Re: When Does Discover Report Balances

Thanks, CD.

Yapsalot… you mention that you had a $600 balance as of Aug 9. Was that a single $600 charge, or were there multiple smaller charges between Aug 5-9 that together totalled $600?

Also, do you mind telling us what your CL for the Discover card is? I am wondering whether Discover has a policy of reporting when your utilization gets up to a certain %. If your CL is $1000 then $600 is a big number. If your CL is $10,000 it is not and it is strange that Discover would report it.

One of strangest things to my mind about what happened is that the card had a $600 balance as of Aug 9, but there was still a delay of another two weeks before Disover reported that Aug 9 balance to the CRA.

Discover Personal Loan Approval$35k Myfico Forums

May 5, 2022 How do banks decide if youre a good credit risk for a loan? to ask your permission to review your personal credit reports, and will

Nov 13, 2019 Often times, personal loans can come with lower interest rates than credit The loan will also appear on both of your credit reports,

Why The Data Matters

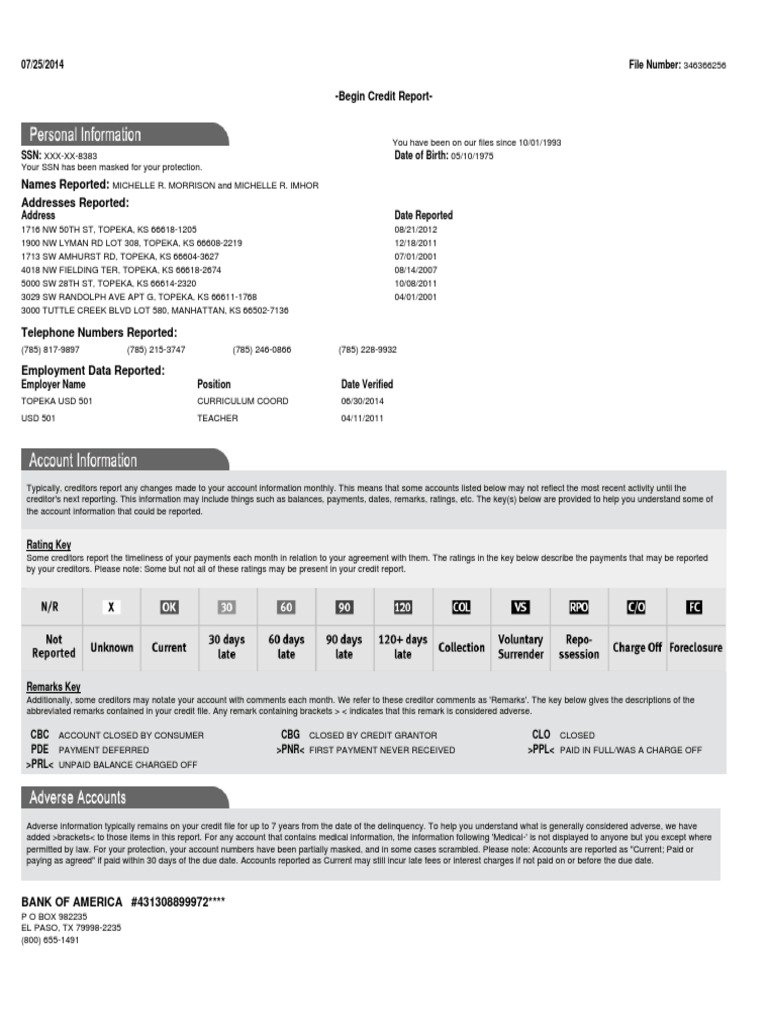

Whether your credit is poor or pristine, all three of your credit scores from Equifax, Experian, and TransUnion will reflect similar scores, yet differ ever so slightly.

Being on the cusp of fair to good credit could make all the difference in getting accepted or rejected for a loan or credit, especially if, for example, your Equifax report reflected the poorer end of your credit history.

And in the case of Discover, a credit card provider with high approval standards, its imperative to have stellar credit when seeking out a card from their portfolio.

Were here to help you identify which credit report and credit bureau are the most applicable for affecting your approval rate for a provider like Discover.

