What A Poor Credit Score Does

Even if you are approved for a loan or credit card with a bad score, you will qualify for difficult terms and higher interest rates. One thing is for sure, you wont be able to qualify for any 0% interest credit cards at all. Similarly, no lender would trust you enough to accommodate personal loan with single-digit interest rate.

Furthermore, you will not be able to enjoy the perk of skipping some utility deposits that are free for users with higher scores. You will find yourself paying more for auto insurance, car renting, or a house.

Thats nothing personal! Banks and financial institutes understand that you are not a bad person but if your credit report reflects that your finances are not stable than not many lenders would feel comfortable doing business with you. Consequently, companies that agree to help you out would do so on terms and conditions of their own choice.

Measures To Improve Your Credit Score

There are several measures that will help you improve your credit score:

- Get your credit report from Bankbazaar.com.

- Review and analyse your credit report. Make necessary changes and improvements.

- Fix your late payments by paying your dues on a timely basis moving forward.

- Pay off debts instead of transferring it to other accounts.

- A good way to build a credit history is to get a secured credit card.

- Increase the credit limit on your existing credit card.

- Have a good mix of secured and unsecured loans.

- Maintain a low credit utilisation ratio.

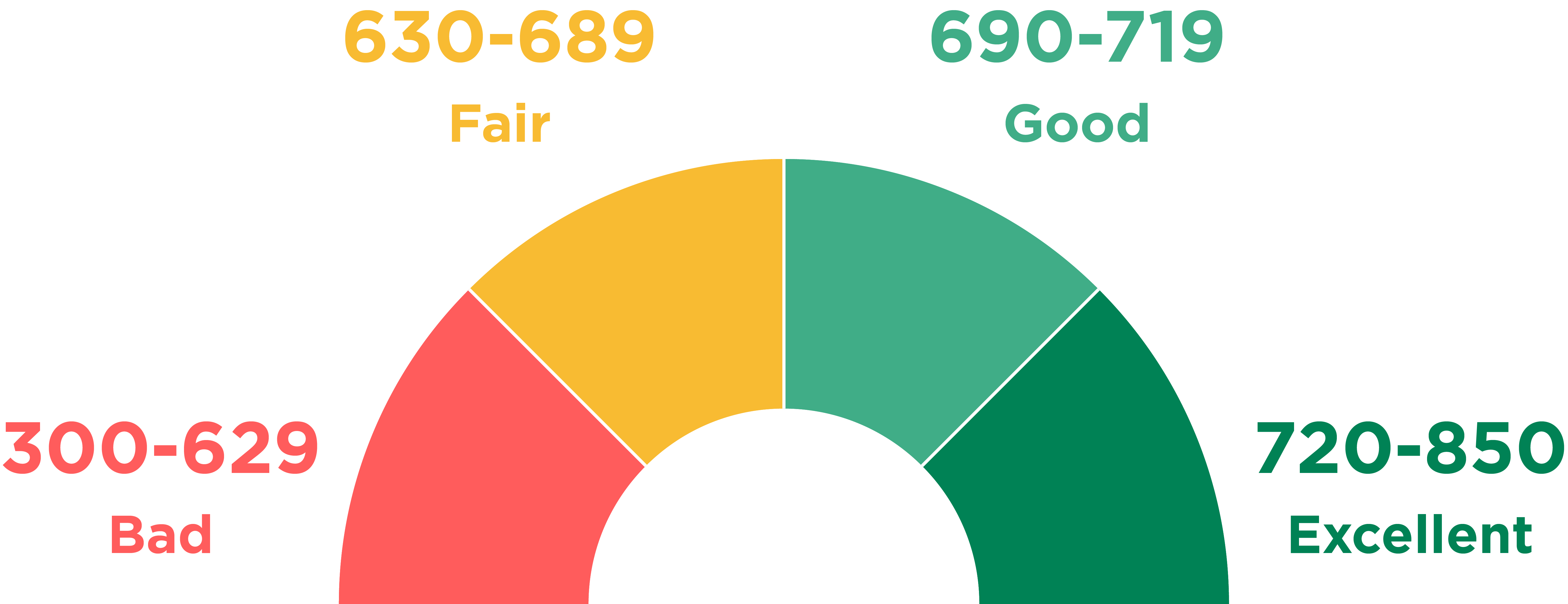

What Is The Credit Score Range In Canada

Your credit score is a three-digit number between 300 and 900 that represents your credit risk. Credit risk is the likelihood youll pay your bills on time, or pay back a loan on the terms agreed upon.

In Canada, credit scores range from 300 to 900 with the average Canadian credit score sitting at 650. According to TransUnion, a score above 650 will likely qualify you for a standard loan, while a score under 650 will likely make it difficult for you to receive new credit.

Its important to understand what your credit score means and how it will impact your ability to get approved for new credit. In order to do that, you need to get your credit report.

Read Also: 1?800?859?6412

Keep Your Credit Utilization Rate Low

The second most important credit score factor is your it accounts for 30% of your score. Your credit utilization ratio measures the amount of credit you use versus the amount you have available. While its usually recommended to keep your credit utilization ratio below 30%, a ratio closer to 0% will help boost your credit score even more.

