How Do I Remove Delinquency From My Credit Report

1 To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.Submit a Dispute to the Credit Bureau.Dispute With the Business That Reported to the Credit Bureau.Send a Pay for Delete Offer to Your Creditor.Make a Goodwill Request for Deletion.

Can I Leave The Country With Debt

If you move abroad with unpaid credit card debt, your creditors may send you to collections or file a lawsuit against you. … Credit card debt usually cannot be recouped outside of the country. But that doesn’t mean the debt ceases to exist. It could even make it harder to establish residency in a new country.

What About Delinquent Accounts

While delinquent accounts are tough to remove from your credit report, Ive know others successfully remove these negative accounts.

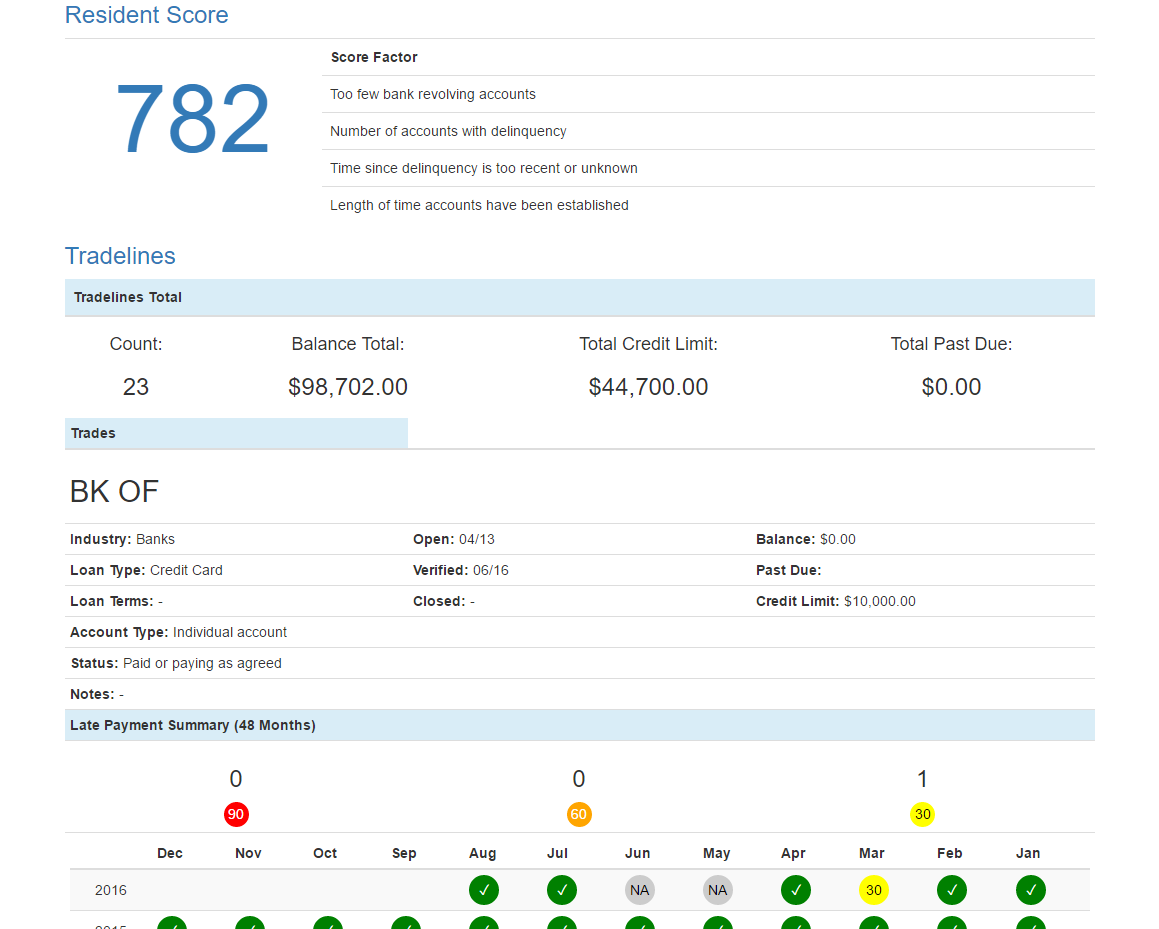

If you have delinquent accounts on your credit report, theres no question that theyre hurting your credit score. These accounts can lower your credit scores 10-40 points per account.

Needless to say, if you can get them removed, you can see a big boost in your scores. Easier said than done, but you do have a few options to help you.

Also Check: Does Klarna Affect Your Credit Score

Dispute By Mail Or Phone

It’s fast, free and easy to manage a dispute online, but if you’d prefer to dispute by mail or phone you’ll find instructions below.

To complete a dispute by mail, provide as much of the following information as possible:

- Personal Information: Name, DOB, Address, SSN

- Name of company that reported the item youre disputing and the partial account number

- Reason for your dispute

- Any corrections to your personal information

Send your documents to:

Please note: We accept either standard or certified mail.

