Key Things To Know About How Progressive Uses Your Credit Score

- Progressive will assign you an auto insurance score, which is based on your credit history, just like your credit score. This auto insurance score could vary from one insurer to another since insurers may take different things into account.

- Your credit score is unlikely to ever be the sole reason that Progressive denies you coverage or cancels your policy.

- California, Hawaii, Massachusetts, Michigan, and Washington do not allow the use of credit scores to determine car insurance rates whatsoever. So, your credit score will not affect your rates with Progressive in these states.

- Specific things that Progressive looks for in your credit history include bankruptcies, late payments, and foreclosures. These will likely result in higher premiums.

- If Progressive has offered you a higher car insurance rate based on your credit history, you are legally entitled to a free copy of your credit report.

Keep in mind that your credit score is not the only factor used to determine your car insurance rates. Car insurance companies mainly take into account things like your age, driving record, and your car’s make and model.

To learn more, check out WalletHub’s report on credit scores and car insurance.

Key Things To Know About How Usaa Uses Your Credit Score

- USAA will assign you an auto insurance score, which is based on your credit history, just like your credit score. This auto insurance score could vary from one insurer to another since insurers may take different things into account.

- Your credit score is unlikely to ever be the sole reason that USAA denies you coverage or cancels your policy.

- California, Hawaii, Massachusetts, Michigan, and Washington do not allow the use of credit scores to determine car insurance rates whatsoever. So, your credit score will not affect your rates with USAA in these states.

- Specific things that USAA looks for in your credit history include bankruptcies, late payments, and foreclosures. These will likely result in higher premiums.

- If USAA has offered you a higher car insurance rate based on your credit history, you are legally entitled to a free copy of your credit report.

Keep in mind that your credit score is not the only factor used to determine your car insurance rates. Car insurance companies mainly take into account things like your age, driving record, and your car’s make and model.

To learn more, check out WalletHub’s report on credit scores and car insurance.

Yes, Travelers does use your credit score as a factor when determining your car insurance rates, as do most major insurers. However, credit checks by auto insurers do not harm your credit score and are only done in states where it is legal for your credit score to affect your rates.

How Do I Choose My Car Insurance Deductible Amount

In most situations, you can choose your deductible amount for each coverage. Here’s a few things you should think about when choosing a deductible.

You can also check out our coverage calculator to see what options work for you.

Also Check: What Credit Score Do You Need For American Express

What Should I Know Before Buying A Used Car

How Much Does Your Credit Score Impact Your Insurance Premiums

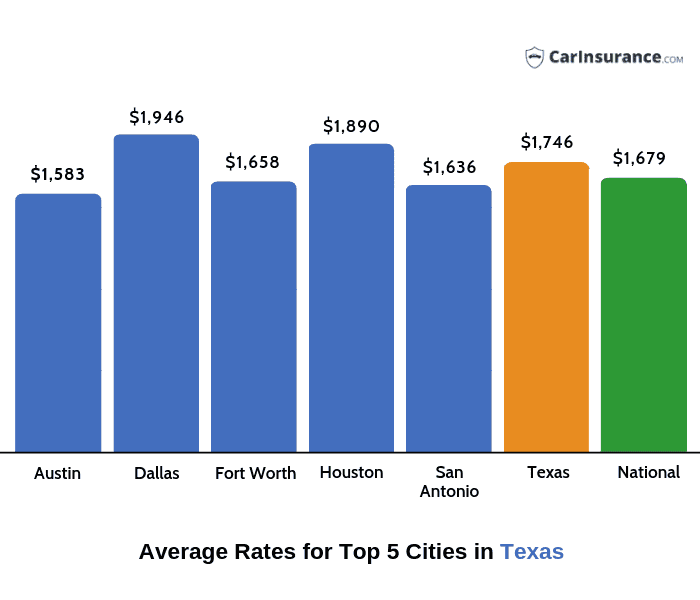

Your credit score is only one factor in determining your insurance rates. If you’re curious about how car insurance works and impacts your rates, there are several factors that play a part in how you’re rated such as your ZIP code, age, and driving history.

That said, your credit score can still have a large impact on your monthly premium. Take a look at the table below to see how having a slightly higher credit score can save you hundreds of dollars each year on your car insurance.

Average Car Insurance Costs by Credit Score

| Period |

|---|

You may be able to find a lower rate by switching to a different car insurance company. Compare quotes from several auto insurance providers to find the lowest price, no matter what your credit score.

