Using Apple Card With Apple Pay

Apple Card is designed to work with any other credit or debit card stored in the Wallet app for use with Apple Pay. You can set it as the default card and use it for in store purchases on iPhone and online purchases on Apple Watch, iPhone, iPad, and Mac.

You Spend Heavily In Specific Everyday Categories

You may pony up for a new MacBook Pro once every few years, but if your everyday spending is focused primarily on a specific area, other cash-back cards may make more sense. Maybe you have a large family and do the bulk of your spending on groceries and gas. The Blue Cash Preferred® Card from American Express earns 6% cash back at U.S. supermarkets, on up to $6,000 a year in spending 6% cash back on select U.S. streaming subscriptions 3% cash back at U.S. gas stations and on transit and 1% cash back on all other purchases. Terms apply . Or perhaps you hit the town regularly? The Capital One SavorOne Cash Rewards Credit Card earns 3% cash back on dining, grocery stores and entertainment, including streaming services, and 1% everywhere else.

Read through Nerdwallets full list of best rewards credit cards for more options.

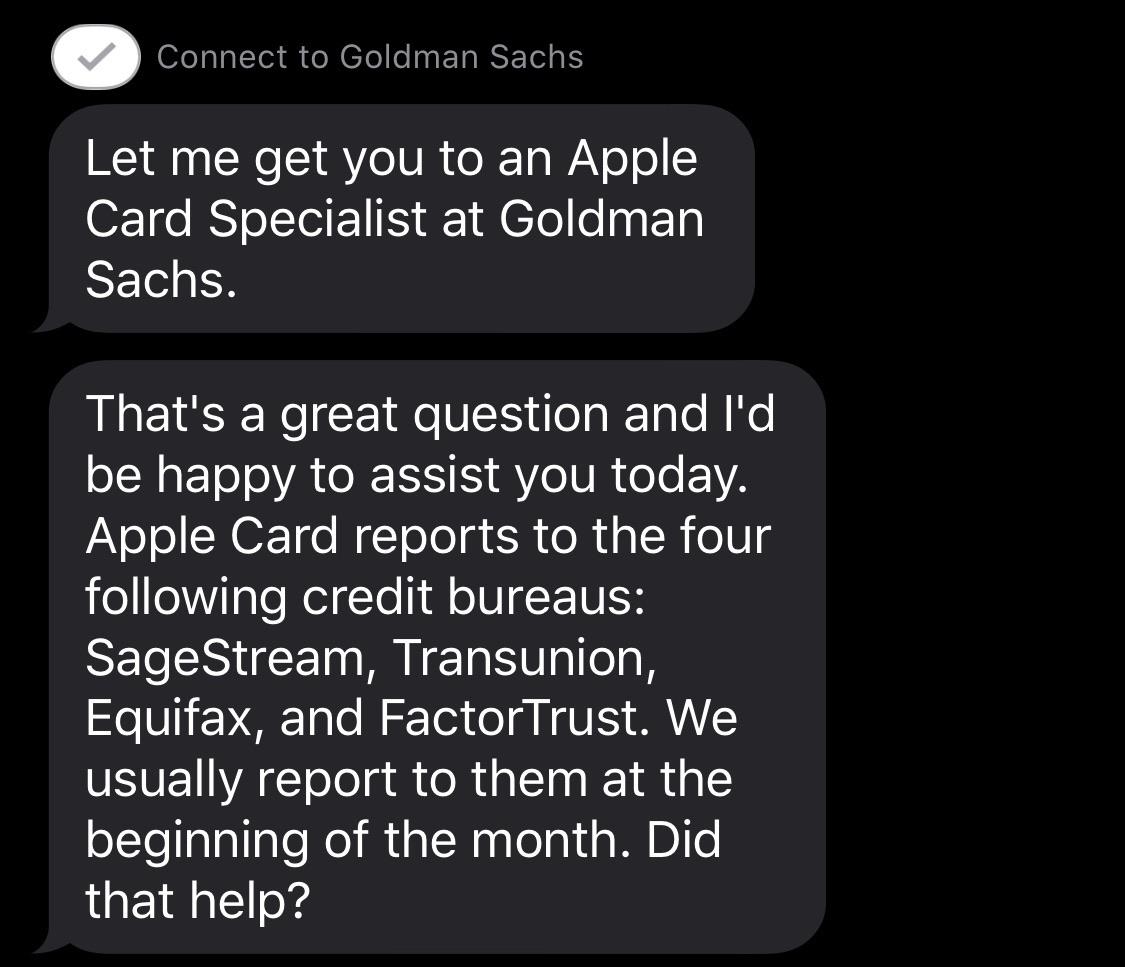

Whats The Mystery Behind Which Bureaus Are Used By Card Issuers

Ulzheimer, the credit-reporting expert, says he understands why some card issuers might balk at divulging which credit bureaus they rely on.

