A Few Key Considerations You Should Make When Choosing A Business Credit Card For Bad Credit:

- Whats the APR for purchases?

- Is there a penalty APR if I pay late?

- Whats the annual fee?

- How much working capital do I need?

- Would a no-personal-guarantee business credit card be a better option for my needs?

- Will this card help me build my personal and business credit so I can access better financing down the road?

Because business credit cards for bad credit are very limited, Navs pick here is a personal credit card with a flexible credit score requirement:

What Is The Credit Limit For The Wells Fargo Reflect Card

Wells Fargo doesnt list specific credit limits for the Wells Fargo Reflect® Card. However, generally speaking, your credit limit will be assigned based on your income, credit score and other debts.

If you’re a current Wells Fargo credit card customer and want to apply for the Wells Fargo Reflect® Card, you should also know that Wells Fargo has the right to reallocate your credit limits between your existing card and your new account.

Who is eligible for the introductory offer? Before you apply, you should be aware that Wells Fargo sets limits on whos eligible for their introductory offers. Specifically, the bank says that “you may not be eligible for introductory annual percentage rates, fees and/or bonus rewards offers if you opened a Wells Fargo Credit Card within the last 15 months from the date of this application and you received introductory APR, fees and/or bonus rewards offers even if that account is closed and has a $0 balance.”

You also may not be eligible if youve opened another Wells Fargo credit card in the last six months.

How To Increase Your Chances Of Getting Preapproved

If you want to boost your chances of getting preapproved, youll need to take some simple steps to improve your credit score. For example, you should make sure to pay your credit card bill and other bills early or on time each month. Considering your payment history is the most important determinant of your FICO score, this is easily the most important thing you should do when it comes to your credit.

Since the amount you owe in relation to your credit limits is the second most important factor that makes up your FICO score, you should also strive to pay down debt. Doing so can decrease your credit utilization rate, which shows lenders youre not at risk of overextending yourself.

Other steps you can take to improve your credit include refraining from opening too many credit card accounts and keeping old credit cards openeven if youre not using them.

Don’t Miss: What Credit Report Do Car Dealers Use

Get Credit For Your Monthly Bills

When you make payments on your debt accounts such as loans and credit cards, your lender reports those payments to the three credit bureaus. However, many of the bills you pay each month dont help to boost your credit. For example, bills like your phone bill and utilities arent reported to the credit bureaus, so they dont affect your credit score.

Experian offers a product called Experian Boost, which gives you credit for the utility bills you pay each month. If you have a slim credit report or are just below the next credit score range, those reported payments may help boost your score.

Wells Fargo Platinum Card: 640+ Fico

The Wells Fargo Platinum card is a popular card for its long introductory APR deal for new cardholders. It applies to both new purchases and balance transfers, the latter making it appealing to consumers looking to consolidate debt.

Cardholders will need to pay a balance transfer fee for all transfers, but the card charges no annual fee. It also offers the same cellphone protection as other Wells Fargo cards provided you pay your cellphone bill with your card.

Don’t Miss: Does Discover Report To All 3 Credit Bureaus

Customer Service At Major Lenders

| CFPB Complaints, 20214 | |

| 0.35 | 829/1,000 |

Wells Fargo has more complaints than most would like to see, according to data registered with the Consumer Financial Protection Bureau . Still, it does have fewer than one complaint per 1,000 home loans.

Overall, its performance suggests you probably wouldnt choose Wells Fargo Home Mortgage solely for its customer satisfaction. But you shouldnt rule it out, either.

Keep in mind these customer service facts detail Wells Fargos performance as a loan originator, but not as a loan servicer.

Wells Fargo Home Mortgage Review For 2022

Wells Fargo is an American staple. Headquartered in San Francisco, its roots as a stagecoach company stretch back into the 1800s.

Today, Wells Fargo carries on its legacy as one of the nations foremost banks and lenders. But Its hard to think about Wells Fargo without remembering some of the banks recent issues.

Reports of millions of accounts being wrongly opened emerged in 2016. And more recent problems have come to light about unnecessary fees being imposed on some home loans, and a computer glitch that led to hundreds of people facing foreclosure.

And yet Wells Fargo is in the top five most popular U.S. mortgage originators, according to the Consumer Financial Protection Bureau most recent data.

So clearly, the financial institution is getting things right for many homeowners.

This could have something to do with its competitive mortgage rates, helpful online tools, and steadily rising customer satisfaction scores.

Here we explore the ins and outs of Wells Fargo Home Mortgage, so you can decide for yourself whether this is the right mortgage lender for you.

