Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Fraud Prevention And Identity Theft

- How do I place a security freeze on my credit report?To add or remove a security freeze visit Experian’s Security Freeze center. Learn more about state-specific rights.

- How do I place a fraud alert?To add a fraud or initial security alert and immediately view your report for any potential fraudulent activity visit Experian’s Fraud Center. You also may call 1 888 EXPERIAN to add a security alert. Consumers do not receive a copy of their report when placing a security alert by phone.

How Can Other Peoples Credit Histories Affect Mine

Your financial associates are just one more contributing factor to the lenders decision whether or not to give you credit. Before youre accepted for a loan or a mortgage, lenders want to make sure you can afford to pay it back. This involves assessing your other financial ties and commitments.

For example, if you and your spouse share a mortgage and your spouse loses their job, youre likely to have to pick up their half of the payments. This could affect your ability to pay off other debts, and potential creditors will take that into account when deciding whether to give you credit.

You May Like: How To Remove Serious Delinquency On Credit Report

How Do I Get A Ccj Marked As Satisfied

If the judgment is paid more than one month after the original judgment, it can be marked as satisfied on your credit file. To do this, you need to send us the relevant Certificate of Satisfaction. The judgment will still remain on your credit report for six years from the judgment date, but lenders will be able to see the amount has been paid.

How Do I Get Ccjs Removed From My Credit Report

CCJs are automatically removed six years after the original judgment date. If you think the judgment was made in error, you should contact the County Court concerned. The courts will also allow a judgment to be removed if it was paid within one month and a Certificate of Satisfaction has been issued.

Don’t Miss: Does Eviction Notice Go On Credit Report

What Is A Soft Inquiry

Soft credit inquiries occur when a creditor checks your credit history without your permission. This could be a lender with whom youve talked to for a pre-approval quote but havent actually applied for a loan. Sometimes a soft inquiry might even be pulled by an existing creditor just checking on your current credit situation.

Soft inquiries do not have an impact on your credit scores.

How Does A Hard Credit Check Affect Your Report

There are two kinds of credit inquiries: hard and soft.

Soft inquiries, as described above, simply verify your score. They can be run when you apply for a job or apartment, but also when you get pre-qualified for a loan or check your credit score yourself.

A soft inquiry doesnt hurt your credit, while a hard inquiry may.

Whenever you apply for a loan, a more invasive credit check is required. Lenders use your history with credit to determine how reliable of a borrower you are.

As such, they may obtain one or all of your credit reports in the screening process or a merged Factual Data credit report.

This type of inquiry is added to your report, where it will stay for two years. Hard inquiries typically drop your score by a couple of points, but they can be more detrimental if you have several of them on your report.

Having a slew of credit applications suggests that youre financially unstable, lowering your score more significantly than a single entry.

There are a few exceptions, like when youre comparison shopping for a mortgage.

You have a 14-day window to apply for loans, during which time your score shouldnt be lowered by each individual application.

Recommended Reading: How To Notify Credit Agencies Of Death

Whats A Factual Data Credit Inquiry

Lets start by answering the question, who is Factual Data? Factual Data or FDC is a company that offers credit verification services to the mortgage industry. Seeing Factual Data means that you applied for a mortgage or to refinance a mortgage.

