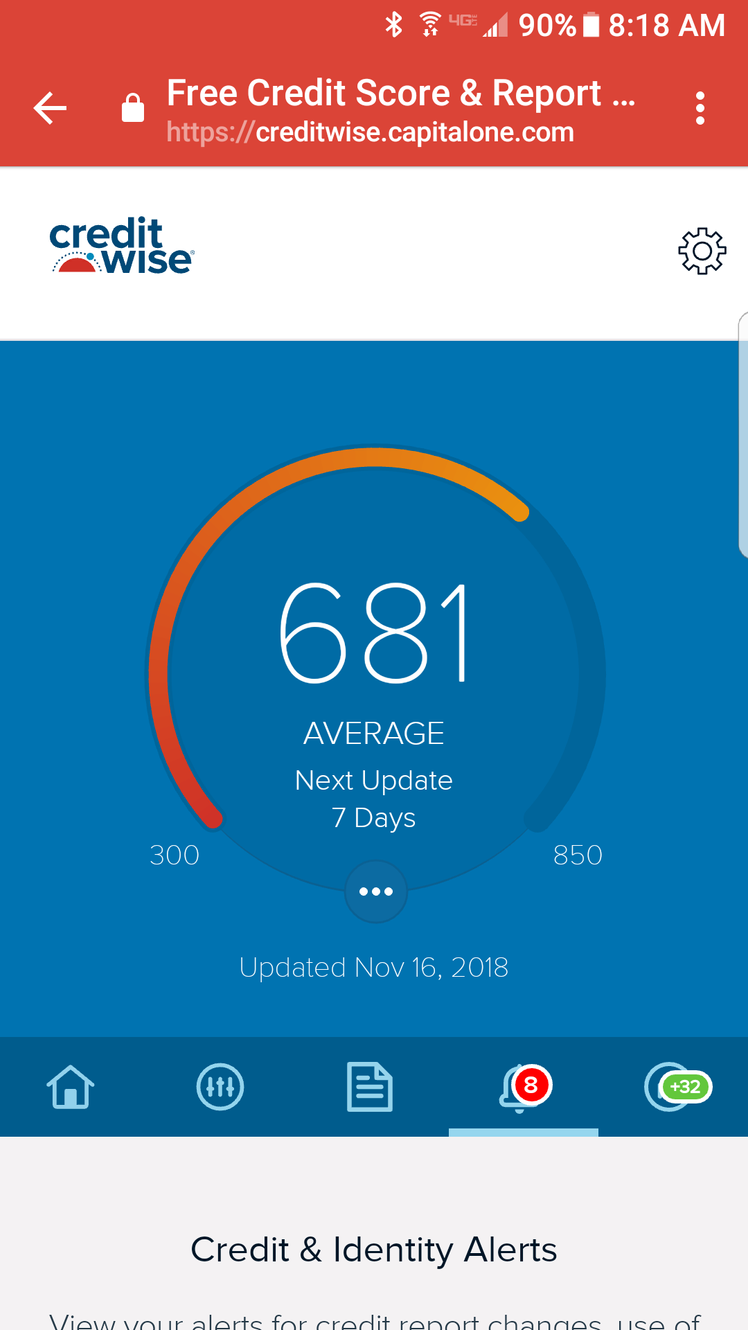

Getting A Mortgage With A 681 Credit Score

Youre eligible for any type of standard mortgage if you have a credit score of 681. The following are all the mortgages you can get:

- FHA loan: Your credit score qualifies you for maximum financing on a mortgage backed by the Federal Housing Administration . Its worth noting that you wont be eligible for an FHA-backed loan if you had a foreclosure in the past three years or filed for chapter 7 bankruptcy in the past two years. 10

- Conventional mortgage: Most lenders will consider giving you a mortgage because your credit score is above 620, which is the minimum score required by the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation . 1112

- VA loan: The US Department of Veteran Affairs backs VA home loans, which are exclusively for members of the military and their families, and they dont impose a minimum required credit score. 13 They instead leave it up to lenders, most of whom will be willing to issue you a mortgage with a credit score of 681.

