Why Is My Fico Score Lower Than My Credit Score

Because each of the three credit reporting bureaus doesnt always have the same information, you could see a difference at each bureau depending on when you access your score. That means your FICO score could show lower than a VantageScore or other credit scoring option that is pulling slightly different information.

Why Does The Fico Score Matter

A FICO Score helps you gain access to credit that you might need for getting an education, mortgages, or car. A good score can save you thousands of dollars as youll pay lower interest and fees. With a high score, lenders are willing to give you the best rates because youre considered low risk when it comes to paying back your loan.

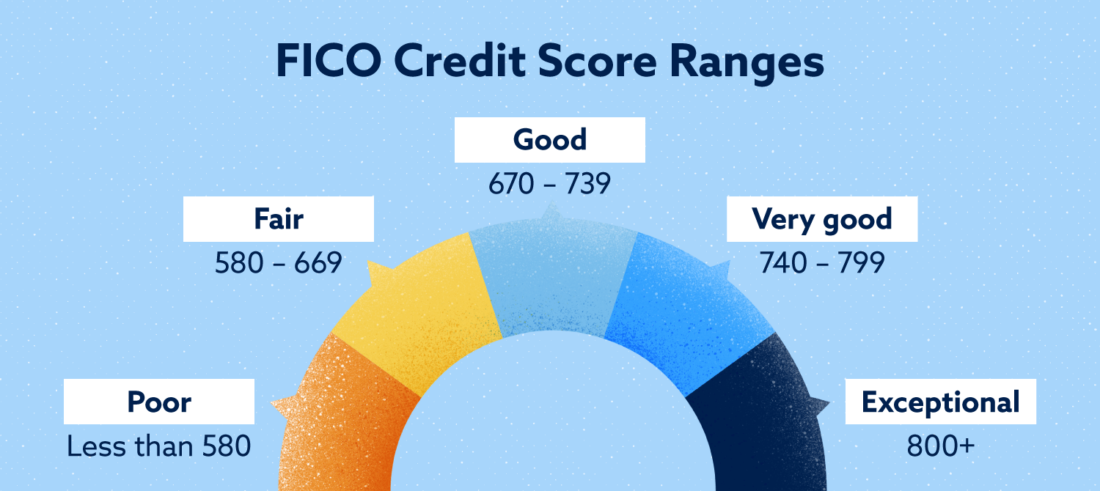

Lenders will deem a score of 670 or better as Good credit with low risks involved. The higher the score, the lower the risk. As your credit report is changing all the time, it also means your FICO Score is being updated. So if you dont have a good credit score through them, this can change quite quickly.

What would you say to easily boosting your credit score ?

Fico Score Vs Credit Score: Which Is Better

Whether a FICO credit score is better than another credit score depends largely on how the scores are calculated and how they’re being used. Again, FICO scores focus on payment history, credit utilization, credit age, credit mix, and credit inquiries to give lenders an idea of how likely you are to pay back the money you borrow. Other credit scoring models may consider different factors to make the same determination.

VantageScores, for example, break down like this:

- Extremely influential: Credit usage, balance and available credit

- Highly influential: Credit mix and experience

- Moderately influential: Payment history

- Less influential: Age of credit history

- Less influential: New accounts

VantageScores range from 300 to 850 like FICO, while assigning different weights to payment history, credit usage, and other activity. So in terms of which score is better, a lender might prefer to use FICO scores if they want to gauge how likely someone is to repay their debt. But if they’re more interested in how much debt someone has and their credit utilization, they may use VantageScores.

