A Good Credit Score Is In The Eye Of The Beholder

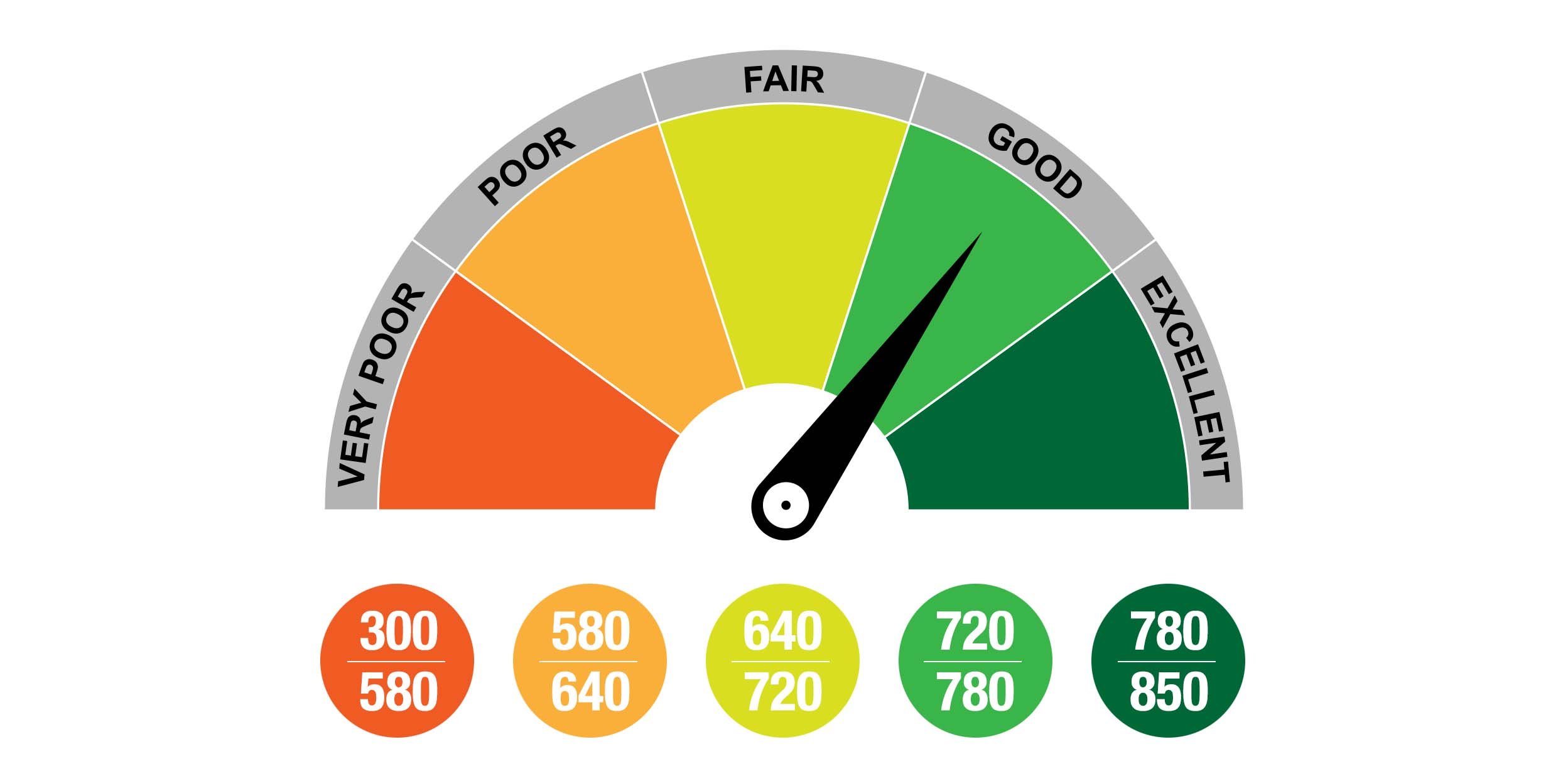

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

What Happens If I Have A Bad Credit Score

We wont lie to you. If youve got a bad score, you are at a disadvantage when it comes to things like procuring new credit cards or loans getting favourable loan terms if you are approved getting a mortgage funded and even successfully renting a home in many Canadian cities.

Because of that low score, prospective lenders may consider you as a risk. Sometimes, this means theyll deny you outright.

This can often be the case for mortgages and rental applications. In busy cities with lots of demand for housing, banks and landlords alike can be more keen to prioritize people with better credit.

Sometimes, even with bad credit, you will be able to obtain loans or credit cards. But these will often come with wicked high interest rates, or will require you to secure the loan amount with collateral, like your home or car, which the lender may repossess if you default on your loan.

