credit score.

Ideally, youll want to make a small purchase every now and again and pay it off immediately. This helps your . It will ensure youre getting the most of your new tradeline.

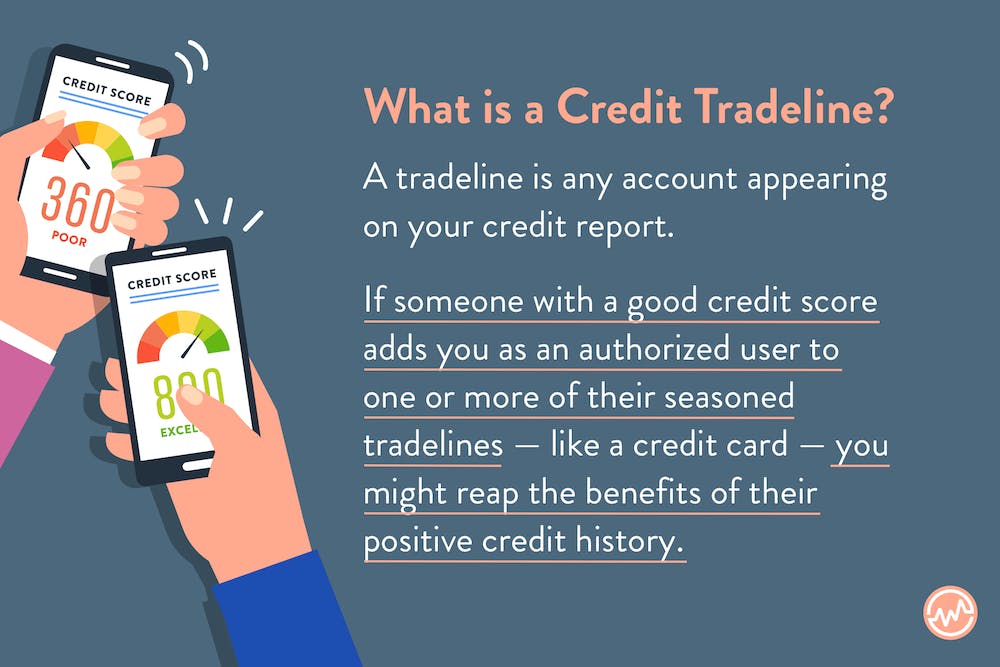

What If You Dont Know Someone With Strong Credit

Piggybacking is an effective way to become credit visible, but it isnt always easy to find a creditworthy person who is willing to cosign something for you or add you as an authorized user on their credit card account. Companies like Coast Tradelines specialize in connecting consumers of different credit profiles. We help match people with strong credit with those who are looking to become authorized users. Both parties benefit because the former receives financial compensation and the latter boosts his or her credit score.Our team at Coast Tradelines strives to make credit available to people of all backgrounds. You can count on us to provide convenient, affordable tradeline services so you can get the credit score you need as quickly as possible. Contact us today to learn more.

Also Check: How Do You Check Your Credit Score

How Can You Add Tradelines To Your Credit Report

Tradelines will definitely boost credit scores, especially an aged credit tradeline.

- There are consumers with no credit and no active collection accounts who have low credit scores due to not having any credit

- For example, for consumers with a bunch of closed out credit account with no credit for the past few years, the chances are they will have lower credit scores

- If credit scores are very low, do not apply for any unsecured credit cards

- This because consumers normally need a credit score of 700 to get approved for an unsecured credit card

- The best way to developing a credit tradeline on the credit report with a low credit score and no credit is by getting a few secured credit cards

- Each secured credit card will boost credit scores

- As secured credit cards ages, credit profile will become stronger and stronger

- Eventually, the secured credit card company will grant a higher credit limit without asking cardholder to put any additional funds

Secured credit cards can eventually become unsecured credit cards and cardholders will start developing a good credit profile.

