Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Recommended Reading: How To Get Credit Report Without Social Security Number

Don’t Miss: How To Remove Repo From Credit

Explore Your Refinancing Options

Now may be a good time to refinance your car loan or your mortgage. Doing so can save you money in the long term and potentially help your credit by making it easier to keep on top of future payments.

Although it is possible to refinance when you have bad credit, youll reap much greater rewards with a 792 credit score. For example, youll get better interest rates, which will save you money and may allow you to pay off the loan quicker.

How To Get A 794 Credit Score

Theres no secret for getting a 794 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 794 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 794.

Also Check: Can You Use Affirm In Store At Walmart

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

What Is A Good Credit Score For Credit Cards

The best credit card offers are typically reserved for consumers with excellent credit. Still, there are plenty of great credit card products that frequently accept consumers with good credit, or even fair credit. Consumers with poor credit are typically restricted to secured credit cards. These cards can help rebuild credit over time.

Read Also: How To Remove Repo From Credit Report

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

What Does A 792 Credit Score Mean Pros And Cons Of Having This Credit Score

Those that have this credit score do not really have any cons, as this is one of the highest scores they can get. Though they are not at the very top of the ladder, they have a couple ways they can improve the score to get it to the top such as paying their payments on time, using the right amount of credit and never defaulting on their loans.

In terms of pros, a 792 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, vehicle loans, credit cards, lines of credit and a wealth of other money loaning services offered through various financial institutions.

Recommended Reading: How To Get An Eviction Off Your Credit

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

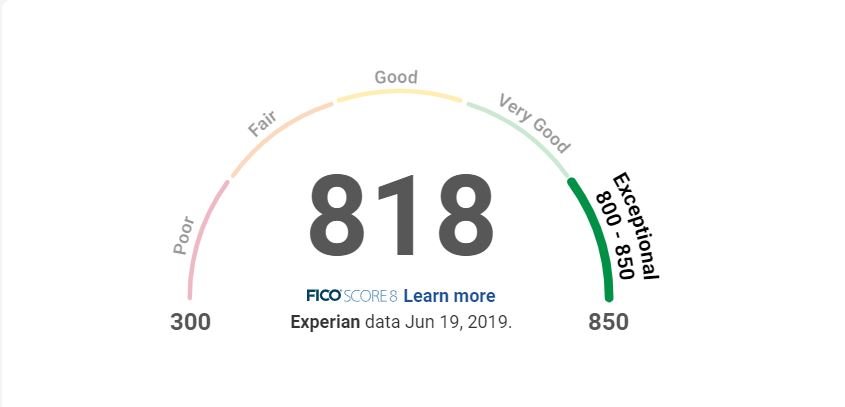

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit Its possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

You May Like: Does Opensky Increase Your Credit Score

Industry Specific Credit Scores

Now that you know what a good credit score is, its time to get more specific.

While traditional FICO scores from the popular scoring company Fair Isaac Corporation range from 300 to 850, there are actually several different models that lenders might use when judging your creditworthiness. These vary depending on what type of credit youre applying for.

A few examples include versions specifically for mortgages, car loans, credit cards, and student loans. Each one will look at slightly different information that is more relevant to the exact type of credit you want.

You May Like: Credit Score Care Credit

How To Improve Your Credit Score From 792 To 800+

A credit score of 792 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 792 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

Ask Your Current Creditor For Better Terms

If you have a revolving credit account with a good payment history, then consider contacting your creditor and asking for better terms, such as a higher credit limit or lower interest rate. Highlight your strong payment history and loyalty as a customer. Some creditors are willing to make accommodations to keep you from looking elsewhere for better terms.

In addition to helping your finances, this can help improve your credit score. For example, getting an increase in your credit limit will automatically reduce your credit utilization rate, as long as you dont start spending more.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Long Does It Take To Get A 792 Credit Score

It depends where you started out.

If you had good credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Also Check: Syncb Ntwk Card

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dont Hit Your Credit Limit

If you want to get into the 800+ credit score club, be sure that you dont use your credit card up to its full limit. Use no more than one-third of your credit limit if you dont want to hurt your credit score, Nitzsche says.

For example, if your credit card has a limit of $9,000, dont have a balance of more than $3,000.

Ideally, credit card utilization should be 10% or less. Jennifer Martin, a business coach, says she has a credit score of around 825, and that she tries to keep her spending to no more than 10% of a credit cards available credit.

Outstanding debt accounts for 30% of a credit score, Ross says.

If you are overextended and close to your credit limit this indicates overextension and you need to work at getting your credit card balances well below the limits, she says.

Also Check: Does Pre Approval Hurt Credit Score

What Can I Do With A 792 Credit Score

792 credit score puts you just one level below the top-tier credit range of exceptional. So, as you may guess, you should have access to most credit and loan options you apply to. And while you may not secure the best interest rates or loan terms possible on the market , you’ll often get very competitive offers.

Need to know your credit score? Find out with our free Credit Assessment

Do You Need An 800 Credit Score

7-minute readSeptember 20, 2020

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

Your credit score is a three-digit number that represents how well you manage debt. Your credit score plays a major role in your ability to get a personal loan, buy a home and open a new credit card. A high credit score is important but just how high does your score need to be?

Well take a closer look at the 800-point FICO® Score. Well show you what it means to have a credit score of 800 and whether you should work on improving your score. Well also give you some tips you can use to work your way toward a perfect 850 score.

Recommended Reading: Removing A Repossession From Credit Report

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.