Top Credit Repair Services For Removing Collections

can help consumers remove false information from credit reports and thus improve their credit scores. Incorrect information can include late payments that arent yours, or paid collections that are older than the seven years theyre allowed by law to be on credit reports.

Here are our top choices for the best services for removing collections from a credit report:

| $79 | 9.5/10 |

Sky Blue Credit Repair disputes 15 items five items per credit bureau every 35 days with customized disputes, re-disputes, and statute of limitation research on debt items. It also identifies untapped opportunities when reviewing credit reports to give customers practical advice on how to raise their credit scores.

Sky Blue Credit Repair offers a 90-day, 100% money-back guarantee on its $79 monthly plan.

Where To Send Your Dispute Letter

| TransUnions online dispute form |

Once youve filed your dispute, your creditor or collector will have 3045 days to provide information verifying the account. 1 If the information on record is incorrect or unverifiable, then the credit bureaus are legally obligated to remove it from your credit reports. 2

Should I Pay Debt Collectors Or The Original Creditor

If the debt is legitimately yours, knowing whom to pay can be confusing. Debt collection agency? Original creditor? Debt that has slipped into arrears often changes hands, sometimes more than once.

There are, essentially, three scenarios when a debt is unpaid and the consumer could be confused about who is being dealt with and who is getting paid.

You May Like: Who Can See My Credit Report

Stage : A Collection Account Is Created

Future lenders desire to see a full report of your credit management history before deciding whether or not to offer you a new extension of credit or a new loan. This credit history is something used again, if youre approved, to determine how much to charge you for financing.

The presence of any collection accounts on your credit reports, whether paid or unpaid, is indicative of elevated risk. This is very important information for a lender to know when reviewing your application for credit.

The Fair Credit Reporting Act allows for even paid collection accounts to remain on consumer credit reports for seven years from the date of default for this reason.

MoneyFactUsing a Credit Repair Company

Need to repair your bad credit after taking care of a collections account? You could use a credit repair company, but its likely wiser to do it yourself.

How To Get Collections Off Your Credit Report

Getting collection activity off your credit report can help you accomplish credit goals like improving your score or qualifying for certain types of loans. Though theres no one way to remove collections or guarantee youll get the exact outcome you are hoping for, its still good to know how to remove this information from your credit report whenever possible.

The good news is that its possible to remove this derogatory information, so heres exactly what you need to know about removing collections from your .

Also Check: How To Remove Disputed Accounts From Credit Report

Check Your Credit Report To Find Out Your Debt

Whether or not you’re paying off debt, it’s important to review your credit report regularly to ensure the information is accurate.

Inaccuracies are rare, but they can happen, so you’ll want to make sure to match up the balance and payment amounts with your own records. Also, look for accounts you don’t recognizeit’s possible that someone may have used your information to open a new credit account fraudulently, and you shouldn’t be liable for that.

If you find inaccurate, unsubstantiated or fraudulent information, you can file a dispute with the credit reporting agencies, which will investigate the claim and have the information corrected or removed if a discrepancy is found.

Paying down your debts is obviously an important step in ensuring your financial stability, and doing so reliably can help you build a healthy credit score. How much debt you owe is the second most influential factor in your FICO® credit score, and it takes into consideration your credit card balances as well as the remaining balances of your loans .

The only factor that’s more important than amounts owed is your payment history. That’s why it’s important to keep in mind that if you don’t make payments on your debts, it can damage your credit score. What’s more, late payments and collection accounts can remain on your credit report for seven years, regardless of if and when you get current on your payments.

