How Can You Check Your Credit Scores

Reading time: 2 minutes

-

There are many different credit scores and credit scoring models

-

You can purchase credit scores from a credit bureau or get one free from some banks and credit unions

Many people think if you check your credit reports from the two nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports do not usually contain credit scores. Before we talk about where you can check your credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score there are many different scores used by lenders and other organizations. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time.

Score providers, such as the credit bureaus Equifax and TransUnion along with companies like FICO, use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the two nationwide credit bureaus may also vary because some lenders may report information to both, one or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you check your credit scores? Here are a few ways:

In addition to checking your credit scores, its a good idea to regularly check your credit reports to ensure that the information is accurate and complete.

Understanding Credit Score & Credit Report

- Detailed information of loans and credit card accounts including limits, outstanding balance and current status

- Information regarding late payments and defaults

- A list of entities that have made an enquiry for your credit report and the reason for the enquiry along with date of enquiry

- Your personal information

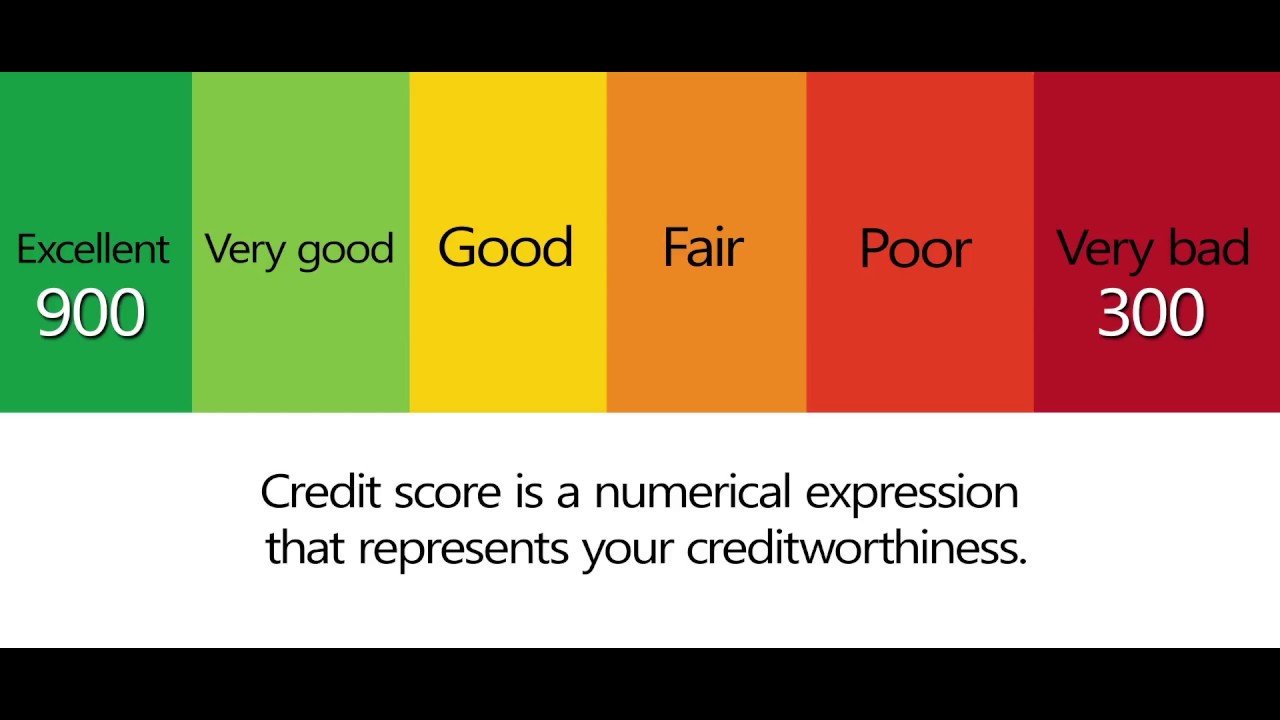

*It must be pointed out that credit reports in India do not include information about your savings, investments, utility bill payments, house rent payments, etc. Credit scores range between 300 and 900. A score closer to 900 is generally considered to be a good score and indicated fiscal prudence.

