Length Of Credit History

Have you been a borrower for long time? A lengthy track record of responsible credit use is good for your credit rating, which is obviously much more difficult to gain when you’re in your early twenties. This explains why oldergenerations typically have the best credit scores. The frequency with which you use your cards also plays a role, so if you have a credit card, use it a little bit to show that you can manage your debt responsibly.

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to:

How To Get A Car Loan With No Credit

How to Apply for NoCreditCheck Car Loans That Bring Decent Monthly Income: Lenders generally have a minimum monthly income. Make a big deposit – The more money you deposit, the less you need to borrow. Use an employee. Having a co-author with good credit makes it much easier to approve a loan. They promise additional guarantees.

How To get a title loan without the car?

Also Check: Is 626 A Good Credit Score

While Theres No Universal Minimum Credit Score Required For A Car Loan Your Scores Can Significantly Affect Your Ability To Get Approved For A Loan And The Loan Terms

In the second quarter of 2020, people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657, according to the Q2 2020 Experian State of the Automotive Finance Market report.

Lower credit scores could result in fewer offers and higher interest rates. But that doesnt necessarily mean you should throw in the towel if your scores arent where you want them to be.

Read on to learn more about how your credit scores affect your odds of getting a car loan and ways you can increase your chances of approval and potentially receive better offers.

How To Get Out Of An Upside

How to get out of car loan refinancing, if possible. Often you cannot refinance a car loan while underwater, but it depends on the lender. Move excess car debt to a line of credit. While many people refuse to use credit cards, transferring the debt to a line of credit may be the best solution. Selling things. Find a part-time job.

Read Also: What Is Syncb Ntwk On Credit Report

Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it’s important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

Why Are There Different Fico Scores

When you apply for credit, whether its your first credit card or a second mortgage, lenders need to decide whether youre enough and likely to repay the money. To do this they check your credit scores or get credit reports from one or more of the major credit bureaus: Equifax, Experian, and TransUnion. Each has its own credit score that is developed by FICO, and these scores are calculated based on your credit history and other information that goes into your credit report.

There are also multiple versions of FICO scores, reflecting the evolution of the credit market and consumer behavior since the scores first became a tool for lenders back in 1989. Just in terms of the amount of credit we use, theres been a big increase over the past few decades, with consumer borrowing rising by approximately 15% over the last four years. A typical borrower today probably would have been considered a higher credit risk under older methods of calculating credit scores.

FICO has rolled out 10 versions of its base score over the years, and most of them are still in use by lenders to some extent. Lenders can choose from the following base versions:

- FICO 2

- FICO 9

- FICO 10 and 10T

Don’t Miss: How To Get Credit Report Without Social Security Number

How Will Your Credit Score Affect Your Total Loan

In the first half of 2018 customers signed loans that were on average $30,958 when purchasing a new car and $19,708 when purchasing a used car. Borrowers signed loans that had a length of term on average of 68-months for a new car, and 64-months for a used car.

Rather than shopping for an auto loan based off of the average loan rate, monthly payments, or length of term, it is best to look at total cost. The total cost of a loan is easier to compare across lenders as it only compares the total out of pocket cost you incur over the contract.