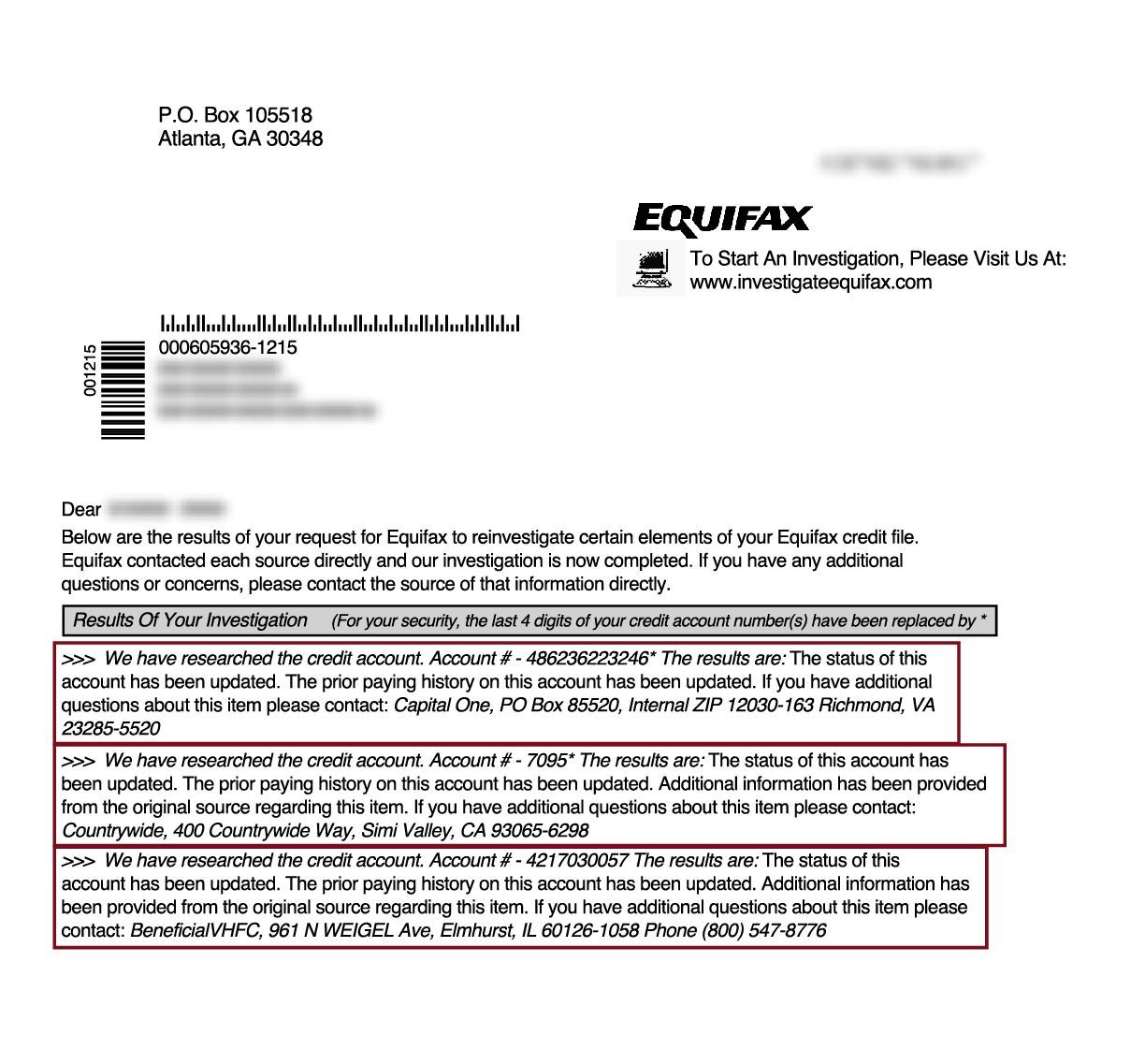

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

Read Also: What Is Revolving Debt On My Credit Report

How Do Debts End Up In Collections

First off, what exactly are collection accounts, and can you remove collections from your credit report? A collection account is a type of account that serves as an indicator of a previous failed payment, which the creditors have chosen to either sell to a collection agency or to a debt buyer. Either way, the collectors goal is to collect the debt from the debtor in full or in part. This collection is recorded on your credit report via the credit report agencies and stays there for up to seven years. In the meantime, you can try to remove the collections report, but that can prove quite difficult.

