What To Do When A Debt Collector Calls

Make sure to ask for and write down the following information:

- the name of the person calling

- the company the debt collector works for

- the name of the company the debt collector is collecting money for

- the debt collectors telephone number

Ask for details on the debt, such as:

- the amount you owe

- who you owe it to

- when you started owing it

Tell the debt collector that you’ll call back as soon as you verify the information. Look at your bills and bank statements to help you confirm if the debt is yours and the amount you owe is correct.

You can ask the collection agency to contact you only in writing. Ask your legal advisor to send a written request to your creditor by registered mail, including an address and phone number at which you may be contacted.

Determine The Accounts Legitimacy

Is the collection account legitimate a past-due debt that you actually owe? If it is, youre going to have a tough time getting it removed from your credit reports. However, if the account is actually incorrect, or should have been removed from your reports by now, then you may be able to get it removed through the dispute process.

Closing A Line Of Credit That Is Already Behind On Payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Don’t Miss: How Do You Read A Credit Report

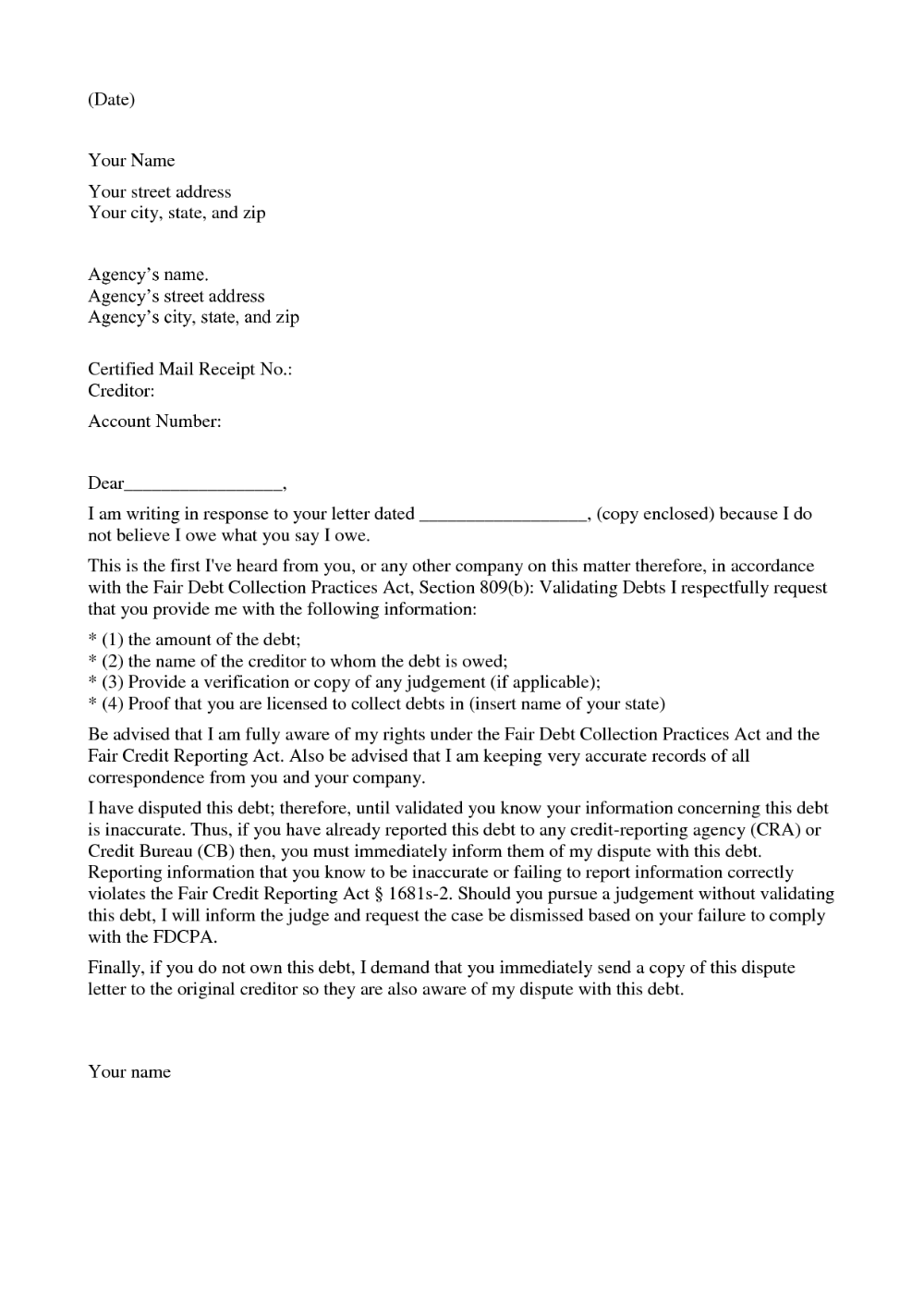

Send Letters To The Credit Bureaus

If the debt really is too old to be reported, its time to write to the credit bureau to request its removal. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. If it cant, the debt has to come off your report.