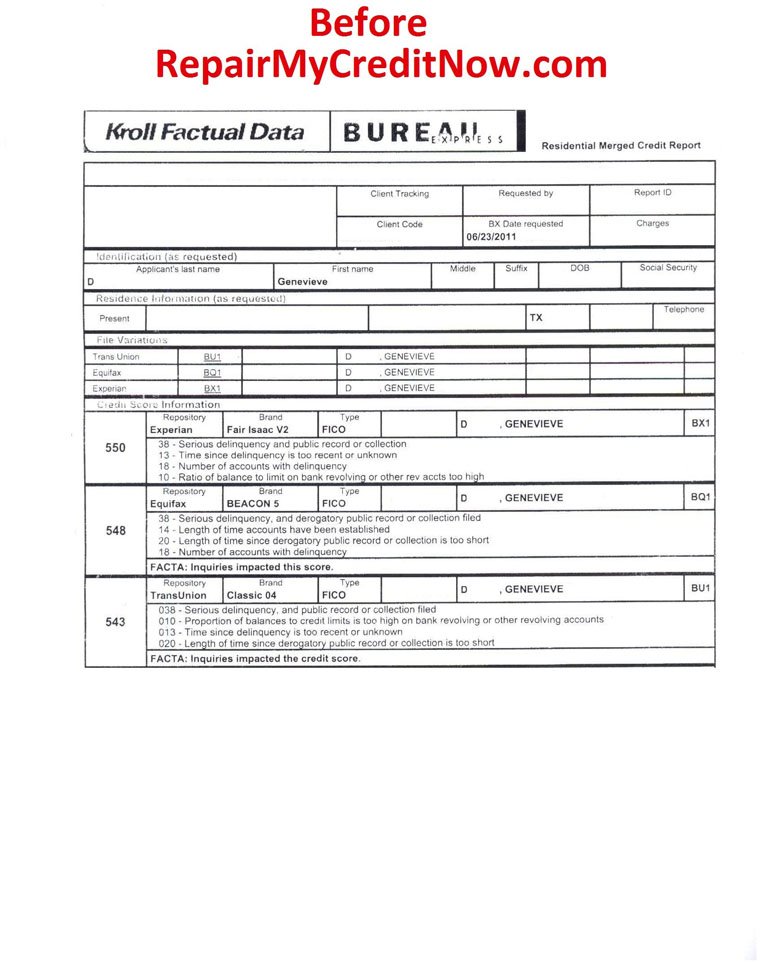

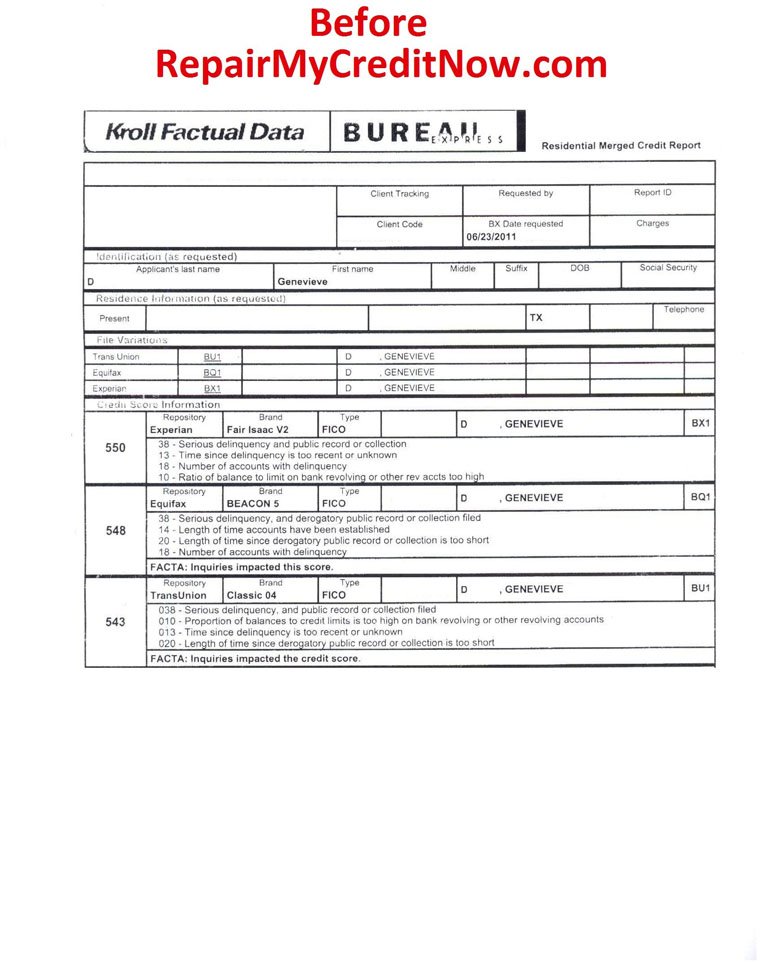

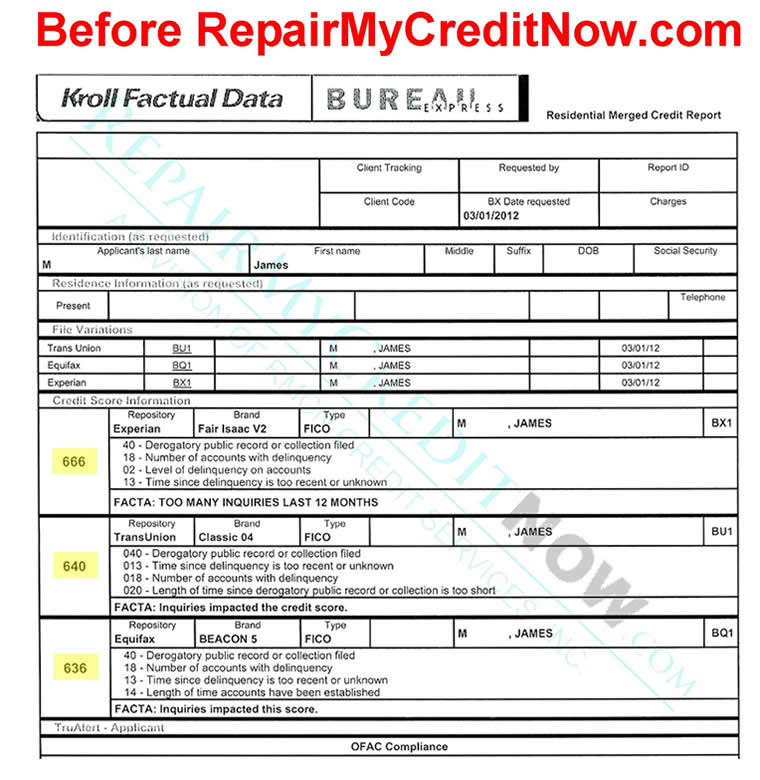

When lenders check credit as part of an application for a home loan, a process known as a credit pull, it may show up on a credit report as a hard credit inquiry.

Heres where Factual Data comes in. FDC will show up on your credit report because Factual Data helps mortgage lenders get information on applicants credit through a merged credit report.

A merged credit report pulls an individuals credit information from a credit card pull databasewhich includes TransUnion, Equifax, and Experianinto a single report that the lender will review as part of the mortgage lending process.

What Is A Notice Of Disassociation

A notice of disassociation is a request from you to TransUnion to remove financial associates from your file. Following various checks to ensure the financial association has genuinely ended, TransUnion will then remove the financial associate from your file.

Once the association has been removed, that other persons credit rating will not be taken into account when lenders are assessing how creditworthy you are.

Also Check: Paypal Credit Report To Credit Bureaus

How Do I Get An Insolvency Removed

Insolvencies are automatically removed from your credit file six years from the original judgment. To remove a bankruptcy or Individual Voluntary Agreement from your file before then, we need the relevant Certificate of Annulment from the issuing court or confirmation from the supervisor of your IVA.

Get Free Help From Consumer Protection Lawyers

