Navy Federal Credit Union Personal Loan Review: Long

4 days ago How Does Navy Federal Credit Union Compare to Other Lenders? vs. Wells Fargo vs. Discover Personal Loans vs. Citizens Bank

Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free

When you obtain your auto loan, Navy Federal Credit Union reports your new loan to the credit bureaus. Your Navy Federal Credit Union loan shows up as a so Does Navy Federal Credit Union report to the credit bureaus?Does Navy Federal Credit Union have a grace period?

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Positive Features To Keep In Mind

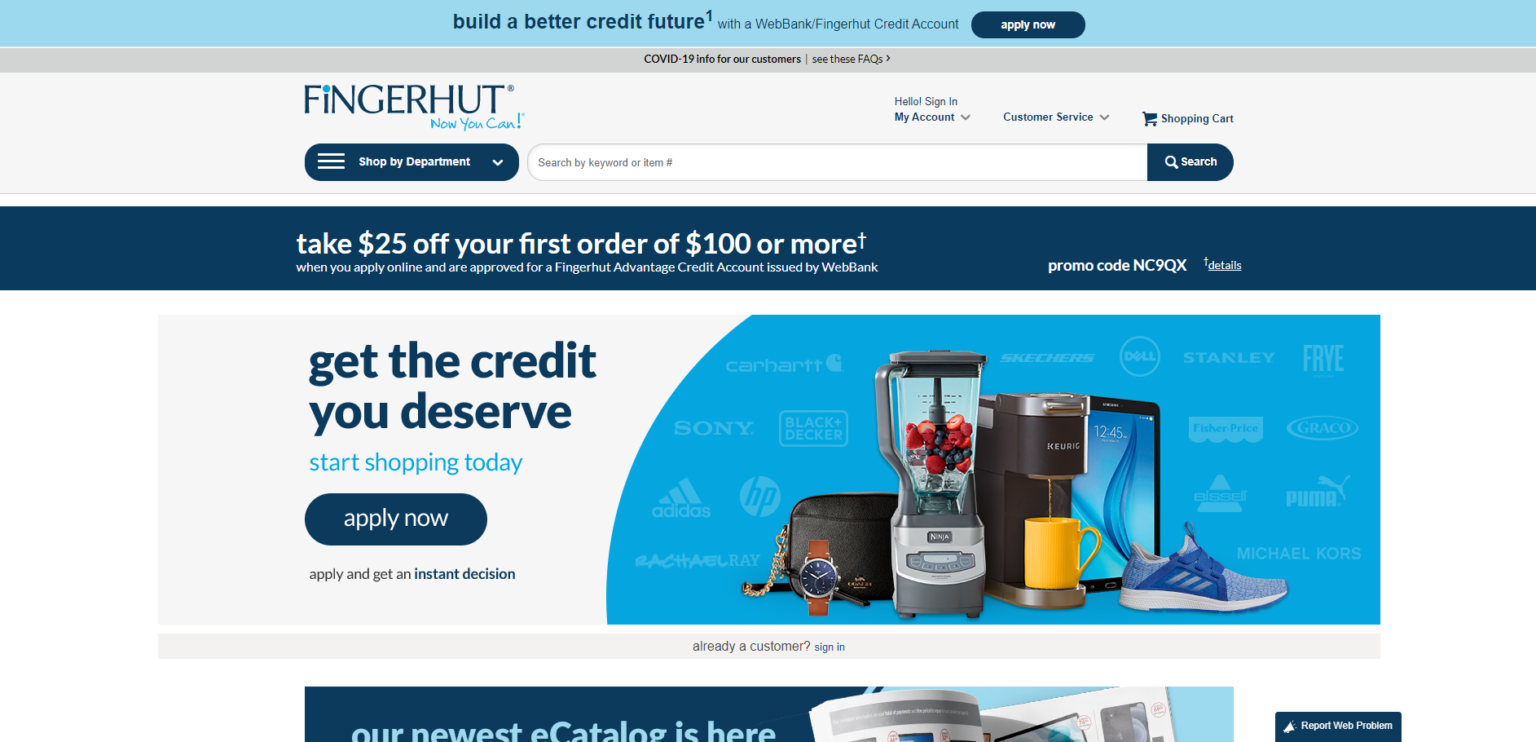

Besides offering a high likelihood of getting approved, a WebBank Fingerhut Advantage Credit Account does have a handful of other beneficial traits:

-

No annual fee.

-

Fingerhut credit can be used at select partnerships with other retailers, like florists and insurance companies. For example, at the time of this writing, you could use your Fingerhut account to make a purchase at Teleflora.com at the same prices available to the general public.

-

According to the Fingerhut website, on-time payments will be reported to all three major credit bureaus, which means good payment behavior can help your credit scores. If you consistently pay your bill in full and on time, you could eventually qualify for a credit card that you can use anywhere, not just at Fingerhut.