Don’t Miss: How To Check Your Real Credit Score

The Credit Score Trap

Roughly 30% of our FICO® credit score is based on a factor called “utilization ratio.” It’s also sometimes referred to as “amounts owed.” Lenders want to know that we have access to lots of credit but are careful about the amount of credit we use. The lower our , the better our overall credit score. Here’s how losing access to that revolving credit could be tough on Wells Fargo customers.

Say a customer previously had a revolving line of credit with a limit of $50,000. Maybe they used $10,000 of that limit to remodel a guest bath or pay off high-interest debt. That meant that their utilization ratio on that loan was 20% .

As long as they weren’t using too much available credit from other sources, that’s a fine ratio. Using 30% or less of available credit is considered good. And it only gets better as the account holder makes regular payments and pays down the balance. Each month, their utilization ratio drops, enhancing their credit score.

Once Wells Fargo closes the accounts , that revolving line of credit disappears. It now appears that a customer who owes $10,000 on a $50,000 revolving line of credit owes $10,000 on a $10,000 loan. So instead of a 20% utilization ratio, they have a 100% utilization ratio.

It may work out for customers who are fortunate enough to have other open lines of credit . But if the Wells Fargo personal line of credit is someone’s sole loan, or they owe more than 30% on other debts, they could see a dip in their FICO® Score.

Wells Fargo Reflect Card Vs Citi Double Cash Card 18 Month Bt Offer

Verdict: Top-notch rewards, but no intro APR for purchases

The Citi® Double Cash Card offers a long intro APR on balance transfers: 0% for 18 months on Balance Transfers after that, the APR will be 15.49% – 25.49% . Cardholders get excellent rewards on all spending: Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

However, you should note that the introductory rate only applies to balance transfers and not to purchases. That makes this card an inferior option if you’re hoping to get a 0% APR on items you buy for a limited period of time.

Don’t Miss: How To Check Credit Rating In India

How To Earn More Wells Fargo Autograph Card Points

The 30,000 points that are worth $300 are just the beginning if you know how to make the most of the Autograph card. Youll earn one point for every dollar spent. Theres no limit to how much you can earn in rewards. However, there are categories that earn an elevated 3X points to accrue rewards faster. The categories are:

- Gas

- Phone service

Why Are There So Many Different Credit Scores

Your credit score is like a photograph its a snapshot of your credit situation at one particular moment in time. And just like a photo, the quality of it depends on where you are that day, whos taking the photo, why theyre taking it, and what kind of camera theyre using.

Standardized credit scores have only been around since 1989 when the Fair Isaac Corporation devised the first credit-scoring algorithm. This credit scoring model called the FICO® Credit Score after the companys name standardized the process of credit diagnostics, and quickly became the industry standard.

Recommended Reading: What Is A Positive Entry On Your Credit Report

How To Dispute Information On Your Credit Report

If you find yourself with the need to dispute information on your credit report because of an error, you can use Forbes Advisorâs comprehensive guide to help you open a dispute. You will need to prepare your personal information and sufficient documentation of the error before youâll be ready to submit a dispute. You can dispute errors directly with each credit bureau any of three ways: online, by mail or by phone. The credit bureau you file a dispute with will investigate your claim and release results within 30 to 45 days.

If the results lead to a change in your credit report, you will receive a free, updated copy of your reportâbut this may take another 45 days. If you are not happy with the results of the dispute, you can resubmit with any additional supporting information to help your case.

Why Do I Have Different Fico Scores

FICO offers multiple versions of its credit score for different uses. For example, you have one FICO credit score thats used when applying for auto loans and another thats used when applying for credit cards. FICO often updates its credit scoring models. They can also be different depending on which credit report is used to calculate them. If a creditor reports a loan account to one credit bureau but not the other two, that can affect the FICO credit scores generated by each credit report.

