Credit Score Car Loan Options

When it comes to securing a car loan, your credit score likely wont matter much in the approval process. Thats because even people in the lowest credit score range of very poor can often get approved for an auto loan. Where your credit score comes into play is the interest rate youll get on the loan.

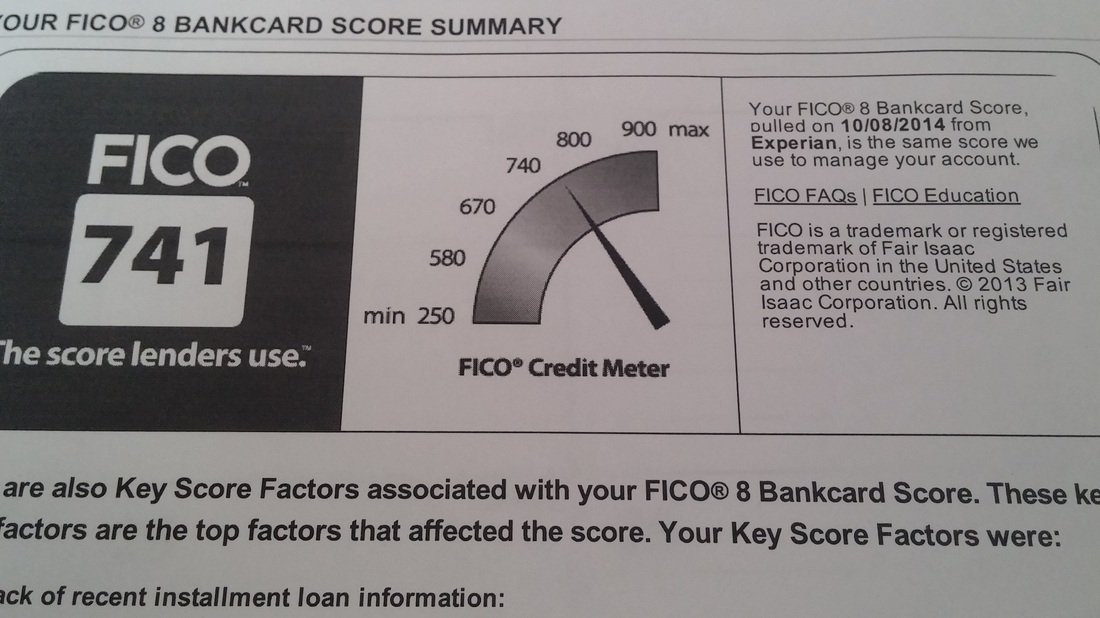

With a credit score of 741, youll receiveon averagean interest rate of 3.65 percent for a new vehicle and 4.29 percent for a used vehicle. This is very different from the rates you might get if you had a much lower credit score.

Additionally, having a score in the very good credit range will likely help you receive reasonable loan terms that include fewer potential penalties.

What Factors Affect Your Credit Score

Your credit score is comprised of five factors: payment history, amounts owed, length of credit history, new credit, and credit mix.

If your FICO Score is 700 to 749, youre probably perfect or near-perfect in the payment history category. At worst, you may have one or two 30-day late payments in your distant past, but nothing recent.

In this credit score range, is likely to be a bigger factor. Its the amount you owe on your credit cards, divided by your total credit card limits.

For example, if you owe $5,000 in credit card debt, and you have $20,000 in credit card limits, your credit utilization ratio was 25%. Any number below 30% is considered good.

Is 741 A Good Credit Score In Canada

Excellent : Youre a credit star!! The credit score at 6.6% is fair, so you wont have a problem handling the cost of credit. There are no low-interest rates to be found for this credit score, but upgrading your score might be your best option. In your case, 599-669 is really only an average for a low score.

You May Like: 888-826-0598

Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.

Read Also: Lowes 0 Financing For 18 Months

Good Credit Score Range For Auto Loans

When determining the interest rates for an auto loan, financial institutions typically rely on FICO® Auto Score 2, 4, 5, or 8. These scores range between 250 and 900. The higher the number the better the score. If youre shooting for the lowest possible APR on your auto loan your Auto credit score should be above 740.

We sampled auto loan interest rates from Unitus Community Credit Union to see how interest varied on a new car loan across a range of credit scores. The results can be seen in the table below.

New Auto Loans: Model Years 2014 and Newer

| 15.24% | N/A |

As with mortgages, the length of the loan also plays a huge impact in your rates. The longer the term on your auto loan, the higher interest you’ll pay. Having a good credit score can mitigate this negative effect.

Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score wouldnt be affected by the balances on my installment loans.

But I noticed that once I paid off my auto loans and student loans, my credit score jumped more than 20 points.

The key here is that you should pay off as much of the loan as possible, if not all of it. The closer the remaining balance is to zero, the more it will benefit your credit score.

For a little bit of perspective, I paid off a $30,000 auto loan, another $20,000 auto loan, and student loans totaling $11,000. Almost immediately after I did this, my credit score improved.

Also Check: 626 Credit Score Car Loan

A 741 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

A credit score is a number that lenders use to help assess how risky you might be as a borrower. Credit scores are based on credit reports, which contain information about your credit history. Generally, a good credit score can signal to lenders that youre more likely to pay back money you borrow.

Having good credit can be a game-changer. It can mean youre more likely to be approved when you apply for a credit card or loan. Good credit can also help you qualify for lower interest rates and better loan terms.

Its not quite as simple as that though. You dont have just one credit score. Heres why. Scores can be calculated using different scoring models, like the ones created by FICO and VantageScore. These credit-scoring models use several factors to generate your scores, drawing on data from different sources, namely the three main consumer credit bureaus . So there are actually many different versions of your credit scores.

