Which Credit Bureau Is The Most Important For Rent Reporting

There is no clear favorite which credit bureau is the best for reporting rent payments. The major credit reporting bureaus have rent reporting options. These are:

- TransUnion ResidentCredit

- Experian RentBureau

- Equifax

What should you do if your credit reports show different scores? The two major credit scoring companiesFICO and VantageScorerate rent payment information differently.

The most commonly used FICO score doesnt include rental payment information.

However, newer versions of FICOFICO 9 and FICO 10include rental payment history in your credit report. VantageScore also includes rent payment information. Therefore, ensuring that your credit history is based on the latest credit scoring models is vital.

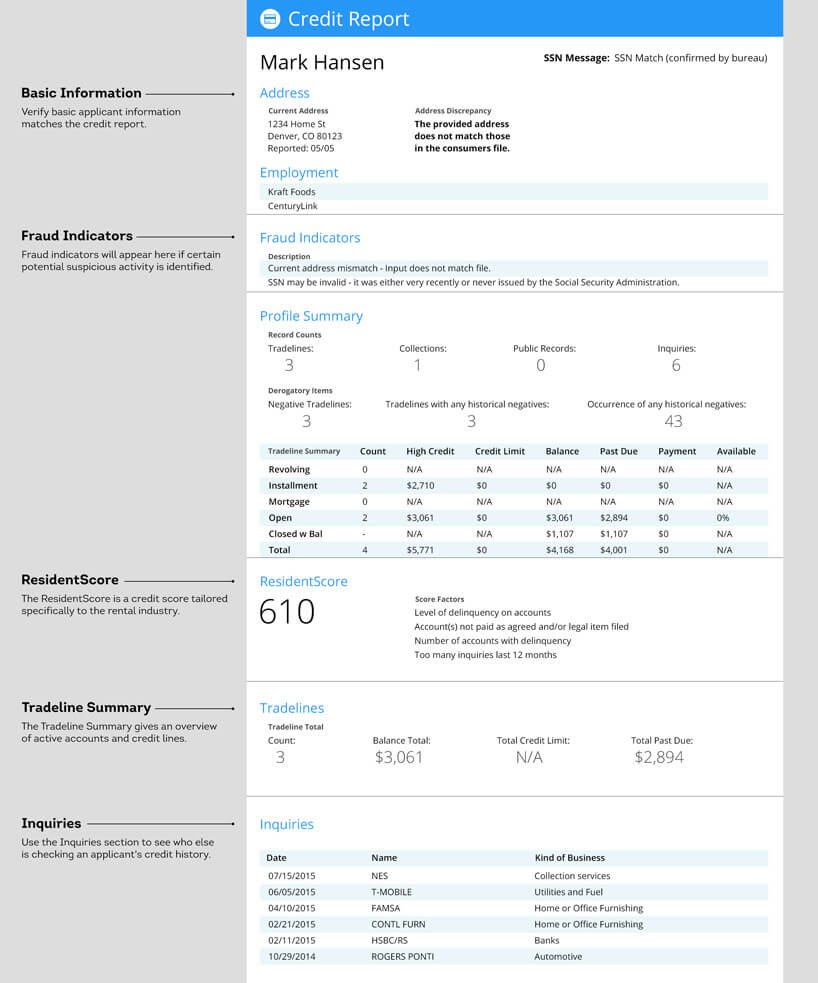

Can Tenants Provide A Copy Of Their Own Credit Report

Tenants who are applying for more than one rental will be understandably dismayed at the prospect of paying each landlord to pull the same credit report. To avoid paying multiple times, they might obtain their own report, make copies, and ask you to accept their copy. Federal law does not require landlords to accept an applicant’s copythat is, you may require applicants to pay a credit check fee for you to run a new report.

State laws might differ, though: For example, Wisconsin forbids landlords from charging for a credit report if, before the landlord asks for a report, the applicant offers one from a consumer reporting agency and the report is less than 30 days old. .) Consider consulting a local landlord-tenant attorney to find out your state’s laws regarding tenant screening and credit checks.

Why Its Important To Report

If youve managed to get rid of a problem tenant, you might not immediately be thinking about reporting them to the big three credit bureaus. After all, your problems are over. Even if you lost some money, why would you want to spend more time on dealing with the same tenants again?

Ultimately, the main reason that you would want to report bad tenants to credit bureaus is to ensure that they are not able to easily cause the same distress to another landlord without due warning.

Sure, you might be able to finally get the money that you are owed when you hire a collection agency or tell the tenant that youre going to be reporting them, but it is difficult in most cases. The good of doing this lies in the fact that irresponsible tenants can be appropriately punished and revealed through this report.

While the report is only a small change that reveals a single bad tenant, it can help to protect another trusting landlord just like you.