I can see some card issuers being hesitant to disclose which bureau they use for card underwriting because consumers are often coached to apply with a lender that pulls the credit report where their score is the highest. Its a rudimentary way to game the system, to some extent, he says.

This isnt national security. But they are certainly not required to disclose that information to a potential applicant, Ulzheimer adds.

A card issuer typically picks one report from one bureau when deciding on a credit card application, he says. Why? Pulling reports from all three credit bureaus for every application would be too costly.

Ulzheimer says a card issuer chooses a bureau based, in part, on what type of agreement it has with that bureau. These contracts almost always include a commitment to buy a certain number of reports from a bureau, he says.

Weve seen reports of Chase, for example, pulling from each of the three major credit bureaus depending on the borrowers home state, Opperman says.

In some cases, a card issuer might pull a report combining data from more than one bureau, although Opperman says this isnt a common practice among card issuers.

Weve seen reports of Chase, for example, pulling from each of the three major credit bureaus depending on the borrowers home state.

Melinda Opperman, president, Credit.org

Recommended Reading: Is 627 A Good Credit Score

About Sharing An Apple Card

If you want to share an Apple Card with trusted family members or friends, set up Apple Card Family and invite friends or family to share your account.

If you dont have an Apple Card, you can apply and if you are approved and accept your offer, you can set up Apple Card Family and invite friends or family.

You can also join a shared Apple Card account by getting an invitation from an account owner to co-own Apple Card. Once you receive the invitation, follow the onscreen instructions.4 You will be prompted to apply for Apple Card.

Make All Of Your Required Payments On Time

To complete this step, regularly make on-time payments on your loans and lines of credit to keep your accounts in good standing. This excludes medical debt. It also excludes any payment where youve agreed with the lender to suspend all payments for a period of time due to hardship. Your required payments must be reported as paid on your credit report until the date that you complete the program.

To help ensure that you make all of your required payments on time, you can set up autopay. When you dont make timely minimum payments on credit cards or loans, it can be reported as a negative event to credit bureaus. This puts your account in delinquency and lowers your credit rating.

If youre a few days late on a required payment, contact your lender immediately to see if making a payment will avoid past due or late credit reporting to the credit bureaus.

Also Check: Do All Judgements Show Up On Credit Report

Ways Apple Card Can Hurt Your Credit Score

- Using more than 30% of your allowed credit may hurt your credit score.

- Missing payments will also be viewed negatively on your credit report.

- Successive missed payments can lead to your card being frozen and unable to use.

- Several months of missed payment can cause your card to be written off as bad debt.

- If the debt on your Apple Card has gotten out of control, DoNotPay can help you minimize the damage.

Conditions That Might Cause Your Application To Be Declined

When assessing your ability to pay back debt, Goldman Sachs1 looks at multiple conditions before making a decision on your Apple Card application.

If any of the following conditions apply, Goldman Sachs might not be able to approve your Apple Card application.

If you’re behind on debt obligations4 or have previously been behind

- You are currently past due or have recently been past due on a debt obligation.

- Your checking account was closed by a bank .

- You have two or more non-medical debt collections that are recently past due.

If you have negative public records

- A tax lien was placed on your assets .

- A judgement was passed against you .

- You have had a recent bankruptcy.

- Your property has been recently repossessed.

If you’re heavily in debt or your income is insufficient to make debt payments

- You don’t have sufficient disposable income after you pay existing debt obligations.

- Your debt obligations represent a high percentage of your monthly income .

- You have fully utilized all of your credit card lines in the last three months and have recently opened a significant amount of new credit accounts.

If you frequently apply for credit cards or loans

- You have a high number of recent applications for credit.

