Pay Your Bills On Time

It may seem like a no-brainer, but a 2018 study showed that 25% of Americans dont consistently pay their bills on time. Why is that an issue? Your payment history accounts for 35% of your FICO score, so every time you become delinquent on a payment, youre lowering your credit score.

Just how much your credit score is lowered depends on several personal factors, like how late you paid and how often you tend to miss payments. Obviously, if you are a regular offender, your credit score will suffer more.

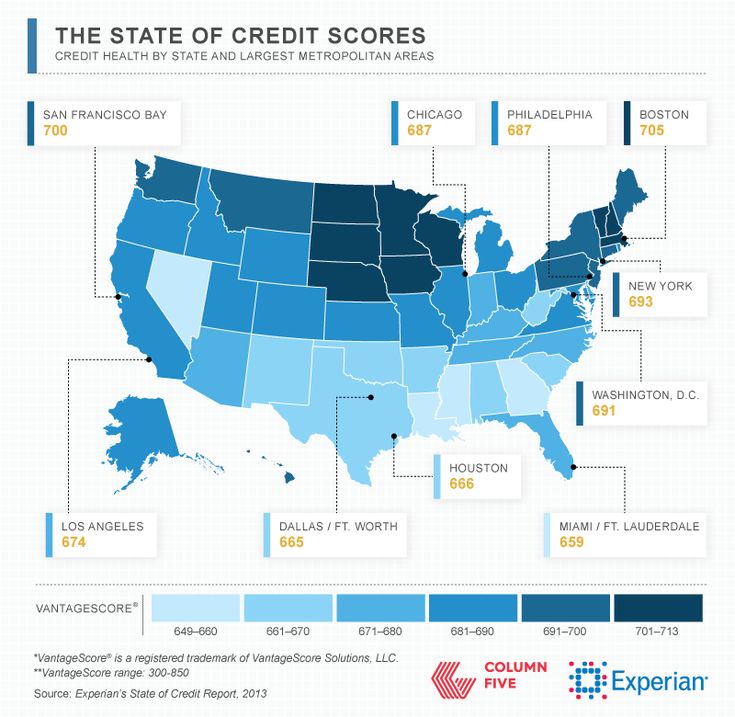

Despite Scores Differing Heavily No State Falls Below A ‘good’ Rating

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Economic conditions can vary widely among states. It’s difficult to get a complete picture of a given area without taking all the key factors into consideration. In the case of credit scores, knowing the average can help residents of a state see how they compare to their neighborsand make it simpler for those considering a move to that state to learn more about how they’d fit in economically. It can also be a factor in assessing business opportunities within a state.

Is A 819 Credit Score Good

A FICO® Score of 819 is well above the average credit score of 704. An 819 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Don’t Miss: Does Having A Overdraft Affect Credit Rating

What Factors Affect Your Credit Scores

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

Credit mix: Scores reward having more than one type of credit a traditional loan and a , for example.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

The Pandemic Forbearance And The Average Us Credit Score

With the CARES Act and private U.S. lenders offering loan forbearance programs, many Americans paused their debt repayments during the pandemic. For context, the U.S. Department of Education reports loans eligible for CARES Act forbearance as âcurrent.â

To that point, TransUnion found that 58% of Americans that enrolled in financial hardship programs during the pandemic increased their VantageScore. Moreover, when TransUnion analyzed the improved credit scores of 1.3 million Americans that participated, it found that short-term involvement resulted in the best credit performance.

For example:

- TransUnion found that 58% of Americans that enrolled in financial hardship programs during the pandemic increased their VantageScore.

- Americans that exited hardship programs early demonstrated a 4.8% delinquency rate in the six months after obtaining a new bank card in the fourth quarter of 2020.

- Americans that remained in hardships programs demonstrated a 4.9% delinquency rate during that same timeframe.

- Americans that avoided hardship programs showed a 5.1% delinquency rate during that same timeframe.

Also noteworthy, for Americans at or below a prime plus VantageScore , those that exited hardship programs outperformed those that remained. Conversely, the hardship mainstays exceeded those leaving the programs for Americans with a super-prime VantageScore . All in all, TransUnion found that 54% of Americans improved their credit scores from Q1 to Q3 2020.

Also Check: How To Dispute An Experian Credit Report

Can I Buy A House With A 684 Credit Score

As mentioned above, a 680 credit score is high enough to qualify for most major home loan programs. That gives you some flexibility when choosing a home loan. You can decide which program will work best for you based on your down payment, monthly budget, and longterm goals not just your credit score.

