Balancing Your Credit Mix

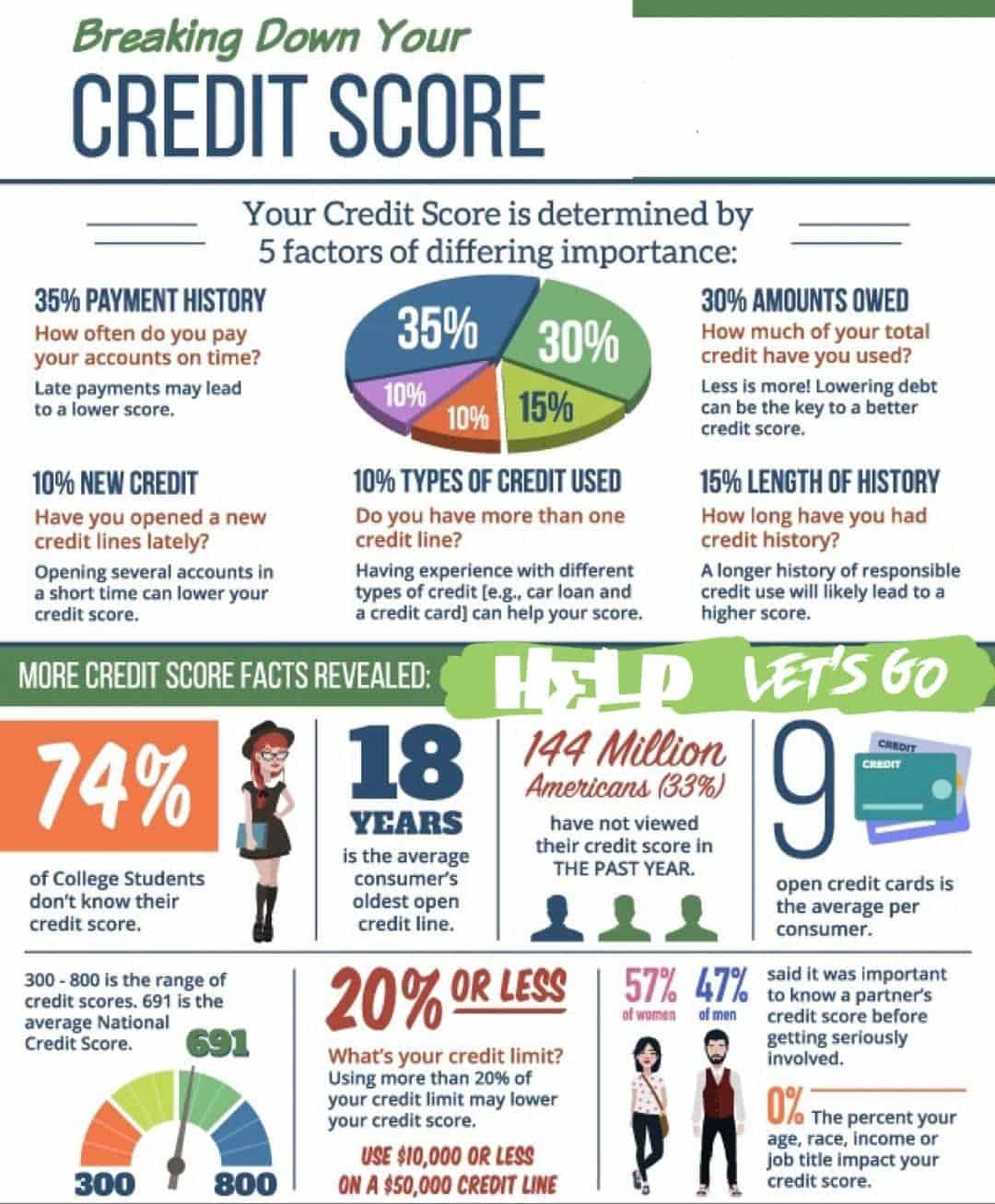

If your credit mix, which accounts for 10% of your FICO Score, is nothing but revolving credit, it could negatively impact your credit score. Getting an auto loan into the mix may help increase your score slightly.

