Why You Should Never Pay A Collection Agency

If the creditor reported you to the credit bureaus, your strategy has to be different. Ignoring the collection will make it hurt your score less over the years, but it will take seven years for it to fully fall off your report. Even paying it will do some damageespecially if the collection is from a year or two ago.

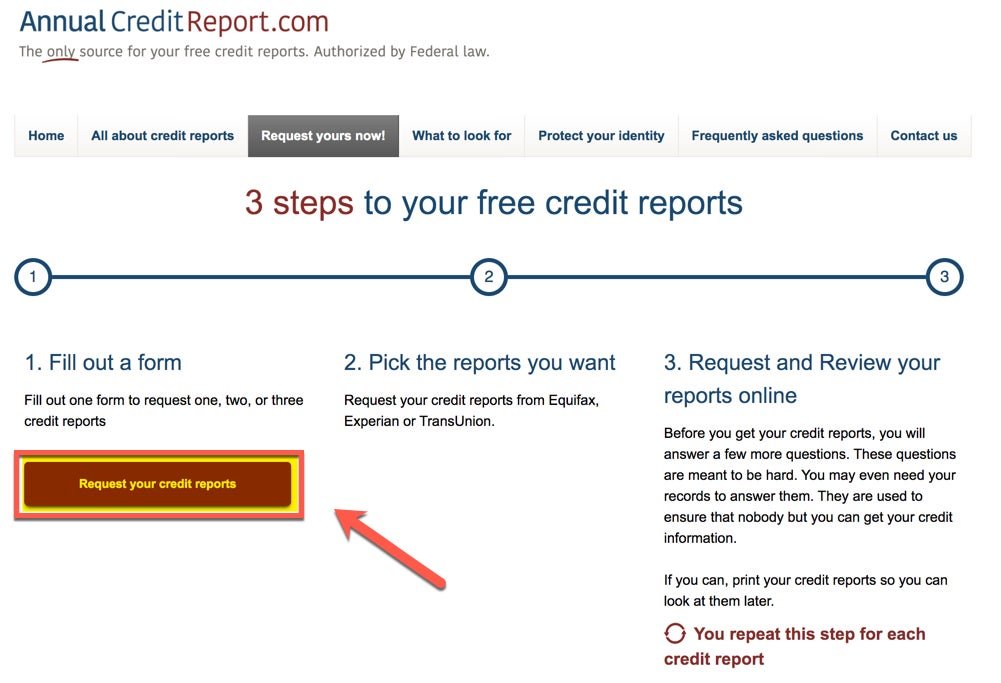

Disputing Credit Report Errors Online

This is probably the most simple and quick way to make your dispute, but sometimes there are drawbacks. You cannot fully complete your dispute online as you will still need to send proof to support your dispute through the mail. However, you can also easily check the status of your dispute online by simply providing your confirmation number. Although the final results of your dispute will only be sent to you by mail. Follow the below links to submit your online credit report dispute:

Best Time To Dispute Credit Report

At the point when negative data in your report is exact, just the progression of time can guarantee its expulsion. A credit revealing organization can report most precise negative data for a very long time and liquidation data for a very long time. Data about an unpaid judgment against you can be accounted for a very long time or until the legal time limit runs out, whichever is longer. There is no time limit on announcing: data about criminal feelings; data revealed in light of your application for an employment that pays more than $75,000 per year; and data detailed in light of the fact that youve applied for more than $150,000 worth of credit or extra security.

Read Also: How To Get Credit Report Without Social Security Number

Send A Goodwill Letter

In the case of a late payment, you can send a goodwill letter to your creditor to ask for what is known as a goodwill adjustment. Usually if you have a good history with the creditor, theyre willing to forgive a late payment;and update your credit report. To be effective, such a letter should include:

- A short history of your interactions with the creditor

- An explanation of why your payment was late

- A request to remove the late payment;from your credit report

How To Dispute An Error On Your Credit Report And Win

Your credit report and credit score are vital parts of your financial health. Using credit responsibly means you can get loans and other credit at the best possible rates. But what if there is a negative mark on your credit report thats just plain wrong?

Money expert Clark Howard says that its up to you to make sure your credit report is accurate. The credit bureaus sometimes make mistakes as do companies that report your activity to the bureaus.

