Keep Your Credit Utilization Low

Aim to get your credit utilization ratio as low as possible. According to The Washington Post, FICO data indicates that people with 850 credit scores have an average credit utilization of just 4.1 percent. That means that if you have $10,000 in available credit, youll want to keep your revolving balances below $410. Anything else needs to be paid off in full before your billing cycle closes.

Is It Possible To Get A Perfect Credit Score

Some people obsess over perfect grades. Others find fulfillment in bowling a perfect 300. Still others make it their life goal to earn the highly elusive perfect credit score. But while getting A’s on all your midterms and even bowling 300s are fairly attainable goals, perfection in the credit world is practically unheard of. Can it really be done? And more importantly, is it a worthy goal to strive toward? Here’s why the perfect credit score may not really matter in the end.

Is it possible?

Yes, it’s possible to get a perfect credit score. However, this answer comes with a few caveats. First off, the “yes” assumes you’re thinking about the 850 FICO score. While the FICO score is the most common score lenders use to determine your creditworthiness, it’s not your only score. There are dozens of scoring models that can be used to determine your score, and each model calculates your score differently. So even if you achieve a perfect score with one model, your other scores may be very different.

Secondly, even if someone is able to achieve a perfect score, there’s no guarantee that it will stay that number or he or she will be able to reach it again. Credit scores change constantly, and every time someone pulls your score, it’s calculated anew.

Is it worth it?

How can I improve my credit health?

Jenna Lee is the social media manager for , a free credit monitoring website that helps more than 22 million people access their credit score for free.

More From US News & World Report

It’s As Much About ‘will You Make The Lender Money’ As It Is About Risk

Many people write to us incensed after rejection “I’ve a perfect credit score, I’ve never missed a payment, why on earth did they reject me?” This is based on a misunderstanding lenders are credit scoring to see if you match up to their wish list of what makes a profitable customer.

Of course, someone who is a bad risk is likely to be scored out as unprofitable by most companies. But the risk of not repaying isn’t the be-all and end-all.

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know. Here are some other things to look out for:

Also Check: Les Schwab Credit Score Requirement

Dont Apply For Credit Too Often

When you apply for a loan, a lender pulls your credit, which causes a hard credit inquiry to show up on your report. This inquiry remains on your report for up to two years. According to FICO, each new hard credit inquiry can lower your score by up to five points. Although the impact of this type of credit check lessens over time, it could keep you from having a perfect credit score.

Benefits Of Perfect Credit

A perfect credit score is an admirable goal and one that’s achievable with lots of dedication and patience. But as a practical matter, lenders consider any exceptional FICO® Scorethat’s a score of 800 or greater on the 300 to 850 scalea mark of excellent credit. Achieving a score in that range is likely to give you the same advantages as a perfect score, including:

Recommended Reading: Highest Credit Limit For Victoria Secret

Does Income Play A Role In Having A Perfect Fico Score

Income is not a factor in determining your FICO® Score. While access to some credit products can be restricted by your income and financial situation, when it comes to achieving a perfect credit score, income is not a barrier.

In fact, in the fourth quarter of 2018, a little over 38% of perfect FICO® Scores were held by people with an estimated average annual income of $75K or less, according to Experian data.

Obviously, having more money can help you pay your bills, but building a healthy credit score really comes down to the basics of paying your bills on time every month and maintaining low , or the amount of debt you carry compared with total credit available.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Also Check: Ccb/mprcc