Read Also: How Long Do A Repo Stay On Your Credit

How To Achieve A Good Credit Score

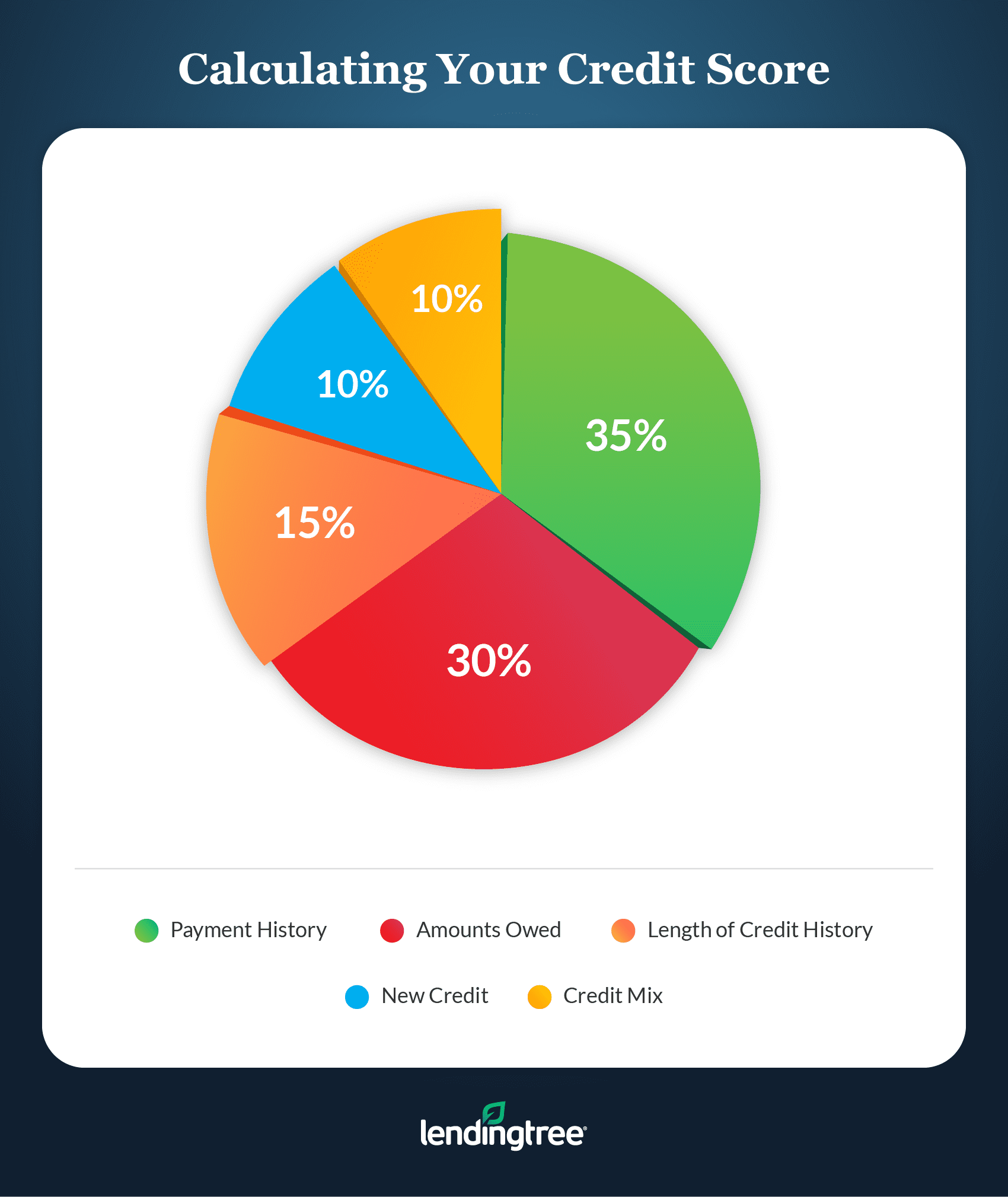

Achieving a higher credit score takes time, patience, and financial responsibility. While you can’t get a perfect 850 overnight, you can focus on behaviors and practices that creditors look for in a borrower. This will hopefully form a habit that will help you maintain good credit in the long run. Here are a few educational tips that can help you start building credit now and in the future:

- Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total credit score, so it’s best to avoid making a late payment.

- Spending well below your credit limit is considered best practice as creditors typically view high spending as risky behavior.

- Read the terms and conditions of each credit card before you apply. Not only do you want to ensure it’s the right card for you, but you also want to know if you’ll qualify. If you apply and get denied, the inquiry may lower your credit score by a few points.

- Maintain a healthy mix of credit cards and loans to show creditors that you have experience managing different types of debt. However, remember to not open too many lines of credit in a short amount of time, as this can be seen as risky behavior.

- Finally, try not to close a credit account only apply for credit cards you intend to keep and build a history with that account.

Importance Of Credit Score

A credit score is important because it is the first thing that lenders check to see if a person is eligible for any loan or credit card. There are 2 ways that credit scores are checked

1. Soft pull or soft check: In this case the bank or NBFC obtains an individuals credit score from other means. For example, if a person checks the eligibility for a loan or credit card the bank will simply check the credit score alone in which case the score will not get affected in anyway.

2. Hard pull or hard check: Here the individual applies for a loan or credit card in which case the bank or NBFC has been given explicit rights to pull the applicants credit score and report which will affect the persons credit score.

It is based on this score from the report that banks get to know how organized you are with repayment of credit. With high credit score you can get great terms on the loan while with bad the person will get high interest rate, lower tenure, lower loan amount or if the credit score is low enough the application will be rejected.

Read Also: How To Remove Repo From Credit

Your Fico Score From Fico

90% of top lenders use FICO® Scoresdo you know yours?Choose your plan.