If your credit score is low

Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application. If your credit score is low ,5 Goldman Sachs might not be able to approve your Apple Card application.

You May Like: How To Find Out Your Credit Score For Free

What The Apple Card Offers On Interest Rates Rewards

The Apple Card has a variable annual percentage rate of 13.24% to 24.24%, depending on your creditworthiness, and there are no annual fees, foreign transaction fees or late payment fees.

Overall, credit card interest rates have been trending higher and are now 18.17%, on average, according to CreditCards.com.

In addition to 3% back on Apple products, cardholders can also get 3% on purchases at Uber and UberEats, Panera Bread, Walgreens, Ace Hardware, T-Mobile, Nike, and Exxon and Mobil stations or 2% cash back on Apple Pay purchases and 1% cash back on everything else.

“If you want to keep it simple, the Apple Card would be a good option,” Rossman said.

For comparison, a generic cash-back card such as the Citi Double Cash Card can earn you 2% across the board and comes with an introductory rate of 0% for 18 months. After that, the variable APR jumps to 16.24% to 26.24%, based on your creditworthiness. There is no annual fee for Citi’s card either, but there are other fees, for foreign transactions, cash advances and balance transfers.

Although plenty of customers have had good experiences with the Apple Card, Goldman has been dogged by an influx of billing disputes, known in the industry as chargebacks, which prompted a recent Consumer Financial Protection Bureau probe into those issues.

Apple Card* Vs Blue Cash Preferred Card From American Express

Even if you dont mind using Apple Pay, the Blue Cash Preferred® Card from American Express may be a more rewarding fit if you spend a good chunk of your budget on groceries, gas and transit. It carries an annual fee of $0 introductory annual fee for the first year, then $95 . In return, the card offers the following rewards: Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases , 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations and on transit and 1% cash back on other eligible purchases. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit.

Dont Miss: How To Remove Repossession From Credit Report

You May Like: What Is 11 Sprint On My Credit Report

Re: When Does The Apple Card Report To The Cb

Apple does not do any mid-cycle reporting or early reporting of an “open card” before a statement generates….so it’s unlikely it will show up now since you were just approved. As you may know, the account statements on the last day of every month and admittedly, GS has been very slow since inception to report. Initially accounts weren’t updated for months. They have gotten better about reporting but no where near the same timeline as other FI’s. As an example, as of today…9/7…my account is showing it’s last update as July 31 and it wasn’t even done on that day…the update is dated July 31st but it truly didn’t show up until days later.

To answer your question, it’s inconsistent and likely won’t show up until mid-month of the previous months statement

How Apple Card And Apple Card Family Is Credit Reported

Learn how Apple Card reports your credit based on your particular role on the account.

Your credit report contains a detailed record of your credit history that is maintained by the credit bureaus. Information within your credit report can be used by lenders for evaluating your credit applications. If an account is reported to the credit bureaus, a lender must provide accurate information about your performance on the account. This includes whether you are paying your bills on time, how much of your available credit on the account is being utilized, and age of the account.

If you have an Apple Card account, this information is reported by Goldman Sachs Bank to each of the three major credit bureaus Equifax, Experian, and TransUnion1 on at least a monthly basis. Your Apple Card will appear as a separate trade line on your credit report labeled APPLE CARD – GS BANK USA or GS BANK USA. It may take up to 45 days from the time of activity for that information to appear on your credit report. Some personal credit monitoring services may take longer to refresh your information after the credit bureaus have published it.

If you choose to , it’s important for everyone to understand how they are uniquely reported based on their role on the account.

Read Also: What Is The Top Credit Score

Changes For The Spark Cash: Wont Report To Personal Credit

Effectively immediately, newSpark Cash Plus for Business cards will not report to your personal credit report, as originally learned by HelpMeBuildCredit and then confirmed to me personally by a Capital One spokesperson.

Note, however:

- Existing Spark Cash cards will still continue to report your business line to a personal report.

- All Spark Miles cards, for now, will continue to report to your personal credit.

- All Capital One cards, including these, may pull all three credit bureaus when opening an account. As far as I know, thats not changing

- This only applies to accounts in good standing. If your account is not in good standing , it will still report to your personal credit profile.

