How Often Is My Credit Report Updated

If youre working to improve your credit or watching for a specific change to your , you probably want to know how often your credit report updates. Being able to predict how your credit reportand ultimately your credit scorewill change is a concern for anyone who knows the importance of having good credit or anyone who hopes to be approved for a major loan soon.

The timing of credit report updates largely depends on when lenders, credit card issuers, and other companies you have credit accounts with send your account information to credit bureaus. If you have multiple accounts with several businesses, your credit report could update daily.

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

How Often Do Credit Scores Update

As soon as credit bureaus receive your information from your creditors, they update your credit report. The information on your credit report influences your credit score. As soon as your credit report is updated, your credit score will change and reflect the new information.

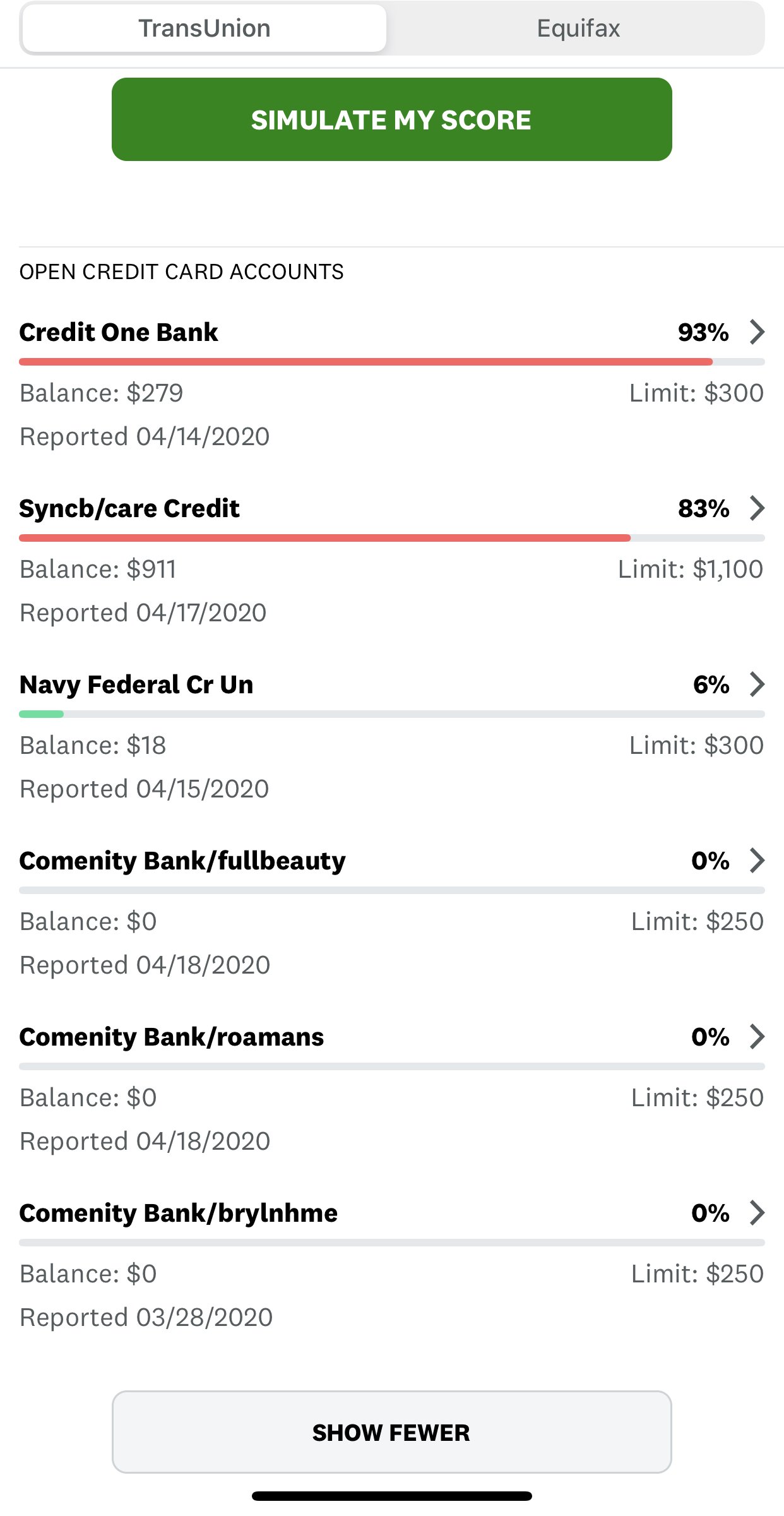

However, if you miss a payment and your creditor reports your payment as more than 30 days late, you might see a drop in your credit score. This late payment will stay on your credit report for seven years and will keep on having a negative effect. Another factor that can cause your credit score to take a significant hit is using more and more of your credit and increasing your . If you suddenly have a spike in credit card debt, you can expect to see a knock in your credit score.