How Do I Remove A Delinquent Account From My Report

As previously stated, delinquent accounts are typically removed seven years after the date of the original delinquency. Even if the debt is sold to a collection agency, the original date of delinquency is normally when you defaulted on the original creditor. Unfortunately, these accounts dont always disappear on schedule, so you may have to put in a little extra work to take them off.

If you realize that a reported delinquency wasnt removed when it shouldve been, you should retrieve a copy of your credit reports from the three major credit bureaus.

The credit reports might not be identical, so its a good idea to know if the delinquency hasnt fallen off one or all of them. If you believe a credit bureau has included a delinquency that is inaccurate or outdated, you can file a dispute with the credit bureau.

Read Also: How To Remove Repossession From Credit Report

Get A Free Copy Of Your Credit Report

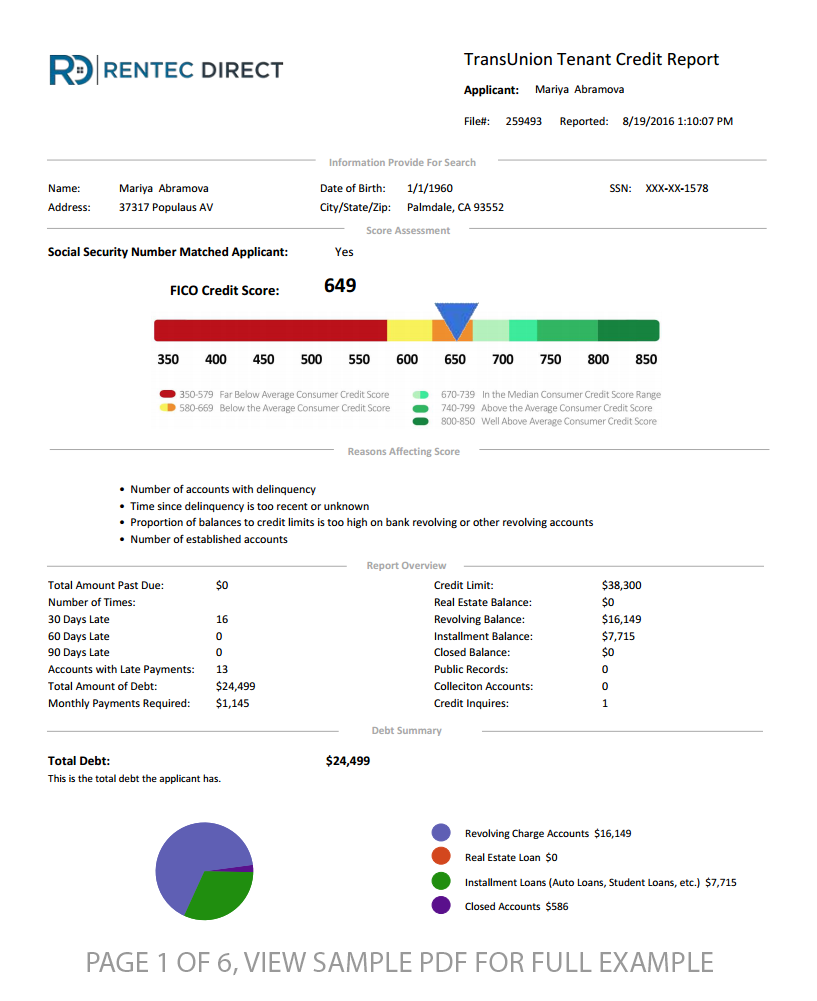

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Dispute The Company That Reported To The Credit Bureau

Now, you do have the opportunity to completely bypass the credit bureau and dispute directly with the company that reported the bill/mistake to the credit bureau, such as the credit card issuer, bank, lender, or debt collector.

You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

If the company determines that the error on your credit report is their fault, they must notify all the credit bureaus of that error so your credit reports can be corrected.

Also Check: Cbcinnovis Hard Inquiry

Ways To Remove Old Debt From Your Credit Report

Having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

How To Remove Delinquent Accounts

First things first, is the delinquent account yours? If it is a mistake, you need to file a dispute with the credit scoring company its filed under.

Theres only 3, its either Experian, Equifax or Transunion. Youll need to create an account online through their websites to file a dispute or you can call them via the phone.

If you have credit monitoring accounts with Credit Karma, you can start to file a dispute from their platform. If the past charge is your responsibility, youll need to contact the company to get it took care of.

You need to see which company added the delinquent account to your credit report. Youre going to need to get the companys name, amount of the bill and their phone number.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for.

To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Does Delinquency Hurt My Credit Score

If your debt remains delinquent for long enough, it will eventually appear as a derogatory mark on your credit report. This generally happens after three or four months of delinquency, and it may coincide with your credit card issuer deciding to cancel your credit card. A derogatory mark will do even more damage to your credit score and might prevent you from getting loans or top credit cards in the future, so do your best to pay off your delinquent credit card account before it has the chance to become derogatory.

What If The Information Is Rightbut Not Good

If theres information in your credit history thats correct, but negative for example, if youve made late payments the credit bureaus can put it in your credit report. But it doesnt stay there forever. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years.

