Can Disputes Hurt Your Credit

There is no reason for a dispute to ever hurt your credit. At worst, it may have no impact on your credit score.

However, your score should rise if a dispute successfully results in the removal of derogatory items from your credit report.

Perhaps the only negative outcome from a credit dispute occurs when consumers abuse the process by submitting frivolous challenges. Eventually, a credit agency will recognize this kind of abuse and just ignore your dispute submissions.

Like the boy who cried wolf, this can come back to bite you when you suffer from a real credit report error.

Disputes Related To Your Personal Information Or An Inquiry

- Added: This item was added to your credit report.

- Address Updated: This may appear to you as Deleted, as your address is updated to the current address.

- Deleted: The item was removed from your credit report.

- Processed: The item was either updated or deleted.

- Remains: The company reporting the information has certified to Experian that the information is accurate, so the item has not changed.

What Makes Up Your Credit Score

Your is calculated using different scoring models, such as the VantageScore and FICO. These are the two most widely used credit-scoring models, and each has its own proprietary metrics and criteria. However, both models have one thing in common: they use data from the major credit reporting agencies to generate your score.

If you want to repair bad credit, it’s important to understand what factors VantageScore and FICO evaluate when generating scores.

VantageScore 4.0 Scoring Model

VantageScore prioritizes total credit usage, balance and available credit. Basically, the model first evaluates the amount of credit you have available to use and how much of it you’re using. Using 30% or more of your available credit can lower your score since lenders usually consider it a red flag.

Other factors considered include your credit mix, payment history, credit history length and new accounts.

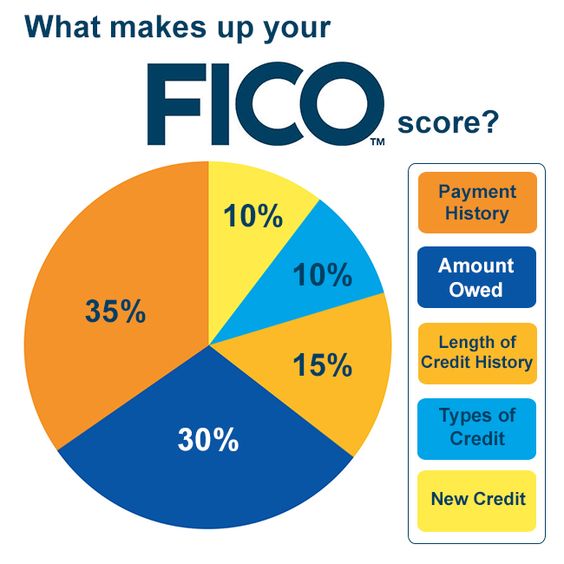

FICO Scoring Model

The FICO score is the industry standard its the oldest credit scoring model and what most lenders use to evaluate a person’s creditworthiness. FICO’s scoring has five categories, each with a percentage value indicating how much weight they place on each:

Don’t Miss: Aargon Collection Agency Scam

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

What Types Of Payments Can I Report To Credit Bureaus

Although you cannot self-report traditional credit account information to the credit reporting companies, there are types of payments you can request to have added to your Experian credit history:

- Rental payments: If you rent a home or apartment, your landlord or property management company can report your on-time rental payments to your Experian credit report through Experian RentBureau. You can also choose to enroll in a third-party rent payment service that will report your payments at your request. Having positive rent payments reported to Experian can be especially helpful for people who are trying to establish their credit history for the first time or who are trying to rebuild after credit difficulties.

- Cellphone, utility and streaming service payments: By signing up with Experian Boost, you can add your positive cellphone, utility and streaming service payments to your Experian credit report going back up to 24 months. Adding this payment information can instantly boost your Experian credit score.

Also Check: What Company Is Syncb Ppc

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

How Long Does It Take To Rebuild Credit

Typically, it takes at least 3-6 months of good credit behavior to see a noticeable change in your credit score. It is difficult to make a change any faster, unless the negative information on your credit report was a minor blip, like being late with bill payments one month.

While it is impossible to put a specific time frame on , it is safe to say the less negative information you have on your report late payments, maxed out credit cards, constant credit applications, bankruptcy, etc. the easier it is to repair your credit score.

It takes more time to repair a bad credit score than it does to build a good one. Mistakes penalize your credit score and can prevent you from being approved for a loan. Though there are lenders that offer loans with bad credit, they end up costing hundreds or thousands of dollars in higher interest rates when borrowing. A poor credit score also can be a roadblock to renting an apartment, setting up utilities, and maybe even getting a job!

You are not going to lose nearly as many points if you are late with one payment as you will if you are delinquent for several months to the point where your account has been turned over to a collection agency. The severity of the second situation is far greater than the first and your score will reflect that.

Here are some time frames for negative information that detracts from your credit score.

Read Also: Syncb Ppc Account

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

Recommended Reading: How To Notify Credit Bureau Of Death

How To Get Your Free Credit Report

Getting your credit report is easy, especially if you havent used AnnualCreditReport.com yet. You can use this service to pull your credit reports from all 3 of the major credit agencies/bureaus quickly and easily, and for free.

The law states that all consumers are entitled to 1 free credit report from each of the major credit reporting bureaus each year.