Don’t Miss: How To Dispute Repossession On Credit Report

Q Will Transunion Accept Tty & Trs

Once all required elements have been met, the standard operating procedure for handling Consumer calls will apply.

Q How Do I Receive A Free Copy Of My Transunion Personal Credit Report

A. You can obtain a free copy of your Consumer Disclosure online through our self-service website. to visit our self-service website.You can also request a copy of your Consumer Disclosure by phone or mail, and it will be mailed to you. To review the options for receiving a copy of your Consumer Disclosure, please refer to the Consumer Disclosure section of our website

Recommended Reading: Affirm Credit Score Approval

What Makes Up Your Credit Score

Your is calculated using different scoring models, such as the VantageScore and FICO. These are the two most widely used credit-scoring models, and each has its own proprietary metrics and criteria. However, both models have one thing in common: they use data from the major credit reporting agencies to generate your score.

If you want to repair bad credit, it’s important to understand what factors VantageScore and FICO evaluate when generating scores.

VantageScore 4.0 Scoring Model

VantageScore prioritizes total credit usage, balance and available credit. Basically, the model first evaluates the amount of credit you have available to use and how much of it you’re using. Using 30% or more of your available credit can lower your score since lenders usually consider it a red flag.

Other factors considered include your credit mix, payment history, credit history length and new accounts.

FICO Scoring Model

The FICO score is the industry standard its the oldest credit scoring model and what most lenders use to evaluate a person’s creditworthiness. FICO’s scoring has five categories, each with a percentage value indicating how much weight they place on each:

How Rapid Rescoring Works

When you apply for a large loan like a mortgage youâll want to put your best foot forward and have the highest credit score possible. Since your credit score is computed using the information in your credit history, adding new, positive information to that history can boost your score. This can be done through rapid rescoring. When it comes to your credit score, a few points can mean the difference between a loan approval or denial or better interest rate.

What new, positive information can you add? If you have enough cash on hand, you can pay off or pay down a credit card. This lowers your credit utilization rate, which increases your credit score. You may also be able to correct simple errors on your report, which can also boost your score.

If your lender doesnât offer rapid rescoring, you can find another mortgage lender that does or wait for an updated credit report under the usual time frame.

You May Like: Does Opensky Report To Credit Bureaus

How To Update Credit Report Fast Rapid Rescore And How Does It Work

Under normal circumstances, updating credit report takes at least 30 to 60 days if it is done the traditional way:

- However, with Rapid Rescore, all the lender needs is proof that borrower has paid down credit cards

- Or proof that the credit reporting agency is reporting erroneous information

- They will have a third party credit vendor contact the three credit reporting agencies

- Provide proof to them and in return, it will be updated in 3 to 5 business days

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

You May Like: Chase Preferred Credit Score

Q How Is The Transunion Personal Score Calculated

The credit industry uses various types of credit scores to assess risk for different types of credit. For example, a creditor may use one type of score when assessing risk for a credit card account and another type of score when assessing risk for a mortgage account.

Ways To Remove Old Debt From Your Credit Report

Having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Recommended Reading: Check My Credit Score With Itin Number

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

How To Check With The Data Furnisher

When you file a dispute, the Federal Trade Commission suggests also informing the company that provided the data to the credit bureaus, such as a bank, lender or card issuer, in writing. These sources of information are known as furnishers. Notifying the data furnisher may cause them to proactively stop reporting the inaccurate information to the credit bureau, although that’s not guaranteed.

Send the letter to the company using the address it listed on your credit report. If there is no address listed, ask the company for one.

The FTC notes on its website: “If the provider continues to report the item you disputed to a credit reporting company, it must let the credit reporting company know about your dispute. And if you are correct that is, if the information you dispute is found to be inaccurate or incomplete the information provider must tell the credit reporting company to update or delete the item.”

