What Is A Judgment

A judgment is the result of a lawsuit. When you owe a certain kind of debt and dont pay it off, the creditor or their debt collection agency may try to recover it by suing you. If the judge rules in favor of your creditor, the court issues a judgment against you.

Not all debt cases go to court. Loans and accounts for certain goods and services, such as credit cards, medical bills and cell phones, may require arbitration instead. But other cases allow debt collectors to go to court in an attempt to recover what they believe you owe them through court judgments.

A judgment might order you to repay the debt by any of several means:

- A payment plan devised with the lender

- A lien attached to your property

In addition, a judge may order you to pay additional fees to cover costs associated with the original debt collection, interest on what you owe and the plaintiffs attorney fees.

What Kind Of Information Is Included In A Public Record

If you file for bankruptcy, the amount the court found you legally responsible to pay will be listed. There will also be an exempt amount. This is the amount the court says you are not responsible to pay.

Lastly, there will be an asset amount for the number of personal assets the court used to make its decision. These will all be listed in the bankruptcy and are the kind of public records that can significantly lower your credit ratings and affect your borrowing power.

Some other things that you might find in your public records might be things you consider personal, things like if you have had financial counseling, a financial statement, garnishments, and financial marital claims from a divorce. However, all of these things affect your income, and so they affect your credit.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Read Also: Does Zzounds Report To Credit Bureau

How To Remove A Judgment From Your Credit Report

If you have unpaid debt, the creditor or debt collector can sue you in court to recover the money. The result of such a lawsuit could be a civil judgment against you.

Read on if you need information on removing a judgment from your credit report, including:

- What is a judgment?

- Types of judgments that can affect your credit report

- 3 ways to remove a judgment from your credit report

- Addressing possible identity theft

- How do judgments affect your credit report?

Although most judgments no longer appear on credit reports, an old one that remains can still hurt your credit, leading to higher interest rates and making it difficult to apply for new credit. Learn more aboutthe cost of bad credit.

The good news is, if a creditor or debt collector has won a court case against you over unpaid debt and the resulting civil judgment appears on your credit report, you may still be able to have it removed.

Depending on the specifics of your debt, you may find that requesting validation of the judgment, submitting an appeal to vacate, or paying off the debt and negotiating for its removal from your credit report are all viable options.

How To Remove A Bankrupcty On Your Credit Report

![[SOLVED] How To Remove A Public Record From Your Credit Report](https://www.knowyourcreditscore.net/wp-content/uploads/solved-how-to-remove-a-public-record-from-your-credit-report.jpeg)

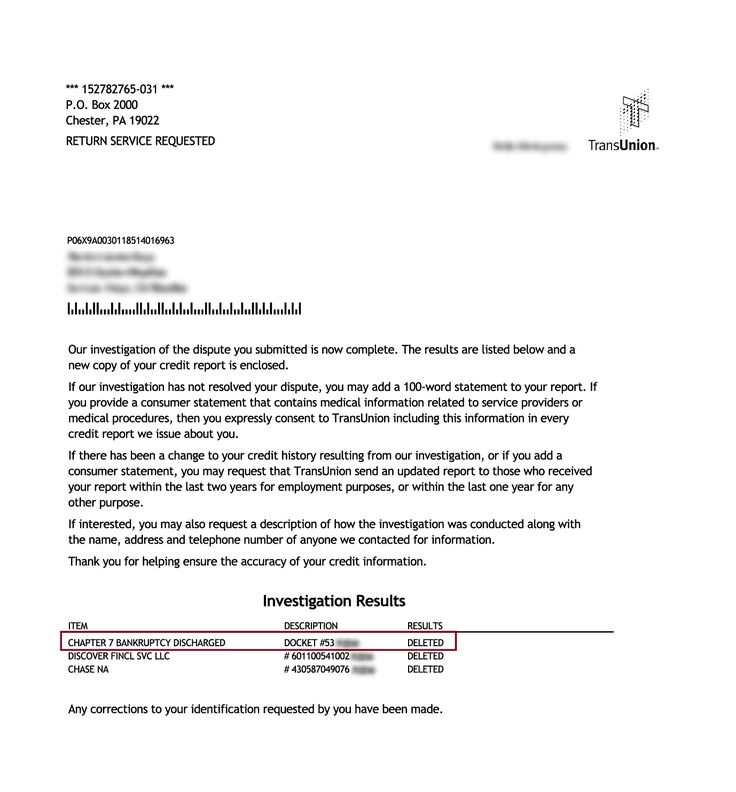

If you find a fraudulent bankruptcy reported in your credit history, youll need to reach out to the court and ask for a written statement that you have not, in fact, filed for bankruptcy. Once you receive this statement, youll forward copies to the credit bureau via Certified Mail along with a letter of dispute.

If you have filed for bankruptcy, you may be able to find an inaccuracy or error in the way the bankruptcy is reported. You can then file a dispute with each of the three major credit bureaus on that basis. Its possible that some technicality may require them to unlist the bankruptcy entirely. But, chances are itll stay on your credit report for the standard seven years if its legitimate. That said, it cant hurt to try!