Recommended Reading: Which Credit Bureau Does Paypal Use

A Closer Look At Trade Lines

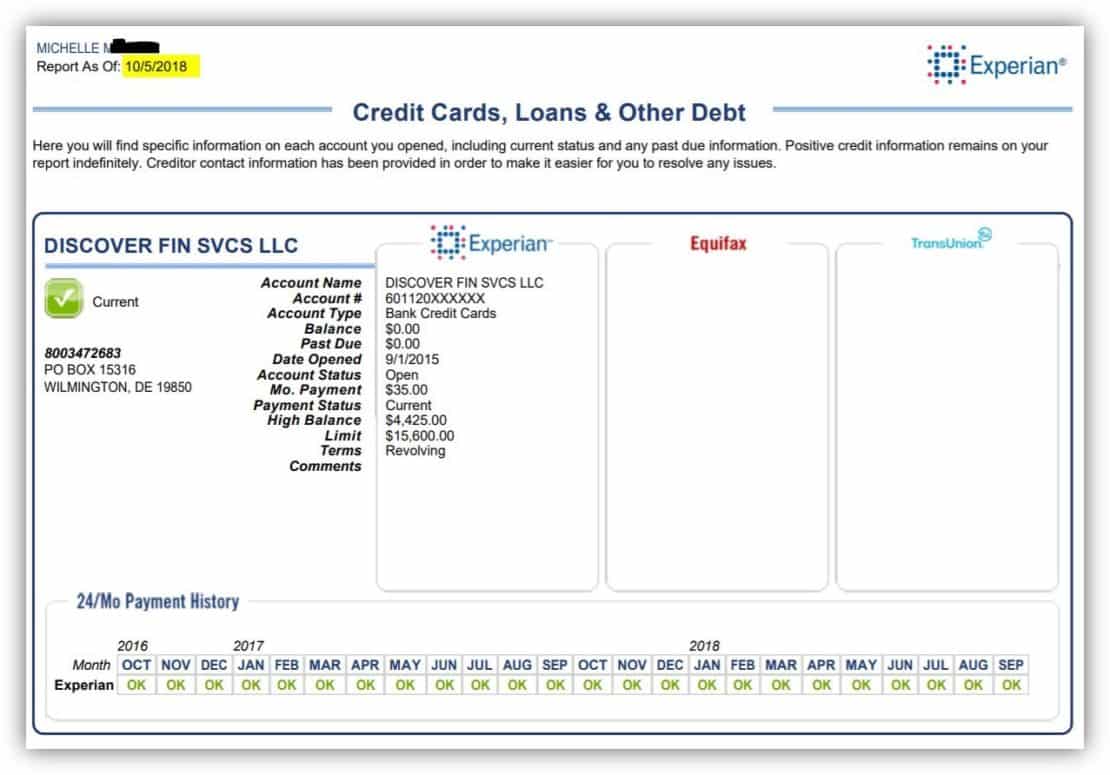

A trade line is a credit account found in your credit report. It can take the form of a credit card, a personal loan, and even an account with a utility service provider. The issuers of your trade lines are expected to submit reports of your credit and payment activities to the three credit reporting agencies. This is how your credit report is built. These companies will report your good, on time payments and your bad, late payments.

So if you pay on time. you will see a series of C for current next to each trade line. At a glance, your potential creditors can see if you have good credit habits. If they see a number (like a 1 that tells them that you paid 1 month late, a 2- means 2 months late and so on.

You should also strive for a good MIX of tradelines. An unbalanced credit report is one that has only 1 or 2 types of tradelines. So as you work on your credit score you want to make sure you get in a good mix of credit cards vs installment loans.

Don’t Miss: Is 741 A Good Credit Score

Why You Should Check For Errors

Once youve obtained your credit report, review it thoroughly to ensure that all of the information reported about you is accurate. If you spot errors on your credit report, like tradelines that are outdated or not completely accurate, you can have them removed by writing to the credit bureau.

Tradelines you dont recognize could be a sign of identity theft. Fraudulent tradelines can be disputed with the credit bureaus.

Find Out What A Cpn Numbers Are And Why There Are Dangerous

Are you wondering if a CPN number can improve your credit situation? Read these important CPN facts and risks before you decide. Learn more to help avoid involvement in synthetic identity fraud.