How Does Your Credit Score Impact Credit Cards You Qualify For

Credit score has a big impact on what credit cards you qualify for. The cards with the best rewards or premium perks typically require a good to excellent credit score, around 670-850. If you have bad credit or no credit, student credit cards and secured credit cards can be a good option to help you build credit, even if they dont come with as many benefits.

However, your credit score isnt the only thing that matters on your credit card application. Lenders may also look at your credit utilization ratio, your debt-to-income ratio, and outstanding balances on your other cards. To have the best chance of qualifying for the cards you want, make sure youre paying off your balance on time and in full, and dont apply for too many new cards in a short period of time.

Learn all about finances in next to no time with our weekly newsletter.

In your inbox every Tuesday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

Don’t Miss: How Long Does Defaulted Student Loan Stay On Caivrs

What Is A Good Credit Score

Every credit agency uses a different system, and the highest possible credit score can be anywhere from 700 to 999. In the table below you can see the ranges for a good, fair, or poor credit score according to MoneySuperMarkets credit monitor service . It’s ratings go up to 710.

When you check your credit with MoneySuperMarkets , well give you an assessment alongside your credit score. That way youll instantly be able to know if you have good credit, or if your score needs some attention.

Ask The Experts: Credit

Checking your credit score is easier than ever. But people still dont do it enough. Why? We posed the following questions to a panel of personal finance experts to find out as well as to get tips for saving money while staying on top of your score. You can see what they said below.

- How much easier is it for people to check their credit scores now than it was 5-10 years ago?

- Is there ever a reason to pay to check your credit score?

- Which benefits a consumer more: daily credit score updates based on one bureaus credit reports or weekly updates based on two bureaus reports?

- What is the biggest mistake that people make in regards to checking their credit scores?

You May Like: Credit Score Needed For Care Credit

Regularly Monitor Your Credit Health

Its important to regularly monitor your credit health based on the information found in your report. Catching and fixing inconsistencies or mistakes on your credit report early can save you from being blindsided by a sudden dip in your credit score and help you spot opportunities for improvement.

You can monitor your credit health yourself by taking advantage of free credit reports and credit score access. Many experts say you can save money and take control of your finances at the same time by self-monitoring using your free credit report. If you make a habit of combing through your report regularly, looking for potential errors or areas of opportunity, you dont need to pay for the service.

But there are also a variety of credit monitoring services that can help you. These services typically offer perks like frequent access to your credit score, notifications when changes are detected, and suggestions for ways to improve your credit score.

The disadvantage is cost. Credit monitoring services offered by the major credit bureaus range from $19.95 to $24.99 a month, and if youre trying to build your credit, spending more money may not be in your best interest.

Understanding Your Credit Score

Credit scores range from 300-850, with 850 being the highest. The higher your credit score, the more likely you are to be approved for a loan or credit card with the best interest rate.

Since there are multiple different versions of your credit score, thanks to different formulas and approaches used by different credit bureaus, it can help to view any given credit score as a general representation of your creditworthiness. Different lenders use different scores, so the score a mortgage lender uses might slightly differ from the score a credit card issuer uses.

Most lenders use the FICO score, according to the Federal Trade Commission. Whatever score different lenders use, the higher the better in terms of getting the best rates. But because different lenders use different scores, the Consumer Financial Protection Bureau notes it can pay to shop around.

Also Check: Tri-merge

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Also Check: Does Carvana Report To The Credit Bureaus

Free Credit Score Resources

Most credit card issuers provide free credit score access to their cardholders making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access, whether you’re a cardholder or not:

Types Of Credit Scores: Fico Vs Vantagescore

There are two main credit scoring models: FICO and VantageScore. However, lenders have a clear preference for FICO its model is used in over 90% of U.S. lending decisions.

FICO and VantageScore credit scores have some similarities: In both, scores range from 300 to 850 and payment history is the most influential factor in determining your score. But they differ in exactly how they weight and rank several other factors.

Don’t Miss: What Day Does Opensky Report To Credit Bureaus

Coronavirus Credit Score Survey & Tips To Protect Your Score

The coronavirus pandemic may be disastrous for Americans credit for years to come. The unprecedented level of unemployment has left many people struggling to pay essential bills and charging more to their credit cards, which is concerning because total U.S. credit card debt already stood at over $1 trillion at the beginning of the year. As peoples credit utilization rises and they miss payments, its unsurprising that 87 million Americans are worried about their credit scores due to the coronavirus, according to a recent nationally representative WalletHub survey.Below are more highlights from the survey, along with tips to protect your score during the crisis.Key Stats

- Many Americans fear credit score damage: 87 million Americans are worried about their credit scores due to the coronavirus. Some of the most worried groups include middle-income people, the 30-44 age bracket and people with fair credit.