- Scores for mortgages, auto loans & more

- $1 million identity theft insuranceImportant information 33

- 24×7 identity restoration

Automatically renews at $19.95/month. Cancel anytime, no refunds. Includes FICO Score 8. Your lender/insurer may use a different credit score. See important information belowImportant information 11.

Additional Fico Score Information

The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. . If you provide the business with information, its use of that information will be subject to that business’s privacy policy. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information.

If you wish to continue to the destination link, press Continue.

Don’t Miss: What Bank Does Carmax Use

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- Types of credit in use

Why Is My Fico Score Different Than Other Scores Ive Seen

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a particular consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores. The FICO® Bankcard Score 9 that is being made available to you through this program is the specific score that we use to manage your account. When reviewing a score, take note of the score date, consumer reporting agency credit file source, score type, and range for that particular score.

Recommended Reading: Les Schwab Credit Score Requirements

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

What Determines Credit Scores

Scoring companies and models may be different, but scores have a few things in common. For starters, according to the CFPB, theyâre all calculated based on data from .

According to the CFPB, scoring models might incorporate the following information from your reports:

Keep in mind that past bankruptcies, foreclosures and collections activity may also figure into your credit score. And the CFPB says those things can sometimes affect scores for 10 years or longer.

You May Like: Does Paypal Report To Credit Bureau

Also Check: Does Ginny’s Report To Credit Bureau

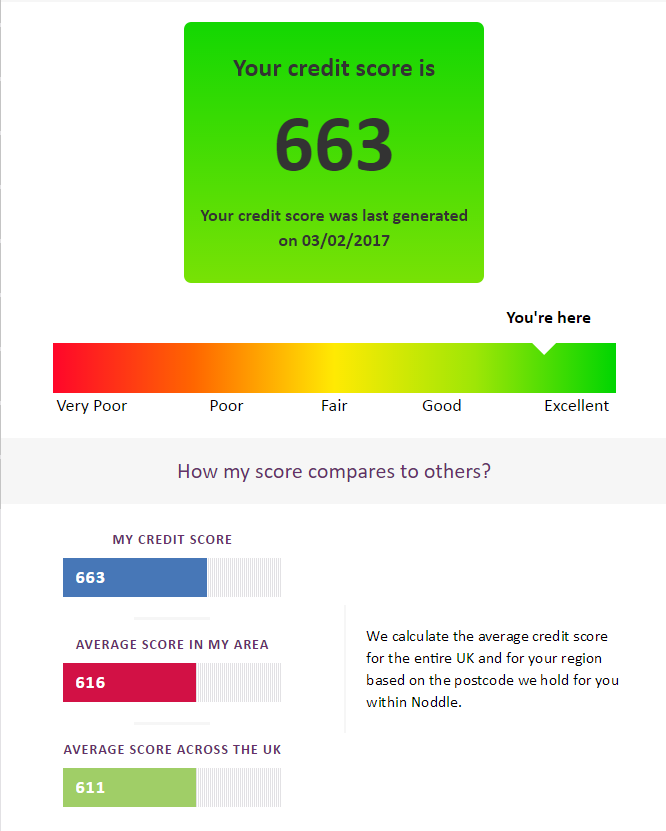

Somebody Tell Me How This Happened

I have literally only two positive items on my credit reports.

Loan and credit strong loan. I have a ton of closed good accounts.

I have one collection for $557 held by portfolio recovery that I refuse to pay.

My Equifax is Frozen.

My scores are Experian 666, TransUnion 657, and Equifax 655.

I was just approved for American Express silver Platinum.

WTH!

Will Closing A Credit Card Account Impact My Fico Score

It is possible that closing a credit account may have a negative impact depending on a few factors. FICO® Scores may consider your credit utilization rate, which looks at your total used credit in relation to your total available credit. Essentially, it measures how much of your available credit you are actually using. The more of your credit that you use, the higher your utilization rate and high credit utilization rates may negatively impact your FICO® Score. Before you close any credit card account, Wells Fargo recommends that you should first consider whether you really need to close the account or if your real intention is just to stop using that credit card. If you really just want to stop using that card, it may make sense if you stop using the card and put it somewhere for safe keeping in case of an emergency. Its also important to note that length of your credit history accounts for 15% of your FICO® Score calculation. Therefore, having credit card accounts that are open and in good standing for a long time may affect your FICO® Score.

Don’t Miss: Does Uplift Do A Hard Credit Check

Why Is My Fico Score Different Than Other Scores Ive Scene

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data that is being made available to you through this program is the specific score that we use to manage your account. When reviewing a score, take note of the score date, consumer reporting agency credit file source, score type, and range for that particular score.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Don’t Miss: Letter To Remove Repossession From Credit Report

The Importance Of Credit Categories Varies By Person

Your FICO Scores are unique, just like you. They are calculated based on the five categories referenced above, but for some people, the importance of these categories can be different. For example, scores for people who have not been using credit long will be calculated differently than those with a longer credit history.