Noting that, taking the steps to boost your credit through all three credit bureaus keeps your credit healthy, plus greatly improves your chances of approval the most for any loan or credit product you pursue.

You May Like: What Is Factual Data On My Credit Report

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

When You Need To Speed Things Up

Lets say youre about to apply for a mortgage, but your score is a little low due to inaccurate information on your credit report. Or maybe youve paid off a large amount of debt, but it hasnt shown up on your report yet.

When it comes to interest rates, a few points off your credit score can keep you from the best rates, which can be costly over time. But given the nature of a mortgage application, you cant wait for 30 days or more for your report to show your current credit status.

Rapid rescoring is one way to address this dilemma. If your lender sees the potential for you to get a better rate, then the lender can request a rapid rescore from a credit bureau. This involves offering proof that the rescore will make a difference in your rate. The lender also has to pay a fee for this service.

Note that only the lender can make this request, not you. But dont hesitate to ask a potential lender about rapid rescoring if you think it will help your case.

Be Proactive With Your Credit Report

Remember, you can get a free credit report every year from each major bureau. If you plan to apply for credit, dont wait until the last minute to see whats on your credit reports.

Check your credit reports at least three to six months in advance so you know if there are issues that need to be addressed. says Griffin. That way, youll avoid unhappy surprises that could derail your application for credit.

More from U.S. News

Read Also: How To Improve Credit Score Fast

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

When Does Discover Report Balances

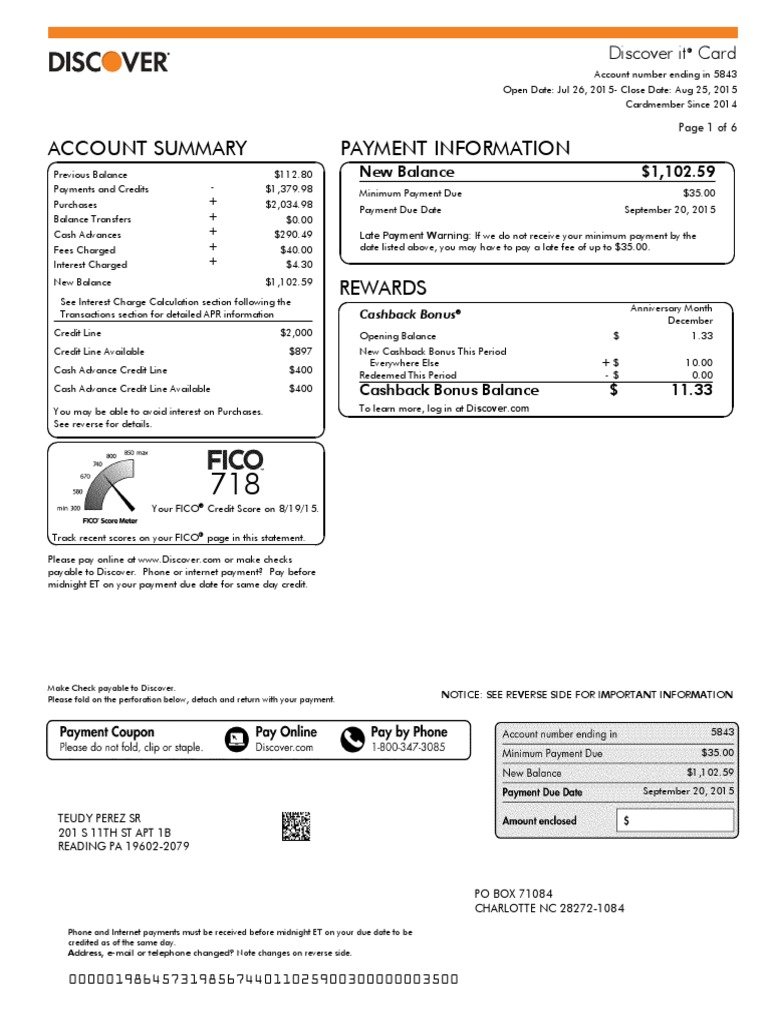

I’ve had a Discover card for four months now. Each month I pay the balance right before the statement cuts, on the 5th of the month, so there is zero balance when the statement cuts and no affect on my FICO score. I got an alert today that Discover reported a balance on August 22, 2016 of about $600. The statement does not cut till September 5 and the August 5 balance was zero. A review of my charges, shows that the $600 balance occurred on August 9.