-

There’s no penalty on the WebBank Fingerhut Advantage Credit Account for paying off your balance ahead of schedule.

You May Like: How To Report Tenant Late Payments To Credit Bureau

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Does Aarons Report To Credit Video Tutorial

For our lovely reader, we provide a handy movie to provide you with a simple tutorial how to put in writing a good does aarons report to credit. The sample below could a just guide when you are no cost to change it based on your difficulties. So, appreciate viewing!

Perfectly, it is all about does aarons report to credit. We hope it can be practical for any small business functions you may have. Thanks for reading through and see you shortly!

Read Also: How To Remove Something From Credit Report

Is Stoneberry Like Fingerhut

Stoneberry is fairly similar to sites like Fingerhut in the sense that it offers a wide range of credit-related features for its customers while also offering a large catalog of products to choose from. The fact that this site offers low monthly installments makes this among the best Fingerhut alternative out there.

You May Like: Unlocking Credit Report

Netspends Account Opening Requirements

Unlike credit and debit cards, Netspend does not require a Social Security Number to open an account.

The company only requires a name, address, and email address to enroll on its website. Then, you create a username, password, and security question. Once you complete these two steps, you receive a card in seven to 10 business days. You can begin to fund the account at any time.

Both credit cards and traditional debit card accounts require applicants to provide a Social Security Number and date of birth. Companies that offer these types of accounts run credit checks prior to approval, which often determines the amount of credit they can provide. They can report this information to credit bureaus whether they approve the account or not.

Since NetSpend accounts are prepaid by the cardholders own funds, a reportable offense would be rare. The company could possibly contact a collections agency if you use the purchase cushion of up to $10 with its NetSpend Premier card and dont pay it back.

Also Check: Does Sprint Report To Credit Bureaus

Does Fingerhut Do A Hard Credit Check

Yes, Fingerhut will do a hard credit check if you want to open an account with them. The good news is that you can apply even if you have bad credit or no credit at all. Unlike traditional credit cards, Fingerhut caters to consumers with poor credit as long as they have a steady income and are not involved in a debt settlement or bankruptcy proceedings.

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Read Also: Does Capital One Report To Credit Bureaus

Does Zzounds Do A Credit Check View Your Merged Credit Report Scores Start Getting Past & Present Credit

Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present Credit

Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present CreditDoes Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present CreditDoes Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present Credit

View Your Merged Credit Report Scores. Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present Credit Does Zzounds Do A Credit Check Try a 30 Day Free Trial Start Getting Past & Present Credit

How To Remove Negative Items From Your Credit Report

Amarilis YeraNorma RodríguezAndrea AgostiniTaína CuevasAmarilis Yera26 min read

Your is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

You May Like: Does Credit Score Affect Car Insurance

Which Stores Accept Fingerhut Credit

Fingerhut plays it close to the vest when it comes to identifying other places you can use its credit account. You have to own an account before you are offered deals from selected partners.

However, Fingerhut is forthcoming enough to mention that florists and insurance companies are two prominent types of selected partners. At one point, Telefora.com was a Fingerhut partner, but these designations can change over time.

The Fingerhut Credit Account is closed loop, meaning it can only be used at the issuing store and selected partners. The account is not associated with any of the major payment networks .

Although the Fingerhut Credit Account is closed loop, it allows you to purchase a wide array of goods and services from the online website or the printed catalog. The ease of obtaining a Fingerhut Credit Account is somewhat counterbalanced by higher prices at this retailer compared with the prices at competitors such as Amazon.

I opened up a Fingerhut account to help my credit score. They have numerous items you can buy and while yes, some of them are a little higher than you can get in stores, this does help build your credit. My score has gone up because they do report to the credit bureaus. I would highly recommend checking them out. Credit Karma Reviewer

Fingerhut Credit Accounts Backstory

Fingerhut was founded in 1948 by Manny and William Fingerhut. The company got its start by selling seat covers for cars, later expanding its product line and moving into selling its products through catalogs.

Fingerhut partnered with WebBank to offer the Fingerhut Credit Account to help customers finance purchases.

Read Also: What Credit Report Does Capital One Use

Does Stoneberry Check My Credit

Stoneberry Credits prequalification process includes just a soft credit check, so it wont impact your credit score. However, after you make your first order with the retailer or one of its brands, your new account is subject to final credit approval. Stoneberry will perform a hard credit check to determine if you qualify for the line of credit.

How Does The Fingerhut Credit System Work

Fingerhut credit accounts are divided into two categories:

Advantage Credit Account with WebBank/Fingerhut.

WebBank has issued a Fingerhut FreshStart Installment Loan.

When you apply for credit on the Fingerhut website, youre applying for two accounts at the same time. You wont know which one youve been accepted for until you submit your application.

Youre applying for both accounts when you submit a credit application on the Fingerhut website. If you dont qualify for the WebBank/Fingerhut Advantage Credit Account, youll be automatically considered for a WebBank Fingerhut FreshStart® Credit Account. You wont know which one youve been approved for until after youve submitted your application.