- USDA loan: As long as you have two tradelines that have been open for 12 months in the past two years, youll meet the credit requirements for a USDA loan because your credit score is above 640. 14 However, you wont be eligible if you have an outstanding judgment, and you might have a hard time qualifying if your credit history shows a foreclosure, bankruptcy, or debt settlement in the past 36 months.

Formulating A Plan To Improve Your 681 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

How To Improve A 681 Credit Score

Its a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law. They can help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items from your credit report. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

Read Also: How To Check Credit Score On Chase

Undisputed Negatives On Your Report

In some cases, you may have false negatives on your report. For example, a loan installment you paid goes unreported. In that case, make sure to dispute these negatives and have them removed from your record. Taking this step could immediately increase your score to the Very Good or Exceptional range.

What Credit Score Is Needed To Buy A House

Ah, the dreaded . Its one of the biggest criteria considered by lenders in the mortgage application process three tiny little digits that can mean the difference between yes and no, between moving into the house of your dreams and finding yet another overpriced rental. But despite its massive importance, in many ways the credit score remains mysterious. If you dont know your number, the uncertainty can hang over you like a dark cloud. Even if you do know it, the implications can still be unclear.

Is my score good enough to get me a loan? Whats the best credit score to buy a house? What’s the average credit score needed to buy a house? Whats the minimum credit score to buy a house? Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated than that? These are all common questions, but for the most part they remain unanswered. Until now.

Today, the mysteries of the credit score will be revealed.

You May Like: Carmax Finance Rates 2015

How Can You Get A Good Credit Score

There are plenty of things you can do to help improve your score, but it can take time and patience, and some will-power too.

Ways to improve your score:

- Register on the electoral roll at your current address. This helps companies confirm your identity.

- Build up your credit history. If you have little or no credit history it can be difficult for companies to score you, which can result in a lower score. Thankfully, there are some relatively simple steps you can take in order to build up your credit history.

- Pay your accounts on time and in full each month. This shows lenders you’re a safe bet and can handle credit responsibly.

- Keep your credit utilisation low. This is the percentage of your credit limit you actually use. For example, if you have a limit of £3000 and you’ve used £1500 of it, your credit utilisation is 50%. A lower percentage is usually seen in a positive light and should help your score go up. To help improve your Experian Credit Score, try to keep your credit utilisation at 25%.

- Sign up to Experian Boost and see if you could raise your score instantly. By securely connecting your current account to your Experian account, you can show us how well you manage your money. Weâll look for examples of your responsible financial behaviour, such as paying your Netflix, Spotify and Council Tax on time, and paying into savings or investment accounts.

Once you’ve got your score where you want it to be, here’s our tips on how to keep it healthy:

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

You May Like: Does Child Support Help Credit Score

Which Credit Cards Can I Apply For With 681 Eq Fico Score

I use FICO SCORE WATCh and I just got a nice bump in my credit score after I paid off a big balance on my credit card last month.

My EQ FICO is now 681.

My TransUnion score is 640 with a high balance that’s yet to be updated.. so I expect a similar score once that’s been updated as well.

I was not able to get a FICO score for EX. for obvious reason, but the report is the same as my EQ.

I was also not able to get the TU SCORE from MyFICO for some reasons, So i go to annualcreditreport.com and get the report from TU and signed up for their 7 days trial to get the TU score, is the TU score from TU site a FAKO Score?

I’m currently looking at some of the Chase cards because they sent me a few offers for the first time since 2+ years last month.

I am looking at Chase Slate, Chase Freedom and Chase Ink

I have not applied or had any inquires for the past 12 months. My only baddie was an auto repossession that I applied for in 08, and went into collection in 09 and has been paid off in settlement in 2011.

Currently I have only ONE credit card, a secured Capital One Card that never lates for the past 2 years, I have had it for about 2 years.

Are there any other cards that I should be looking at that I would qualify?

Thanks for anyone’s help in advance.

Dont Take Out New Credit Accounts Or Loans

Whether youre a firsttime homebuyer or a homeowner on your third purchase, when it comes to debt, less is always best especially when youre looking to qualify for a new home loan.