CPN or CPN number can stand for credit privacy number, credit profile number, or consumer protection number.. You have probably seen some businesses claiming to sell CPNs as a way for consumers with poor credit to apply for credit with a clean slate. Since the CPN is a different number than your SSN, it does not have your credit report associated with it.. As described above, the only way to get a CPN is to purchase a stolen or fake Social Security number.. An SSN is a government identifying number and the government does not sell these numbers or offer CPN applications.. Clearly, using a CPN on any credit or loan application in place of your SSN is misrepresenting your Social Security number, which, the FTC states, is illegal.. The credit repair companies may tell you to apply for credit using the CPN or EIN, rather than your own Social Security number.. These companies may be selling stolen Social Security numbers, often those taken from children.. It cannot legally be used in place of your SSN to apply for credit and it may very well be someone elses stolen SSN.

Read Also: Do Payday Loans Show On Your Credit Report

Heres An Example Of A Statement Date And A Report Date Back To Back:

As you may recall, I said that it is nearly impossible to add tradelines to your credit report within 24 to 48 hours. Well, in this case, you could have for TransUnion, if you were added before midnight on 8/21/2012 . However, even if you were added on 8/21/2012, the tradeline would not have REPORTED until 72 hours later on Experian, and 7 days later on Equifax. No tradeline company has control over this. Therefore, if they give you an unrealistic date, they are probably deceiving you .

Maintaining Tradeline Activity Is Important

Once you establish tradelines for your business, keeping your accounts active can be important. After all, other businesses and creditors want to see that you have a track record of paying your bills on time, or in the case of companies using D& B Paydex Scores, paying them early.

With Experian, a tradeline will be considered new when its first added to your credit report. It becomes a regular tradeline if its updated with new activity at least once every three months.

However, if three months pass without any activity, the tradeline becomes an aged trade. If there arent any updates for 36 months, the tradeline can fall off your Experian business credit reportalthough it can go back to regular status if its updated in the future.

Don’t Miss: How Much Does A Hard Credit Pull Affect Your Score

Apply For A Secured Credit Card

One tradeline that is both easy to get approved for and hard to abuse is the secured credit card. If you have poor credit and want to add tradelines to your account, then the secured credit card is a good one.

A secured credit card requires a security deposit equal to the amount of your credit line.

These cards do have fees, generally an interest rate and annual fees. It is better to check with your local bank to compare interest rates and annual fees to make sure you get the best possible deal.

Guide To Buying Primary Tradelinesface Fiction Or Fraud At Tradelinesupplycom

Uncover the facts, fiction, and fraud related to buying primary tradelines for credit building. Discover the risks and opportunities with buying primary tradelines. Find out if primary or authorized user tradelines are better.

However, when it comes to buying tradelines, AU tradelines are still very powerful tools, while buying primary tradelines is unfortunately often associated with scams and fraud.. If a primary tradeline is an account opened in your name, of which you are the primary user, how could you buy one that already exists?. So how does it become your primary tradeline?. As we mentioned above, in many of the most common tactics of buying and selling primary tradelines often the seasoned aspect is either missing or actually has negative payments associated with the history.. When buying primary tradelines, it is probably more likely to be an installment debt such as an auto loan, which is not as impactful, and you cannot legitimately show any payment history since this was not your account.. When it comes to buying authorized user tradelines vs. primary tradelines, we believe it is actually better to buy AU tradelines for several reasons.. Whats your take on primary tradelines?

Also Check: How Do You Find Out What’s On Your Credit Report

What Are Tradelines And How Can They Benefit My Business Credit Report

Tradelines or trade information comprises the financial payment obligations that a business has to its creditors, suppliers, and service providers that involve payment terms like Net 15, Net 30, 60 or 90. It means your business has that much time to pay back the balance of what you borrow. So, for example, if your business buys $300 worth of products at Net 30 terms, you have 30 days to pay it back.

A business will start to add tradelines over the course of its lifecycle and establishing tradelines early in the life of the business can be very beneficial. Experian gets a lot of questions about how tradelines impact a business credit score, so in this post, we explain how that all works.

How Many Tradelines Should I Have

Balancing Out Derogatory Accounts Derogatory accounts need to be outweighed by positive accounts, so ones credit report should contain at least 2-3 positive tradelines for every negative account. Therefore, multiple tradelines may be necessary to balance out derogatory accounts damaging ones credit.