Consider your vehicle.

Your credit score may not be the only factor contributing to higher rates. Depending on your type of coverage, a more expensive car can cost significantly more to insure. Finding a more affordable car or paying off your auto loan could help you lower your premium.

Also Check: Is 637 A Good Credit Score

Providers That Dont Factor Credit Into Your Insurance Rate

It is standard practice for most insurance providers to look into your credit score before they give you a quote. However, some providers do not check your credit score when you apply for a policy. Here are some insurance carriers that may not look at your credit score:

- Equity Insurance

These insurance providers may not be available in all states.

In some states, it is against the law for insurance companies to use your credit score to calculate your rate. Currently, insurance companies in California, Hawaii, Massachusetts and Michigan cannot look at your credit history before selling you a policy. But keep in mind that if you fail to make the payments, insurance companies in these states could still cancel your coverage.

About Geico Home Insurance

While Geico is best known for its auto insurance, it does provide the option for customers to purchase homeowners insurance through its website and agents. However, Geico functions as a broker and matches customers with third-party home insurers through the Geico Insurance Agency. This means that a homeowners insurance policy purchased from Geico will actually be from another company.

If you already have car insurance from Geico, purchasing a homeowners policy may qualify you for an auto insurance discount. However, Geico doesnt allow you to choose the insurer youll be matched with. And, once purchased, youll have to work with the third party directly to manage your policy and file a claim so theres little convenience from bundling.

For more details, see What Does Homeowners Insurance Cover?

Beyond these standard coverage types, your options for customizing your policy may differ depending on which company Geico matches you with.

Recommended Reading: How Long Before My Bankruptcy Is Off My Credit Report

You Have A Poor Driving Record

Your driving record is probably the most important factor in determining your car insurance rates. If your record is poor, with accidents and driving violations, and you have a history of claims, your rates will be high. You will also pay more than average if you’re bad with credit, young , or unmarried.

Can A Car Insurance Deductible Be Waived

In most situations, your deductible will apply. However, there are some cases where your deductible may be waived. If you have comprehensive coverage and make a claim to repair windshield glass damage, your deductible may be waived.

You can always check with your insurance representative for any questions. In some states, you may purchase additional auto insurance coverage that will waive your deductible in some scenarios. Check your state reference page for more info.

Don’t Miss: How To Report A Death To Credit Bureaus

Factors That Affect Your Costs

Multiple factors impact how GEICO determines your insurance rates. Actuaries identify statistical patterns to determine risk level. Age, driving experience, driving record, the covered vehicle’s safety features, where you live, and your are some of the factors GEICO considers.

The credit history GEICO and other auto insurers consider is not the same as your credit score. They calculate a credit-based insurance score.

Like most insurers, GEICO does require you to select male or female when you request a quote for auto insurance. Unfortunately, its underwriting process has not been updated to reflect broader awareness of non-binary, genderqueer, agender, and bigender issues.

Did You Know You May Have Car Insurance Coverage You Didn’t Know You Had

Don’t pay more for coverage you may already have on your GEICO Car Insurance! Check out this list of car insurance coverage options you might not even know you have.

Read Also: How To Get A Public Record Off Your Credit Report

Key Things To Know About How The Hartford Uses Your Credit Score

- The Hartford will assign you an auto insurance score, which is based on your credit history, just like your credit score. This auto insurance score could vary from one insurer to another since insurers may take different things into account.

- Your credit score is unlikely to ever be the sole reason that The Hartford denies you coverage or cancels your policy.

- California, Hawaii, Massachusetts, Michigan, and Washington do not allow the use of credit scores to determine car insurance rates whatsoever. So, your credit score will not affect your rates with The Hartford in these states.

- Specific things that The Hartford looks for in your credit history include bankruptcies, late payments, and foreclosures. These will likely result in higher premiums.

- If The Hartford has offered you a higher car insurance rate based on your credit history, you are legally entitled to a free copy of your credit report.

Keep in mind that your credit score is not the only factor used to determine your car insurance rates. Car insurance companies mainly take into account things like your age, driving record, and your car’s make and model.

To learn more, check out WalletHub’s report on credit scores and car insurance.

Yes, The General does use your credit score as a factor when determining your car insurance rates, as do most major insurers. However, credit checks by auto insurers do not harm your credit score and are only done in states where it is legal for your credit score to affect your rates.

