What To Do If Your Chase Sapphire Preferred Card Application Is Rejected

When an application is rejected, you can inquire about the rejection and petition for approval by contacting Chases reconsideration line or by calling the number listed in the rejection letter. By law, card issuers are required to inform rejected applicants of the reason why an application has been denied. Applicants can respond to this information and make their case to a Chase representative using whatever valid evidence they can provide.

Its been widely reported that Chase has a strict policy against too many accounts open within a short period of time . Under this rule, if an applicant has opened five or more accounts in the last 24 months, a card application will likely be rejected. To avoid being denied for the Sapphire Preferred card for having too much activity on your credit profile, make sure youve opened fewer than five accounts in the last two years before submitting a new application. This information is readily available on a free credit report from one of the major credit bureaus .

World Of Hyatt Credit Card

The World of Hyatt credit card is a great option for folks who prefer to earn Hyatt points or who stay at Hyatt hotels frequently. This card offers a sign-up bonus of up to 60,000 Hyatt points: 30,000 Bonus Points after spending $3,000 on purchases within the first 3 months from account opening Plus, up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spend on purchases that normally earn 1 Bonus Point, on up to $15,000 in the first six months of account opening.

This card carries a $95 annual fee and rewards you with 9x Hyatt points per dollar spent at Hyatt hotels and resorts. Youll typically need a slightly higher credit score to get approved for the World of Hyatt card, likely in the 700+ range. Read our World of Hyatt credit card review here.

Try These Cards Instead & Use Responsibly To Build Credit

If you need a little work on your credit score before applying for a new Chase credit card, you should consider one of the options below.

These cards specifically work with consumers who have bad credit histories. And they report your payment and spending history to the three major credit reporting bureaus. With responsible behavior, you can improve your credit score over time and possibly upgrade cards faster than you think.

| Yes | 8.0/10 |

All new First Access Visa® cardmembers receive an initial $300 credit limit minus your first years annual fee upon activation. After your first year, monthly service fees will be charged directly to the card.

First Access claims that it often approves applicants that other issuers wont, which makes it a promising option if your score is very low.

Also Check: Kroll Factual Data Complaints

Who Does Chase Use For Credit Checks

Chase uses all three credit reporting bureaus to check an applicants credit history. Its difficult to determine which report the bank will pull for your application because the bank bases its pull on your location and the card youre applying for.

In other words, Chase Slate® applicants in Oklahoma may have their TransUnion credit report pulled, whereas applicants for the same card in Virginia may have their Equifax credit report pulled.

Below is a chart showing which bureaus reports are most commonly pulled by Chase bank in each state:

Each bureau maintains an independent credit report associated with every American who has applied for financing, whether its a line of credit or a loan. Some credit issuers access and report to all three bureaus. Some only use one and others may use two of the three.

That means one of your creditors may report your account history to one bureau, but the other two have no record of the loan. This could work to your advantage if you have late payments. It can also hurt you if you have a track record of on-time payments.

Whenever you apply for a credit card, you want the issuing bank to see the best possible version of your credit report. But you cant choose which bureau the bank uses to pull your report.

Chase doesnt publish its pull methodology, so theres no surefire way to know which score the bank will see when you apply for a card. We can only speculate based on data.

What Is Chases 5/24 Rule And How Does It Work

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

If you have excellent credit but recently got denied for a Chase credit card application, it may be because of a unique rule that denies most people new Chase cards if they’ve opened too many accounts in the past two yearsfive, to be exact. Here’s a look at Chase’s “5/24” rule.