In this article, well show you how to ensure there are no errors on your credit report and guide you through the steps you need to take to correct any inaccurate information.

Also Check: Check Credit Score Without Social Security Number

What Errors Can Negatively Affect Your Credit Reports

You can file a dispute for any incorrect information on your credit report. But that doesnt mean all disputes will impact your score. For example, errors that are small, like misspelled names, incorrect addresses or wrong birth dates, wont qualitatively affect your report or score. These errors should still be fixed, because they can cause delays with future lending applications.

Unfortunately, though, they likely wont impact your score. This is because these errors are more of an identification issue than a credit history issue.;

The exception to the above is if your misspelled name or incorrect birth date resulted in another persons debts being added to your report. For example, if another Jane Does collection account were added to your report incorrectly, it could significantly lower your score.;

On the other hand, inaccurate or unverified information on your report related to credit can significantly impact your score. Examples include inaccurate hard inquiries, incorrect loan amounts, missed or late payment information and false judgments. Youll want to dispute these errors right away, but approval can take some time as itll require verification from a data furnisher.;

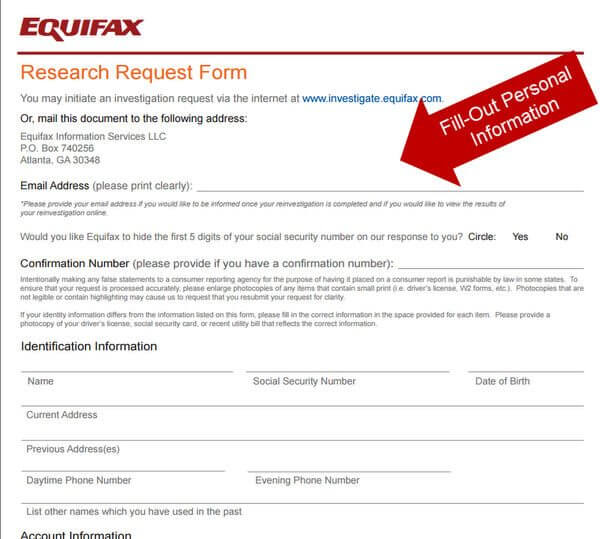

Disputing Credit Report Errors By Mail

When submitting your credit report via the mail, it is a given that it will take more time. When you make your dispute with the credit bureau, they then have 30 days to respond to you, or 45 days if you need to send additional paperwork during the 30 day period. In your written letter you need to make clear the information that is incorrect and if possible include a copy of proof. Keep track of when you posted the letter and send it through certified mail. Also be sure to request a return receipt so you know when the letter is received by the credit bureau.

You can send your written dispute to the following major credit bureaus:

Equifax dispute by mail address:

P.O. Box 740256

Experian dispute by mail address:

P.O. Box 4500

TransUnion LLC dispute by mail address:

Consumer Dispute CenterChester, PA 19016

Recommended Reading: What Credit Score Does Carmax Use

Disputes Related To Your Personal Information Or An Inquiry

- Added: This item was added to your credit report.

- Address Updated: This may appear to you as Deleted, as your address is updated to the current address.

- Deleted: The item was removed from your credit report.

- Processed: The item was either updated or deleted.

- Remains: The company reporting the information has certified to Experian that the information is accurate, so the item has not changed.

What Can You Dispute On A Credit Report

You can dispute the following types of credit-report errors:

| Types of Credit-Report Errors | Description |

|---|---|

| Inaccurate Personal Info | This could be a misspelled name, an unknown address or an unrecognized employer. The last two, in particular, could be signs of fraud. If thats the case, you may need to suppress/block the info. |

| Duplicate Accounts | Sometimes, accounts are listed twice by mistake. In other cases, debt collectors may relist accounts to trick you into making a payment. |

| Fraudulent Accounts | This could be an honest mistake. But criminals are known to open financial accounts under other peoples Social Security numbers, rack up charges and leave their victims to clean up the mess. While you can dispute this type of error, its best to suppress/block any issues stemming from fraud. |

| Inaccurate Payment History |

You cannot dispute accurate information just because it reflects poorly on you. More accurately, you can try, but you probably wont win. There are strict timeframes for how long negative information stays on credit reports. And theres nothing you can do to shorten them.