So! Bad credit scores are, well, bad. They dont make you a bad person. But its worth trying to improve yours to save yourself stress and money in the long term.

Recommended Reading: Does Affirm Affect Your Credit Score

Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

You May Like: How To Get A 900 Credit Score

How Is A Credit Score Calculated

Your credit score is calculated using an algorithm that is undisclosed to the public. Essentially, the creation of your score is influenced by the following factors.

Both FICO and VantageScore take these factors into consideration, but their algorithm weighs them differently.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Read Also: Aargon Agency Payment

Better Chance For Credit Card And Loan Approval

Borrowers with a poor credit history typically avoid applying for a new credit card or loan because they’ve been turned down previously. Having an excellent credit score doesnt guarantee approval, because lenders still consider other factors such as your income and debt. However, a good credit score increases your chances of being approved for new credit. In other words, you can apply for a loan or credit card with confidence.

How Can I Fix My Credit Score

If you have a bad credit score, do not despair, friends. You can fix it. We believe in you!

The first step: get stuck into the weedy bits. Do you know what your credit score is, like, right now? We offer monthly credit score monitoringmaybe go check that out for your updated score .1

Similarly, consider requesting your credit report from the bureaus, Equifax or Transunion. Comb through those dot-matrix printed pages and make sure you can account for all of the information presented. This info is what your credit score is based on, after all.

Also be sure youre looking for any unrecognizable credit inquiries that could indicate attempted fraud. If you need a helping hand, we also offer identity fraud protection.2 We monitor your Equifax credit bureau daily for hard inquiries, which can be early signs of fraud. If we find anything, well notify you, and guide you through steps to help stop criminals scheming after your identity.

If you find incorrect info or a concerning inquiry, call the bureau right away to fix it.

Once youre all squared away, its time to work on your credit hygiene. This may sound hard and overwhelming, but it doesnt have to be. Your credit score could improve speedily if you:

- Make regular payments on all of your debt

- Pay off overdue loans ASAP

- Dont use more than 35% of your available credit regularly

You can read more tips from the Canadian government here.

Don’t Miss: Syncb Zulily Credit Card

Why Are Fico Scores Important

FICO Scores help millions of people like you gain access to the credit they need to do things like get an education, buy a first home, or cover medical expenses. Even some insurance and utility companies will check FICO Scores when setting up the terms of the service.

The fact is, a good FICO Score can save you thousands of dollars in interest and fees as lenders are more likely to extend lower rates if you present less of a risk for them.

And overall, fair, quick, consistent and predictive scores help keep the cost of credit lower for the entire population as a whole. The more accessible credit is, the more lenders can loan and the more efficient they can be in their processes to drive costs down and pass savings on to the borrowers.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Also Check: How To Get Public Records Removed From Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Don’t Miss: Paydex Score Chart

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

How Does My Fico Score Affect The Sort Of Loan I Can Qualify For

Your credit score tells a lender how much debt you owe, and whether you have a history of making payments on time, and lenders use this to determine what the interest rate will be on your loan, which is the amount the lender is charging you for borrowing money. The more you are being charged on top of the amount you are borrowing , the higher your interest rate.

The lower your credit score, the higher your interest rates, generally speaking, says Corraro. A low credit score means that a financial institution is taking a risk in lending to you. That higher interest rate is one of the banks primary ways to protect against that risk.

So people with good-to-great credit get lower interest rates, though the exact rate will depend on a variety of factors, including the overall national interest rate. People with fair credit scores can often still get a loan, but their interest rates, and therefore their monthly payments will be higher. People with bad credit scores can still get loans, but they tend to come with very high interest rates.

To get an idea of what interest rates for car loans, 30 year fixed mortgages, and credit cards might look like, in a general sense, for people with bad, fair, and excellent credit scores, take a look at this handy table.

| Excellent Credit Scores |

|---|

| 20.5% |

Recommended Reading: Public Records On Credit Report

What Is A Credit Score

Your credit score is a number between 300 and 900. The higher your number, the more creditworthy you are. This is important because any lender will look at your number and other personal information to determine if they should lend you money. If youre a new immigrant or a student, you may not have a credit score at all.

If you ever need any kind of loan in the future such as a mortgage, car financing or a line of credit, youre going to need a good credit score. Even applying for some credit cards requires a good credit score. Keep in mind that having a good to excellent number can work to your benefit as lenders may offer you lower interest rates or better products.

Its worth noting that the term FICO score and Beacon score are sometimes used in Canada when referring to credit scores. These are American terms, but are interchangeable in Canada.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Don’t Miss: Does Qvc Easy Pay Report To Credit Bureaus

Why Are There Different Fico Scores

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

You May Like: How To Remove Serious Delinquency On Credit Report