Also Check: Is Carmax Pre Approval A Hard Inquiry

How Chase Credit Journey Works

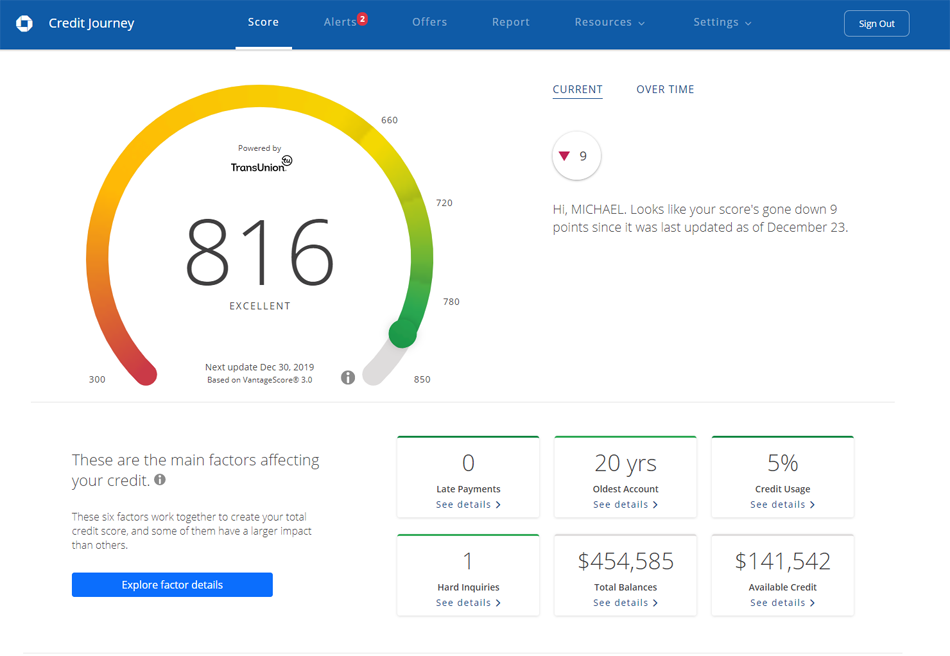

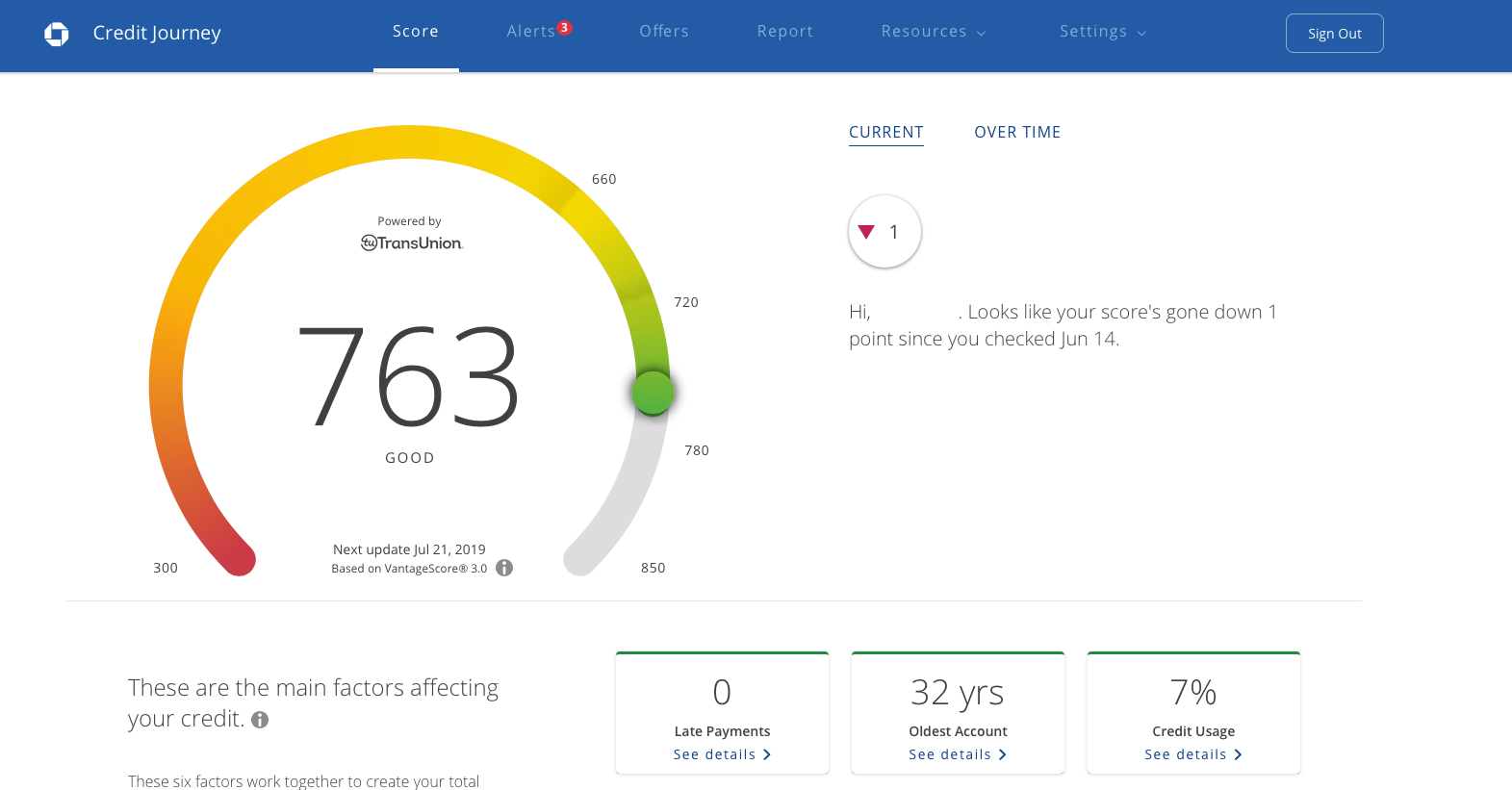

When you sign up for the Chase Credit Journey free credit score product, you give Chase authority to access your credit information. Chase then gets your credit report and VantageScore 3.0 credit score information based on your Experian profile.

Chase pulls your information with a soft inquiry, which does not damage your credit score.

When you log in to your Credit Journey page, Chase immediately brings you to your credit dashboard.

This dashboard displays your most recent credit score and the date your credit score will update next. You can also view your credit score history by clicking the Over Time tab.

Below your score, Chase lists the six major factors that impact your credit score along with how youre doing on those factors based on data from your credit report.

You can click on any of these factors to see detailed information about how youre doing on that factor.

Related: How Your Credit Score Is Calculated

Where Is The Chase Credit Journey Login Page

Once youve signed up for an account, it isnt always easy to remember where to log in to Chase Journey.

If you have Chase products, such as a checking account, savings account or a credit card,log in to your Chase account here. Once logged in, My Credit Journey is listed on the left side of the page.

If you dont have any Chase products,. Bookmark it so you can easily find it next time you need it.

You May Like: How To Raise Credit Score By 50 Points

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

How To Calculate Your 5/24 Score

If you’ve recently opened new credit cards and want to apply for a Chase credit card, you may not know where you stand for the 5/24 rule. To calculate your 5/24 score, simply review your and count the number of accounts that were opened in the past 24 months.

This also includes if someone added you as an authorized user on their account. And any accounts that were opened within the past two years but also closed within that time should still be counted.

Recommended Reading: Zebit Report To Credit Bureau

Donotpay Can Help You Solve Problems In All Areas

The sky’s the limit when it comes to things that DoNotPay can help you with. They solve problems across all areas. In the area of credit issues alone, DoNotPay provides a number of services.

- Do you need help with a debt validation letter? DoNotPay can help.

- Are you seeing collection items that you don’t agree with on your credit report? DoNotPay can help you get them removed.

- Are you concerned that there are too many inquiries on your credit report? Let DoNotPay help.