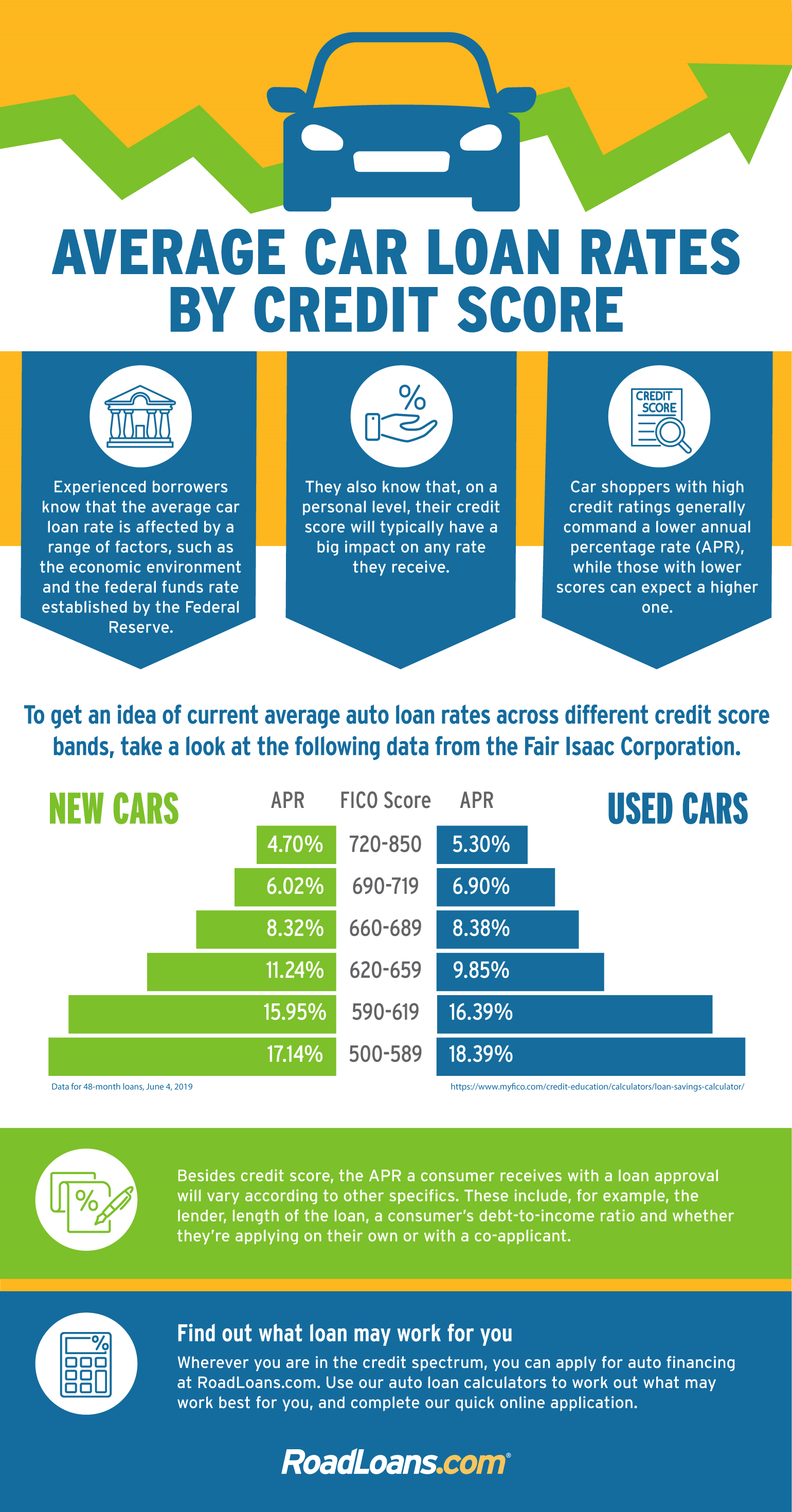

Based on the average loan amounts, length of term annual percentage rate, here is how much a credit score can affect your total loan costs.

Total cost of loan based on credit score

| $31,847 |

What Credit Score Do You Need To Buy A Car

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you worry that your credit score could keep you from buying a car, you underestimate how much car dealers want to sell you one. But a higher score will almost certainly get you a lower interest rate on the loan.

A target credit score of 660 or above should get you a car loan with an interest rate around 6% or below.

That data comes from a June 2020 report from credit bureau Experian. It also found that, on average, the credit score needed for a used-car loan was 657 while the average credit score needed for a new-car loan was 721.

Still, almost 30% of car loans went to borrowers with credit scores below 600, according to Experian. Almost 4.5% of used-car loans went to those with scores below 500.