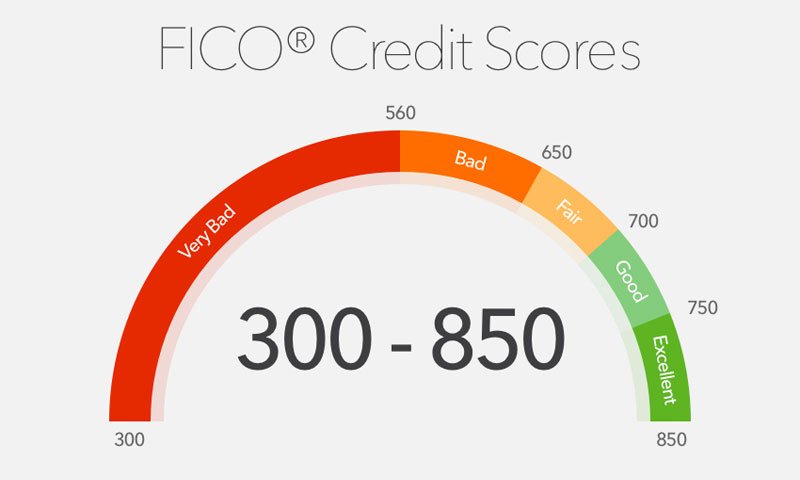

Understand How Scoring Works

First, it helps to understand how credit scoring works. Many creditors use the popular FICO or VantageScore scoring systems, which combine financial data collected from major credit bureaus Equifax, Experian and TransUnion to determine your rating. Each system ranges from a low of 300 to a high, or perfect score, of 850.

Scores are tied to financial decisions you make, such as paying off your student loans or .

He Has Long Standing Credit History

The average age of Droske’s accounts is 10 years and 11 months on the report that CNBC Select reviewed. His oldest account is 34 years and 10 months old.

Length of credit history is a key factor FICO considers when determining your credit score, so it helps that Droske started using credit at a young age.

Droske learned early on about the impact of people’s credit on their purchases during his first job in finance at a car dealership’s lending department.

“I would see two people buying the same car on the same day, and one person gets 5% and the other person gets 19% based on credit,” Droske says. “That very quickly taught me the impact of credit, and then I was really curious about what made that number move.”

Also Check: Usaa Credit Card Approval Score

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

A Perfect Credit Score Is Possible But Is It Worth It

Most people in the financial services industry have never seen a perfect credit score, and a lot of consumers think it is impossible to achieve.

However, David Howe, president of SubscriberWise has proved the skeptics wrong. After obsessing over his credit score for years, Howe has become the first consumer to achieve simultaneous perfect 850 FICO scores from all three credit bureaus as well as a perfect 990 Vantage score.

I recently had a chance to speak with Howe about how he achieved the perfect score, so here are some of his insights on the matter and whether or not a perfect score is meaningful to consumers.

Perfect scores can be achieved According to Howe, who stresses that he is not a FICO expert, perfect credit scores are not as elusive as people think, but they definitely go beyond simply paying your bills on time and not running up too much credit card debt. The top score requires a perfect storm of credit strategy and life situations.

For example, in order to have a perfect credit score you must have no credit inquiries whatsoever within the past year. Youll also need one active revolving account that you actually have a balance on, as well as one active installment loan, such as a mortgage.

In other words, if you carry a zero balance on all of your credit cards or dont have a loan, its impossible to achieve a perfect score, according to Howe.

Read Also: Experian Unlock

Important Credit Score Factors

Payment history

The most important part of your credit score is your payment history, which accounts for 35%. A solid track record of always paying your bills on time will go a long way toward an eventual perfect score, while just one missed payment can screw things up considerably.

The effect of a late payment on your credit score depends on the severity, when it happened and how often you pay late, according to credit reporting agency Equifax. Generally, though, the later the payment, the worse it is for your score.

Your current credit situation also plays a role. For example, if a person with a 780 FICO score and no history of late payments became 30 days late on a payment, they could experience a drop of 90 to 110 points. However, if that persons current score were 680 and theyd missed a couple of payments in the past, they could expect to lose just 60 to 80 points after another 30-day late payment.

Amounts owed

The next-most heavily weighted credit score factor is how much debt you owe in relation to the total amount of credit available to you. This is also known as your credit utilization. The more of your available credit you use, the more of a risk you are to lenders since it can seem like youre relying too much on credit to get by.

Length of credit history

The length of time youve been using credit is also important to your score. Creditors like to see that you have a history of borrowing money responsibly, so longer credit histories are viewed more favorably.

Council Tax Arrears & Parking Or Driving Fines

Councils don’t share data about your payments, whether good or bad. If you’re in arrears, it won’t affect your credit score. However, it’s always wise to prioritise your council tax payments as many councils are quick to prosecute. Council tax arrears are dealt with as a criminal matter, not a civil one, so you could end up with a criminal conviction.

Any fines you’ve incurred, for example, a parking or driving fine, won’t be listed. Even though they’re issued by the courts, they aren’t ‘credit’ issues, so they’re not listed.