The Fair Credit Reporting Act requires credit bureaus to correct or delete any information that cant be verified or that is incorrect or incomplete, typically within 30 days. Otherwise, they are in violation and you are within your rights to file a lawsuit, as well as file a complaint with the Consumer Financial Protection Bureau.

Make sure to craft a case so strong that the creditor will have to acknowledge that its correct or present tangible evidence to the contrary. Include copies of anything that supports your claim, such as copies of court filings that show the correct date for a judgment or bankruptcy or a letter from your original creditor showing when the account became delinquent.

If a collection agency is reporting an account as a different debt, include any paperwork showing that the two accounts are really the same debt.

Send this letter certified with a return receipt requested so that you can prove when it was sent and that it was received.

Why this is important: If you can prove that the debt is older than legally allowed to show on your credit report, the bureau can remove it.

Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

How to remove negative items related to identity theft

If you believe youve been a victim of identity fraud, file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

To prevent further damage to your credit history, these are the steps you should take:

- Notify the incident to Transunion, Experian and Equifax through phone or mail

- Place a security freeze and fraud alert on your credit report

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

Read Also: What Is A Good Credit Score To Buy A Car

What A Debt Collector Can’t Do

A debt collector can’t do the following:

- suggest to your friends, employer, relatives or neighbours that they should pay your debts, unless one of these individuals has co-signed your loan

- use threatening, intimidating or abusive language

- apply excessive or unreasonable pressure on you to repay the debt

- misrepresent the situation or give false or misleading information

A debt collection agency can’t add any collection-related costs to the amount you owe other than:

- legal fees

- fees for non-sufficient funds on payments that you submitted

What Should I Expect After Filing A Dispute

Investigation of your dispute

When reviewing your dispute, if we are able to make changes to your credit report based on the information you provided, we will do so. Otherwise, we will contact the company that reported the information to us to verify the accuracy of the information you’re disputing.

Your dispute will be processed in approximately 10-15 days for electronic submission and 15-20 days for postal mail

After our investigation is complete, a confirmation letter or email will be sent to you with the results and outcome of the investigation. If we require additional information in order to complete our investigation, we will notify you. If you submitted your dispute electronically, we will notify you by email. If you mailed in your completed form and documents, we will send you a letter. Due to COVID-19, we are experiencing longer than normal processing times. We appreciate your patience.

Read Also: What Is The Most Accurate Credit Score App

The Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

Write A Dispute Letter

Once you have the proof in hand, its time to write your dispute letter. In essence, this letter explains to the credit bureau that you feel this collection was made in error and that you would like it removed from your report. It also references the paperwork that you have provided to back up your claim.

If you need more help, check out our guide on how to write a credit dispute letter for more detailed instructions.

If youre having trouble getting a resolution, you can contact the Consumer Financial Protection Bureau to submit a complaint as well.

Also Check: Can An Eviction Be Removed From Your Credit Report

Dispute A Debt On Your Credit Report With The Credit Bureaus

According to the Fair Credit Reporting Act , consumers have the right to dispute information they believe to be incorrect or incomplete. Credit bureaus will investigate to determine the validity of your collection dispute.

The investigation usually runs for 30 days. If the consumer reporting agencies prove that your claim is valid, they will correct or remove the information in question. Otherwise, the negative mark will remain on your credit report for up to 7 years.

You can dispute a debt on your credit report by mail or online.

File A Dispute Via Mail:

Recommended Reading: Experian Unlock My Credit

What Are My Rights Under The Fair Credit Reporting Act

The Fair Credit Reporting Act, or FCRA, is composed of our legal rights that are under the oversight of the Consumer Financial Protection Bureau.

The Federal FCRA is in place to protect your rights regarding the privacy of information held by consumer reporting agencies.

If you are the victim of identity theft or are active-duty military personnel, you have additional rights under FCRA.