With so many different credit scores out there, what counts as a good credit score can vary. What one model or lender defines as good could be different from what other models or lenders define as good.

Heres what you need to know about building and maintaining a good credit score and, if youre aiming higher, how you can eventually take that score from good to excellent.

+ Credit Scores By Income

700+ Credit Scores by Income

People who make at least $50,000 per year are significantly more likely to have a credit score of at least 700. And people who pull in $75,000 to $99,999 per year are in the sweet spot for a score that begins with a 7 or an 8. But note that it is possible to get into the 700-plus club if you earn less or wind up with a way lower score even if you make a lot more. Its all about spending within your means.

Don’t Miss: How To Remove An Eviction From Your Credit Report

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

What Does A 741 Credit Score Get You

| Type of Credit |

|---|

| 31.08% |

*Based on WalletHub data as of Oct. 7, 2016

As you can see, the majority of us are in the top two tiers of the credit-score range. A lot of people dont know where they stand, though, considering that 44% of consumers havent checked their credit score in the past 12 months, according to the National Foundation for Credit Counseling. If youre one of them, you can change that by checking your credit score on WalletHub.

Read Also: Les Schwab Credit Score Requirements

What Does Not Count Towards Your 741 Credit Score

There are many things that people assume go into their 741 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Mortgage Rates For Good Credit

Your credit scores are just one factor to consider when youre looking to get a great mortgage rate. Having good credit can help you get a better rate, but so can factors such as

- The type of mortgage loan youre looking for

- The total cost of your home

- Your debt-to-income ratio

- The size of your down payment

The average credit score it takes to buy a house can also vary greatly by location.

Once you have a general picture of your overall credit as well as how much house you can afford and the type of loan you want its a good idea to shop around. This can give you a better idea of what different lenders could offer you.

Compare your current mortgage rates on Credit Karma to learn more.

Don’t Miss: How To Remove A Repo From Credit Report

Frequent Credit Card Use Is Required To Take Full Advantage Of Rewards

Depending on the rewards offered, earning them can be a bit complicated. It may be easy in the first year, due to a generous sign-on bonus. But the ongoing rewards arent always so easy.

Take travel rewards, for example. If a travel rewards card offers two points for every $1 you spend, youll have to spend $1,000 per month to earn 2,000 points. In one years time, you can earn 24,000 points spending at that level, equal to $240 in travel purchases.

But the critical connection is being able to spend at that level every month. If you dont normally use a credit card, you may not accumulate a meaningful number of points.

How To Get A 750+ Credit Score

If you want to know how to improve your credit score, look no further than the Credit Analysis section of your free WalletHub account. Youll find grades for each component of your credit score, along with an explanation of where you stand and tips to improve. Getting your credit score to 700 is kind of like making the honor roll in school. You need mainly As and Bs to pull it off.

For example, heres a common credit scorecard for someone with a 750 credit score:

- Payment History: A = 100% on-time payments

- A = 1% – 10%

- Debt Load: A = < 0.28 debt-to-income ratio

- Account Age: B = Average account is less than 9 years old

- Account Diversity: A = 4+ account types or 21+ total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

You dont need to match this scorecard exactly to build a credit score of 700 or even higher. Different profiles can get the job done. For example, you might have an A in Credit Utilization but a B, or even a C, in Account Age. Its the complete picture that matters.

Was this article helpful?

Related Scores

You May Like: Notifying Credit Bureau Of Death

What Is A Credit Report

While a credit score is a simple shorthand for your creditworthiness, a credit report is a more complete overview of your financial history, and its one of the major tools a lender uses in determining whether or not to give you credit. Contained within your credit report is key identifying information like your address and social insurance number, your payment history with your creditors, a record of bankruptcies or any court judgments that would affect credit worthiness, a list of lenders or other parties that were authorized to look into your credit, and any banking or collections information.

Canadians are entitled to one free credit report per year from either Equifax or TransUnion. to apply for your free credit report from Equifax by mail, and to receive your free credit report from TransUnion either by mail or online. If you cant wait a year for your free report from the credit bureau, Borrowell, a Canadian financial technology company and credit monitoring service, can give you free access to your credit score any time. I reached out to Borrowells CEO, Andrew Graham, to get his thoughts on the value of this new offering.

Borrowell has recently launched free credit report monitoring. For the first time, Canadians are able to monitor important information in their Equifax credit report on a monthly basis for free online, said Graham.

Getting Mortgages With 741 Credit Score

As with personal loans, credit scores in this range tend to produce favorable terms. With 741 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point five percent. If youre in the market for house, try pushing off your search until your credit slightly improves to lock in a more ideal rate.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 741 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 741 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

Don’t Miss: Equifax Address To Report Death

What’s A Good Credit Score By Age

Credit scores vary widely by age. Typically, the younger an individual is, the lower their credit score is expected to be. For a college student, having a credit score above 680 can be considered good. However, by the time an individual is in his late 40s, that same score isn’t quite as good when compared to others in their cohort. This is due to the nature of how a credit score is calculated. Things like the average age of credit and diversity of credit accounts matter a great deal. The older one gets, the easier it is to build up those two factors. Generally speaking, the average credit score goes up with age.

A college student, however, may not require a credit score above 780, therefore a good credit score is something that changes with age. A fresh graduate is unlikely seek a mortgage, where a credit score of 640 would mean high interest rates. Therefore, its typically good enough for individuals in that age group to have a score between 640 and 680.

Recent college graduates are ahead of the curve if they have any credit score at all. According to data by the Consumer Financial Protection Bureau, over 30% of those between 20 and 24 years of age have no credit score. These individuals are referred to as “credit invisible”.