This can result in a quick score improvement, as it takes effect as soon as the new loan shows on your credit report. However, the improvement will be slight because it accounts for just 10% of your credit score.

How A New Auto Loan Can Impact Your Credit

Does it actually matter whether your new loan shows up on your credit report? It might. If you’re building or rebuilding your credit, a new auto loan can help you out in a few ways.

First, it adds to your . A car loan is considered an installment loana loan with fixed monthly payments and a predetermined payoff periodwhich is a different type of credit than a revolving credit card account. Having a car loan appear on your report shows creditors that you have experience managing diverse types of credit. It may also boost your credit score: Credit mix accounts for 10% of your FICO® Score, the scoring system used most commonly by lenders.

Your credit score will also benefit from having timely monthly loan payments show up on your credit report. Payment history is the most heavily weighted factor in calculating your score, so you want your monthly payments to count.

What are some typical reasons your new auto loan might not appear on your credit report?

Financing A Car With No Credit

If you dont have a credit history, youre not alone. There are an estimated 45 million Americans who have little to no credit. It will require some work on your part, but it is possible to purchase a car with no credit. Here are the steps to take when looking for an auto loan with no credit:

Check your credit report

Your credit report contains the information that gives lenders insight into your borrowing history. A credit report includes your personal information and credit history. Consumer reporting agencies use this information to calculate your . Lenders rely on this score and whats in your credit report to determine whether to give you an auto loan.

Even if you dont have a credit card or havent borrowed money before, you should always check your credit report before trying to finance a car. Mistakes happen, and your credit report could contain erroneous information. If your credit report isnt accurate, you may be denied for a loan or receive higher interest rates.

There are three main credit reporting agencies: Equifax, Experian and TransUnion. Your reports from each may not match, so its important to review all three. You can receive free copies of your credit report from each bureau by visiting www.AnnualCreditReport.com.

Find your best no-credit loan

Start by establishing a budget and determining how much car you can afford. With that number in mind, you can begin investigating financing options from the following institutions:

Dealer financing

Online lenders

Read Also: When Does Discover Report To Credit Bureaus

Dont Be Afraid To Walk Away

Buying a car is often a very high-pressure sale that can impact your credit score significantly, either in a good way or bad. Thats why it is so important to do your homework and take your time, regardless of how much you want a car.

If you like a vehicle that costs more than what you can afford, dont accept a longer loan term to achieve cheaper monthly payments. If you accept longer terms on a car loan, you will pay more in interest over the life of the loan and may pay more for the car than its actually worth over time.

Cars do not appreciate in value like houses. Its often said they depreciate the moment you drive it off the lot. Keep in mind that if you do get a longer term loan and are forced to sell the car before you have finished paying off that loan, you still have to pay back the balance on the loan.

Your best bet is to walk away from a car you know you cant afford and find a comparable vehicle that costs less.

Re: Car Loan Is Not Reported On Credit Reports

@MovingForward_2012 wrote:It will hurt your score initially because it is a new account but as it ages, it will increase your score. I would try to get them to report if you can backdated to the beginning if you have never been late as it will show future lenders that you had this loan and paid it off never late. It will help your auto enhanced score on your next car.

Actually in this case the tradeline is already pre-aged, and it should be a straight boost.

Everything else is spot on, but I would absolutely atttempt to get it reported OP… certainly any positive tradeline I can get on my reports I want on there, and an auto tradeline is a good one to have.

Just be aware that the lender isn’t required to report by law, but try to get it done. Which lender is it?

Actually, last night I downloaded an iphone app called Credit Sesame which is based off of the Experian credit reports, and it was on there! However, I’m pretty sure I’ve checked my Experian report before and I don’t remember seeing it. Is it possible that it can get recognized by certain programs and not others?

It’s a really small company called EQ Finance.

Recommended Reading: Does Divorce Affect Credit Score

Shortening Your Length Of Credit History

When you add a brand-new car loan to your credit report, itll shorten your length of . The exact impact will depend on the age of your other accounts and how many accounts you have.

The negative impact can happen as soon as your loan is reported to the credit bureaus by the lender. Fortunately, since the length of credit history accounts for only 15% of your credit score, it likely wont have a significant impact.

