Key Differences Between Fico And Vantage Score

The differences between the FICO score and Vantage Score are relatively minor:

- VantageScore is designed to keep track of new or infrequent credit users. This can be an advantage for young adults, or to anyone who for any reason has dropped off the consumer radar for a time.

- When you apply for a new loan, the lender checks your credit rating. Consumer protection law requires that multiple applications are treated as one query so that you don’t get dinged multiple times for comparison shopping. Because the two rivals handle these queries a little differently, VantageScore may ding you a little more than FICO will.

- Both compile a credit score at the moment it is requested. The FICO system relies on current information as it is reported to the credit bureaus. The VantageScore system incorporates information on your spending behavior over the past two years.

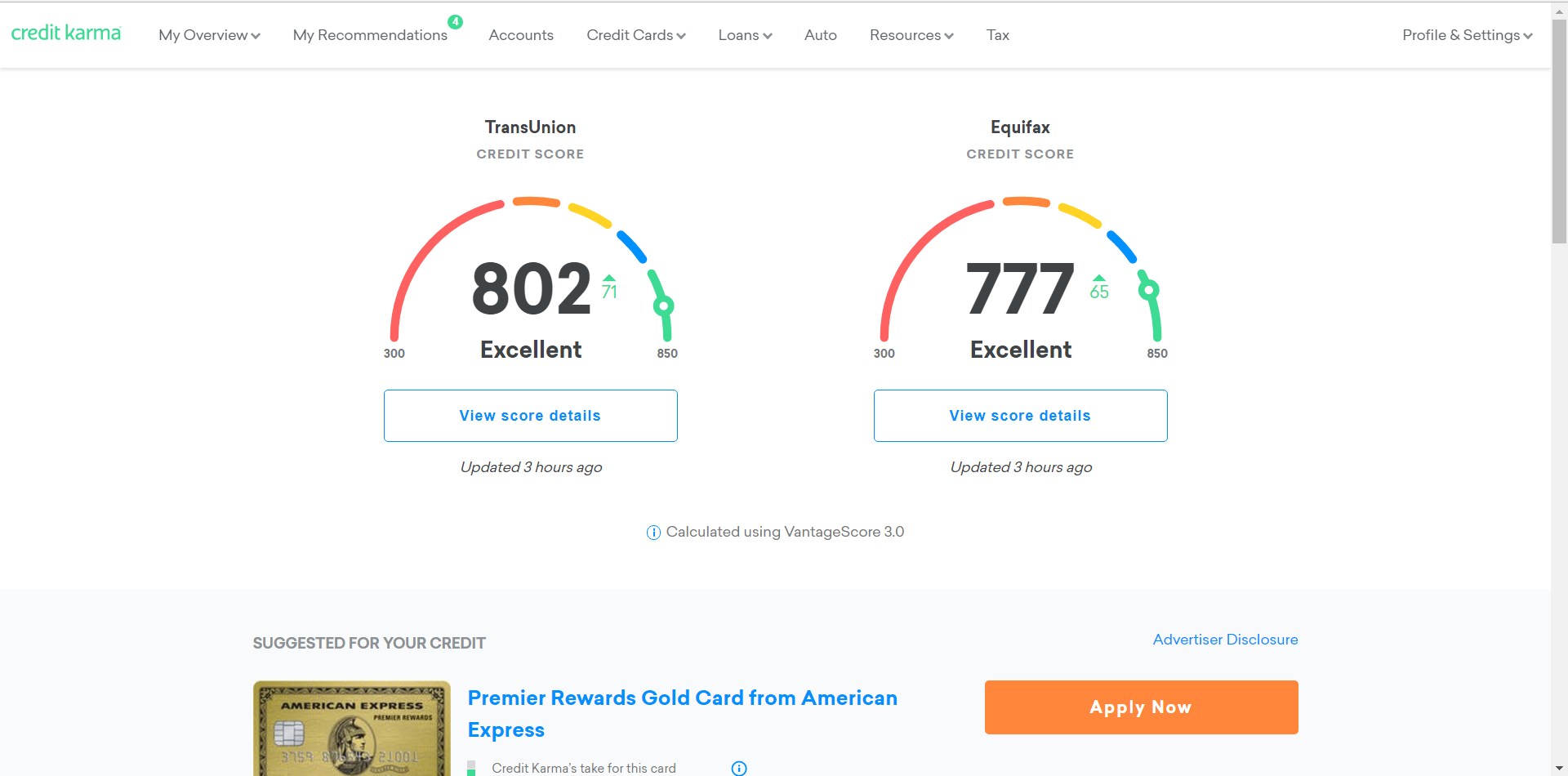

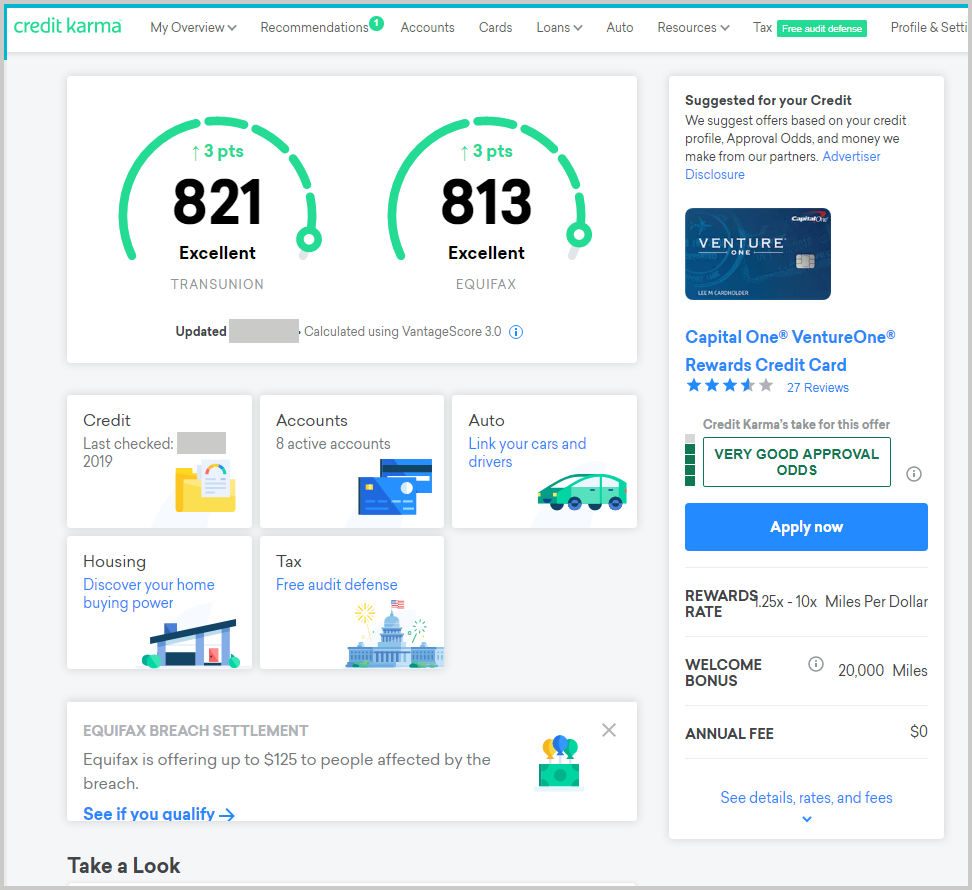

Why Are My Credit Karma And My Fico Scores Different

VantageScore and FICO are the two big rivals in the credit rating business. Credit Karma uses VantageScore. Their models differ slightly in the weight they place on various factors in your spending and borrowing history.

On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Check Your Credit Score For Free With Credit Sesame

Credit Sesame offers a truly free credit report. You will not have to provide credit card information. Also included:

- Free credit monitoring

- Access your credit score daily

- Data encryption the same 256-bit system used by banks

- Privacy protection

- Optional Sesame Cash Digital Debit Account

- User-friendly app with over 300,000 five-star reviews

There are many sources of free credit reports, and they have varying degrees of accuracy. To recap:

- There is no one credit score. Most consumers have dozens of credit scores.

- It takes two items to generate a credit score a report from a credit bureau and a credit scoring model.

- There are industry-specific scoring models geared to sectors like auto financing, mortgages, or credit cards.

- Educational credit scores for consumers are not used by lenders to make underwriting decisions.

- Educational credit scores and reports can tell you what information lenders are seeing and how your credit scores are trending.

All three credit bureaus house your credit data and all three offer free and paid services. The right one for you depends on how closely you want to monitor your files and how much you want to pay.

Read Also: What Is The Highest Credit Score You Can Have

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO. FICO stands for Fair Isaac Corporation, the biggest competitor in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

VantageScore and FICO are both software programs that calculate credit ratings based on consumers’ spending and payment history. FICO is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer , Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most frequently used base model and which of its many versions is used.

