How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Choose A Credit Repair Firm Carefully

- Avoid offers of a quick debt reduction or debt settlement plan with high upfront fees.

- Be aware that some fraudulent agencies will get away with using a nonprofit status just to collect your money. Legitimate agencies should be willing to sit down with you and discuss your spending habits and help you come up with a budget.

- Unrealistic promises, such as erasing your debt for pennies on the dollar in a short time, or promising to reverse a bad credit score, should be red flags.

- Work with a Minnesota licensee that has a local office with staff available to answer your questions.

You May Like: What Is Syncb Ntwk On Credit Report

Regarding Negative Information In Your Credit Report

When any negative information in your report is correct, there is only so much you can do. Correct negative information cannot be disputed. Only time can make it go away. A credit agency can report most correct negative information for seven years and bankruptcy information for up to 10 years. Information about an unpaid judgment against you can be reported until the statute of limitations runs out or up to 7 years, whichever is longer. Note that the seven-year reporting period starts from the date the delinquency took place.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

You May Like: Klarna Credit Score

Check With Your Lenders For Better Interest Rates Offers And Higher Credit Limits

One way to try to increase your credit score is by increasing your debt to total credit ratio. Check with your lenders for better interest rates, offers, and higher credit limits. These days, credit card companies often offer cards with higher limits and other programs/benefits based on good practices which helps expand your available debt. But, do not use the added debt. By keeping the same low balance with a higher total credit limit, your ratios look much better, thus leading to a higher score.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

You May Like: Does Paypal Credit Report To Credit Bureaus

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

You May Like: Credit Inquiries Fall Off

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

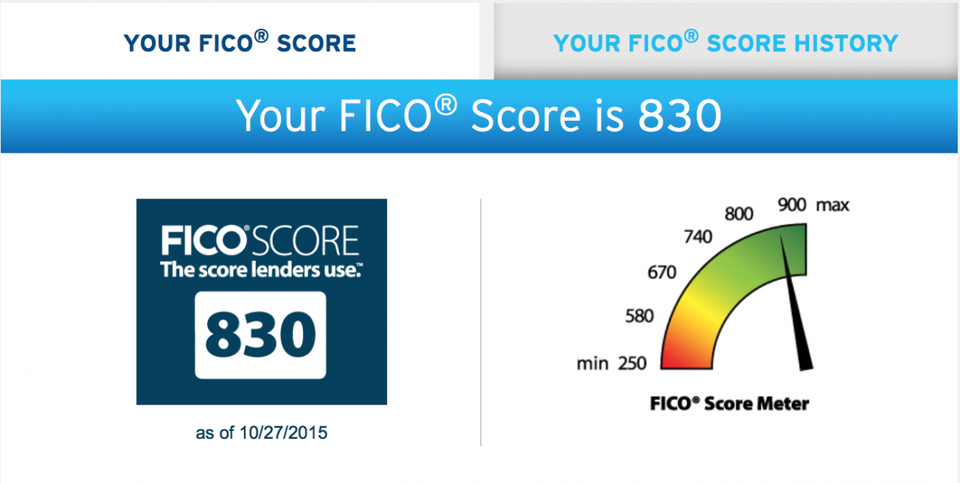

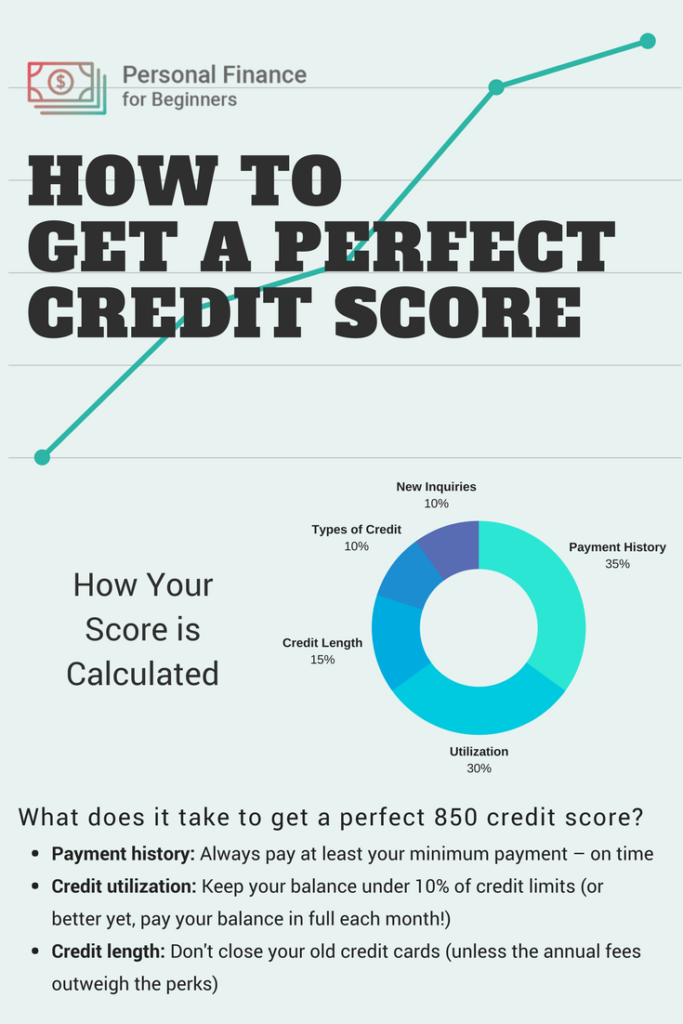

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Recommended Reading: What Credit Report Does Comenity Bank Pull

Why Do Banks Need To Check My Credit Score

Banks take a risk in lending to their customers. When a loan is lent, the lender wants to be sure that the amount is paid back with interest promptly. Therefore, lenders would like to ensure that they are lending only to the creditworthy or those who will pay back the amount responsibly. For banks or any other financial institutions, the only way to determine the creditworthiness of an individual is through his/her credit score.