Its unfortunate that existing Spark Cash cardholders wont get the new benefit, but one possible strategy would be to open a new Spark Cash card now even if you already have one or a Spark Miles. You are allowed to have two of the same Spark card.

You can earn the cash on your new Spark Cash Plus and you can convert those into miles online. Or cash out as cash. Thats a benefit of having both Capital One Spark cards the ability to cash out at full value or convert to miles.

Its great to see that Capital One is hearing that people do care about this distinction and is moving to be more in line with all other issuers .

Also See:

Who Qualifies For The Apple Card

To get an Apple Card, you need to be 18 years or older and be a U.S. citizen or a lawful U.S. resident with a U.S. residential address .

An iPhone running iOS 12.4 or later is required to use the Apple Card, and it will not be available if you do not have an iPhone. Two-factor authentication must be turned on, and you must be signed in to iCloud on your iPhone with your Apple ID.

Also Check: What Is A Fair Credit Score

Apple Card: All The Details On Apple’s Credit Card

Apple in August 2019 released the Apple Card, a credit card that’s linked to Apple Pay and built right into the Wallet app. Apple is partnering with Goldman Sachs for the card, which is optimized for Apple Pay but will still works like a traditional credit card for all of your transactions.

There’s a lot of fine print associated with the Apple Card, so we’ve created this guide to provide details on what you can expect when signing up for the card. Apple Card has been available since 2019, and Apple is continuing to add new features. You’ll find everything that you need to know about Apple Card below.

Why Your Application Is Pending Or In Review

Goldman Sachs might need more time to review some applications, or request more information to verify your identity. After you apply, you are shown a message in Wallet app that will indicate your application is in review. Updates regarding your Apple Card application will be sent to the primary email address associated with your Apple ID.

Read Also: Is 670 A Good Credit Score

How Often Do Credit Reports And Scores Get Updated

The next logical question is, when your credit card issuer sends the information to a credit bureau, when does it appear on your credit report?

Generally, you can count on your information to be added to your credit report as soon as the bureau receives it. According to TransUnion, when the credit bureaus receive information regarding your accounts, they typically add it to your credit report right away.

Your credit scores are calculated based on the data in your report every time a creditor requests them. However, you probably shouldnt expect any dramatic changes every time your credit issuer reports your most recent payment. Building credit can be a lengthy process that requires patience, but if you pay on time every time, youll see the results.

Your credit score isnt guaranteed to change with every timely payment.

Brian Martucci, credit expert at Money Crashers

Credit scores update when the information used to calculate them changes enough to produce a different result, Brian Martucci, credit expert at Money Crashers, explains. In other words, your credit score isnt guaranteed to change with every timely payment.

That might not be the case with late payments. Whenever a delinquency appears on your credit file, it can significantly hurt your credit. The longer the debt goes unpaid, the more damage it can do to your scores.

See related: How long does a late payment stay on your credit report?

If Your Application Is Declined Because Your Identification Information Couldn’t Be Verified

Make sure your name, address and other information provided on your Apple Card application is correct. If you find inaccurate information, re-enter the information as needed.

If you are asked to verify with an ID, follow these steps:

After you complete these steps, submit your application again. If your application is declined again for the same reason, contact Apple Support.

Your credit score won’t be impacted if you’re declined, or don’t accept your offer. Your credit score might be impacted if your application is approved and you accept your offer.

You can apply for Apple Card again, but you might receive the same decision.

If you want to receive a different decision on your application when you apply again, you should review your credit report to see if you have conditions that might result in a declined application and then check for these common errors in your credit report.

*If the information on your ID doesn’t match the information you entered for your Apple Card application, try to apply again after you update your ID.

Also Check: What Credit Score To Get A Mortgage

How To Make Purchases Online

To use your Apple Card for mobile purchases, simply select Apple Pay at checkout. Double-click the side button on your iPhone to confirm the purchase, complete the authentication step and the transaction will process automatically. You can also make Apple Pay purchases on your iPad, Apple Watch or Mac.

Re: Apple Card Reporting

Im aware that they include the financed amount for Apple products in the utilization, Im just not seeing any updated balance for September. I read a few posts about people experiencing this late last year/early this year but was wondering if they were still having delayed or inconsistent reporting.

You May Like: What Date Does Capital One Report To The Credit Bureaus