Recommended Reading: Does Aarons Do A Credit Check

What Are The Penalties

Having bad credit often indicates that you are a more risky borrower, which can make it harder to get approved for new credit cards, a mortgage, or other loans. If you are approved, you may be offered only a high interest rate or other unfavorable terms.

Bad credit can impact other areas of your life as well. If you have bad credit, landlords may not accept you as a renter, or may only agree if you have a co-signer. It can even make it harder for you to get a job if your potential employer checks your credit score as part of your job application.

A good credit score shows youre a dependable borrower, which makes lenders more willing to have a relationship with you and give you funds. Consumers with very good and exceptional credit scores have better odds of loan, rental, and mortgage approval. They can choose from a wider selection of credit cards and loans with more favorable interest rates.

Most businesses that check credit scores are easier to work with when you have a good credit score.

Read Also: Notify Credit Bureaus Of Death

Stay On Top Of Industry Trends And New Offers With Our Weekly Newsletter

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary websites rules and the likelihood of applicants credit approval also impact how and where products appear on the site. CreditCards.com does not include the entire universe of available financial or credit offers.CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the banks website for the most current information.

You May Like: Debt Recovery Solutions Verizon

Greater Chance Of Getting A Lower

Owning your own home with a low mortgage rate is one of the top benefits to having good credit. This is a long term loan and the lower your interest, the more money you save in the long run. Your good credit could have lenders competing for your business so you have the luxury of shopping around for the best offer. If you dont have good credit right now, you should work on improving it before trying to get a mortgage or youll be stuck paying high interest for years.

Read Also: Check Credit Score Without Social Security Number

Recommended Reading: Is Credit Wise Score Accurate

Fico Credit Score Ranges

Heres how the FICO credit scoring system ranks credit scores:

- Exceptional: 800-850

- Very Poor: 300-499

The average VantageScore in 2021 was 698well within Vantages good credit score range.

In the VantageScore model, a score between 300 and 660 is considered a bad credit score, with scores below 500 deemed very poor.

What Does A Bad Credit Score Mean To You

Whether you know it or not, your credit rating can have an impact on your financial life. Thats true even if you dont have much debt. So it could really pay to know what your credit score is. That way, you know where you stand, and can take some steps to improve it.

A poor credit rating could limit your eligibility for a mortgage, loan or credit card. Youre also likely to be charged a higher interest rate and be restricted to a lower credit limit.

So it really could pay to do everything possible to improve your credit score.

If you have a very poor credit score, you could find it a bit more challenging to get a mobile phone contract, household utility or internet provider. You could also find it harder to be approved for a mortgage, credit card or personal loan since companies use your credit score to decide how reliable you are when it comes to paying your bills.

When it comes to your credit rating, it really could pay off to know the score. So take the time to find out your credit score and credit history. A good place to start is The truth about your credit rating: Seven common myths busted.

And if you want the bottom line on average and good credit scores, have a look at What is a good or average credit score.

Don’t Miss: 820 Fico Score

How A Lower Credit Score Can Impact You

A bad credit score can result in higher interest rates on your mortgage, car loan and credit cards. It can also affect you in other areas, such as renting an apartment or purchasing a cellphone plan.

While your credit score may seem to be just a number, not maintaining it can cost you hundreds, if not thousands of dollars in the long run, said James Lambridis, founder and CEO of DebtMD, a fintech platform that connects people with professionals to help them become debt-free.

And a bad credit score can even affect the amount of any security deposits you might owe when renting an apartment or connecting utilities.

Additionally, car and truck insurance as well as homeowners and private life insurance monthly premiums typically go up if you have a lower credit score, Christensen said.

And more and more banks and credit unions are using your credit scores in their decisions to approve your application for a new checking account, he added.

Although your score is not used during any sort of hiring or job interview process, Christensen said, your credit report can be used, and a lower credit score indicates there is negative activity on your report.

While your credit score may seem to be just a number, not maintaining it can cost you hundreds, if not thousands of dollars in the long run.

James Lambridis, CEO, DebtMD

What Determines Credit Scores

Scoring companies and models may be different, but scores have a few things in common. For starters, according to the CFPB, theyâre all calculated based on data from .

According to the CFPB, scoring models might incorporate the following information from your reports:

Keep in mind that past bankruptcies, foreclosures and collections activity may also figure into your credit score. And the CFPB says those things can sometimes affect scores for 10 years or longer.

You May Like: Does Paypal Report To Credit Bureau

What Affects Your Credit Score

There are manyin fact, hundredsof credit scores that lenders use to help make lending decisions. Several factors affect those credit scores. But in almost all credit scores, the two factors that affect your credit scores the most are your payment history and credit utilization rate.

- Payment history: With the FICO credit scoring models, your bill payment history makes up 35% of your credit score. Consistently making payments on time helps your score, while missing payments will hurt it. Furthermore, the longer your payment is late, the more your score will suffer. And recent late payments have a greater effect than those that happened further in the past.