If youve used up your annual credit report and you feel that you need to pull a fresh report, then you can use any of the credit bureaus websites to pull your report.

Most offer credit reports from all 3 bureaus, too. Other services, such as MyFICO.com , offer 3 reports as well. It doesnt matter where you get them, just be sure to have a recent report just in case theres anything new that pops up, and its always good to know your current credit scores .

There are a few ways you can go about this.

1. File Complaints with the Consumer Financial Protection Bureau

2. Write dispute letters to the CRAs.

How Should I Report That Someone Has Died

When someone dies, a family member or an appropriate person such as an executor should send a notice letter to one of the three credit reporting companies and request that they update the credit record to indicate that the person is deceased. The credit reporting company will then share that information with the othertwo credit reporting companies so that they can update their records.

The letter should include the following information about the deceased:

- Legal Name

Read Also: Carmax Installment

The Creditor Doesn’t Report To Cras

Your report might also be missing accounts. This kind of omission can happen if your local bank or credit union doesn’t provide information to credit reporting agencies. If you’re in this situation, try the following:

Ask the CRA to Add the Information

Send a copy of a recent account statement and copies of canceled checks showing your payment history and ask the credit reporting agencies to add the information to your file. The nationwide credit reporting agencies themselves don’t specifically say that they will add accounts to your report if you report them, or whether they will charge you to do so. But it doesn’t hurt to try.

Ask the Creditor to Report the Information

Another possibility is to ask the creditor directly to report your account information to the reporting agency. Creditors and the credit reporting agencies generally have existing contracts. So, if a creditor isn’t already providing information to the credit reporting agency, it might not want to spend the resources necessary to do so just for your account. But again, it’s worth a try.

Use an Alternative CRA

You can create a free account at www.prbc.com. Its website, however, lacks the kind of consumer information you see on the websites for the three nationwide credit reporting agencies. Before you jump into this option, find out whether the creditors you are seeking credit from will agree to use a credit score from this company.

Read more articles and Q& As on Repairing and Rebuilding Your Credit.

Types Of Information That Show Stability

Some information you might want to add include:

Your current employment, including your current employer’s name and address and your job title. You might wisely decide not to add this information if you think a or a creditor has a judgment against you. Current employment information could be a green light for a wage garnishment.

- Your previous employment, especially if you’ve had your current job fewer than two years. Include your former employer’s name and address and your job title.

- Your current residence, and, if you own it, say so. Again, don’t do this if you’ve been sued or you think a creditor might sue you. Real estate is an excellent collection source.

- Your previous residence, especially if you’ve lived at your current address fewer than two years.

- Your telephone number, particularly if it’s unlisted. If you haven’t yet given the credit reporting agencies your phone number, consider doing so now. A creditor that can’t verify a telephone number might be reluctant to grant credit. On the other hand, once it’s in your credit report, any debt collector who wants to collect from you will be able to reach you. If you’re not yet ready to deal with debt collectors, you might not want to add a telephone number.

- Your date of birth. A creditor will probably not grant you credit if it doesn’t know your age. But creditors also can’t discriminate against you based on your age.

- Your Social Security number.

You May Like: Navy Federal Auto Loan Rates By Credit Score

Want To Feel More In Control Of Your Finances

Our free and flexible Couch to Financial Fitness plan will help you build confidence to manage your money.

Step by step we can help you cut your spending, develop core saving muscles, and create better habits for the future.

In the UK, companies called credit reference agencies compile information on how well you manage credit and make your payments.

The three main CRAs are:

Does Removing Hard Inquiries Improve Your Credit Score

Yes, having hard inquiries removed from your report will improve your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

Also Check: Is 575 A Good Credit Score

Keep Your Balances Low On Revolving Credit Such As Credit Cards

How much of your available credit you actually use is called your credit utilization ratio, and it makes up 30% of your credit score. For example, if you have a credit card with a $12,000 line of credit and youve charged $9,000 in purchases recently, that means your credit utilization on that one card is 75%. That kind of ratio is going to have a negative impact on your credit scores, because, according to Experian, it can be seen as a flag to potential lenders or creditors that youre having trouble managing your finances. Experts generally agree that its best to keep your credit utilization below 30% if at all possible.

Keep in mind however, that if you pay your balances in full each month meaning, you arent paying interest charges your credit utilization will remain low no matter how much you borrow month to month.

What Kinds Of Credit Can I Consider

Having a variety of different types of credit can very much help your credit score. Lenders want to see that you are effectively able to handle different types of credit. Those include , auto loans, and even mortgages.

If you have fifteen different credit cards, adding another credit card will likely not bump your low credit score.

Consequently, ensuring a broad variety of loans can help.

So what can you consider?

- Secure credit cards: These cards require you to deposit a certain amount in an account before you can use the card. You then borrow against this balance. Getting a secured card can help you pump up your credit score as the company reports positive payment history.

- Store cards: Store credit cards can often be helpful to your credit score because they are limited in their use. They do not carry card network designations, like Visa or Mastercard, which means they can only be used in the store issuing the card.

- Traditional credit: If your report is heavy on credit cards, you may want to consider a more traditional loan for your next large purchase. These can include a bank loan, personal loan or even a retail installment sales contract that you get through a furniture or electronics store.

Don’t Miss: What Credit Report Does Comenity Bank Pull