In addition, as the information in your credit report changes, so does the evaluation of these factors in determining your FICO Scores.

Your credit report and FICO Scores evolve frequently. Because of this, it’s not possible to measure the exact impact of a single factor in how your FICO Score is calculated without looking at your entire report. Even the levels of importance shown in the FICO Scores chart above are for the general population and may be different for different credit profiles.

Ready To Learn More About Fico Scores

Head over to the myFICO® Forums for in-depth, community-led discussions about FICO Scores. Ask questions and get answers from thousands of experts and others that have been through similar situations.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Don’t Miss: Itin Number Credit Report

Causes Of A Bad Credit Rating

Having no credit historyIf you dont have a credit history, credit reference agencies will have no information to use to judge your creditworthiness. You might not have a credit history if youve never taken out a credit card or any kind of loan. Younger people tend to have no credit history because their parents are usually financially supporting them.

Failing to stick to the credit agreementPart of your creditworthiness is being seen as trustworthy. Making late payments, missing payments or paying less than required by your credit agreement will be added to your credit history. By being consistently unreliable with payments, your credit score will be classified as Very poor or Poor.

Declaring bankruptcy will negatively affect your credit rating. Being declared bankrupt will stay on your credit report for six years. Bankruptcy means being unable to repay your outstanding debts. For more definitions of different financial and mortgage-related terms, check out our glossary.

Choosing the wrong credit cardA credit card can either improve or ruin your credit rating, so you need to choose a credit card wisely. Choose a credit card which has a limited credit limit and interest rates that you can handle.

Only paying the minimum every monthAvoid paying off the bare minimum when it comes to your credit card. Paying more than the minimum means you will spend less on interest and can improve your credit score.

Which Credit Score Matters The Most

While there’s no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

While that can help you narrow down which credit score to check, you’ll still have to consider the reason why you’re checking your credit score. If you’re accessing your credit score simply to track your finances, a widely-used base score like FICO® Score 8 works. This version is also helpful for gauging which credit cards you qualify for.

If you plan to make a specific purchase, you may want to review an industry-specific credit score.FICO lists the specific scores that are used for various financial products. FICO® Auto Scores are ideal if you want to finance a car with an auto loan, while it’s good to check FICO® Scores 2, 5 and 4 if you plan to buy a house.

Dont miss:

You May Like: Do Evictions Show Up On Credit Report

Whats The Difference Between Vantagescore And Fico

The major difference between VantageScore and FICO is the scoring models they use to determine your credit scores. The scoring models are largely based on your credit reports. While they look at similar factors when calculating your scores, different factors like credit usage, payment history, credit types and more can be weighed differently. VantageScore is a collaboration between the three main consumer credit bureaus: Equifax, Experian and TransUnion.

Is The Fico Score Im Seeing The Same Score Wells Fargo Uses When I Apply For A New Account

Depending on the product you are applying for, the same FICO® Score type may be used however, some product applications will use a unique scoring model that is different than what you are seeing.

The FICO® Score provided here is for educational purposes and may differ from the scores used to make underwriting decisions. Typically, creditors and lenders, including Wells Fargo, use more specific industry credit scores that are customized for the type of credit product youre applying for. For example, auto lenders typically use a credit score, such as a FICO® Auto Score, that is specifically designed to better predict the likelihood that you would not default on an auto loan. Mortgage lenders use a score developed specifically for mortgage loans. Or, your credit or lender might also use a proprietary credit score thats developed for use by just that company.

Don’t Miss: Is A 524 Credit Score Bad

What Is Fico 8

FICO 8 is still the most widely used FICO credit score today. If you apply for a credit card or personal loan, odds are that the lender will check your FICO 8 scores from one or more of the major credit bureaus.

FICO 8 is unique in its treatment of factors such as , late payments, and small-balance collection accounts. Here are some key things to note about FICO 8:

- This scoring model is more sensitive to higher credit utilization .

- Isolated late payments on your credit report may not count against you as much as having multiple late payments.

- Small-balance collection accounts in which the original balance was less than $100 are ignored for credit scoring purposes.

Its also worth pointing out that there are different versions of FICO 8. With FICO Bankcard Score 8, which is used when you apply for a credit card, the focus is on how youve handled credit cards in the past. FICO Auto Score 8, on the other hand, doesnt emphasize credit card activity and history as heavily.

Regardless of which FICO credit scoring model is involved, the same rules apply for maintaining a good score. These include paying bills on time, maintaining a low credit utilization ratio, and applying for new credit sparingly.