You May Like:

You May Like: What Is A Good Credit Score To Rent A House

Apply For Credit Accounts Through Merchants

If you dont have strong credit, then there are some creditors who have lenient qualification processes.

If you have a good credit score and you can manage more credit, then apply for an additional credit card or a line of credit.

In general, apply for a type of credit that you do not have. If you have a credit card, then apply for a line of credit.

This shows the creditors that you can handle different types of credit.

Be an Authorized User

This is another way to add credit tradelines to your account with very low risk. Credit accounts can have more than one authorized user.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Check My Credit Rating For Free

Buying Tradelines: Can They Help Improve Your Credit Score

Learn why tradelines are important to borrowers and lenders. Check Your Credit Report

Simply put, tradelines are credit accounts listed on your credit report. Each of your accounts is listed separately on your credit report, which provides information about the specific debts and creditors. Knowing how to read tradelines is crucial, as it can help you better understand your credit score, how to improve it and identify what lenders see on your credit report.

Heres a brief guide to understanding tradelines and how they affect your credit score:

Try An Alternative Credit Reporting App

People with thin or nonexistent credit profiles can turn to alternative credit reporting. Alternative credit collects data not typically included in credit reports, such as rent, utility and phone payments. This lets you build your credit score through bills you already have. Popular apps for alternative credit reporting include IE, Experian Boost® and ExtraCredit.

Recommended Reading: Do Prosper Loans Show On Credit Report

What Is An Example Of A Trade Line

A trade line is created for every credit line you own. An example of a trade line is your car payment history. When you begin repaying a car loan, a trade line is created that summarizes your contact information, your current payment status, the date the line of credit was opened, and the date the line was closed.

The trade line will also report current information such as the date of your last payment, the current balance remaining, and your monthly payment amount.

The Benefits Of Increasing Your Credit Score With Tradelines

There are many benefits of increasing your credit score by adding new tradelines. Some of these benefits include:

- Increased credit limit adding new tradelines can increase your credit limit. The more credit you have available the better your credit score.

- Increased length of credit history adding aged tradelines to your credit report can increase your length of credit history. Lenders like to see accounts open longer than 10 years for excellent credit.

- Lower interest rates having a good credit score can lower your interest rates for loans, mortgages and credit cards.

- Better credit card options when your credit score is increased it opens up new credit cards options such as 0% interest, balance transfers and rewards.

Related: How To Buy Tradelines To Increase Your Credit Score

Don’t Miss: How To Order Free Credit Report

Does It Matter How Long The Tradeline Reports

Because tradelines operate like inactive accounts on your credit report, it does not matter how long they continue to show on your credit report. The boost you need to look out for is the initial effect on your score. After that, how long it continues to report on your credit report does not make a big difference in your score.

Say, for instance, that the account continued to show for the entire seven years. In the first year, your credit score might climb 100 points because of access to more credit and the ability to piggyback on someone with a more robust credit history.

However, your credit score would not continue to climb by 100 points every year after that. The same is true if it stops showing on your report after two months or less.

Online Jewelry Club Card

Get a $5,000 unsecured primary tradeline on your credit report. This will be your account, in your name, and you are the primary account holder.

The purpose is to boost your credit score and help build a solid foundation for your credit.

The injection of an unsecured $5,000 credit limit paired with super low utilization is bound to make your credit report stronger.

Easy approval even if you have bad credit.

Approvals are immediate.

HOW IT WORKS:

You place an order for at least $100 for one jewelry item from their website, and they will ship it to you. Select a low cost item of only $100 to keep your cost down. You will be required to pay for anything you order so dont defeat the purpose by buying what you dont need. Their website looks outdated but I promise this is not sketch, its legit. I have this card.

Once you get approved which is a quick process right on your order form, they will begin processing you for a $5,000 line of credit which will report on your credit. Read their how it works page for additional info.

Ensure you make the payments because they are reporting the usage and re-payment history.

You must be at least 18 years old and a U.S. Citizen.

Household income must reflect $1,400

Once this tradeline reflects on your credit report, for many people, the injection of the perfect positive account with $5,000 credit limit and super low utilization has a powerful impact spanning months into the future given the small payments are made on time.

Don’t Miss: Do Mortgage Pre Approvals Affect Credit Score