- Americans want missed payment forgiveness: 86% of Americans agree that credit scores should ignore any missed payments during the coronavirus pandemic.

- Housing payments take precedence: 58 million Americans are most worried about paying their mortgage or rent during the coronavirus pandemic, followed by 46 million most worried about paying their credit card bill.

- Women anticipate more debt: Women are 21% more likely than men to expect to get into more debt during the coronavirus pandemic.

How to Protect Your Credit Score During the Coronavirus PandemicSurvey Methodology

Check Your Credit Score With Moneysupermarket

Checking your credit score is quick and easy with and whats more, its completely free. Finding out your credit score is the first step to improving your financial wellbeing, and well give you regular updates along with personal tips to help boost your score and give you better access to great credit deals.

Also Check: Does Paypal Credit Report To Credit Bureaus

What’s The Best Way To Find Out My Credit Score

Having a good credit score can boost your chances of being accepted for credit. Here’s how to check yours for free

Whenever you apply for a , a personal loan or a mortgage, your lender will look at your credit history and your credit rating or score. That means if youre thinking of applying for new credit its a good idea to get hold of your credit file first to see what it says about you. That way youll be able to see if there might be any issues before you apply. You can also take steps to correct any mistakes and look at ways to boost your score.

In this guide well show you how to check your credit score quickly, easily and for free and without damaging your credit record. Well tell you everything you need to know about what your credit score means for you and your finances.

Why Is Checking Your Credit Score Important

Your credit score is a number that shows how well youve managed your finances in the past. With a higher score, lenders are more likely to offer you credit, and your interest rates could be lower too.

But it doesnt end there your credit score is also taken into account when companies work out your insurance premiums or what kind of mobile phone contract theyll offer you. Good credit even helps with renting a house or getting a new job.

Its important to stay on top of your credit record and the first step is finding out your credit score. That way, you can take steps to improve your credit if it is low and could hamper your chances of being accepted for credit.

Don’t Miss: What Is Cbna On A Credit Report

Who Can Request A Copy

- lenders and creditors

- insurance companies

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

Don’t Miss: What Company Is Syncb Ppc

How To Check My Business Credit Score

Businesses also have credit scores, which are used by lenders, banks, partners and other agencies to determine their creditworthiness and/or legitimacy. Business credit score ranges are usually on a scale of zero to 100. A businesss credit score is in many ways shorthand for does this business repay its debts, but the score itself could be determined by a host of factors including number of credit accounts, payment history, credit utilization and more.

A good credit score for a business is 80 or above.

To establish business credit and obtain a credit score, your business will need to meet a few benchmarks. It must be registered as its own legal entity , and it must have either a Taxpayer Identification Number or an Employer Identification Number through the IRS, as well as a Data Universal Numbering System number through Dun & Bradstreet.

Once your business is properly registered and has a credit history, you can start checking its credit score in a number of ways.

Can I Buy A Copy Of My Report

Yes, if you dont qualify for a free report, a credit bureau may charge you a reasonable amount for a copy of your report. But before you buy, always check to see if you can get a copy for free from AnnualCreditReport.com.

To buy a copy of your report, contact the national credit bureaus:

Federal law says who can get your credit report. If youre applying for a loan, credit card, insurance, car lease, or an apartment, those businesses can order a copy of your report, which helps in making credit decisions. A current or prospective employer can get a copy of your credit report but only if you agree to it in writing.

Also Check: Usaa Free Credit Report

What Other Free Tools Does Credit Karma Offer

Free credit reportsOn Credit Karma, you can check your free credit reports from Equifax and TransUnion. And as with your credit scores, you can check your free credit reports as often as you like.

Free credit monitoringCredit Karmas free credit-monitoring service can alert you to important changes on your Equifax and TransUnion credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can sniff out any suspicious activity.

Mobile appThe allows you to check your credit scores on the go. The app also features tools ranging from the newRelief Roadmap to opt-in push notifications that help alert you to potential changes on your Equifax or TransUnion credit reports.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Read Also: Remove Repossession From Credit Report