Read Also: How To Get Credit Report Without Social Security Number

How To Reduce Your Auto Loan Interest Rate

Improving your credit score is one of the best ways to score a lower auto loan interest rate. You can do that by checking your and to get an idea of which areas you need to address.

Common ways to improve your credit score include getting caught up on past-due payments, paying down credit card debt, limiting new credit applications and disputing inaccurate information on your credit report.

As you work on building your credit, here are some other ways you may be able to reduce your auto rate:

Consider each of these options and determine the right ones based on your situation, goals and abilities.

How Does My Credit Score Affect My Auto Loan Rate

Depending on your credit score, the interest rate you receive can vary widely. In fact, the difference in interest rates on a new car loan for someone with excellent credit versus someone with very poor credit can vary by as much as ten percentage points.

Use our 3-step loan calculator to determine the difference in interest rates.

For example, if your excellent credit qualifies you for 6% interest rate on a $18,000 vehicle rather than the 12% interest rate for which a less-than-stellar credit score might qualify, you’ll save more than $50 each month over the five-year term of the vehicle loan. That’s a $3,000 savings thanks to your good credit!

When it comes to car buying, your credit score plays a major role in the type of financing that’s available to you. For people with a strong score, this works in your favor. You might be in the perfect position to obtain an auto loan.

For those with lower scores or no credit, this may pose a bit of a challenge, but don’t despair! There are actionable steps you can take toward improving your score. The good news is that a properly managed auto loan can improve your credit score moving forward. So once you secure an auto loan, you can work toward strengthening your credit history for your next car, truck, or recreational vehicle.

Now that you are armed with all the facts you need to obtain an auto loan, all that’s left to do is find the right vehicle for you.

Also Check: How Personal Responsibility Can Affect Your Credit Report

Is Now A Good Time To Buy A Car

If you happen to be considering purchasing a new or used car, it could be a great time to be in the market. Some anticipate many auto dealers are considering promotions for auto lending such as attractive cashback incentives, 0% financing, longer loan terms and other incentives to move inventory. But you’ll have to qualify to get access to the most attractive terms, and having a higher FICO Score is often quoted as one of the key requirements.

It’s in your best interest to be prepared and to know where your credit stands before you step foot on the lot to test drive that car of your dreams. In addition to researching the pricing of the models you are interested in and understanding your current vehicle’s value , you’ll also want to review your credit scores.

What If Ive Got A High

Buying a car with less-than-perfect credit can be expensive. Youll pay a higher interest rate, which means your monthly payment will be higher and you could end up paying thousands in interest over the life of the loan.

If you find that you cant qualify for an auto loan rate under 9.99%, we strongly recommend you reconsider your car-buying strategy. You can use our car affordability calculator to see how much car you should really be buying, or our auto loan calculator to see how different scenarios will affect your monthly payment.

In the event youre already stuck in a high-rate loan, you do have some options. Of course, you can sell the car and pay off the loan. While that might be the smartest financial move, its hardly realistic if you still need the car for transportation. The good news is that you can refinance your auto loan. If, for example, your didnt know better and accepted a bad loan deal, or, your credit score has improved since you took out the loan, you may be able to get a lower auto loan rate when you refinance.

Keep reading to learn more about how to find refinancing lenders and check your rate.

Also Check: Bp Visa/syncb

Fico Credit Score & Auto Loans

FICO Credit Score & Auto Loans

If you are considering buying or leasing a new vehicle, you may be paying close attention to your credit score. This number determines what your car loan interest rate will be, and will also determine your eligibility for loans. So what what exactly is a credit score and how does it impact the car buying process?

The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. Were going to take at look at FICO® since it has long been the auto industry standard.

FICO is an acronym that stands for: Fair Isaac Corporation, the company that developed the FICO® credit scoring.

FICO® credit scores are the auto industry standard for determining a potential buyers creditworthiness. Using a variety of factors, the company will give you a three digit score ranging from 300 to 850 .

Though FICO keeps the specifics of their credit scoring algorithm a secret, there are certain known factors that weigh into determining a persons credit score.