You May Like: What Is The Most Accurate Credit Score Site

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dispute Credit Report Errors Keeping Your Credit Report Accurate

October 6, 2016 by Consumer Center

It is important that your credit report contains accurate information about you. Inaccurate information about your debt or past payments can have negative consequences. Unfortunately, creditors do not always report your credit history fairly or accurately.

The Fair Credit Reporting Act, or FCRA, is a federal law that promotes your right to have accurate information presented in your credit report. It is the responsibility of your creditors to report your information to the credit bureaus and correct any errors in your credit report.

Once you have settled a debt or paid it in full, your creditors are required by law to report the change promptly. They must also update your credit status once you discharge a debt through bankruptcy. The law mandates that they notify all three credit bureaus and provide them with the most recent information.

Although creditors are required under the FCRA to change your credit report status, they do not always follow through. Correcting errors and making changes to your credit report may just not be your creditors top property. These tasks can easily slip through the cracks.

A good way to keep your credit report accurate is to dispute credit report errors. Read on to learn how to dispute errors on your credit report.

Recommended Reading: How To Remove A Closed Account From Your Credit Report

Request Proof And Gather Evidence

If your bill is already paid, you may be able to remove the remark from your report. Collect as much documentation as you can to prove the bill was paid. Ask for payment records from your doctors office, find copies of canceled checks or dig up old credit card statements. This way, you have everything that you need to make your dispute. Paid bills that have gone to collections should not continue to be affecting your credit score negatively.

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

Recommended Reading: How To Get Debt Removed From Credit Report

Where To Take Your Claim

Spot something that doesnt look quite right? Under the Fair Credit Reporting Act, credit reporting agencies such as Experian, Equifax and TransUnion are required to investigate your credit report dispute.

You also can take your complaints to those responsible for supplying information to the credit bureaus: banks, retailers, mortgage companies in short, anyone who is in the business of granting credit plus debt collectors.

The scuttlebutt: Experts do not think highly of lenders or debt collectors investigatory expertise or enthusiasm. This perception might be connected to the limited scope of lenders obligations. They need only look at what the consumer owes, whether the account holder keeps payments current, and if they have the consumers name right. This limited scope makes their reviews seem to be quick and shallow, with the result that errors sometimes are deemed accurate.

To be certain, contact both. Thats the recommendation from the Consumer Financial Protection Bureau.

How To Settle With A Debt Collector

Unburdening all or part of your personal debt via settlement may seem intimidating, but one of the great truths is that you really can negotiate anything. When speaking about money that you owe on your credit card, for instance, there might be opportunities to negotiate and settle what sum you actually owe. When you know your facts and are able to show willpower, you can, in some cases, reduce your balances by as much as 50% to 70%.

Debt settlement is a contract between a lender and a borrower for a bulky, one-time payment of part of ones existing debt in return for the remaining debts forgiveness. If you owe $8,000 on a single credit card, for example, you may approach the credit card company and offer to pay $4,000. In return for this big, one-time payment, the credit card company can agree to forgive or even erase the remaining $4,000.

It may sound too good to be true, but you really can negotiate to settle with a credit card company or a collection agency about your balance. As such, its no surprise that lenders dont actively advertise settlement agreements. Independent data on success rates is unavailable, too. The thing is, if the situation is really that you are in debt, harshly lagging on expenditures and free-falling towards bankruptcy, your lender may be willing to take what they can get. This will give them the opportunity to get at least a part of the money back while also giving you one last chance to get back on your feet.

Get Help With Your DEBT

Also Check: Does Child Support Show Up On Your Credit Report

How Much Does A Collection Account Affect Your Credit Score

A collection account can significantly affect credit scores. Thatâs because your credit score is made up of five main factors: payment history, credit utilization, credit history, credit mix and credit inquiries.

Of the five factors, your payment history accounts for a whopping 35% of your credit score. When your habit of late payments is significant enough to have reached the collections stage, credit bureaus take that seriously and correspondingly decrease your score. In turn, potential creditors will not deem you as creditworthy, meaning it will be much harder to get credit cards, loans, and more.

Late payments on accounts that haven’t been sent to collections will still appear on your credit report and can also impact your credit score, although less severely. If you believe a late payment has been recored on your credit report by mistake, you can dispute late payments in a similar manner to disputing collections.

Dispute Errors W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

Don’t Miss: How To Check Credit Score Without Hurting It

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behavior so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.