Read Also: Which Credit Bureau Does Comenity Bank Use

Use A Credit Build Card To Build A History & Restore Past Issues

You need to build a decent recent history to show that you can be responsible with credit and use it well. The catch-22 is that as you have a poor credit history, getting credit is difficult.

The solution is to grab a credit rebuild card. See the full guide for full help, how to protect yourself, and top picks.

This is a card with a hideous rate, say 35% APR, which accepts people with a poor credit history. Yet provided you repay the card IN FULL each month, preferably by direct debit, and never withdraw cash, you won’t be charged interest, so it’s no problem.

Then just spend say, £50 a month on the card, and provided you have no other issues after six months or so, things should start to improve. After a year, it should make quite a difference.

Obviously, if you already have a credit card you aren’t using, then you can do the same on that without the need to apply for a new one.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

Don’t Miss: Does Carmax Report To Credit Bureaus

What Lenders Don’t Know Ignore Conspiracy Theories

Many people believe every element of their life is on their credit reference files, but actually it’s mainly just a strict set of financial data. Though over recent years, the information contained on them has grown.

So let’s debunk some myths. Here are a few of the more common things people think are on their files, but aren’t.

Race, religion, ethnicity. These personal details about you are not held.

Salary. How much you earn isn’t on your file either, though you’ll usually be asked on the application form.

Savings accounts. As savings are not a credit product, they don’t appear on credit files. This data is therefore only available to banks you hold savings accounts with. However, when you apply for a savings account, the provider might do a soft search of your credit report to check your ID, and do anti-money-laundering checks.

Medical record. Medical problems you may have had in the past aren’t listed.

Criminal record. No criminal convictions are listed.

There are a host of other things that aren’t held on your credit report, including:

Once You Take Out A New Loan Your Credit Ceases To Be Perfect Anyway

If you do manage to obtain a perfect credit score of 850, bear in mind that your perfection may not last very long.

If a person with an 850 score takes out a new loan, they stop being perfect immediately, Haney said. First, a hard inquiry will knock about 5 points off their score right away at the bureau furnishing the credit report used by the lender. Then the extra account reported by the lender will hurt two sub-factors at all three agencies:

The average length of history will be shorter.

The new credit activity will be higher.

Learn: 90-Second Moves To Raise Your Credit Score 200 Points

You May Like: How To Remove Hard Inquiries Off Your Credit Report

Why Having A Perfect Credit Score Is Overrated

Theres no such thing as perfect except when it comes to your credit score. There, we have a precise number for perfection: 850. Pretty dang high, right? It is when you consider that the average FICO Score in the U.S. is 711, while the average VantageScore is 688. And yet, we hear it all the time in the world of personal finance, student loans and real estate. Its like a taunting mantra: You must have perfect credit You must have perfect credit But how important is a perfect credit score? Is it worth building our financial lives around?

In short, the answer is no. Having a perfect credit score is overrated, so you may as well stop striving for that towering 850 figure, which, for most, is unattainable.

Is It Possible To Get A 850 Credit Score

Where a perfect 850 FICO credit score may seem impossible and a myth, the truth is there are some people in the United States with a perfect 850 credit score. In fact, these people make up 1.2% of the American population! So the first myth is busted: having a perfect score of 850 IS possible.

If it is possible, is it necessary? Absolutely not.

You can have a decent credit score and an excellent reputation without hitting 850- in fact, a score that is 740+ is also a good fit. For insurance companies that are credit based, a good credit score can give you a reasonable premiums deal- meaning a better credit score will get you less monthly premiums to pay.

If you really want to get a perfect score of 850, heres how you can do so:

The first step is utilization, if youre someone who waits until the end of the month or when the statement closes to pay off your debt, you could unconsciously be affecting your credit score. A good way to lower utilization without changing your spending habits is to pay off your balance before the statement closes.

Moreover, if it is possible, make a budget sheet of all your expenses. You will be able to determine which of these you can easily cut back on and which ones arent too necessary- this way you will take less credit because you would have already cut your unnecessary expenses.

FICO uses percentages to indicate the importance of each factor to your credit scores.

| FICO |

Read Also: Tri Merge Credit Report Mortgage