- Do you need help fixing your credit score? DoNotPay can help you with that too.

If DoNotPay can help you with all these things in just the area of , imagine what other services they can provide in other areas.

What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

Read Also: Chase Sapphire Preferred Credit Score Needed

How Can I Improve My Score To Get This Card

If you dont yet have a high enough credit score to qualify for the Chase Freedom Unlimited card, you can make several moves to improve your credit score. Here are some things you can do immediately:

- Check your credit report. Its not uncommon for credit reports to have errors on them, and theyre not always in your favor. You can request one free copy per year of your credit report from each of the three credit bureaus at annualcreditreport.com. If you find any errors, you can get the credit errors fixed before you apply for the Chase Freedom Unlimited card.

- Get a secured credit card. Think of a secured credit card as a starting point. Theyre available to almost anyone, as long as you put down a refundable deposit. In return, theyll help you grow your credit score so you can apply for other, better cards later like the Chase Freedom Unlimited card.

- Pay down other credit card debt. The amount of credit card debt you have has a big impact on your credit score. If you have credit card debt now, you may be able to see an increase right away if youre able to pay down some of it.

- Ask for a credit limit increase on your other credit cards. If you have other credit cards with a balance on them, call up those banks and ask for a credit limit increase. This makes it look like youre using a smaller percentage of your available credit, which can positively impact your score. But remember, dont spend up to that new credit limit or youll be in the same spot as before.

Ink Business Preferred Credit Card

With the Ink Business Preferred you can earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases within the first three months of account opening. It the Ultimate Rewards earning card with the highest welcome bonus, one thats worth at least $1,250 in travel when you redeem your points through the Chase Travel Portal.

Even though the Ink Business Preferred is a business credit card, Chase will use your personal credit score in deciding whether to approve you. In general, its a good idea to have at least a score of 740, though there have been reports of people with lower scores being approved. Regardless, youll also need business income, and sometimes Chase goes as far as asking for documents for proof of business, like a business license, invoices, business card, etc.