Finally, if you reach out to the court for a written statement and find they do have a bankruptcy on file, even though you havent filed for one, youll need to take further steps with them to resolve the issue. The court will likely ask for documentation and records to prove the miscommunication and ultimately expunge the public record. At this point, you can proceed with filing your dispute with the credit bureaus.

Also Check: Removing Items From Credit Report After 7 Years

Public Records Arent Necessarily Gone Forever

Although the credit reporting agencies have agreed to remove certain public records from credit reports for now, that doesnt mean tax liens and judgments wont be added back to credit reports in the future. There are two reasons: Its not illegal to put them on a credit report, and the credit bureaus only agreed to remove them for a time.

New Public Record Policy

In the past, there were three types of public records that could appear on your credit report: bankruptcies, judgments and tax liens. In recent years, however, there have been major changes that have reduced the number of public records added to credit reports to one.

While its still common today to find bankruptcies on credit reports, you typically wont find a judgment or tax lien.

The reason judgments and tax liens have gone missing from credit reports is because of new policies adopted by the three major credit reporting agencies Equifax, TransUnion, and Experian stemming from a 2015 settlement between the CRAs and 31 state attorneys general.

The landmark settlement resulted in the creation of the National Consumer Assistance Plan , an initiative designed to make credit reports more accurate and make it easier for people to fix any errors.

As part of the consumer-friendly changes, the credit reporting agencies agreed to implement new standards related to public records. Namely, for any public record to be included on a credit report, it has to satisfy the following criteria:

- The public record has to contain, at minimum, the consumers name, address, plus a Social Security number or date of birth.

- The public record information must be updated/verified at least once every 90 days.

Bankruptcy records already met these stricter requirements. Many tax liens and civil judgments, however, did not .

Read Also: What Is Syncb Ntwk On Credit Report

Recovering From Damaging Public Records

Bankruptcy is by far the worst type of public record for your credit score, and it’s best to avoid filing if you can.

However, it’s also bad for your credit scoreand your stress levelsif you’re stuck with mounting bills you can’t afford to pay. In some cases, bankruptcy can be the fresh start you need, and keep in mind that a bankruptcy won’t stay on your credit report forever.

In the meantime, sticking to credit best practices can help you rebuild your credit and boost your score.

How To Remove Bankruptcy Lawsuits And More From A Credit Report: A Step

A while back, I reached out to Corey Gray to see if hed be interested in joining the brain trust at Credit Repair Cloud.

Not only is Corey super experienced in the credit and debt industry, but he shares the same core values that I do: the credit repair industry is all about helping others and changing lives.

When he accepted, I was thrilled. Now, I can tap into his knowledge, on-demand! One credit topic that we often discuss are dreaded public recordsand how to remove them from a credit report.

Public records like bankruptcy, civil judgments, and tax liens have a major impact on your clients credit score. By being able to remove them for your clients, you can make an immediate and meaningful difference in their financial lives.

Trust me, if you can help them with this, your customers will love you!

Recommended Reading: Why Is There Aargon Agency On My Credit Report

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

How To Get An Eviction Off Your Record: 6 Steps

If you’ve ever been evicted, looking for a new place to live can be intimidating. You may wonder how to get an eviction off your record, or whether it’s even possible to have an eviction expunged.

The good news is that while renting after an eviction is challenging, it’s not impossible. When you need a place to live but you have an eviction on your record, knowing where you stand and what information appears on your rental history can help you correct inaccuracies or even remove the eviction altogether.

Read Also: Unknown Address On Credit Report

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

How Does Bankruptcy Affect My Credit Score

Both chapter 7 and chapter 13 bankruptcies can drastically affect your credit score, with chapter 7 having more of a negative impact because accounts were discharged without payment.

You can expect bankruptcy to reduce your credit score by 100+ points.

As mentioned before, these will stay on your credit report for 7-10 years.

Recommended Reading: When Do Hard Inquiries Fall Off Credit Report

Wait Out The Credit Reporting Time Limit

If all else fails, your only choice is to wait for those negative items to fall off your credit report. Fortunately, the law only allows most negative information to be reported for seven years. The exception is bankruptcy, which can be reported for up to 10 years. The other good news is that negative information affects your less as it gets older and as you replace it with positive information. The wait may not be as difficult as youd think. Consumers can request their own credit report for free every 12 months from the three major reporting agencies. So, to be sure, you should request a report after the aging period to confirm.

It is important to note, however, that while the credit reporting agency will generally delete the negative information from the report after the seven-year aging period, information may still be kept on file and can be released under certain circumstances. Those circumstances include when applying for a job that pays over a certain amount, or applying for a credit line or a life insurance policy worth over a certain amount. Depending on where you live there may be more favorable regulations under state law, such as a shorter statute-of-limitations. You should contact your state’s Attorney General’s office for more information.

In the meantime, you can improve your credit by making timely payments on accounts you still have open and active.