- Amounts owed: FICO scores consider how much of your available revolving credit you’re using at any given time, also called your credit utilization ratio, for 30% of your score. Your is based on the amount you owe on revolving credit such as credit cards compared with the total amount of credit that you’ve been extended. To calculate your ratio, divide all your revolving credit balances by your total credit limits on those accounts. The more you owe relative to your total credit limit, the more it could lower your credit score. In general, always try to maintain a ratio of 30% or less to avoid hurting your score. For top credit scores, keep your utilization under 6%.

There are three other factors that affect your credit score to a lesser degree.

What Is An Average Credit Score In The Uk

There isnt an average credit score in the UK, but there is an average credit category. Most people fall into the Fair credit category, which is the credit equivalent of average.

The average credit category for Equifax and Experian is the Fair category. TransUnion’s average credit score falls into the Good category but it’s very similar to other credit reference agencys Fair category.

Read Also: What Does Your Credit Score Tell Lenders About You Brainly

Causes Of A Bad Credit Rating

Having no credit historyIf you dont have a credit history, credit reference agencies will have no information to use to judge your creditworthiness. You might not have a credit history if youve never taken out a credit card or any kind of loan. Younger people tend to have no credit history because their parents are usually financially supporting them.

Failing to stick to the credit agreementPart of your creditworthiness is being seen as trustworthy. Making late payments, missing payments or paying less than required by your credit agreement will be added to your credit history. By being consistently unreliable with payments, your credit score will be classified as Very poor or Poor.

Declaring bankruptcy will negatively affect your credit rating. Being declared bankrupt will stay on your credit report for six years. Bankruptcy means being unable to repay your outstanding debts. For more definitions of different financial and mortgage-related terms, check out our glossary.

Choosing the wrong credit cardA credit card can either improve or ruin your credit rating, so you need to choose a credit card wisely. Choose a credit card which has a limited credit limit and interest rates that you can handle.

Only paying the minimum every monthAvoid paying off the bare minimum when it comes to your credit card. Paying more than the minimum means you will spend less on interest and can improve your credit score.

Factors That Affect Credit Score

There are multiple factors that affect a persons credit score. They are

- Payment history The most important factor. How regular you are on your loan payments

- Amounts owed Having very high debts or maxing out credit cards with dues continuing for many months will have a negative impact on your score

- Length of credit history The longer the , the higher the credit score

- With different types of loans available CIBIL, Equifax etc. needs a debt to determine your score

- New credit Taking out credits within short time increases your credit risk

It is based on these that your credit score is calculated by the 4 credit bureaus operating in India CIBIL, Equifax, Experian, Highmark. A persons credit score will vary from bureau to bureau as each uses their own proprietary algorithm to calculate the credit score.

You May Like: Public Record On Credit

Top Credit Card Recommendations For Canadians With Bad Credit

A bad credit score limits your options when youre shopping for a credit card. Cards with generous rewards or competitive perks will only be available to those with the best credit. So if your score is less than 575 or you have no Canadian credit history, your first priority should be improving your score so you can get a better card later. Use a secured credit card in the meantime to help fix your credit.

Home Trust Secured VISA

What Is Bad Credit And How Do You Improve It

Join millions of Canadians who have already trusted Loans Canada

Your credit is an important tool that lenders, creditors and other entities use to evaluate your likelihood to pay bills and debts. So, if you currently have bad credit, it can be difficult to get approved for a loan, credit card or even an apartment rental. Thankfully, credit can be improved by building better financial habits and using credit responsibly.

Don’t Miss: What Score Is Needed For Care Credit

Importance Of Credit Score

A credit score is important because it is the first thing that lenders check to see if a person is eligible for any loan or credit card. There are 2 ways that credit scores are checked

1. Soft pull or soft check: In this case the bank or NBFC obtains an individuals credit score from other means. For example, if a person checks the eligibility for a loan or credit card the bank will simply check the credit score alone in which case the score will not get affected in anyway.

2. Hard pull or hard check: Here the individual applies for a loan or credit card in which case the bank or NBFC has been given explicit rights to pull the applicants credit score and report which will affect the persons credit score.

It is based on this score from the report that banks get to know how organized you are with repayment of credit. With high credit score you can get great terms on the loan while with bad the person will get high interest rate, lower tenure, lower loan amount or if the credit score is low enough the application will be rejected.

Definition And Examples Of Bad Credit

Having bad credit means you have negative aspects in your credit history that indicate you are a risky borrower. There are several factors that can contribute to bad credit, including:

- Previous delinquencies

- High debt balances

- Recent bankruptcies

Bad credit is usually indicated by a low credit scorethe numerical summary of the information in your credit report. FICO scores are one of the most widely used credit scores. They range from 300 to 850, with higher scores being more desirable.

The FICO credit score range is broken up into five ratings:

- Exceptional: 800 and above

- Poor: Below 580

You May Like: How To Get Repos Off Your Credit

What Is The Lowest Acceptable Credit Score

The FICO® Score , which is the most widely used scoring model, falls in a range that goes up to 850. The lowest credit score in this range is 300. But the reality is that almost nobody has a score that low. For the most part, a score below 580 is considered “bad credit.” The average FICO® Score in the U.S. is 704.