So, how does a debt end up in collection accounts on credit reports? If a debt is still unpaid 30 days after its due date it goes on record as delinquent. This is when the creditors start calling and reminding you that you have an unpaid debt. After 180 days of unpaid debt, the creditors have the option to sell that debt to a collection agency for a certain percentage of the entire amount. Since the creditors have sold your debt to a collection agency, it is the agencys job to send you notices about the debt and is the one that will collect it.

| DID YOU KNOW: According to Shelly-Ann Eweka, a wealth management director at TIAA, a great solution on how to get out of credit card debt fast is to personally contact the creditor and ask to set up some sort of payment plan that would work for both sides. |

Send Letters To The Credit Bureaus

If the debt really is too old to be reported, its time to write to the credit bureau to request its removal. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. If it cant, the debt has to come off your report.

The Fair Credit Reporting Act requires credit bureaus to correct or delete any information that cant be verified or that is incorrect or incomplete, typically within 30 days. Otherwise, they are in violation and you are within your rights to file a lawsuit, as well as file a complaint with the Consumer Financial Protection Bureau.

Make sure to craft a case so strong that the creditor will have to acknowledge that its correct or present tangible evidence to the contrary. Include copies of anything that supports your claim, such as copies of court filings that show the correct date for a judgment or bankruptcy or a letter from your original creditor showing when the account became delinquent.

If a collection agency is reporting an account as a different debt, include any paperwork showing that the two accounts are really the same debt.

Send this letter certified with a return receipt requested so that you can prove when it was sent and that it was received.

Why this is important: If you can prove that the debt is older than legally allowed to show on your credit report, the bureau can remove it.

Read Also: What Does Dla Mean On A Credit Report

Can I Get A Paid Collection Account Off My Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A paid-off collection account will come off your credit report eventually, but it’s not usually possible to get this account taken off your credit report proactively. You can ask your creditor to take the account off your report – either as a condition of your full payment or as a matter of good will – but no creditor is obligated to honor this request. This article will go into detail about how an account that has been sent to collection can affect your credit score, how a “pay for delete” letter works, and what you can do if the collection account on your credit report is there by mistake.

Having a collections account noted on your credit history can have a negative impact on your finances. Maybe the negative item has dropped your credit score too low to get a good interest rate on a car loan, or maybe the reminder that you werenât always able to pay your debts on time is making new creditors hesitant to lend you credit at all. Having this account on your credit report isnât doing you any favors, but youâve worked hard and youâve paid off the collection account , so now what?

How Long Can You Be Forced To Pay Collection Accounts

Every debt has a statute of limitations, or a certain length of time that debt collectors can take legal action to force you to pay it. After this, it becomes time-barred debt and you cant be sued over it anymore.

The statute of limitations on your debt depends on your state or jurisdiction and the type of debt you have, but its usually between 3 and 6 years. 6 Once the statute of limitations has passed, debt collectors can still try to get you to pay, but they wont have any legal recourse and wont be able to get a court judgment against you.

Leave really old debts alone

The statute of limitations on your debt sometimes begins from the date of your most recent activity on the account. Be very careful to avoid doing anything on an old credit account that might reactivate the debt.

Specifically, refrain from doing any of the following:

- Making any payments

- Acknowledging the debt is yours

- Agreeing to a repayment plan

- Accepting a debt settlement offer

Even the smallest payment could revive debt collection efforts and result in legal action against you, so its better to play it safe and only acknowledge the debt if youre willing to pay the full amount owed.

Theres no legal way to completely erase your credit history.

Recommended Reading: Is My Fico Score My Credit Score

A Repossession Wont Haunt You Forever

Watching your car be hauled away because you defaulted on your auto loan can be devastating in more ways than one. The credit damage from a repossession can last for years, dragging down your credit score and making it difficult to qualify for new credit. But even if you need to wait the full seven years to say goodbye to a repo on your credit report, seven years is not forever. Your credit will recover.

Of course, the best thing to do is to prevent your loan from defaulting in the first place. If youre at risk of falling behind on your auto loan payments, contact your lender right away. Defaults arent profitable for anyone involved, and its in your lenders best interest to help you find a way to repay your debt but they can do a lot more to help you if you contact them before you start making late payments.