Ask The Courts How The Bankruptcy Was Verified

Next, you will need to contact the courts that were specified by the credit bureaus.

Ask them how they went about verifying the bankruptcy. If they tell you they didnt verify anything, ask for that statement in writing.

After you receive the letter, mail it to the credit bureaus and demand that they immediately remove the bankruptcy as they knowingly provided false information and therefore are in violation of the Fair Credit Reporting Act.

If all goes well, the bankruptcy will be removed.

Don’t Miss: How Long Does It Take Capital One To Report Authorized User

Public Records On Credit Reports

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Laws editorial disclosure for more information.

If youve ever looked at your credit report, youve probably noticed a section called public records. These are entries that are also on file with local, county, state or federal courts. Keep reading to learn more about which public records appear on credit reports.

What Is A Public Record On Your Credit Report

Before we dive into the steps you need to take to remove public records, lets define our terms and get clear about what, exactly, were talking about.

So, which items count as derogatory public records? There are several financial scenarios in which you can end up with a public record on your credit report:

- Bankruptcies, whether personal or in a proprietary business scenario.

- Tax liens, whether you failed to file or owe the government money.

- Lawsuits and civil judgments with financial consequences, such as an accident in which you havent paid the defendant for damages or a suit against you by a former landlord. Its important to keep in mind that not all disputes will wind up on your credit reports. If the two parties can reach a settlement before the case is taken to court, there will be no public record of the event on your credit report.

So, now that you know the different types of public records, how do you go about getting rid of them?

Don’t Miss: What Is Syncb Ntwk On Credit Report

Public Records Could Plague Your Credit For The Better Part Of A Decade

Even if you repay the money you owe, public records with negative information typically remain on your credit reports for seven to 10 years.

Public records with adverse information may even occasionally wind up on your credit reports by mistake. According to a 2012 study by the Federal Trade Commission, one out of five consumers had an error on at least one of their three credit reports that was corrected by a credit reporting agency after it was disputed.

The good news is, in some cases, you may qualify for relief.

Experian®, Equifax® and TransUnion® have begun removing unverifiable public records from about 12 million credit reports.

The three major consumer credit bureaus recently adopted stronger public record data standards for consumer credit reports, requiring tax liens and civil judgments to include your name, address and either Social Security number or date of birth.

Millions of old public records dont contain all of this information, so the credit bureaus are removing them from consumer credit reports.

Theyre also removing medical collection accounts that have been or are being paid by insurance.

If you spot an error or an unverifiable public record that doesnt belong on your credit report, Credit Karma may be able to help you dispute it. And if all else fails, we can show you ways you can rebuild your credit.

Just remember, youre not alone. Were here to help.

The Public Record Entries

First, its essential to understand the three types of public record entries that can impact your credit report.

A tax lien is a law-imposed lien upon property for the payment of taxes. Typically, a tax lien occurs when a person fails to pay taxes owed on property , income taxes or other forms of taxes.

A civil judgment is a legal ruling against a defendant in a court of law. It refers to a judgment on a noncriminal legal matter and often requires the defendant to pay monetary damages.

Bankruptcy is a legal process in which people or other entities who cannot repay debts to creditors try to seek relief from some or all of their debts. In most jurisdictions, bankruptcy is usually imposed by a court and is often initiated by the debtor.

You May Like: How Accurate Is Creditwise Credit Score

Diy Vs Professional Credit Repair

It can often feel like credit repair is a catch-22. You may not have a lot of expendable income to hire a professional credit repair company, but you likely dont have the know-how or emotional bandwidth to tackle it yourself either. We get it.

Bankruptcy is the negative item we most encourage our readers to get professional help with though. The steps weve outlined are advanced tactics that in most cases are best left to credit repair specialists. They are more familiar with the ins and outs of the credit bureaus and court systems, as well as the steps well be outlining.

Below are the credit repair companies we recommend.

How To Remove Derogatory Items From Your Credit Report

Removing derogatory items from credit reporting is a key step in improving credit. Heres what you should know.

A clean credit report is key to getting most of your applications approved. Derogatory items can land on your credit report whenever you make a misstep with your credit accounts. Late payments, high balances, bankruptcy, and debt collections are all derogatory items that can damage your credit, hurt your credit score, and make it harder for you to get approved in the future. If you are approved despite having derogatory items on your credit report, you may end up with higher interest rates or down payment requirements than if you had a clean credit report.

Derogatory items dont stay on your credit report forever. You may be able to remove derogatory items from your credit report if you take the right steps.

How Derogatory Marks Land On Your Credit Report

Most credit card companies and lenders send regular account updates to the credit bureaus. Theyre not legally obligated to report your account information, but when they do, they must report only accurate and timely information. Creditors typically have an agreement with the credit bureaus to provide information about your account.

The credit bureaus also use local, state, and federal public records to find information about foreclosure, bankruptcy, repossession, lawsuit judgments, and tax liens. Whenever this derogatory information is discovered, its updated on your credit report.

You May Like: Does Loan Me Report To Credit Bureaus