Is There A Magic Number

Be sure to check your credit report a few months before applying for an auto loan to ensure its accuracy. If youre not sure where you stand, you can order a free copy of your credit report 3-6 months before applying for an auto loan. That way, if you need to improve your credit, youll have time to do it. Its a good idea even if you arent borrowing for your car purchase because credit scores can also affect your car insurance premium.

Don’t Miss: How Long Is A Collection On Your Credit Report

Why Dont My Payments Show Up On My Credit Report

The lenders also stop reporting the payments on that loan even though you are still making them. This explains why payments dont show up on credit reports. Is this fair? This doesnt seem fair, does it? Perhaps you filed Chapter 7 bankruptcy or Chapter 13 bankruptcy so that you could keep up on your house or car payments.

Why Does My Car Loan Not On Credit Report

The best lemon law attorney talks about Why does my car loan not on credit report. We lemon law attorneys offer a free legal consultation about Why does my car loan not on credit report. We know how tough it can be to have a defective or problematic car, truck, motorcycle, or appliance.

Generally, to learn more about Why does my car loan not on credit report laws, the best thing to do is to get a free consultation with a lemon law attorney. Through a lemon law case in California, an individual could win compensation from the automobile manufacturer.

We are lawyers for both Northern California and Southern California. We handle cases throughout California County. We offer a completely free consultation. Also, there is no fee unless we win.

You May Like: A Credit Score Tells A Lender How

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Dont Fret About The Temporary Drop In Points

As we said, active credit has a better impact on your credit score than past closed accounts. However, while your credit score may go down for a little while after you complete the loan, when you apply for future vehicle financing your past completed auto loan look great on your credit reports if you maintained a good payment history.

Because you paid off your car loan, it tells auto lenders that you were able to fulfill your obligations successfully. This means you probably have a higher chance of qualifying for future credit because youve proven your ability to repay loans.

Most auto lenders dont just consider your creditworthiness from your credit score, but your credit reports as a whole. This applies to subprime lenders as well, and theyre lenders that specialize in assisting borrowers with credit challenges. A past car loan that had a great payment history and was completed may mean more to a lender than your credit score, depending on the lender.

Read Also: How Long Does Student Loan Approval Take

You May Like: How Much Is It To Get A Credit Report

Your Lender Does Not Report To All Credit Bureaus

While many lenders report loan activity to all three credit bureaus, some only report to one or two. In fact, some lenders don’t report to credit bureaus at all. If your loan doesn’t appear on one of your credit reports, try checking the other two.

Ultimately, lenders are not required to report their accounts. But be aware: Just because a lender doesn’t report your loan and successful payment history, it doesn’t mean they can’t or won’t report negative information if your car is repossessed or you default on your loan.

Installment Loans Help Diversify Your Credit Mix

Buying your new car can also have the added benefit of diversifying your credit mix. If your credit profile consisted of revolving credit accounts before getting your car loan, the new loan payments could contribute to how lenders score your credit mix.

When lenders review your credit report they want to see different types of credit with good payment histories and a good credit score. A good credit mix can include:

- Other revolving debt

A healthy credit profile with various types of credit proves to a lender that you can responsibly manage multiple payments and due dates simultaneously.

Installment loans can also help you improve poor credit by consolidating high-interest credit card debt to one low monthly payment.

If you originally got your car loan at a higher interest rate due to low credit, you could refinance your auto loan to lower your monthly payments once your credit score has improved.

Don’t Miss: Can Anyone Check Your Credit Report Uk

How Credit Scores Affect Car Finance

There are several different types of car finance available if youâre looking to purchase a new vehicle,but whichever one you choose, an important part of the process will be getting a credit check. Financecompanies want to know about your credit history so they can evaluate how likely you are to repay yourloan. Below, we explain how your credit report affects your chances of getting car finance, thedifferent types of loan available and what to do if your application is rejected.

Why Was I Denied A Car Loan

Lenders frequently reject applicants because of credit score, credit history and overall debt.

- Errors in the application. You can be denied a loan due to simple errors in the application. If you miss a section or note information incorrectly, lenders may reject you without giving you the chance to update inaccurate details.

