Problems With Credit Reporting

Heres where it gets complicated. Some businesses only provide information to the CRAs when an account is past due or has been written off and/or turned over to a collection agency. Creditors will write off a debt when it is deemed uncollectible.

Some of these creditors include:

- Utility companies

- Doctors and hospitals

- Lawyers and other professionals.

The three reporting agencies are making increasing efforts to gather monthly information from utility companies, phone companies and local retailers. That increases the amount of data in an individuals credit profile, which cuts down on the guesswork.

Why You Might Want A Different Credit Card

It has an annual Annual fee

Many of the top secured credit cards don’t charge annual fees. You can even find alternative cards for those with limited or no credit that have no annual fee and no security deposit requirement. Consider the , for example, which is also issued by WebBank and touts itself as a low-cost option for those looking to build a credit history. Petal’s issuer also uses its own underwriting model to evaluate creditworthiness, considering such things as income, spending and savings. The annual fee is .

It doesn’t earn rewards

With a starter card, the goal is to establish a credit history. Rewards arent as important but some starter cards do offer them. The aforementioned , for example, has a rewards program. So does the . It earns 3% cash back on travel and entertainment and 2% cash back at restaurants for purchases up to $500 per billing cycle . For all other purchases, it earns 1% back.

If you have at least fair credit, you can even find rewards-earning options among major lenders. The offers 1.5% on all spending. It has an annual fee. But it may also offer you access to a higher credit line after you make your first five monthly payments on time.

It has A permanent ‘payment due’ date

If you have at least fair credit, the doesn’t require a security deposit.

A lower credit limit

What Credit Bureau Does First Premier Bank Use

You can apply for one with bad credit or no credit score at all. There is a fixed rate, though: First Premiers APR of 36% for its unsecured cards and 19.9% for its secured credit card. On the plus side, First Premier reports your activity to the major credit bureaus TransUnion, Experian and Equifax.

You May Like: What Credit Bureau Does Sprint Use

Don’t Miss: How Do Evictions Show Up On Credit Reports

Easily To Qualify With Any Credit History

There’s no minimum credit score for the Merrick Bank Double Your Line® Secured Visa® Card, and you can even get approved with bad credit or no credit history at all. You will need to meet a few qualifications, however: You must be at least 18 years old, have a valid Social Security number and U.S. address, and not have a pending bankruptcy filing or outstanding tax obligations.

Once your application gets approved, you’ll need to provide a refundable security deposit before Merrick Bank will open your account. The deposit, which will also serve as your credit limit, is set at $200.

Once you start using your card, Merrick Bank will report your account and payment information to all three major credit bureaus. Your on-time payments can help build and improve your credit, while paying late or not at all could hurt it.

Can Opening A Bank Account Hurt Your Credit Score

Put very simply, opening a checking account very seldom, if ever, affects your credit score. There are a few exceptions to this, but they are rare and typically dont have a major impact. Your credit score is intended to track how you handle your debts, such as making mortgage payments, repaying loans, and so forth.

You May Like: Will Carmax Approve You With Bad Credit

When Does Capital One Report To Credit Bureaus 2022

What to know all about capital one and when does capital one report to credit bureaus? Your credit scores are based on the information in your credit reports. And your credit scores like your reports can change over time. But how often do they change?

The short answer: It depends. Read on to learn about when your credit scores might change and to get tips for improving your scores and monitoring your credit.

What Is The Accepted Credit Score Range For Most Cards

Merrick Bank offers credit to customers with no credit history. As a result, you can apply for the Double Your Line Secured Visa and Secured Visa credit cards with no credit history and even no to poor credit scores.

According to FICO, a poor credit score means a credit score of less than 580. So, even if your credit score is below 580, you can apply for Merrick Bank Secured credit cards and rebuild your credit.

Recommended Reading: Klarna Credit Approval Odds

First Premier Bank Gold Mastercard

| Up-to $125 first year, $49 annually. | |

| Rewards Earning Rate | This card does not offer a rewards program. |

| Foreign transaction fee |

The First PREMIER Bank Gold Mastercard is no longer available. The information contained in this article is accurate as of November 2021.

The First Premier Bank Gold Mastercard is not one of our top-rated credit cards for bad credit. You can review our list of the best credit cards for bad credit for what we think are better options.

Apply For Secured Credit Card

When you are first building your credit, you may not qualify for an unsecured or regular credit card. This may be due to either a low credit score or not yet having any credit score.

A secured credit card may be an option to establish credit that may eventually help you qualify for other cards with higher limits and better rates. A secured credit card means you put money down to secure the card, which serves as a guarantee to the card issuer that you can pay your bill when its due. Your deposit often is equal to your credit limit.