What Is Considered An Average Credit Score

The words fair and average are sometimes taken to mean the same thing. But in credit-scoring terms, fair and average are very different. Based on the numbers shown above, the average American has what would be termed good credit, which ranges from 670 to 739 in the FICO score model and 661 to 780 in the VantageScore model. This is better than fair credit, which checks in at 580 to 669 for FICO and 601 to 660 for VantageScore.

So, fair and average are really two different measures in credit scoring, even though both have numerical functions. Average in this instance is a mathematical term, also known as arithmetic mean. In other words: add up all individual credit scores and then divide the sum by the total number of those individuals.

The word fair, as outlined in the ranges above, is actually the next-to-the-last category above poor. The difference in credit scoring between fair and good is actually pretty substantial in terms of what one score will cost you to get a loan or to access credit versus the other.

Recommended Reading: How Long Do Closed Accounts Stay On Your Credit Report

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 716 in 20212.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Average Credit Score By Year

Americans actually have better credit than ever. The average score has increased by about 10 points in the past seven years. Here’s how it’s risen, according to FICO data from October of each year:

| Year | |

| 2021 | 714 |

Americans have more consumer debt than ever before, holding a total of $14.3 trillion in debt in the first quarter of 2020. But at the same time, credit scores are rising. The period spanning from June 2009 until early 2020 became America’s longest-running period of economic expansion, and brought low unemployment rates. This could have contributed to America’s rising credit scores, with more people borrowing money and paying bills on time.

You May Like: How To Dispute A Late Charge On Credit Report

Use Different Types Of Credit

Keeping your balances low isnt the only key to maintaining a good score and building a strong credit history. Having a diverse credit mix will also bode well for you in the long run. This should include both revolving and installment credit. Credit cards are revolving, while car loans and mortgages are installment credit. Your credit score considers how you handle both types of credit, which is why just having a fistful of credit cards wont help you as much as a credit card or two and a mortgage or other installment loan.

How We Conducted This Study

ElitePersonalFinance always has up-to-date studies.

Our goal is to consolidate the information and present the findings in a way thatâs easy to understand by parsing through the latest data from FICO, Equifax, Experian, and TransUnion. If you enjoyed the study, please provide your feedback. Moreover, if there is anything that we missed or anything that you believe needs updating, please let us know, and we will respond promptly.

Don’t Miss: What Is The Lowest Credit Score To Buy A Car

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Keep Your Credit Utilization Ratio Low

The second most important factor is your this measures how much debt you have versus your available credit limit. For example, if you have a $2,000 balance and your total credit limit is $10,000, your credit utilization ratio is 20% .

Its often recommended to keep this ratio under 30%. However, keeping it closer to 0% could raise your score even more.

Also Check: Does Applying For A Credit Card Affect Your Credit Score

Fico Score Vs Vantagescore

Many people don’t realize that there are actually multiple credit scores. These are two of the most common:

- FICO® Score uses a credit scoring model designed by the Fair Isaac Corporation.

- VantageScore is an alternative to FICO developed by Equifax, Experian, and TransUnion in 2006.

Early models of the VantageScore system scored consumers on a scale of 501 to 990. Today, both are on a scale of 300 to 850.

It’s also helpful to understand how your score compares to the average, both in the United States generally and for people within your demographic group.

The data below on the average credit scores in America will tell you everything you need to know to see where you stand when it comes to your credit.

The Average Us Fico Score Continues To Rise

Each year, we share the average U.S. FICO® Score, which now stands at 716. This is eight points higher than it was one year ago, and five points higher than the last time we reported on the average FICO Score in October 2020. At that time, the news that the FICO Score had trended up in the early months of the COVID-19 pandemic was greeted with some surprise. But there is considerably less surprise about these latest results: the data shows that a growing economy, accompanied by historic home price appreciation, strong performance of equity markets, and evidence that the payment accommodation programs offered by lenders since the onset of the pandemic have helped affected borrowers bridge the gap that opened up in their finances as a result of COVID-related income loss.