Also Check: Is 650 A Good Fico Score

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Crbc Verifies Payments & Reports Credit

After your account is established with CanRentBuildCredit.com, you will pay your rent through our online portal. Once the funds have been received, we will verify that the funds meet or exceed the amount due for your monthly rent. Then, we report to all three of the national credit bureaus: Experian, Equifax, and TransUnion. This can show on your credit report in as little as 7 days.

Note: Processing payments through our system can take up to 5 days. We suggest that all renters make payments a minimum of 5 days before the past due date.

Read Also: What Mortgage Company Uses Factual Data

Does Paying Rent Late Affect Your Rental History

A copy of your credit history shows up with your rental history. So, this means that your rental history can be packaged with your missed rent payments, late rent payments, and any other infractions. Of course, this is only possible if the landlord reports you to the credit bureau.

Wondering how a negative rental history can affect you? Well, if you have a history of being irresponsible with rent, then it’s likely any future landlords will think twice before approving your rental application. Unsurprisingly, landlords prefer tenants who can demonstrate consistent on-time payments over an applicant with even just a single late payment.

This means that, unfortunately, it really doesnt matter if you had amazing credit up until that point a single late payment can easily knock you out of the running for future apartments.

But don’t despair a missed rent payment doesnt mean you wont be able to rent ever again. Plenty of landlords will overlook bad rental history as long as you can explain what happened. And perhaps provide a guarantor, like a co-signer or a substantial security deposit.

The Positive: Reporting On

When you regularly report rental payments to the credit bureau, most of these payments will be standard, on-time payments. When the credit bureaus receive this information, it shows that a positive tradeline is active on the account.

If credit reporting is something that you are thinking about doing, its important to learn about the benefits for yourself and for your tenants. With this information, you can build stronger relationships with all of your tenants.

Recommended Reading: How To Print Your Credit Report From Credit Karma

Services You Can Use To Report Rent Payments

Theres not a direct way for you to report rent payments to credit bureaus yourself. Instead, you can use one of the many reporting services which send information about your monthly payments to credit bureaus. Before signing up for a reporting service, make sure you know how much youll pay and which credit bureaus the service reports to.

What Can I Do If I’ve Paid Rent Late

The first thing you need to do is bring your account up to date as soon as possible. The more you put it off, the more the late rent can damage your credit score.

If youre going through a tough time, your landlord may understand the situation and grant you an extension. You can even try to convince them to remove the black mark from your credit report if you have a good rapport.

However, it goes without saying that the best way to avoid all of these issues is to prioritize rent in the first place. We strongly suggest setting up an automatic bank deposit plan if you tend to be forgetful!

Don’t Miss: 623 Credit Score Credit Card

Motivate Tenants To Pay On Time

Reporting rent payments to credit bureaus gives Landlords an advantage. When Tenants understand that timely payments increase their credit score and late or missed payments decrease it, they have a powerful incentive to keep their end of the rental bargain.

Renters know that, as easily as they can build credit each month, late or missing rent payments can weaken their credit file. Those Tenants may soon find themselves being passed over or paying more for housing and other necessities.

When Landlords report rent through FrontLobby, their delinquencies decline by 36%.

Landlords end up with more responsible Tenants. In turn, this also translates into fewer instances of property damage.

Rent Reporting Encourages Tenants To Pay Rent Online

Providing rental payment reporting is one of the best ways to get tenants to pay rent online. Of course, the easiest way to do this is to use a dedicated rental payment app that incorporates rent reporting. But using an app for rent payments has more advantages. For example, tenants can set up recurring payments, and landlords can block a partial payment.

Even though tenants can use digital payment apps like PayPal, Zelle, and Venmo to pay rent online, these platforms have significant disadvantages. First and foremost is that there is no way to report rent. So, if you are using a digital wallet for rent collection, it may be best to consider an alternative.

You May Like: How To Get A Repossession Off My Credit

Can A Landlord Ruin Your Credit

Just because you’ve missed rent payments, it doesn’t mean your landlord will automatically report you to the credit bureau. This is where your relationship with your landlord and the rapport you’ve built comes into play. For example, if you’ve been paying on time for years and have been an exceptional tenant, your landlord is more likely to be sympathetic to your circumstances and not report a late payment.

Of course, not all landlords will care what your situation is, especially if you’re consistently late on your payments and have built up rent arrears.

There are cases where a landlord might use a rental payment service that may automatically report the late rent or rent defaults to the credit bureau. It’s also likely that they’re liable to report you if the house is part of a property management company, as they might have various policies on late payment.

We recommend you ask for clarity around the issue of late payment before you sign a lease on a place, especially if you know you’re going to have a rough time ahead financially.

Add Rent To Credit Reports

In a welcome new development, the major credit agencies now accept rent payment history from Landlords. That history gets included on a Tenants consumer credit report.

For Tenants, this is a game-changer. Tenants want their rent payments reported. Their positive payment history improves their credit records, giving them access to attractive amenities and money-saving financing rates.