Recommended Reading: Experian.com Viewreport

Don’t Miss: How To Get A Credit Report From Credit Karma

This Card Is Best For

- Motivated to create positive credit historyCredit Builder

According to Experian, 33% of Americans have credit scores between 300 and 669, which is considered the very poor to fair range. If your score falls in that range, you may struggle to qualify for credit cards or loans. Secured credit cards like the Merrick Bank Secured Visa can be a useful tool to improve your credit score with responsible card use.

Merrick Bank will report your account activity to the three major credit bureaus, so using the card responsibly can help you potentially qualify for unsecured cardsincluding ones that offer rewards and benefits like travel insurancelater on.

Is The Card For You

The Merrick Bank Secured Visa® credit card will help you build your credit by reporting your activity to credit bureaus. Additionally, it provides free educational resources to help you make the right choices with your money and free regular FICO credit score updates so you can track your progress. Youll start out with a generous line of credit, depending upon your deposit, and have the opportunity to boost your credit line based on automatic reviews.

Just be aware that other cards in this space are available with similar or better benefits without charging an annual fee.

You May Like: Zebit Reviews Bbb

Watch For Interest Charges

If you can, pay off your balance in full each month. Not only will this help your credit, but it could also save you money on interest charges.

The Merrick Bank Double Your Line® Mastercard® Credit Card charges a variable purchase APR of 20.20% – 29.20% . With an APR this high, interest charges could add up pretty quickly if you carry a balance from month to month.

Become An Authorized User On Someone Elses Credit

Similarly, you can become an authorized user on another persons credit card. Again, this is often a parents card, but this method also works with spouses who have good credit. You get the benefit of their credit history associated with the card, in addition to the chance to use credit responsibly. The key here is to make sure the other person never makes late payments or defaults on their card. You should consider contacting the card issuer to make sure that they report information on authorized users to the credit bureaus.

Dont Miss: Attcidls

-

Identity insurance

Yes, $1 million for all plans

See our methodology, terms apply. To learn more about IdentityForce®, visit their website or call 855-979-1118.

Whos this for? IdentityForce® UltraSecure and UltraSecure+Credit offer the most extensive security features that monitor your information on a variety of sites and services, including the dark web, court records and social media .

Consumers receive alerts for potential fraud on your bank, credit card and investment accounts, as well as the use of your medical ID, social security number and address.

For a complete credit monitoring and identity protection service, opt for UltraSecure+Credit. This plan provides the added benefit of three-bureau credit monitoring and credit score updates. You can also track how your score changes over time and simulate how certain actions can impact your score .

Also Check: Zzounds Payment Plan Denied

Secured Sable One Credit Card

- New! Get a dollar-for-dollar match on all cash back at the end of your first year with Sableâs Double Cash Bonus.

- Earn 2% cash back on everyday purchases at Amazon, Uber, Uber Eats, Whole Foods, Netflix, Spotify, and more! Plus, earn 1% cash back on all other purchases.

- No credit check or US credit history required

- No SSN required for non US citizens

- Build US credit history from day 1 at major credit bureaus

- Get unsecured in as little as 4 months

- No annual fee, no minimum security deposit

- Premium benefits like coverage in the event your covered cell phone is stolen or damaged , rental car insurance, and much more!

| N/A |

You May Like: Does Aarons Do A Credit Check

Merrick Bank Credit Card Q& a

Get answers to your questions about Merrick Bank Credit Cards Reviews below. For more general questions, visit our Answers section.

Yes, Merrick Bank is a legitimate credit card company that issues real credit cards. It is a top 20 VISA credit card issuer with nearly three million customers, specializing in helping customers build, or rebuild their credit.

All Merrick Bank credit cards benefit from zero liability protection, so you won’t be held responsible for unauthorized charges made with your card or account information.

The Merrick Bank Classic Secured Visa Card is a good way to start building or rebuilding your credit, as it is open to applicants with Bad credit. It does have an annual fee , which gets replaced by a monthly fee on your first account anniversary, but it only requires a minimum refundable security deposit of $200. Your deposit acts as your credit line and you can add to it whenever you like, up to the maximum amount allowed.

You can also check out other secured credit card offers, as well as find some additional tips on how to improve your credit and monitor your credit score for free, right here on WalletHub.

The easiest way you can pay your Merrick Bank credit card is online, either through the Cardholder Center, or by using the goMobile app. Alternatively you can make a credit card payment by phone at , via mail or through a money services.

Recommended Reading: Brandon Weaver Credit Repair Reviews

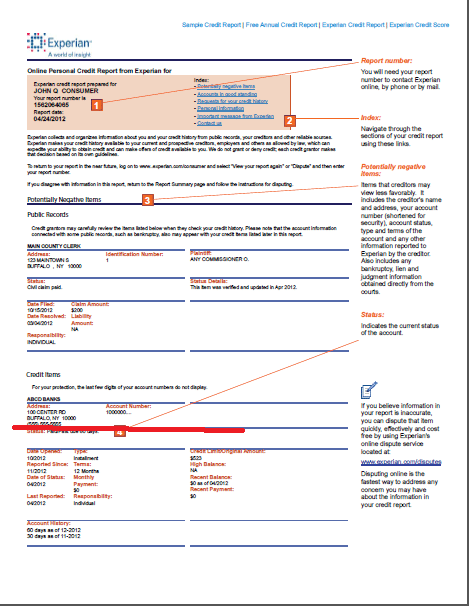

Review Credit Report For Errors

- Incorrect street address

- Incorrect name

- Fraudulent accounts, otherwise known as accounts that you didnt open. Beware, as this could be identity theft.