Many people are surprised when they arrive at the dealership, and find that their FICO credit score is not the same three-digit number they saw on the credit monitoring service that they have used.

If you want to know your exact score before you begin car shopping, simply visit myfico.com

Generally speaking, banks require a minimum credit score of 600 to give an auto loan without any down payment.

What Is A Good Credit Score To Buy A Car

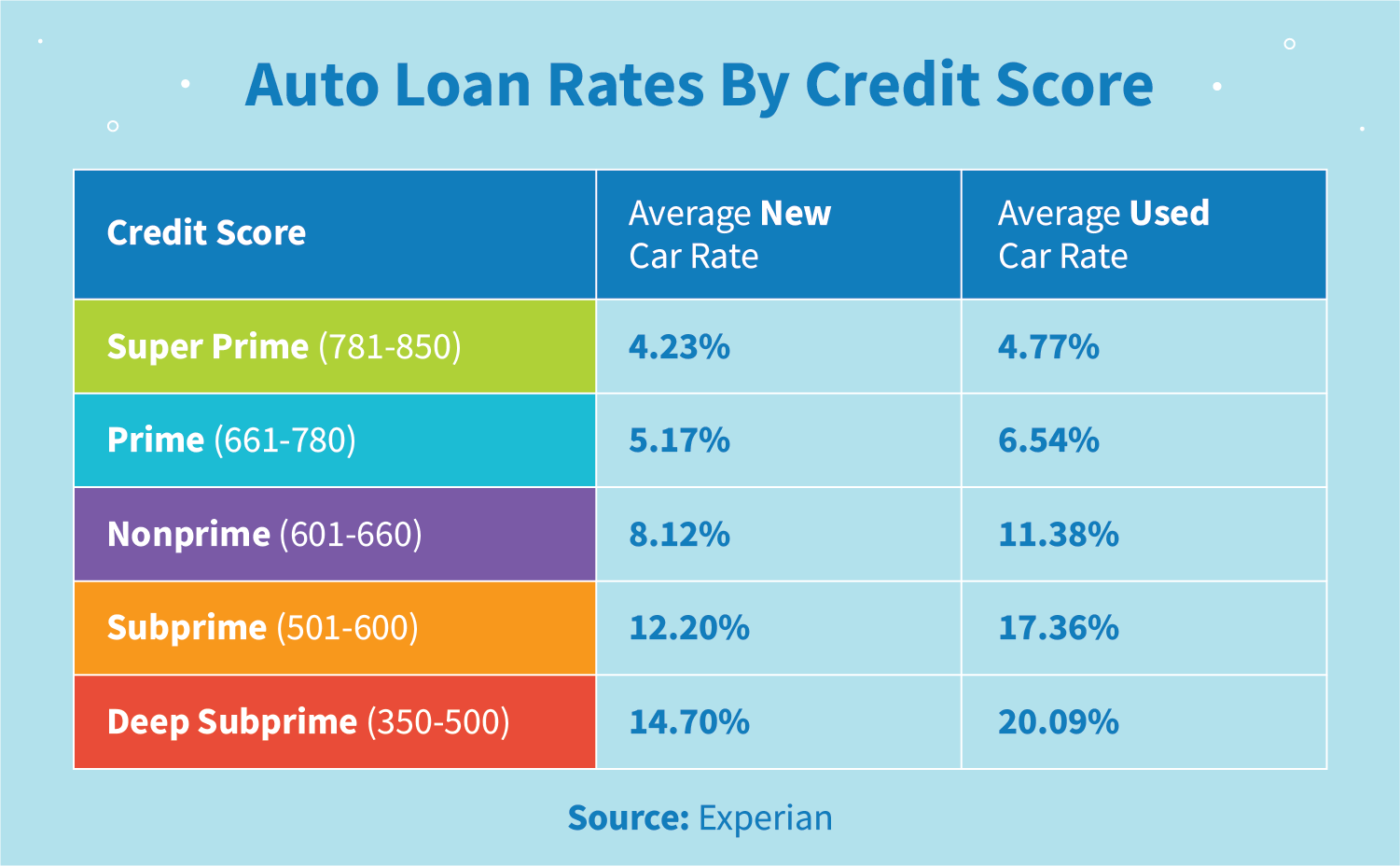

How do FICO scores affect how much youll pay over the long haul? Lenders use bands of scores to determine interest rates. These are the bands used by Experian:

- 800-850: A score in this range is considered excellent. Experian says 21 percent of borrowers have a score in this range.