Landlords benefit too. Landlords and Property Managers know how heavily regulated the rental industry is. When Tenants default on their rent, Landlords must go through a long and costly legal process to remove the Tenants and capture missed payments. Late payment fees are prohibited or limited and often ineffective as a deterrent.

But Landlords who report rent payments to credit agencies see a higher incidence of on-time rent payments. This means less time spent chasing down Tenants, collecting late fees or filing evictions.

Read Also: Lowes 0 Financing For 18 Months

Does Paying Rent Build Your Credit Score

Your credit score is a number that tells lenders if you usually pay your bills on time, are able to keep your credit card balances low, and are able to manage different types of credit, among other key factors. So, when you make on-time payments, your credit score may improve or remain the same if it is high. Based on your credit score, lenders may be willing to extend new credit or a loan to you.

The latest versions of VantageScore® and FICO® Score use rental payments that land on your credit report as elements to generate your credit score.

Donât Miss: How To Check Credit Rating

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: Ccb Credit Inquiry

Why Report Rent Payments

Good credit is the cornerstone of financial health.

All of that is about to change. The major credit bureaus now accept rent payment history from landlords and include that history on the individual renters consumer credit report. This means you can now add rent to credit reports. This is a game-changer for tenants, who can now see improvement in their credit reports. That unlocks a multitude of savings and benefits, allowing access to the best financing rates and the best amenities. It is no wonder that 68% of renters surveyed would choose a landlord who reports rent payments.

Landlords Who Report Rent See Fewer Delinquencies

Good credit builds over time and requires a mixture of credit accounts. The traditional way to build credit is to take out a credit card, springboard that into a car loan, and eventually take the step of securing a long-term mortgage. As credit matures, consumers benefit by qualifying for the best interest rates and financing terms, making it easier to build wealth.

But more tenants today are staying in the rental market, either as a lifestyle choice or because mortgages are more difficult to obtain and housing is becoming more expensive. Over time, those renters fall behind homeowners who benefit from making monthly mortgage payments, forcing tenants into a downward spiral of spending more of their income on interest and fees to access credit lines.

Best Rent Reporting Services In 2021

Summary: Not all rent reporting services are created equal. We review ten rent reporting options and how to choose the right one for you.

On-time rent payments can boost your credit score, but only if you take action to place them on your credit report. Rent reporting companies can help you do that.

All three credit bureaus will include rental payments in credit reports if they receive that information. They usually wont get it from your landlord. Credit bureaus charge a fee for reporting information, and landlords dont want to pay it.

A rent reporting service can record your on-time payments and boost your credit score. Many will report up to two years of previous payments. You will pay a fee for this service, but if you have a thin credit file and youre trying to establish credit, it may be worth the cost.

Also Check: Does Wells Fargo Business Secured Credit Card Report To Bureaus

Fill Vacancies Faster By Reporting Rent Payments

Savvy landlords who sign up with credit reporting bureaus find it easier to attract new tenants. Studies show that when given a choice between two similar apartments, but one landlord offers to report rent for free, most tenants will choose the one that includes rent payment history in credit.

Its good to note that only around 20 percent of landlords offer a rent payment reporting service. Therefore, you set yourself apart from the competition in the local rental market. Rent reporting could become your USP to attract more tenants to vacancies.

Why Renters May Struggle To Establish Credit

Even for Tenants who always pay their full rent on time, Landlords have not had the means and tools to report rent payments to credit bureaus. This has deprived renters of a major opportunity to raise their credit score.

Today, more Tenants than ever are staying in the rental market. This is partly for lifestyle reasons and partly because of higher housing prices and tougher criteria for obtaining mortgages. Over time, these renters fall behind homeowners, whose mortgage payments get recorded by credit agencies. Many of these Tenants descend into a downward spiral of spending more and saving less, as they use much of their income to pay not only rent, but also the interest and fees associated with less desirable credit cards and loans.

But now, with support from Landlords, Tenants have a liberating new way to improve their credit score.

You May Like: Can A Closed Account Be Reopened On My Credit Report

California Senate Bill 1157

So, what exactly does the bill do? Simply stated, California SB 1157 requires operators of multi-family units in California that receive federal, state, or local subsidies to offer each resident in a subsidized apartment home the option of having their rental payments reported to major credit bureaus.

SB 1157 will require landlords managing assisted housing developments with more than 15 units to report rent to at least one of the national credit bureaus. In addition, any multi-family rental housing development that receives governmental assistance is considered an assisted housing development and will be required to follow the new law for any lease agreements signed after July 1, 2021. Those agreements must include the offer to report rent payments. For leases already in effect, the offer of rent reporting had to be issued by October 1, 2021. The offer must include the following:

When the offer of rent credit reporting is made, the landlord needs to provide the tenant with a self-addressed, stamped envelope to return their written election of rent reporting. SB 1157 is in effect until July 1, 2025, and allows landlords to report FICO 9, FICO 10, and VantageScore 3.0 and 4.0 credit scores.