Read Also: Pre Approval Hurt Credit Score

You May Like: How To Dispute Credit Report And Win

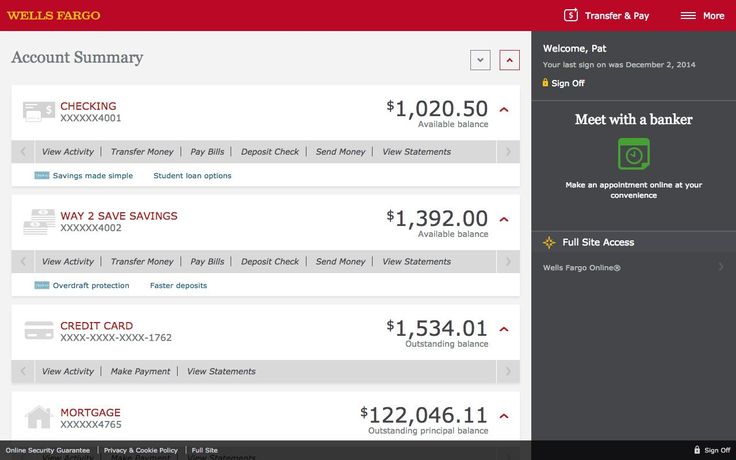

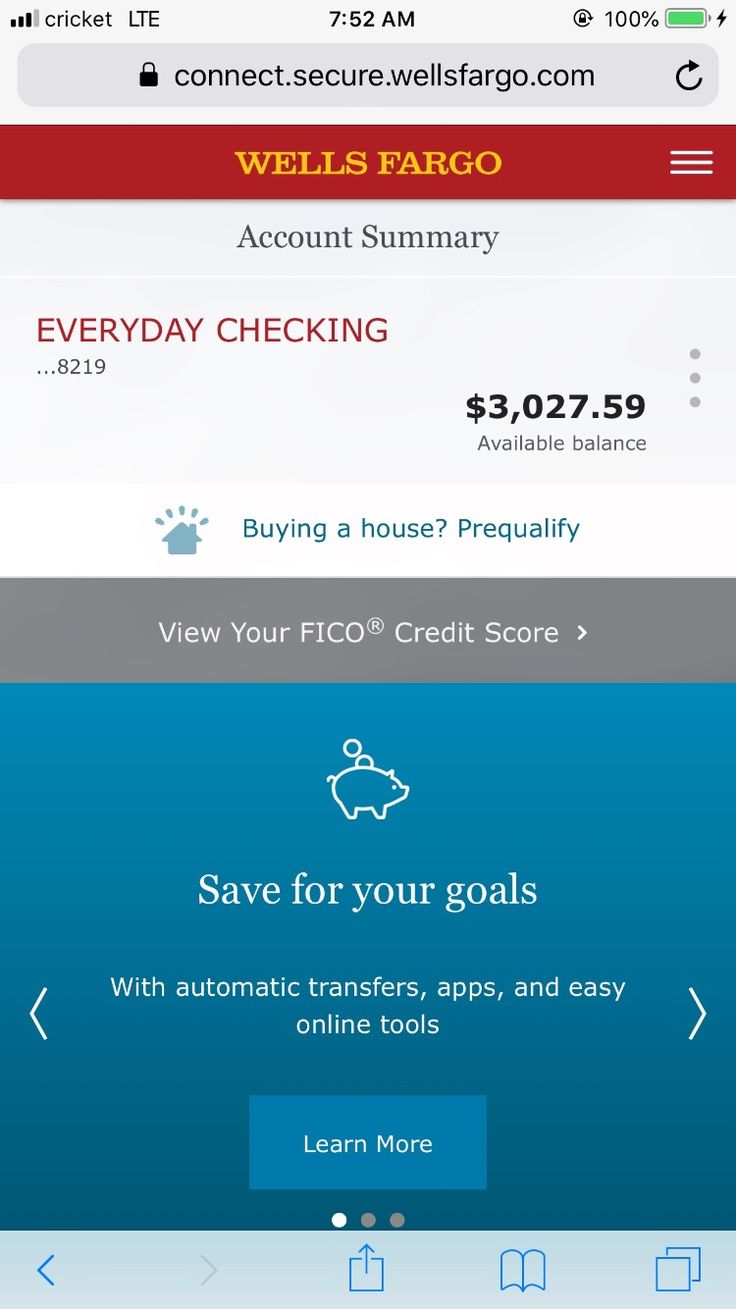

How Can You Get Your Credit Score For Free

As one of the largest banks in the country, Wells Fargo serves millions of Americans, but its is limited compared to some of the more prominent names like Chase and American Express. But that isnt necessarily from lack of trying Wells Fargos stable of credit cards most with no annual fee are still competitive offerings in the space.

Part of what helps Wells Fargo is that it seems to have flexible credit requirements, offering credit to a wide range of credit scores. But, that flexibility isnt limitless. And, since Wells Fargo doesnt offer online pre-qualification, youll probably want to know your credit scores before you choose a Wells Fargo credit card for which to apply.

Luckily, getting your credit scores is easier than ever and, often, completely free. To start, the majority of major credit card issuers now offer you monthly credit score updates for being a cardholder. These scores can typically be accessed through your online banking portal or mobile app.

You can get a free credit score from a number of sources, including through the Experian credit bureau.

If you dont have a credit card that offers credit tracking, you can get a free FICO credit score from Experian that is updated every 30 days. Both Discover and Capital One offer free credit scores, and you dont need to have an account to access the free score feature.

Additionally, many third-party companies have joined the credit score market, offering free credit scores and credit tracking.