Sure, you can explain special circumstances on the Personal Statement portion of your credit report to explain a negative notation. But if the information is accurate, it wont be removed.

For your convenience, heres a quick recap of how WalletHub recommends handling the credit report dispute process:

Read Also: Speedy Cash Collection Agency

If You Find An Error Contact The Business That Reported It

If you spot something questionable or find an outright error on your report, contact the reporting entity involved. This could be a credit card company, the lender for your house or car note or even a landlord. It may just be a simple misunderstanding, in which case it should be relatively easy to clear up.

But no matter what caused the error or how insignificant it might be, you should send an official dispute letter to the company that reported the information to the credit bureau. Include a copy of the credit report itself, making sure you highlight the error. Also send any documentation you have in your favor. According to the Federal Trade Commission, the letter should look something like this:

Enclosures:

To ensure that the letter makes it to its destination, you should send it by certified mail, return receipt requested.

How Quickly Will My Score Improve After A Credit Dispute

If youve noticed a mistake on your credit report, youre probably looking forward to disputing it and getting it removed so your credit score can improve. But you might also be wondering, How long does it take for a dispute to be removed from your credit report? After all, the dispute has to be filed, approved and updated. So, how often does your credit score update? Will you see an immediate change?

The answer is a bit complicated. Ultimately, how long it will take depends on several factors. This includes what kind of items youre disputing, how long the dispute takes, if the dispute is successful and how quickly your reports update.;

In theory, if everything goes according to plan, the process can take anywhere from one to three months.;;

You May Like: How Long A Repo Stay On Your Credit

The Credit Bureaus And The Dispute Process

first

What are the mailing addresses for the 3 credit bureaus?

Equifax:

Experians National Consumer Assistance Center, PO Box 2002, Allen, TX 75013

How to write a credit dispute letter?

How to file a dispute with the credit bureau?

How long does a credit dispute take?

Who do I call to dispute my credit report?

Do online credit disputes work?

Yes. Unfortunately, it not yet as sophisticated as the traditional way. Thats why along with your online dispute, you are still encouraged to send a copy of your letter by mail. Follow these links to do an Equifax dispute, Experian dispute, or Transunion dispute online.

How often can you dispute something on your credit report?

How to cancel a dispute on credit report?

How To Track Your Dispute Status

Once you’ve submitted your dispute, Experian will send you alerts via email whenever there is a status update. If you already have an account with Experian, you can also view your dispute alerts in the main Alerts section of your Experian account. Alerts you’ll receive while Experian processes your dispute include:

- Open: This indicates the dispute process has been initiated.

- Update: Your dispute investigation has been completed and your credit report is being updated with the results.

- Dispute results ready: Your credit report has been updated with the results of the dispute investigation.

Also Check: Can You Have A Credit Score Without A Social Security Number

Removing Late Payments From Credit Reports

Successfully removing late payments from credit reports involves a direct strategy because the data furnisher is the original lender. However, disputing something does not mean the negative information will come off or your file or stay off.

You need to prioritize which erroneous delinquencies to dispute and adopt unique tactics for items before and after the 7-year expiration.

The number of points your score will go up once these derogatory items disappear varies. Deleting hard;inquiries rarely makes a lasting or meaningful difference. Therefore, prioritize the most recent and severe late payments for removal.

How To Dispute A Credit Report And Win

Your rating document contains relevant information regarding where you stay, how you pay your bills, and also whether you’ve been filed a claim against or even imprisoned, or even have actually declared insolvency. Credit report mentioning business market the details in your report to collectors, insurance providers, employers, and also other services that use it to evaluate your documents for credit history, insurance policy, job, or even renting a residence. The federal government Exhibition Credit history Coverage Act promotes the accuracy and personal privacy of relevant information in the reports of the nation’s credit coverage firms. Some monetary specialists and consumer supporters suggest that you evaluate your credit score record regularly. Why? Considering that the relevant information it has has an effect on whether you can easily acquire a financing as well as just how much you will definitely need to pay out to borrow amount of money.