- 740-799: A score in this range is viewed as being very good. Borrowers in this category qualify for low interest rates, but not as low as those for borrowers with excellent credit. Roughly 25 percent of all borrowers have a FICO score within this range.

- 670739: Roughly 21 percent of borrowers have a score that falls within this range. A score in this category is considered good and will qualify you for a decent rate.

- 580-669: About 17 percent of people have a score in this range. This type of credit score is considered to be fair, and it places you in the subprime category. Subprime borrowers pay higher interest rates than those with good, very good, or excellent credit.

- 300-579: A score in this range is considered very poor and places you in the subprime category. Roughly 16 percent of borrowers have scores in this range. Borrowers in this category pay the highest interest rates, and some may be denied credit altogether.

You can expect to pay anywhere from a few to 15 percentage points more for a loan than a borrower with good credit and those percentage points can make your monthly payment much higher.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

Buy A Car Now Or Work On Your Credit

The bottom line is that there is no set minimum FICO® Score to get a car loan. There’s actually a good chance that you can get approved for an auto loan no matter how bad your credit is.

Having said that, subprime and deep-subprime auto loans can be extremely expensive, so just because you can get a car loan with bad credit doesn’t necessarily mean you should. The savings from a moderate score increase can be substantial, so it could be a smarter idea to wait for a bit and work on rebuilding your credit before buying your next car.

Your Scores With The Big 3 Bureaus

Three main bureaus gather data from creditors to calculate your credit score. The three main bureaus are Equifax, Experian, and TransUnion.

Historically, each bureau would serve a different geographic area, but now theyre all nationwide. Experian and Equifax are the larger of the three and typically the ones with which most people are most familiar. However, TransUnion is equally important.

Recommended Reading: Will Paypal Credit Report To Credit Bureaus

What Is The Fastest Way To Tighten Abs

The fastest way to tone your abs is to buy machines that will last, give you full range, and don’t cost much. The best investment in abdominal training equipment is to buy a stabilization or exercise ball.

Whats a good credit score to buy a carWhat’s the lowest credit score you can have to buy a car? A credit score of 660 or higher should get you a car loan at a good interest rate, but borrowers with a score of only 600 or even 500 have options.Can I buy a car with a poor credit score?Yes really! You can buy a car with bad credit, but you may have to pay a higher annual rate or need a family member or friend as collateral. Yes really! You can

Ones Credit History Counts

A personal auto loan approval is dependent upon ones credit score but many consumers do not think about what financing a car will do to credit score. The factors considered when calculating credit scores include how much money one owes, payment history, the length of time one has had credit and the types of financing one has had in the past. A first time car loan applicant may have higher auto loan rates if the person is young, does not have a long credit history, or has had a history of making late payments on previous debts. It is the responsibility of the person who received financing for a car to make sure their rating is impacted positively by making all of the necessary payments on time.

A car loan also affects ones credit score positively if he/she has a young credit history or a desire to remedy a bad credit rating. At the same time, a credit score can be affected negatively if one neglects to make the assigned payments on time. After so many missed payments, a car can be repossessed, which can ruin a credit score.

It may seem like a no-brainer, but in some cases, your lender may have restrictions on how they report your auto loan. This may be especially true if you are landing from a small dealer or other informal lender who may handle financing themselves. Make sure that your auto loan will go to the books to help you build credit.

Read Also: Reporting Death To Credit Bureaus