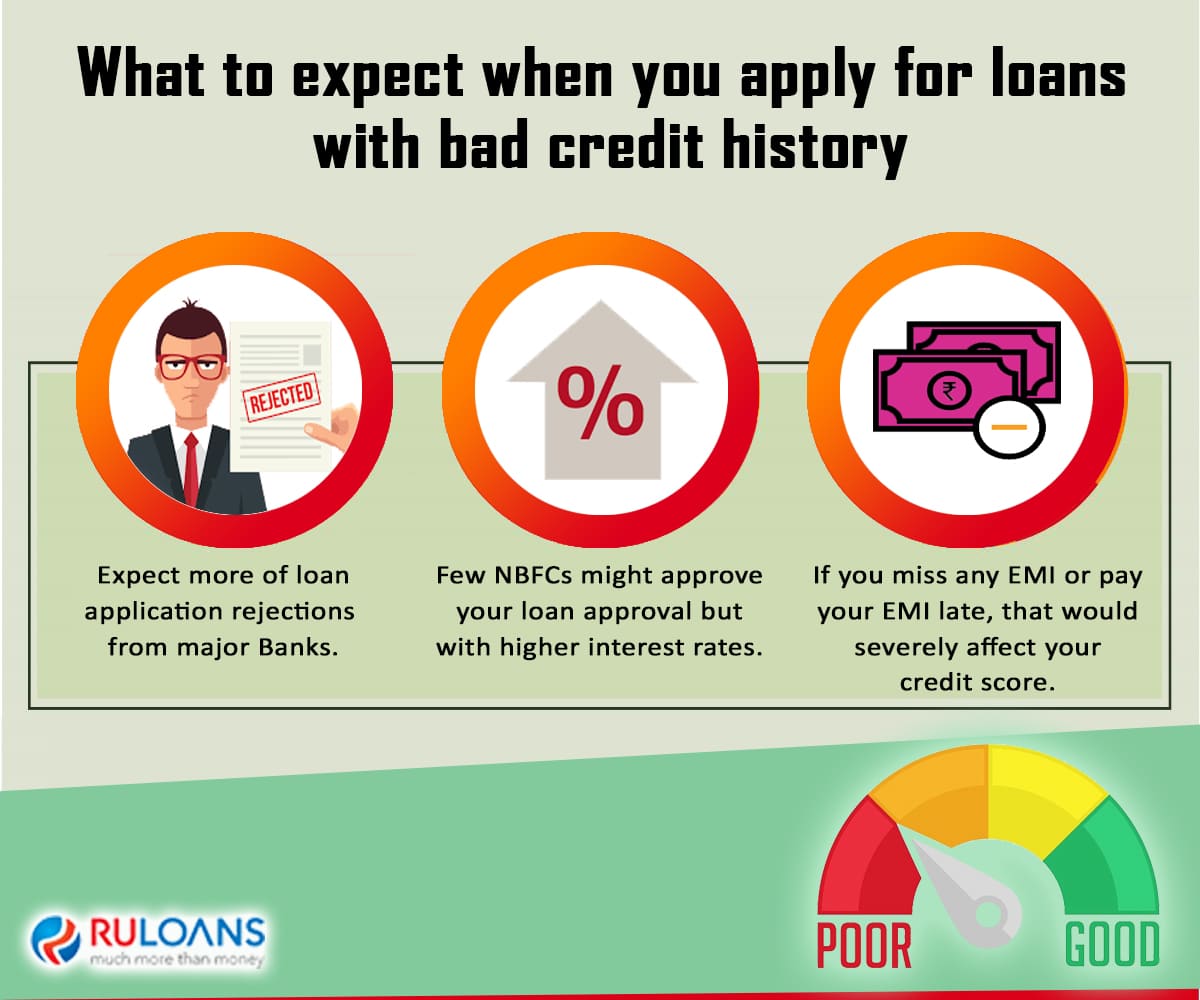

- Poor credit score. Most lenders have a minimum credit score as part of their eligibility criteria. There are auto loan lenders for bad credit. However, In general, lenders want to see fair credit a score of 620 or higher. If your credit score is lower than this requirement, you will immediately be denied.