Therefore any application for any form of credit is not approved without carrying out a credit check from the credit bureaus. Currently, banks have also started pricing the loans depending upon the credit scores.

Can Equifax delete or change my credit information on its own?

No, Equifax or any credit bureau cannot delete or change any information on its own.

The generation of the credit data is done at the lender’s end according to your credit actions. The same is reported to the credit bureau by the lenders. Your credit score is calculated based on the data shared by the lenders. So the credit bureaus have no role to play when it comes to data, it makes the calculations based on the information provided by the lenders.

In case of any errors in your credit information, you would need to raise a concern with the credit bureau who would then forward it to the lender for making necessarily corrections.Only when the corrected data is sent by the lender, will the Credit Bureau makes changes to your credit information.

Check Your Credit Report

Because your credit score is so important in getting loans, credit, and housing, its important to check your credit reports regularly to make sure they are correct and complete. Checking your credit reports will also alert you to identity fraud because youll see if someone has opened accounts in your name or if late payments have been reported for purchases you didnt know about.

You can get one free copy of your credit report every 12 months from each of the three major credit reporting companies . All three credit reporting companies collect credit information, but different things may show up on the different credit reports. You can monitor your credit for free by getting free copies of your credit report. There are two common ways to do this:

In addition, you can get a free copy of your credit report:

To order a free credit report, go to Annual Credit Report or call 1-877-322-8228. You can also fill out the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Don’t Miss: How To Unlock My Experian Credit Report

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Don’t Miss: How Do I Unlock My Experian Credit Report

Late Credit Card Payment

How much a late installment may influence your credit score can rely upon a few different aspects. With regards to your credit score, for instance, a late installment will be assessed depending on how late the payment is, and the recurrence of late payments.

Each credit reporting organization has its own model for assessing your data and allotting you a credit score accordingly, so your credit score will differ between different credit rating organization.

However, the longer an installment goes unpaid, and the more repeated the behavior is, the more damaging it is on your credit score. For example, a payment that is ninety days late can have a more negative impact on your credit scorethan a payment that is just thirty days late. Besides, the more recent the late payment, the more negative of an impact it could have on your overall credit score.

Also, one late payment could have a damaging impact on your credit score, particularly if it is high. If your score is already low, one late payment wont hurt it as much but still does some critical damage. For instance, if you have a credit score of 800, and you make one 30-day late payment on your credit card, it can lead to credit score drop of as much as 90 to 100 points. For a consumer who has never missed a payment on any credit account, this can be very damaging indeed.

What To Do When You Cant Make A Payment On Time

If you find you cant make a payment, it is better to make a partial payment at least. It will still hurt your score, but not as much when you skip a payment altogether. Just dont just skip a payment. Call your lender or service provider and let them know you will have difficulty making your monthly payment. See if you can have the due date extended or the late fees waived. If you are out of a job and tight on fiscal resources, see if you can work out a new payment plan. Make every effort to pay your lenders on time, every time. Otherwise, your credit score will be hurt every time you miss a payment. Note that all overdue payments can eventually wind up on your credit report if they go into a default status or are passed along to a collection agency.

Don’t Miss: Syncb Ppc

Why Is A Credit Card Account That I Already Paid Off And Closed Still On My Equifax Credit Report

Its a common misconception that paid off or closed accounts should be removed from the Credit Report. It takes up to 8 to 10 years for your credit activities to be removed from your Credit Report. Moreover, having a good credit history is vital factor for having a good credit score.

If your credit card account that you have closed late payments, defaults or any other negative remarks, it takes up to 7 years to get it removed from the Credit Report. However, it wont have much bearing on your credit score if your current credit accounts have 100% positive payment records.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Don’t Miss: Speedy Cash Credit Check

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Work On Your Credit Score

If you have a low credit score, taking time to improve it is actually a good idea. Making payments on time in full consistently without missing the due date could help raise your credit score. Your credit score is largely dictated by how much debt you have and whether you pay your bills on time in a consistent manner. Focusing on these two factors could be a huge help in improving your credit.

On the other hand, if you have no credit history, you can opt for score building credit cards and make small purchases on it that you could pay off in full every month. This will help build a credit history. When you apply for a loan, lenders apply to the credit bureaus to take out your credit history. They do this to study your risk as a borrower. They can only do so if you have a credit history in the first place. If you dont have a credit history, they cannot judge you as a borrower and hence, offer you high rates or reject your loan application outright.

Working on your credit scores could unlock lower interest rates and preapprovals by more lenders. You could play this to your advantage as it gives you a wider pool of lenders from which you could choose the best deal. There is no fast road to an excellent credit score but building responsible financial habits can go a long way toward boosting your credit health.

Here are a few dos and dont to building a good credit score:

Don’t Miss: Does Carvana Build Credit