- Inaccurate credit limits

- Wrong birth date

- Spouses information is inaccurate

- Accounts that are mistakenly shown as being open or closed. Look to see if theres a notation on the account saying if you or the creditor closed the account .

- Wrong payment status information

Four Ways To Ruin Your Credit

Your credit score says a lot about you. It paints a picture of your financial practices that can affect your ability to borrow money, buy a home and even land a job. Yet, despite its importance, many people are surprised to learn that credit can go from good to bad in no time at all. And, most often a few bad borrowing practices are to blame. Here are four of the best ways to ruin your credit.

Read Also: Does Affirm Help Your Credit Score

Monitor Your Credit For Free With Creditwise From Capital One

Whether youre trying to maintain your credit or improve your credit scores, its important to monitor your credit regularly. Why? Because monitoring your credit can help you see exactly where you standand how much progress youve made.

You can also get free copies of your credit reports from all three major credit bureaus. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Capital One usually reports to the credit bureaus 3 days after the closing statement. Unlike other credit card companies, they do not immediately report a new balance of 0. If you need your balances to show 0, plan 3 days ahead of your closing statement.

How Does Your Score Affect Your Life

1. Interest Rates

Anytime you apply for a loan, a lender is likely going to review your credit history and credit score. Lenders use your credit score to determine the likelihood that you will repay your loan as outlined in your loan terms. Lenders may also use your credit score to determine your interest rate and down payment requirement. This applies to home loans, car loans, personal loans, credit cards and more.

2. Insurance Rates

Insurance companies may also review your credit history before determining your rates. They use the information in your credit report to determine your insurance score. This insurance score is then used to determine your overall insurability, which can affect your monthly premiums and your ability to qualify for discounts off of normal insurance rates.

3. Employment

Some employers check the credit reports of prospective employees before extending job offers. They do this to predict your level of responsibility at work by looking at how financially responsible youve been in the past.

4. Housing

Some landlords insist on seeing your credit report as part of your lease application. You have to give your permission in writing, but with a quick credit check, your landlord or property manager can make assumptions about your ability to pay rent on time.

5. Utilities

Also Check: How To Unlock My Experian Account

Make On Time Payments

Making on time payments sounds like a super simple thing to do however, we all live in the real world where things almost never go as planned.

Be sure, no matter what, to make your payments on time because it is super important and is one of the largest factors in your credit score.

No matter what, avoid late payments.

How Often Do Credit Reports And Scores Get Updated

The next logical question is, when your credit card issuer sends the information to a credit bureau, when does it appear on your credit report?

Generally, you can count on your information to be added to your credit report as soon as the bureau receives it. According to TransUnion, when the credit bureaus receive information regarding your accounts, they typically add it to your credit report right away.

Your credit scores are calculated based on the data in your report every time a creditor requests them. However, you probably shouldnt expect any dramatic changes every time your credit issuer reports your most recent payment. Building credit can be a lengthy process that requires patience, but if you pay on time every time, youll see the results.

Your credit score isnt guaranteed to change with every timely payment.

Brian Martucci, credit expert at Money Crashers

That might not be the case with late payments. Whenever a delinquency appears on your credit file, it can significantly hurt your credit. The longer the debt goes unpaid, the more damage it can do to your scores.

You May Like:

Also Check: Apple Card Shopping Cart Trick

When Does Capital One Report To Credit Bureaus

The long answer to when does capital one report to credit bureaus: Since your credit scores are based on the information in your credit reports, your scores can be updated whenever your reports are updated.

How often your reports are updated might depend on how often the three major credit bureaus Equifax®, Experian®, and TransUnion® receive information from lenders.

Every lender has its own schedule for detailed data to the credit bureaus. And lenders normally dont report data to every one of the credit bureaus simultaneously. Be that as it may, data is ordinarily revealed every 30 to 45 days.

As such your scores could change every time new data like new records or changes to your record adjustments are accounted for by a lender and reflected in your credit reports.

Since every lender has its own announcing schedule and strategies, your credit scores can change often even multiple times each day. Its typical for your scores to vary a bit.

And remember that you have a wide range of credit scores. That is on the grounds that there are many credit-scoring models numerical formulas used to ascertain credit scores. And every formula is somewhat unique.

Formulas can utilize data from only one credit report or a blend of various reports. Then, at that point, every formula could allocate various degrees of significance to that data.