Figures 1. National Average FICO® Score Has Continued to Rise Through the Pandemic FICO Score® Distribution Shows Similar Trend Towards Higher Scores

You May Like: How To Remove Disputes From Credit Report

The Other Side Of The Coin

While the continued improvement in U.S. consumer credit profiles in aggregate is encouraging, it is important to note that there are millions of consumers for whom the financial strain of the last year has been observable in their credit files. In fact, some 17% of the FICO scorable population experienced a score decrease of 20 or more points between April 2020 and April 2021 . For many, this decrease has been driven by the inverse of the aggregate credit trends that are driving the national average FICO® Score upwards: the impacts of COVID-19-related income disruptions has led to missed payments and/or ramped up debt levels, as personal loans and credit cards are used as a lifeline to cover life necessities.

Figure 4. 37% of FICO Scorable Population Experienced Year-Over-Year Score Decrease

To learn more about FICO® Scores, check out these resources:

Average Credit Score In The United States: 711

The average FICO® Score among American consumers is 711, according to myFICO. This is classified as a “good” score.

This is an increase of five points from 2019’s average score of 706. It continues a multi-year trend, as the average FICO score increased in nine of 10 previous years.

However, while most recent increases were one or two points annually, this year’s increase is the largest in a decade.

Don’t Miss: How To Dispute Hospital Bills On Credit Report

Median Us Equifax Risk Score By Income

The New York Fed found that median credit scores are highly correlated with income. And with Americans in lower-income brackets often having less access to affordable credit, they often fall behind on their payments, which reduces their credit scores. As such, the vicious circle often keeps these Americans from achieving their financial goals.

For context, the income brackets define as follows:

- Low income: < 50% of an areaâs median income.

- Moderate income: 50%-79% of an areaâs median income.

- Medium income: 80%-120% of an areaâs median income.

- High income: > 120% of an areaâs median income.

| Income Bracket: | |

| High Income | 774 |

Also noteworthy, Equifax Risk Scores are nearly interchangeable with FICO Scores. However, the data from Equifax is for educational purposes, and lenders donât use it to determine your creditworthiness. However, the overall assessment is the same: the higher the credit score, the lower the credit risk.

How Does My Credit Score Impact My Credit Card Interest Rate

Cut from the same cloth, a stable and reliable credit score will also benefit you when it comes to credit card applications. As an unsecured form of borrowing, lenders are wary of extending large credit limits to high-risk borrowers.As such, maintaining a respectable score will not only lower your annual interest rate â but also allow you to qualify for options with higher minimum balances, lower annual fees, and greater rewards as well.

You May Like: How To Dispute Credit Report Online And Win

Whats The Average Credit Score By State

Where you live doesnât directly impact your credit scores. But you might still be curious about the credit score ranges in different states.

You can use the following averages to see how your credit scores compare with the average score in your state.

Average FICO Score by State in 2021

| State |

|---|

Source: Experian 2021 Consumer Credit Review

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Also Check: What Can You Do With A 700 Credit Score

Six Factors That Affect Average Credit Score

So, now that you have a few frames of reference to compare your score to, what can you do about it? Understanding how to improve your score starts with gaining some knowledge regarding what goes into calculating it. In most cases, its these six factors:

- Payment history: Whether youve paid past credit accounts on time

- Total debts owed: The amount of money you owe to creditors

- The amount of available credit youve borrowed

- Length of credit history: How long your credit accounts have been established

- New credit: How many credit accounts youve opened in a short amount of time

- The types of accounts that make up your credit report

Myth : The National Average Credit Score

With multiple credit bureaus and credit score models, everybody has their own idea. So let’s ask them. #myth10

Mum’s the word on a number that used to get all the love. But it’s no big deal: Just another “quirky environment” thing in the on-again off-again credit bureau/Fair Isaac relationship said a FICO spokesman. Quirky indeed .

Don’t Miss: How Long Does It Take To Increase Credit Score

Why Credit Scores Aren’t Improving

The average credit score has stayed steady in part due to an uptick in missed payments. As of April, just over 15% of the population had dealt with a 30-plus day past-due bill in the past year an increase of a little over 1% from the year before.

Then there’s the rising level of consumer debt. The average credit card utilization was 31% as of April , according to the report.

And finally, more consumers are getting credit cards, taking new credit activity back to pre-pandemic levels.

To find out your credit score for free, you can use a service like Credit Karma or Credit Sesame. If you’re not happy with what you see and want to improve your own credit score, experts recommend paying your bills on time, monitoring your credit utilization ratio and regularly pulling your free online credit report to check for errors and/or fraud.