All of my other accounts report balances just after the statement cuts. This mid-statement report by Discover seems unusual but I don’t have a sufficient history to know if it is normal. I noticed other forum members stating that Discover reports just after the statement cuts. The report did lower my FICO score a few points which is not a catastrophe but I like to keep my score controlled as much as possible and if Discover is now reporting at random times, I probably won’t use the card. Anyone have any experience with mid-statement reporting from Discover?

You May Like: Does Badcock Furniture Report To The Credit Bureau

When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

What To Do If Your Credit Card Is Still Not Showing Up

Don’t panic if the credit card you opened is not appearing on your Experian credit report. It may be on the other two or just one, so pull your credit reports from the other credit reporting bureaus and read them over. Hopefully it will be on at least one of them. You can get your credit reports from all three credit bureaus through AnnualCreditReport.com or through Experian.

Not there? Your credit card issuer may not send your account activity to any of the bureaus. In the future, select an issuer carefully to be sure it will appear on all three of your credit reports. If necessary, call the company to find out before you apply.

In the event you do spot issues, such as identification errors, take action to rectify the problem. Call the credit card company and update your identification information. To make sure lenders get the full picture of your payment history, you’ll want all your accounts to show up on your credit report and factor into your credit scores.

Having a long history of on-time payments in your credit file will help your credit rating rise. So if your credit card isn’t showing up, consider adding other types of information to your credit report. By signing up for Experian Boost, you can have your utility and cellphone bills added to your credit report at no extra cost to youwith the likely benefit of a credit score increase. It makes sense to have those timely payments work in your favor!

You May Like: Does Perpay Report To Credit Bureaus

How Else Can A Death Get Reported To The Bureaus

Apart from a family report, the bureaus can also get notified of a death by:

The SSA regularly forwards an updated list of the newly deceased to the three credit bureaus. However, these records only cover social security beneficiaries whose deaths were reported to the SSA by funeral directors, family members, or a legal representative.

A spouse or a legal representative of the deceased should contact all the creditors involved and notify them of their client’s death. If you hold joint accounts with the deceased, make sure to provide enough details to prove that only one spouse is deceased. This should help to keep the accounts open so you don’t have to suffer any financial constraints.

As the creditors update their records with the credit bureaus, the death also gets reported.

Note that the SSA and creditors typically take longer to report deaths, leaving a potential gap for fraudsters to take over the deceased’s accounts and use them to:

- Open up new credit accounts

- Commit tax fraud

The best option to help maintain your loved one’s clean credit report is for you to report the death as early as possible.

What Further Actions Can I Take To Maintain A Loved Ones Credit Report

You can take the following actions to maintain your loved one’s credit report..

- Request for credit reports. Request their credit reports from the three credit bureaus and make sure to review them thoroughly so you can gather information on their credit status.

- Report any suspected fraud on the credit report. If you come across any suspicious activity on the deceased’s credit report, alert the lenders whose accounts have been affected. If the lenders can verify the fraud, file a report with the Federal Trade Commission . Upon receiving a copy of the identity theft report from the FTC, you can now file a report at your local police department for proper investigation.

- File a dispute if there are any errors. If you find errors on your loved one’s credit report, you can file a dispute with the credit bureaus and have them corrected under the FCRA. If they can’t validate their claims, they are also required to remove the mark completely.

Don’t Miss: How To Access My Credit Report

Re: What Does Discover Report To Credit Bureaus

Whatever is on your statement is what is reported. Example Your statement cuts on the 4th and you have a balance of $25. That is what is reported.

wrote:

Hi, I just recently got accepted for a Discover It credit card, with a limit of $500. This is my first credit card, and I had some questions regarding the way Discover reports to credit bureaus.