- Limited credit history. If you have limited or no credit history, lenders will not be able to gauge your ability to make future auto loan payments. They may use it as a reason to deny your application.

- Large amount of debt. If you have a lot of debt gathered from other loans or credit cards, your DTI ratio or debt-to-income ratio will be higher. A DTI ratio of 50 percent or higher is considered a red flag and may lead to rejection.

Read Also: How To Get Creditors To Update Credit Report

Why Did My Credit Score Drop After Paying Debt

There are several factors that make up your credit score, and paying off debt does not positively affect all of them. Paying off debt may lower your credit score if it changes your credit mix, or average account age. Here are some scenarios that could negatively affect your credit score:

- You eliminated your only installment loan or revolving debt: Creditors like to see that youre able to manage various types of debt. And if eliminating a particular debt makes your credit report less diverse, it can negatively affect your score. For example, if you pay off an auto loan and are left with only credit cards, your credit mix suffers.

- Youve increased your overall credit utilization: Keeping the overall utilization of your available credit low results in a better score. But when you pay off a revolving line of credit or credit card in its entirety and close the account or let the account go inactive , it decreases the total amount of credit you have available, potentially increasing your remaining utilization rate.

- Youve lowered the average age of your accounts: The longer your accounts have been open and in good standing, the better. Having a 20-year old account on your report is a good sign, even if you dont use it closing that account and being left with accounts no more than five years old dramatically reduces the average age of your accounts.

You May Like: What Is The Housing Loan Interest Rate

What Is Voluntary Repossession

Voluntary repossession is a term used to describe when a consumer voluntarily surrenders property secured by a loan, such as a car or a motorcycle, to the lender that financed the purchase.

In other words, you bring the car back to the lender before they have to send the repo man to take it from you.

The real question are: WOULD they report it and CAN they do it? This is only a guess, but my guess is that they probably would not and likely can not.

I say this only because companies that report to the credit bureaus, also known as credit furnishers, have to agree to supply or furnish information to the credit bureaus on a consistent and routine basis.

If they dont meet that requirement, they get cut off by Equifax, Experian and TransUnion and can no longer act as suppliers of credit information.

It sounds like Chacon Auto is not registered as an authorized credit furnisher if they were, they would surely be reporting your payments.

Therefore, Im doubtful that they would automatically become one just to report your repossessed loan.

Again, this is only my opinion. Not fact or law. But I just wanted to give you some perspective. Now, I could be wrong, or maybe you can be wrong, and you didnt look at all 3 credit reports or something, and you didnt realize that they are in fact reporting your car payments.

So please dont take my opinion to mean go ahead and turn in your car because they probably wont report you!

Facebook Comments

Recommended Reading: Who Is Syncb On My Credit Report

Beware Of Buy Here Pay Here Financing

Some dealerships specialize in financing auto loans for people with no credit. When you dont have time to go through a traditional lender or dont have the money for a large down payment, financing through a buy here, pay here dealer may seem like the best option.

However, buy here, pay here financing is not always as rosy as it sounds and should be avoided when possible. Dealers know that your financing options are limited when you have no credit or bad credit, and they charge higher interest rates and car prices as a result. Some dealers even install tracking devices that may disable the vehicle if you miss a payment. Not every buy here, pay here dealer reports timely payments to the credit bureaus, so this form of credit may not help you build your credit history.

What Can I Do About Defaulted Student Loans

Once your student loan repayment plan begins, youâll have to make monthly payments by the due date, each and every month. Late payments usually result in fees and possibly other penalties, but not all late payments will appear on your credit report.

Federal student loans that are 90-days past due will be reported to the credit bureaus and appear on your credit report. A federal student loan payment thatâs been delinquent for 270 days will be reported as a defaulted student loan.

Private student loans donât have to follow the federal student aid guidelines. Private lenders will report late payments and default according to the loan terms, which the borrower accepts when taking out the loan. Private student loan payments can be reported as past due as soon as 30-days after the first missed payment. Private student loans are often reported as defaulted after 120 days of delinquency, but can be classified as in default after a single missed payment. When a student loan account is in default, the entire balance of the loan becomes due.

Don’t Miss: When Does Bankruptcy Fall Off Credit Report Canada