You May Like: Navy Auto Loans

What Factors Do Card Issuers Consider

An applicants credit score is the first indication of credit status, but card issuers also evaluate several other factors:

- On-time payment history: While not as heavily weighted as other factors, too many late payments count against a credit score and appear in a credit report for up to seven years.

- A is the percentage of credit a cardholder is carrying against the total credit they have available across all accounts. Large balances carried over month-to-month can quickly snowball into a high credit utilization rate. Its generally recommended that, if possible, you keep your credit utilization rate below 30%.

- Number of open accounts : Card issuers want to know how many credit or loan accounts an applicant currently has open, including how many were opened in the last 12 to 24 months. Too many accounts opened within a short period of time is a major red flag to issuers. It tells a lender that an applicant may be churning and burning credit cards to gain access to rewards or sign up bonuses.

- Income and monthly bills: Card issuers also analyze an applicants annual gross income and monthly bill payments like rent, mortgages or loans. Lenders want to know that the applicant will be capable of making regular, on-time payments.

- Age: Cardholders in the range of 18 to 22 may find it difficult to qualify for an ultra-premium rewards card like the Sapphire Reserve card because of a short credit history. Issuers want to make sure that an applicant has a sufficient credit history.

Should You Get Chase Journey

If you take nothing else from our Chase Credit Journey review, know that the service is absolutely 100% free. You dont even have to give payment information. For that reason, you have nothing to lose by signing up.

Personally, I think there are better free credit score products out there. However, theres nothing wrong with signing up for multiple free credit score services. In fact, I suggest it.

This way, you can keep tabs on all of your credit reports and credit scores. Simply sign up for complimentary services that offer different bureaus or scores to get a better picture of your overall credit score.

Recommended Reading: Affirm Delinquent Loan

How To File A Dispute With The Credit Bureau

Is the data on your credit report not quite right? You need to get this corrected so that your credit score will show up accurately with lenders. It may take some time to get to the bottom of these errors, so start as soon as possible. Then, keep tabs on your Chase Credit Journey score to determine what impact those corrected errors made on your score.

The process for filing a dispute is relatively easy, but you will need the addresses of the three credit bureaus.

Start by writing a letter detailing the error that needs adjusted. You may also want to include their dispute form and any proof you have that supports your point. Here are the addresses and forms you will need to include based on which agency has the misinformation:

Mail your letter to Equifax at:

Equifax Information Services LLCP.O. Box 740256Atlanta, GA 30348

If you need to file a dispute with Experian, you will need their dispute form. Mail both the form and your letter to:

Experian

Much like Experian, you should mail your letter and dispute form to TransUnion at:

TransUnion LLC Consumer Dispute CenterP.O. Box 2000Chester, PA 19016

When you send in this information, be sure to make a copy of it for your records. This way you have the exact information you sent in if you need to contact them about the issue again. Be sure to file it away somewhere safe.

Southwest Rapid Rewards Premier Credit Card

Best Southwest value card

- This card is best for: Southwest regulars who want a little more value than whats offered by the Rapid Rewards Plus.

- This card is not a great choice for: Someone looking for top-notch travel perks like boarding upgrades and annual travel credits.

- What makes this card unique? Your rewards rates and sign-up bonus match those of the Rapid Rewards Plus, but your spending will also earn you Tier Qualifying Points a way to get a headstart towards elite status with Southwest.

- Is the Southwest Rapid Rewards Premier card worth it? Yes. For a Southwest customer looking to earn their way to A-list status with the airline, this card is a valuable tool to make your travels a little more affordable.

Jump back to offer details.

Read Also: Comenity Bank Credit Bureau Dispute

What Happens If My Card Application Is Denied

It can be surprising and perhaps confusing if your application for a credit card is denied. By law, the card issuer is required to explain why you were denied, but the language used may not be clear.

If you dont clearly understand a denial, you can contact the card issuer and inquire about your application. Sometimes the denial can be reversed, a process known as reconsideration. To speak with a Chase representative about your personal credit card application, call 1-888-270-2127.

Once you reach a Chase representative, you will be told why your application was not approved. Often, there are simple explanations, including the issuers inability to verify your address or other personal details. If this is the case, once Chase receives the correct information, it may be able to approve your application over the phone, despite an earlier denial.

In other situations, you may be denied for more significant reasons, which you also may be able to resolve. For example, Chase may determine that it has already extended as much credit as its willing to you. However, if you want to move some of your available credit from one of your existing cards, then Chase might approve your application.

Finally, you may have a poor credit score or credit history that prompted the denial.