- Does Discover report to the 3 major bureaus ? Yes

- Does Discover report to the bureaus on my statement date ? Usually within 5 days YMMV especially new accounts with Discover could take 45 days

- I want to keep my % utilization below 10%, as I am building credit. Say I use $200 out of my $500 limit in the month of December, from December 5th 2013 to January 3rd 2014. That mean’s I have a 40% utilization. However, let’s say I still use $200 out of the $500, but on January 2nd, I pay the amount I owe down to $45, which is 9% utilization. Would Discover report that I used 9% or 40%? Also, would the credit analysts at the bureaus see that I paid it down, as in, would they only see 9% utilization, or would they see my original 40% utilization, and then see that I only owe 9% left by the statement date? Doesn’t matter how much you use it as long as before statement cuts it’s paid down to 1-9%

Thank you very much to all who answer!

The statement closing date is the date shown on your statement. On my Discover statement, it shows the following in the upper left hand corner:

Current Scores: EQ 775 , EX 756 , TU 760

Review: Is The Discover It Secured Credit Card Good For Rebuilding Credit

Very few credit cards for people with bad credit will offer as much as the Discover it® Secured Credit Card. The card provides users with as much as 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter. 1% unlimited cash back on all other purchases – automatically. Usually, having a subprime means you have to settle for less than stellar options, but the Discover it® Secured Credit Card has changed up the secured credit card scene in a major way.

We recommend individuals only charge purchases to it that they can afford to pay off at the end of each month. Otherwise, any positive effects of the cash back rewards will be eaten away by interest fees, and youll be walking away with a net loss.

Bottom line: The Discover it® Secured Credit Card is one of the best credit cards for rebuilding credit.

Also Check: How To Get A 720 Credit Score In 6 Months

How Credit Scores Work: Your Guide Student Loan Hero

Mar 25, 2020 Credit scores and credit reports are not the same So when youre building your credit, its important to focus on the range that your

May 3, 2022 Can I refinance loans that have already been refinanced? Yes, you can refinance loans as many times as you want with Discover. Note that each

Jul 29, 2020 You can now request your credit reports for free weekly from each of the nationwide credit reporting agencies through December 31, 2022 by

How To Check Your Credit

Being in the dark about your credit, but applying for credit anyway, could mean risking rejection, unaware that your credit isnt up to par. Or, it could mean knowing that your credit is exemplary, just the ammunition you need to be confident about applying for loans and credit products that are more competitive.

Start by checking your own credit. Dont worry, it wont drop your credit score. Discover pulling your credit through Equifax will affect your credit slightly, but a self-check is known as a soft pull that has zero effect on your score.

One legitimate and free resource is AnnualCreditReport.com, the only official credit report database authorized by the U.S. government itself, so theres no need to fret about scammers soliciting your credit card or personal information. The site provides you with your full, detailed credit report aggregated from Equifax, Experian and TransUnion alike.

Keep some of these tips in mind when accessing your credit report:

You May Like: How Long Does A Credit Check Last On Your Report

When Are Credit Scores Updated

, but knowing the information in your report can help you understand credit score movements. When information is received by the credit reporting agencies, its typically added to your credit reports immediately. And when the information in your credit report changes, . How much they change depends on what information is updated. For example, making one more on-time payment may not cause your score to jump significantly after a year of consistent payments. But if you significantly lowered your balances across your credit cards, you may see some positive score movements. Making payments consistently and keeping balances low are good ways to keep your credit on track. Over time, with these good habits, you should see your .

The Problem With Credit Reporting

Looking to establish your credit history or boost your credit scores before buying a house or making a large purchase? Youll want to make sure your positive credit history is reported.

But heres the thing: Not all lenders report your activity to credit bureaus. If they do, they might not report to all three of the major credit bureaus, either. Credit reporting is a voluntary practice, and credit card companies dont always reveal which credit bureaus they report to. Some companies, like Capital One, explicitly state that they report your credit standing to the three major credit bureaus. Others may not reveal that information so openly.

All in all, its best to keep your credit in good standing across the board. You can do this by making on-time payments in full and keeping your balances low.

Recommended Reading: When Does A Bankruptcy Leave Credit Report