Don’t Miss: Does Opensky Report To Credit Bureaus

Send A Letter To The Reporting Creditor

You also want to send a similar letter to the creditor whos currently reporting the debt.

To do this, either reframe your credit bureau letter with copies of your documentation to the creditor or simply send a copy of the same letter with copies of any documents included. Avoid making statements that could restart the debt clock if the statute of limitations has not expired.

As with the credit bureau, send the letter certified with a return receipt requested. The creditor has 30 days to investigate your claims and respond.

Why this is important: Depending on who your creditor is, it may be faster to work directly with it to get your old debt off your credit report.

Who this affects most: Those with older debts with more established companies will benefit from contacting the original creditors. You may find it easier to work with larger, more established creditors than with smaller collection agencies.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: Experian Unlock

Make A Goodwill Request For Deletion

With pay for delete, you can use money as the bargaining chip for getting negative information removed from your credit report. If youve already paid the account, however, you dont have much-negotiating power. At this point, you can ask for mercy by requesting a goodwill deletion.

In a letter to the creditor, you might describe why you were late, state how youve since been a good paying customer, and ask that the accounts be reported more favorably. Again, creditors dont have to comply and some wont. On the other hand, some creditors will make these deletions if you talk to the right person.

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Don’t Miss: What Credit Score Does Carmax Use

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Also Check: 888-826-0598

The Basics Of Business Credit Reports

Your business credit report only includes debts that are under your companys federal tax identification number also known as an employer identification number. Any personal lines of credit that you have are not listed on the report. This is true even for business credit cards that are still listed in your name.

Information that is present on your trade credit report is voluntarily sent to the reporting bureaus from the businesses that own the debt. This means some lines of credit may not be listed on the report.

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

Recommended Reading: How To Get Credit Report Without Social Security Number

Why Doesn’t The Dollar Amount On My Public Record Match The Balance Due

The dollar amount reported on a public record does not reflect the balance due rather, it is the total amount owed prior to any payments. The amount reported on the public record remains the same regardless of whether payments are being made. However, if the item has been paid, it should reflect Paid Civil Judgment if a paid Judgment, or Released if a paid lien.

Dispute With The Lender

Once you know that theres an incorrect late payment on one or more of your credit reports, its time to contact the lender who reported it.

If this is a credit card issuer, this may be as simple as calling the number on the back of your card, or checking our list of . Otherwise youll need to look up the appropriate contact information to call your lender.

You may have success simply by calling and notifying them of the error. They might check their own records, see the mistake, and take steps to rectify it.

In other cases, the lender may request proof that you didnt make a late payment, i.e., proof that you made a timely payment for the billing period in question. A letter containing a copy of a bank statement showing the payment, or some other kind of documentation, may be able to satisfy a creditors request for proof. If your lender is satisfied, it will fix the error.

As a template for this letter, check out our sample letter to a credit bureau below. Youll have to change some of the information to send it to your lender instead of a credit bureau, and youll also have to adjust some of the text based on what they tell you on the phone. But this should give you a good starting point.

If the lender agrees that the delinquency is an error, get it in writing. Get a written verification that the late payment was a reporting error by the lender, and not your fault.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

If Your Credit Reports Contain Errors Or Outdated Information Heres How To Dispute Those Items With The Credit Reporting Bureaus

By Amy Loftsgordon, Attorney

A “credit report” is a detailed record of how you’ve managed your credit over time. Credit reporting agencies, like Equifax, Experian, and TransUnion, collect data from creditors, lenders, and public records to produce the reports. The agencies then sell the reports to current and prospective creditors, and anyone else with a legitimate business need for the information. For example, lenders use credit reportsor the that results from the data in itto help them decide whether to grant you credit and, if so, under what terms. The better your credit report, the more likely your credit request will be granted, and the lower your interest rate will be. Many landlords, employers, and insurance companies will also consider your credit history when making a decision.

So, your credit report is either a valuable asset or a liability, depending on its contents. The Fair Credit Reporting Act requires credit reporting agencies to adopt reasonable procedures for gathering, maintaining, and distributing information. It also sets accuracy standards for creditors that provide data to agencies. Even with these safeguards, credit reports often have errors and inaccuracies.

In this article, you’ll learn:

What Is A Delinquent Credit Card Account

In the credit card industry, any account past due is a delinquent account. But many creditors wont report an account as delinquent to credit bureaus until at least 30 days after the missed due date. And if youve previously had a clean payment history, your creditor might not report the delinquent account until after two consecutive missed payments.

Additionally, there are multiple levels of delinquency that may be reported on your credit reports. A debt can be reported as 30, 60, 90 and then 120 days late. Multiple delinquencies or a longer period of delinquency can affect your credit scores much more negatively. For example, your credit scores could drop as much as 125 points after numerous missed payments are posted to your credit reports.

Also, even after youve fully paid off these debts, the missed payment information on your credit reports may still remain for up to seven years, signaling potential irresponsibility to future creditors. So its usually in your best interest to fulfill at least the minimum payment due each month, and, if you do end up with delinquent accounts, to eventually pay those off, especially if theyve gone into collections.

Read Also: Does Balance Transfer Affect Credit Score