Opening new credit accounts or any other type of loan will not only have a negative impact on your debttoincome ratio, but the hard inquiries required to qualify for a loan can lower your credit score by several points each.

Similarly, avoid closing existing lines of credit, like credit cards, to keep your available credit limit higher. his is beneficial to your overall credit utilization ratio. Plus, the average age of your credit is also a factor in determining your credit score range.

Recommended Reading: How To Remove Serious Delinquency On Credit Report

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -21 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Regardless of your circumstances, there are steps that you can take immediately to increase your credit score.

Recommended Reading: Does Ginny’s Report To Credit Bureau

Credit Score: Is It Good Or Bad

A FICO® Score of 681 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO® Scores “acceptable” borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

21% of U.S. consumers’ FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

What Does Good Credit Mean

A FICO Score between 670 and 739 generally qualifies as a good score. The good credit range for VantageScore, another credit scoring model, goes from 661 to 780.

But what does a good credit score mean, beyond the numbers?

Lenders use credit scores and other financial information to determine what kind of interest rates you qualify for. If your financial history shows that you consistently pay your bills in full and on time, youre considered less of a risk and youll probably qualify for better interest rates.

Good credit can make it easier to get approved for and to secure a mortgage or car loan. It also improves your chances of qualifying for more favorable interest rates, which can save you money on interest charges over the life of your loan.

Of course, people with excellent credit usually get the lowest rates. Aim to get and keep your credit score as high as possible.

Don’t Miss: How To Get A Repo Off Your Credit

How A 680 Credit Score Affects Mortgage Rates

Conventional loan mortgage rates vary widely based on a borrowers credit score.

Prime mortgage borrowers those with 20% down and a credit score above 720 get access to the best and lowest mortgage rates you see advertised online and in print. Everyone else gets access to something different.

When it comes to setting rates, 680 is right in the middle of the line.Take a look at a snapshot of FICOs MyFICO mortgage rate tool, which shows how rates vary based on credit score:

| 3.717% | $1,478 |

1APR refers to the “effective interest rate” youll pay each year after the mortgage rate and loan fees are combined

2This rate snapshot was taken on November 8, 2021, and is for sample purposes only. It assumes a loan amount of $300,000. Your own interest rate and monthly payment will vary. Get a custom mortgage rate estimate here

In this example, the borrower with a 680 credit score has a mortgage payment thats $64 more per month than someone with a 760 credit score.

That might sound like a small difference. But it adds up to $768 more per year, and an extra $23,040 over the 30year life of the loan.

This is why experts recommend getting your credit score up as much as possible before applying for a home loan. Small differences in the short term can mean big savings in the long run.

Petal 2 Cash Back No Fees Visa Credit Card

Best for credit-building with cash back

- This card is best for: Anyone who could benefit from some extra incentive to start building a good credit score as they earn cash back.

- This card is not a great choice for: Established credit users. If you already have a good credit score and disciplined spending habits, you could find a card with a more rewarding cash back program pretty easily.

- What makes this card unique? You automatically earn 1 percent cash back on eligible purchases, but the rate rises to up to 1.25 percent after six on-time monthly payments and up to 1.5 percent on eligible purchases after 12 on-time monthly payments.

- Is Petal® 2 Cash Back, No Fees Visa® Credit Card worth it? For beginners, this cards credit-building capabilities and incentive-based cash back program could be a useful way to navigate an early stage of the personal finance journey.

Jump back to offer details.

You May Like: Does Sprint Report To Credit Bureaus

Error = Article Spin Timeout Terminated

Fortunately for those along with fair credit, one can improve their report with time and effort. Delinquent accounts plus late or neglected payments can harm your own credit score. A new history of spending your bills on time will aid your credit score.

- If one takes your time and effort to be able to raise their good credit score also just a little, there will be benefits that could arrive from this.

- Ultimately, the fifth in addition to final primary aspect that your credit score will examine is your type of credit.

- Your credit score will incorporate all the various credit accounts that will you have, plus the more you have and the particular more you handle responsibly, the higher your score may be.

- Examples of different types of credit includes credit cards, instalment loans, home mortgages, plus car payments.