Recommended Reading: How Long Do Things Stay On Chexsystems

How Discharged Debts Appear On Your Credit Report

If your debts are legally gone, how do they remain on your credit report? Your former creditor just doesnt bother to update the report.

Some of them, and I kid you not, some of them will be so out of it that they will keep automatically pulling your credit report every month just like you still had an open account with them!

Everyone thinks it wont happen to them, but it does. It happens to thousands and thousands of people every year many of whom become my clients.

How Do You Update Personal Information On Your Credit Report

The easiest way to update the personal information on your credit report is to update it with your creditors. Your creditors report your account each month, sending your current balance along with any updates to your personal information like your address. You can also update your information with each credit bureau individually.

Read Also: How To Remove Public Records From Credit Report

Option : Credit Repair

This is the most common and usually best way to get negative items removed from your credit report. Here is how it works:

- If you believe an item cant be verified, you can dispute it with the credit bureau that issued the report.

- The credit bureau has 30 days to verify the information.

- If it cant be verified then it must be removed.

This is a process known as . Its usually used when you find mistakes on your credit report, like a missed payment that you made on time. Since creditors cant verify erroneous information, its the best way to get rid of negative items in your credit report that shouldnt be there.

However, in addition to removing mistakes, it can also be useful for get rid of re-sold collection accounts. Charged-off debts can change hands many times, from one debt buyer to the next. These portfolios of bad debt often include incomplete account information. As a result, the collector cant verify the original debt. This means with the help of a good , you may be able to have these accounts removed.

Looking for a way to remove negative items from your credit report? Connect with a Debt.com accredited credit repair service now!

Social Security Number Change

It is difficult and unusual to change a Social Security number, but it is sometimes necessary. For example, someone facing continuing damage due to fraud perpetrated using their stolen Social Security number may be able to obtain a new one. As with other identifying information, new numbers should be provided to creditors, who will pass that information along to credit agencies.

The credit agencies have differing policies about Social Security number changes:

- Experian: Update your number with your creditors. It is not necessary to change it directly with Experian.

- Equifax: If you would like to change your number directly with the agency, submit a request to update it with Equifax at the address on your credit report. One of the following types of documentation is required:

- Copy of the new Social Security card

- Pay stub with the number

- W-2 form or 1099 form

- Medicaid or Medicare documentation

Don’t Miss: Creditninja Pre Approved Program

What Are Todays Mortgage Rates

Rapid rescoring is an effective way to erase incorrect information from your credit report and qualify for a mortgage.

Not sure whether youd qualify for a home loan? You can check your eligibility with lenders using the link below. If your score is low and you could benefit from a rapid rescore, your loan officer will help you get the process started.

Q How Do I Remove Or Update My Confirmed Fraud Statement

A.Should you wish to remove the protective statement from your credit report or extend its expiration, we offer two methods:

- In writing: for mailing instructions and TransUnion requirements.

Please note: If your disputed account have not been deemed fraud by a creditor, your statement will be removed. However, if you still wish to protect your credit report, you may place a Potential Fraud Alert.

Should you wish to amend the address or phone number youve provided, please contact us:

- In writing: for mailing instructions and TransUnion requirements.

Any changes to the statement, such as your contact details, will extend the warning for an additional six years from the updated date.

You May Like: Is Credit Wise Score Accurate

Q How Do I Receive A Free Copy Of My Transunion Personal Credit Report Or Place A Fraud Warning If I Live Out Of Country

A. For a former resident of Canada TransUnion requires both sides of two pieces of photocopied identification indicating last Canadian Address plus current proof of address from current country of residence for mailing. Together these combined pieces must contain your name, current address, last Canadian address, date of birth and signature.

- Do NOT send any original copies of identification.

- If submitting a request for more than one consumer in the same envelope, please ensure that the request and identification for each consumer are submitted on separate request forms and separate 8 ½ x 11 sheets of white paper

How Frequently Do Errors Occur On Credit Reports In Canada

Although TransUnion wasnt able to provide specific statistics on the number of errors typically found on credit reports, they say errors are relatively infrequent.

In comparison to the total number of credit-active individuals in Canada, we see relatively few file disputes per year, says David Blumberg, public relations director of TransUnion.

He adds that commonly disputed items on credit reports tend to relate to payment information or updates related to debt repayment programs, such as bankruptcy and credit counselling.

Other errors can include personal information errors and signs of identity theft and fraud .