Geico Vs Progressive: Getting A Quote

Getting a quote from Progressive or GEICO is quick and easy, and both companies have online quote tools that can be used for most policies.

To get a quote, youll need to provide basic personal information, as well as information specific to the policy youre buying, like the make and model of your vehicle for auto insurance, or the number of employees you have for commercial insurance.

If you cant get a quote online for the type of policy you need, you can call an agent to start a new quote.

Recommended Reading: How To Remove A Judgement Off Your Credit Report

Pare Down Your Coverage

Most states require a certain amount of bodily injury liability and property damage liability coverage. But there are other coverage options that you may be able to get away with not having, depending on the state.

Less coverage usually means lower premiums, but it could also lead to higher costs in the long run, so its important to approach coverage decisions with caution.

You Have A Low Insurance Score

Every major insurance company uses a credit-based insurance score to calculate premiums where allowed by law. Like , insurance scores are based on credit report information, only they are used to predict a driver’s likelihood of filing a claim. The rationale is that individuals who are careful with their money tend to be careful drivers, too.

However, insurance scores are controversial, so they are banned in Massachusetts, Hawaii, and California. Most other states also have restrictions on their use, which can be found on the state insurance regulator’s website.

Don’t Miss: How To Find Your Credit Rating

Reduce Your Car Insurance Coverage

Most states require a certain amount of bodily injury liability and property damage liability coverage. But there are other coverage options that you may not have to purchase, depending on your state.

Less coverage usually means lower premiums, but it could also lead to higher costs in the long run, so its important to approach coverage decisions with caution.

Key Things To Know About How Travelers Uses Your Credit Score

- Travelers will assign you an auto insurance score, which is based on your credit history, just like your credit score. This auto insurance score could vary from one insurer to another since insurers may take different things into account.

- Your credit score is unlikely to ever be the sole reason that Travelers denies you coverage or cancels your policy.

- California, Hawaii, Massachusetts, Michigan, and Washington do not allow the use of credit scores to determine car insurance rates whatsoever. So, your credit score will not affect your rates with Travelers in these states.

- Specific things that Travelers looks for in your credit history include bankruptcies, late payments, and foreclosures. These will likely result in higher premiums.

- If Travelers has offered you a higher car insurance rate based on your credit history, you are legally entitled to a free copy of your credit report.

Keep in mind that your credit score is not the only factor used to determine your car insurance rates. Car insurance companies mainly take into account things like your age, driving record, and your car’s make and model.

To learn more, check out WalletHub’s report on credit scores and car insurance.

Yes, The Hartford does use your credit score as a factor when determining your car insurance rates, as do most major insurers. However, credit checks by auto insurers do not harm your credit score and are only done in states where it is legal for your credit score to affect your rates.

Don’t Miss: Which Credit Score Matters The Most

Driving History And Habits

- Good Driver Discount: If you havent been in an accident for five years or more, you could save up to 22% on most coverages.

- Seat Belt Use Discount: If you and your passengers always wear your seatbelts, you could qualify for a discount on your medical payments or personal injury protection premiums.

How Does Your Credit Score Affect Auto Insurance Rates

A higher credit score decreases your car insurance rate, often significantly, with almost every company and in most states. Getting a quote, however, does not affect your credit.

Your credit score is a key part of determining the rate you pay for car insurance. Better credit often gets you a better rate, and worse credit makes your coverage more expensive.

Poor credit could more than double insurance rates, according to a nationwide analysis of top insurers. In contrast, very good credit could reduce rates by as much as 24% compared to average credit.

Nearly every insurer checks your credit. However, simply getting a quote does not have any impact on your credit score.

You May Like: Do Student Loans Show On Your Credit Report

What Are The Types Of Credit Inquiries

There are two types of credit inquiries:

- Soft Pull: A soft pull is also called an involuntary inquiry. It’s used when creditors send potential customers preapproved offers and when potential employers check job applicants’ credit history. Checking your own credit score is also considered a soft pull because you aren’t actively seeking credit. It has no effect on your credit score.

- Hard Pull: A hard pull is voluntary, which means you asked for the credit check because you are applying for credit. You complete an application giving a lender permission to run a credit check, and they use the information to decide whether to approve your credit application and determine its terms. A hard pull indicates you’re actively shopping for credit, and it will be visible to other lenders. Too many hard pulls are bad for your credit score.