Wells Fargo At A Glance

|

Affordability |

|

|

Loan flexibility |

|

|

Transparency |

|

|

Customer experience |

|

You May Like: How Many Points Does A Mortgage Raise Your Credit Score

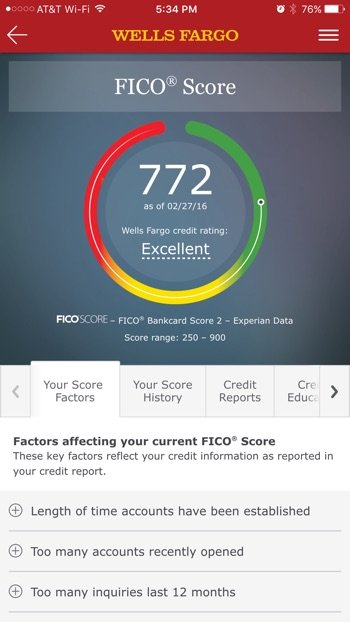

Checking And Understanding Your Credit Score Just Got Easier

There are no limits to how often you can check your credit score. The CreditView Dashboard gives you the power to:

View your score anytime.

Your score1 is updated once per month upon log in and checking it will not affect the score.

Use the Score Simulator.

This tool estimates what your score could be if you make certain changes.

Review your progress.

Use the Score Trends Graph to view up to 12 months of your credit score history.

Access credit education.

Learn credit basics, how to raise your score and more.

Personal Credit Scores Are Key To Getting Approved

While a business credit card is for business purposes, a personal credit score is still a key qualifying factor across nearly every major business credit card. For business owners with great credit, this is awesome news you dont have to worry about establishing a business credit score, submitting business tax returns or financial statements, or getting someone to believe in the vision of your business as youd need to do for other business financing options. A great credit score helps power approvals and opens up a plethora of options for the applicant to choose from. However, if you have a bad personal credit score or not enough data to produce a credit score a major problem for the small business community, as Nav noted in its study a few years ago on credit ghosts it can prove extremely problematic. Since businesses are already viewed as riskier borrowers from the lenders perspective, credit requirements for business credit cards are sometimes even tighter than the personal credit card realm. There are just a handful of options from the major business credit card issuers for business owners with bad or no credit.

Note there are exceptions:

Recommended Reading: Bankruptcy Removed From Credit Report Early

Recommended Reading: How To Get Free Credit Report

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Free Credit Score Alternatives

Free credit-monitoring sites such as Credit Karma, Credit Sesame and Quizzle offer non-FICO credit scores and you can check your credit profile anytime online and through their mobile apps. They each use consumer data from a different credit bureau. Below are each services credit data source and credit score model.

- Quizzle: Equifax, VantageScore

So, if youre left out of Wells Fargos free credit score promotion, you can check out the other banks or use any of the above services. Remember, with these alternatives, youll get ongoing information regarding your credit, as opposed to a one-time peek. Luckily, you can use a non-official FICO score to figure out how to make improvements in your credit. An improvement with one credit score will be reflected in all types of scores.

Monday, 27 Jul 2015 1:42 AM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

Don’t Miss: Is 610 A Good Credit Score

I Don’t Agree With My Fico Score Or Score Ingredients What Should I Do

If you feel information is inaccurate, your next step should be to review the details in your credit report. If there’s incorrect information within your Experian credit report, you may want to submit a dispute directly with the lender or company that provided the information to the credit-reporting company. Include any documentation you have, such as copies of a canceled check or payment verification email. For questions about Wells Fargo accounts, contact us anytime.

If the creditor investigates and agrees there was an error, they’ll send an update to all the credit bureaus it reports to and have the late payment corrected or deleted. You can monitor your credit reports for the changes, which may take several billing cycles to appear.

Accessing Your FICO® Score through Wells Fargo Online®

Wells Fargo Autograph Card Details

For starters, the Wells Fargo Autograph Card comes with a sizeable welcome bonus and a 0% introductory APR on purchases for 12 months after opening your account .

Once approved, new cardholders can earn 30,000 bonus points after spending $1,500 in purchases within the first three months of card membership, which represents a $300 cash redemption value.

As you spend with the card, you will be able to earn:

- 3X points per dollar at restaurants

- 3X points per dollar at gas stations

- 3X points per dollar for travel-related purchases, including transit

- 3X points per dollar for select streaming services and phone plans

- 1X point per dollar for other purchases

Cardholders can then redeem their points for travel, cash back, statement credits, gift cards or other merchandise. In terms of redemption value, points are typically worth one cent per point, though some redemptions such as using them for gift cards or to buy merchandise can be lower, so use your points wisely.

- Up to $600 worth of cell phone protection against damage or theft when you use it to pay your monthly bill

- Complimentary access to Visa Signature Concierge services, which can be used to book tickets for travel and other sports and entertainment events or to make exclusive dining reservations

- Rental car insurance via the auto rental collision damage waiver

- No foreign transaction fees for using your card abroad

Don’t Miss: Who Can Order A Credit Report