What cant be changed?

While you may be able to fix some errors on your credit report, some information cant be changed.

Any information that is factual and accurate cant be changed. For example, if you paid your car loan or credit card late, even if you paid off the amount owing or closed the account, the negative mark will still remain on your credit report for six or seven years, depending on the type of information and the province or territory where you live.

It can take a while for some negative information to fall off your credit report. The amount of time it takes to disappear depends on what type of information it is and the province or territory where you reside.

For the majority of negative information, it will appear for at most six or seven years on your credit report.

Don’t Miss: Does Sprint Report To Credit Bureaus

Get Your Credit Score

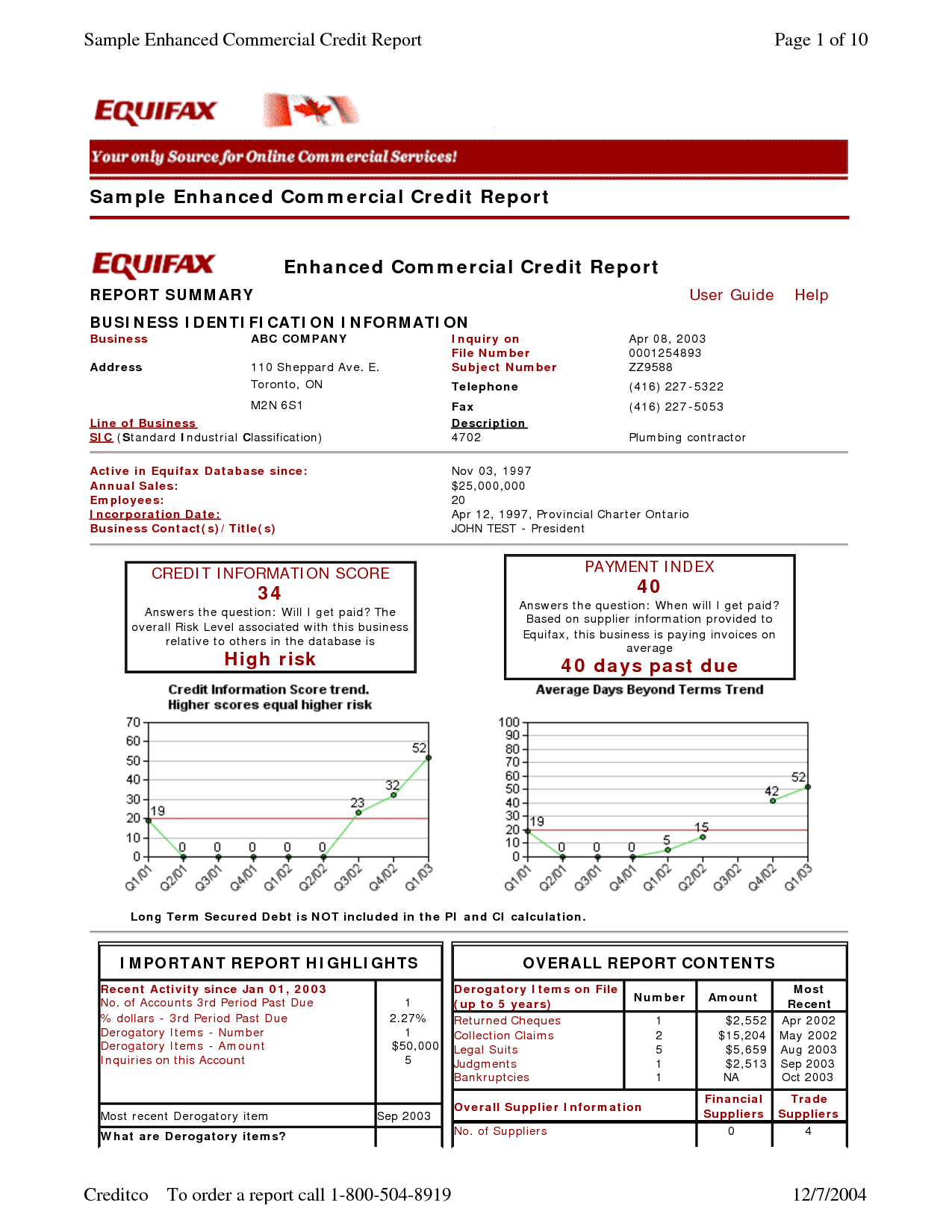

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.