The key point is that your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

How To Get Your Equifax Credit Score For Free

Like Experian, Equifax offers a free 30-day trial of its full credit monitoring service. It costs £7.95 a month after the free trial.

Alternatively, you can get your Equifax report and score free through ClearScore.

The company makes its money from commission on products you take out via its website.

Don’t Miss: How To Clear A Default On My Credit Report

Our Credit Reporting Review Summed Up

| Company Name |

|---|

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Credit Reporting: FreeCreditReport.com, Identity Guard, Experian, MyFICO, TransUnion, Identity Force, Lex On Track, Nav Credit Reporting, Credit Karma, FreeScore360.com, and MyScoreIQ®.

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don’t click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process,

How To Choose A Credit Monitoring Service

Start by evaluating why you need a credit monitoring service. For example, if youre already a victim of identity theft, choose a company that monitors all three of the major credit bureaus. Likewise, select a provider that offers high identity theft insurance coverage and additional features like dark web scanning.

Needs vary, but consider these general factors when choosing a credit monitoring service:

Recommended Reading: What Is The Lowest Possible Credit Score

Points Difference From The Truth

I got my credit checked today. I was thinking that all was good and all but when I found out that the Experian app was lying to me – I decided to write a report when the app ask me if I enjoyed the Experian app I hit the button that said no. The next prompt was would you like to give feedback, so I hit yes I started my speak with manners of course. I started my lecture the same I was thinking that my credit was good because that is what the app was portraying or reflecting -that I had a good rating. Well in fact it was 40 points lower! Bummer right! So I hade been believing a lie all this time! I almost got threw with that sentence and the app kicks me out and I have to sign in again!! So I sign in again and to see if it saved my heart breaking story. No its not there and there is not a button to give a survey that I can find! So I call for the help line and am greeted by a computer animation voice and choices it gives me 5 options and then tells me to call back a a convenient time! I fell like Someone was reading my text and didnt want me to finish telling the truth about this app telling sweet little lies! Be careful for they speak out both sides of their mouth! Liers

How Does A Credit Monitoring Service Work

A credit monitoring service works by having the user set up their profile, verify their personal informationincluding current address, date of birth, Social Security number, etc.and create a secure password-protected account. The user gives the credit monitoring service permission to monitor their credit and alert them when any activity occurs. Some credit monitoring services monitor all three credit bureaus, while other companies may only monitor one or two.

Don’t Miss: What Is Credit Score Out Of

How Accurate Is Creditwise Credit Score

It is smart to monitor your credit score, as this lets you plan for major loans, check for fraud, and track your financial health. But how accurate is the popular CreditWise service from Capital One?

Take a closer look at how much accuracy you can expect from CreditWise. You will also learn more about the other features that CreditWise includes, why you should care about your credit score, and how to improve it.

What Is A Credit Report

Your credit report is a collection of account history from companies youve created a credit account with or companies your creditors have designated to collect on their behalf. The information in your credit report helps new creditors and lenders decide whether to do business with you and the appropriate cost to charge you.

Also Check: How To Check Credit Score Without Affecting It

Equifaxs Credit Score Range

Equifax credit score model uses a numerical range between 280 and 850, while FICO and the latest VantageScore models use a range between 300 and 850. What is a good Equifax credit score? Anything 660 and higher.

Here are the Equifax credit score ranges:

- Poor: 280-559

| FICO® Bankcard Score 10 | FICO® Bankcard Score 10 |

All three bureaus provide a free credit report each year to consumers through the governments annualcreditreport.com website.

However, Equifax is the only one of the three bureaus that created a proprietary credit scoring model for educational purposes.

TransUnion offers free continual access to a VantageScore credit score and TransUnion credit report if you sign up for credit monitoring and fraud prevention services for $24.95 per month. Accessing your report does not generate a hard inquiry and it does not hurt your credit scores.

Experian offers a free credit report and FICO 8 score using Experians data if you sign up for its free basic credit monitoring. If you sign up for Experian CreditWorks Premium , you get access to FICO scores using reports from all three bureaus and Experians FICO 2 score, which mortgage lenders use.

What Do Credit Score Apps Do

Credit scoring apps let you check one or more of your credit scores. Depending on the app, you may have access to a FICO® Score or VantageScore® credit score, the two main consumer credit scoring models. The score will be based on your credit report from one of the three credit bureaus: Experian, TransUnion or Equifax.