You May Like: Does Speedy Cash Report To Credit Bureaus

Best Reason To Dispute Credit Report

You have three reasons you can challenge something on your credit report: If its not yours, if its not exact or if the revealing is sketchy. If the detailing isnt precise, a bank must eliminate the thing from your credit report. In the event that the loan boss doesnt, you have grounds to document a claim under the Fair Credit Reporting Act. This is costly and tedious, so your smartest option is to attempt to get it eliminated through a straight test.

What Is A 609 Dispute Letter

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’ve spent any amount of time on the internet looking for credit improvement tips or tricks, you’ve likely landed on one of the many articles dedicated to the so-called 609 Dispute Letter. A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if you’re willing, you can spend big bucks on templates for these magical dispute letters. Unfortunately, you’d be wasting your money on letter templates because there’s no evidence suggesting they are any more effective than other credit reporting dispute letter templates.

You May Like: 611 Fico Score

You Can Get Professional Help With Your Dispute

Reviewing your credit report and filing disputeswhen necessaryshould be part of your regular financial routine. Senior Director of Public Education and Advocacy at Experian Rod Griffin encourages consumers not to be afraid of disputes. He states, If you find information you believe is fraudulent, dispute it and get it corrected right away. Disputing information is free and does not hurt your credit scores.

You can increase the chances of your dispute being approved by using a credit repair service. CreditRepair.com, for example, offers credit repair services that will review your credit report and file disputes on your behalf.;

Additionally, dont forget there are other ways you can improve your score. For example, taking an interest in can help you build healthy financial habits that will increase your credit score. And a strong credit score can open the door for many other economic opportunities.;

When Should You Dispute

One thing to note when youre filing a dispute is you should not do it if you have any big purchases coming up. If youre shopping around for a mortgage, a car loan or anything that comes with a lot of borrowing, you should probably avoid disputing. Having an open dispute could make it difficult for you to get good mortgage rates.

If you have a lot of open disputes, it may make it even harder for you to get the mortgage you need. If youve already started a dispute, its definitely a good idea to wait before trying to get a mortgage or vehicle loan. The good news is most disputes do not take a long time. You can have a dispute open, investigated and back off of your report within just a few weeks if youre able to do it electronically.

The sooner you dispute after realizing you have an error on your report, the better. Unlike obtaining new credit or applying for credit, there arent many wrong times to file a dispute on your credit report. Make sure you do the dispute the right way.

Read Also: How To Check Credit Score Without Social Security Number

Errors On Credit Reports Could Include

- Identity-related errors such as a misspelled name, wrong phone number or address, or your information incorrectly merged with another persons credit record

- Incorrectly reported accounts, such as a closed account reported as open or an account wrongly reported as delinquent

- Account balance and credit limit errors

- Reinsertion of inaccurate information after its corrected

How To Win A Credit Report Dispute

Resolving mistakes on your credit reports can be difficult, to say the least. What;should;be a straightforward process can be time-consuming and the credit bureaus are certainly not the easiest companies to deal with.

If you know what youre doing, and how to win this is time well spent. Disputing negative items on your credit reports;can boost your credit score;and help you qualify for credit and loans with much more favorable interest rates.

There are three main credit bureaus youll be dealing with: Experian, TransUnion and Equifax. Save up your patience, because youll probably need it.

As you go down this road, dont expect any quick responses from any of the three bureaus but;be persistent; because your hard work will eventually pay off big time.

A 2013 FTC study found that 1 in 5 consumers have errors on their report, and;5% have mistakes serious enough to result in less favorable loan terms.

Heres what you can do to dispute these mistakes and win.

You May Like: Does Zzounds Report To Credit Bureau

Dont Accept No For An Answer

If youve disputed an error several times and it continues to be verified by the credit bureaus, consult a lawyer experienced in Fair Credit Reporting Act cases. The best place to find one is at the website of the National Association of Consumer Advocates, says Joy. Click on Find an attorney and check the profiles of the attorneys in your state to see if they handle FCRA cases.

You can also submit a complaint with the Consumer Financial Protection Bureau, which will forward your complaint to the credit bureau and ask for a response.

Finally, dont lose patience, says Rahul Sharma of College Station, Texas, who spent six years trying to get multiple errors off his reports. When you look online, people advise that you cant do anything; there is no hope, says Sharma. However, if you keep pushing for it, youll eventually get the errors off your reports, he says. Just dont give up, Sharma adds.