Both lines of credit are provided by WebBank and are designed to allow you to purchase Fingerhut products and pay for them over time with a 29.99 percent APR. Thats the extent of the resemblances.

The WebBank/Fingerhut Advantage Credit Account is a joint venture between WebBank and Fingerhut.

The WebBank/Fingerhut Advantage Credit Account is a closed-loop store credit card, which means you can only use it to shop at Fingerhut or authorized partners. Ill get to that later.

The following are some of the highlights:

- There is no annual fee.

- Purchases have a 29.99 percent interest rate.

- A $38 fee will be charged for late or returned payments.

On your first purchase, you may or may not be required to put down a deposit. Youll never know unless you apply.

There is no annual fee.

Don’t Miss: How Long Does Chapter 13 Stay On Credit Report

Can Fingerhut Build Your Credit

The Fingerhut Credit Account reports your payments to all three of the major credit bureaus, Experian, TransUnion, and Equifax. This gives you the opportunity to build or rebuild your credit, but it depends on you.

The Fingerhut Credit Account will report your payment history, which will help you build your credit score.

If you pay your bill on time and pay at least the minimum amount due each month, your credit score should increase over time. Keep in mind that you must do this consistently one missed payment can undo all your progress.

On the other hand, if you are delinquent paying your bill, you may go into collection. This can devastate your credit score and will remain on your credit report for seven years. In other words, your creditworthiness determines the impact on your credit score.

By the way, the Fingerhut FreshStart® Installment Loan does not report your payments to the credit bureaus. However, if you repay the loan on time, you can graduate to the credit account, which will report your payments.

The Fingerhut Credit Account can help build your credit score in another way. Over time, you may have your credit limit increased by Fingerhut. If you use only some of your credit, you will maintain a low , which helps boost your credit score.

Fingerhut Credit Review: Easier Credit Access But With Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you’re looking for a way to buy something and pay it off over time, but your credit isn’t great, you may have considered shopping with Fingerhut.

Fingerhut is a catalog and online merchant offering thousands of products ranging from electronics to bedding to auto parts, all available to buy and finance through the company’s own credit line. The retailer caters to those with less-than-stellar or nonexistent credit history, so applicants might have better odds of approval with Fingerhut than they would with some major issuers.

But unlike other you can only use Fingerhut credit to purchase items from the company’s offerings or authorized partners. You’ll also encounter steep prices and interest rates, so make sure you understand what you’re getting with a Fingerhut credit line.

Read Also: Can A Closed Account On Credit Report Be Reopened

What Is The Flexshopper Personal Shopper

Sometimes you have your heart set on a certain item that you dont see anywhere on the FlexShopper site. When this happens, you can use the FlexShopper Personal Shopper to order items from alternative merchant sites. FlexShopper works with merchants such as Amazon, Best Buy, Dicks Sporting Goods, and Overstock.com. Simply browse your favorite shopping site, select items you want to rent, and select shipping or store pick up options. Youll pay for these goods using your FlexShopper leasing plan.

Recommended Reading: How To Calculate Credit Score From Report

Other Ways To Build Credit

While Fingerhut offers a great way to build credit, there are alternatives if you dont want to pay the fees.

- Become an authorized user

If you have a close family member with good credit, ask to be an authorized user on a credit card. You dont have to use the account, but if your family member uses it and pays the balance on time, youll get credit for the proper use of the credit card, especially the on-time payments.

- Try Experian Boost

Experian Boost helps increase your Experian credit score . It connects to your bank account and tracks payments made to your cable, streaming services, and utilities. If you make your payments on time, you get credit for the payments on your Experian credit score.

- Apply for a secured credit card

If you want a credit card you can use anywhere, try a secured credit card. Your credit line is equal to the deposit. If you miss a payment, the credit card company keeps your deposit, so theres no risk for them.

Look to alternative credit building sites like Perpay.

You May Like: Is 817 A Good Credit Score

Fingerhut Credit Account Reviews

You may have considered shopping with Fingerhut if youre looking for a way to buy something and pay it off over time but your credit isnt great.

Fingerhut is a catalog and online retailer that sells thousands of items ranging from electronics to bedding to auto parts, all of which can be purchased and financed using the companys own credit line. Fingerhut caters to those with a poor or nonexistent credit history, so applicants may have a better chance of approval than they would with some major lenders.

However, unlike other credit cards for people with bad credit, you can only use Fingerhut credit to buy things from the companys store or authorized partners. Youll also come across high prices and interest rates, so make sure you know what youre getting when you get a Fingerhut credit line.

Fingerhut is an online retailer that sells a variety of products such as clothing, home goods, and electronics. It also has a store credit card that allows customers to shop online and through catalogs.

If youve been turned down by other credit card companies due to poor credit, Fingerhut might be a better option. Fingerhut reports to all three major credit bureaus, so responsibly using your card can even help you improve your credit score.