Some apps will offer you access to multiple credit scores based on a single credit report, or scores based on more than one of your credit reports. It’s normal for information in your credit reports to vary, which can lead to different credit scoreseven when the same scoring model is being used.

Because you might not know which report and score a creditor will check, getting a score based on credit reports from each of the three credit reporting agencies may be helpful. However, your FICO® Score and VantageScore credit scores tend to move in tandem, so if you’re looking to get a general sense of where your credit is at, tracking one score may be enough.

In addition to letting you track one or more credit scores, a may:

- Send notifications if there’s a suspicious change in your credit report or score.

- Explain the main factors impacting your score.

- Offer suggestions on how to improve your score.

- Let you check your credit report.

- Come with or offer identity theft monitoring services and insurance.

You May Like: How Does A Credit Card Settlement Affect Your Credit Score

Age And Type Of Credit

This is different from the FICO model because account history and the types of credit are two of the three least important factors for FICO. One of the big differences for the VantageScore Model is that it does not consider closed accounts when determining the age of your accounts. FICO will continue to count your closed accounts until 10 years after they are closed.

So your average age of accounts will often be significantly lower with the VantageScore Model. This is why people like me who have opened up and closed a lot of cards have a significantly lower VantageScore Model Score than FICO the average age of our accounts is significantly lower and it carries more weight.

What Affects My Credit Score

Your score will ultimately be based on how responsibly you use your credit facilities.

For example, you lose 130 points with Experian if you fail to pay a bill on time but will gain 90 points if you use 30% or less of your credit card limit.

Like lenders, each credit reference agency has its own system for assessing your creditworthiness and will take into account different factors when calculating a score.

However, certain things will have a negative impact on your score regardless of the agency – for example, not being on the electoral roll, or making a late payment.

Bear in mind that the timing of entries in your report is more important than the type of activity.

Lenders are most interested in your current financial circumstances, so a missed payment from a few years ago is unlikely to scupper your chances of getting credit.

- Find out more: how to improve your credit score

You May Like: How To Check Equifax Credit Score

The 6 Best Free Credit Reports Of 2022

- Best for Credit Monitoring:

- Best for Single Bureau Access:

- Best for Improving Credit:

- Best for Daily Updates: WalletHub

AnnualCreditReport.com makes it simple to review your Equifax, Experian, and TransUnion credit reports all in one place.

-

Reports from three major bureaus available

-

No account requirement

-

Only accessible once a year

-

No credit score access

In 2003, a Federal law passed granting every consumer the right to a free report from all credit reporting agencies each year. AnnualCreditReport.com is the centralized site that allows every consumer to access their free credit report granted by Federal law.

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus Equifax, Experian, and TransUnion at no cost. You can obtain one free credit report every 12 months through AnnualCreditReport.com, without signing up, creating an account, or entering your credit card information. Alternatively, you can call 1-877-322-8228 to order your legally free credit report.

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

Also Check: How Can You Get A Bankruptcy Off Your Credit Report

How Accurate Is The Equifax Credit Score

The accuracy of any credit score depends on the completeness and correctness of the data being analyzed. Credit scoring models have more similarities than differences, and if you apply all scoring models to the same set of data, your scores should be similar.

You tend to see greater differences among scores when scoring models are applied to different databases. For instance, FICO 5 works with data from Equifax, while FICO 2 pulls in data from Experian and FICO 4 uses TransUnions database. The results from FICO 5, 4, and 2 may vary because all creditors dont necessarily report to all three bureaus. TransUnion might have information about a late payment when Experian doesnt.

Another reason that scores might vary is that creditors dont always report to each bureau at the same time. So each bureau might show a different balance on the same account, and that can impact your credit utilization and your credit score.

The Equifax credit score is an educational credit score. Educational credit scores have been shown to differ significantly from those that lenders use to make underwriting decisions. According to the Consumer Financial Protection Bureau , educational credit scores sold by credit bureaus to consumers differ from those used by lenders by a meaningful amount about 20% of the time. Meaningful means the two scores would have resulted in different underwriting decisions or loan pricing.

Mycredit Guide From American Express

American Express also offers a free credit tool to everyone customers and those who dont have an Amex account.

Just like Capital One, Amex pulls their information from TransUnion and provides a score based on the VantageScore 3.0 scoring model.

The MyCredit Guide also offers you various credit monitoring tools for helping you improve your credit including alerts, goal settings, and a credit score simulator.

While the service is completely free, Amex does not offer a dedicated mobile app, although you can access the MyCredit Guide tool via their mobile website.

Read Also: How To Remove Negative Info From Credit Report