How Do Collections Affect Credit

Some lenders use older versions of both credit scoring systems that still count paid collection accounts, however, and there’s no way to know ahead of time which credit scoring method a lender will use when deciding to approve a loan application. So while paid collections on your credit report may still hurt your chances of approval, paying off the account gives an opportunity to do the least possible damage.

Also Check: How To Check My Business Credit Score

What Is A Goodwill Deletion

The goodwill deletion request letter is based on the age-old principle that everyone makes mistakes. It is, simply put, the practice of admitting a mistake to a lender and asking them not to penalize you for it. Obviously, this usually works only with one-time, low-level items like 30-day late payments.

How Much Do Collections Affect Your Score

Although there’s no formula to calculate how much a collections account affects your credit score, it’s important to know there is little difference between a paid collection account and those that remain unpaid regarding your credit score.

In fact, paying old collections accounts can activate them again and further impact your score. If you want to remove a collections account for the purposes of borrowing, check with your lender to find out the best approach for your loan approval.

The type of debt does play a part in how it affects your score. Medical collections, for instance, are given less weight in the latest FICO scoring models.

Recommended Reading: How To Get A Truly Free Credit Report

Removing Collection Accounts From A Credit Report Without Paying

The only way to remove your collections from a credit report without paying is by proving that your collection accounts contain inaccurate collections. This proof can be sent to the credit bureau when you file a dispute. And how to dispute a collection debt? Luckily, forms are available on the credit reporting agencies websites. Usually, the investigation process takes around 30 days, so afterward you can expect to receive a notice stating whether your proof has been approved and your collections have been removed. Otherwise, your collections will stay on your credit report for a set period of seven years.

| DID YOU KNOW: Credit repair companies can actually help you dispute the debt you have with your creditors by analyzing your full credit report and contacting the credit bureaus in your name. This not only saves you time but is more effective as the have experience in the process and know how to properly negotiate with the credit bureaus. |

What Going Into Collections Means

Depending on the type of debt owed, collections can affect you in different ways. If your debt is unsecured, such as credit card debt, and you default on your payments with that debt sent to collections, the credit card company would stop trying to collect the debt from you. Instead, the collections company that your debt was sent to, would pursue the debt and try to collect money from you. If your debt was secured, such as an auto loan and you default, then the lender might repossess your car, sell it at auction, and sell the remainder of debt you owe to a collections company. Lenders can collect money from debt in the following ways:

- Contact you on their own and ask for payment using their internal collection department.

- Hire a collection agency to try and collect.

- For revolving debt, such as credit card debt, the credit card company could sell your debt to a collection agency, which would then try to get the money from you.

- For installment loan debt, such as an auto loan, the lender may repossess the car, sell it auction, and then sell the remaining debt to a collection agency.

The federal Fair Debt Collection Practices Act strictly regulates how debt collectors can operate when trying to recover a debt. For example, they can’t threaten you with imprisonment or make any other kind of threat, if you don’t pay. However, they can and typically do report the unpaid debt to credit reporting agencies.

Recommended Reading: How Many Points Does Your Credit Score Go Up

What Should You Know About Debt Collections And Dealing With Debt Collectors

In the US, its very easy for people to fall victim to debt collector scams or to paying debt they no longer owe. That is why the first thing you need to receive from the collection agency is a debt validation letter which contains confirming information concerning your debt, the name of the creditor, and how to resolve the debt.

This debt collection letter is supposed to be in your hands within five days of the agency first contacting you. Afterward, you will have 30 days to dispute the debt. You have the right to request official written evidence of your payment from the collection agency.

A common misconception is that a debt collector is supposed to be rude and frighten you into paying your debt. According to the Federal Trade Commission and the Fair Debt Collection Practices Act , debt collectors are not allowed to use abusive language and scheming practices when collecting debts. If they do, you can report them directly to the FTC.

Here is some additional information on what a debt collector can and cannot do:

| DID YOU KNOW: The statute of limitations is a law that provides a time frame during which debt collectors have the right to take legal action against your unpaid debt, such as taking the case to court. This usually lasts three to six years and is only available if you do not try disputing collection accounts during that time. |