Factual Data Ignore Your Dispute? If you have tried to dispute your Factual Data credit report and they have not made corrections after 30 days, it may be time to get legal help. Assert your rights. Do not let Factual Data credit report errors keep you from getting a home or the credit you deserve. Has your dispute with Factual Data been ignored? Did reports provided by Factual Data, AmRent, or DataVerify cause you to be denied housing? Did the Factual Data credit report cause you to be denied credit?

The consumer protection attorneys at Francis Mailman Soumilas, P.C. can help you.

We have been fighting for the rights of consumers for over 20 years against false credit reporting. We know how serious these reports are and the major impact errors can have on your life. The case review is free. If you have a case, there is not out of pocket cost to you. We only get paid when we win money for you.

If you need help call us at 1-877-735-8600 or fill out the form on this page and a representative from Francis Mailman Soumilas, P.C. will be in touch.

Factual Data Contact Information

Also Check: How To Remove Serious Delinquency On Credit Report

Where To Order A Credit Report

There are many different websites and services you can use to generate credit reports.

In the United States, three giant credit reporting agencies collect the financial data used in most credit reports:

Personally, I use Cozy. It has a downright idiot-proof way of requesting reports from tenants and borrowers .

The best part is that the system actually requires the applicant to pay for the report, so it doesnt cost me anything to do this essential piece of homework on the people Im considering working with.

Experian provides the credit reports from Cozy. Luckily,theyre some of the most user-friendly credit reports Ive ever seen. And Ive seen a lot of them in my time.

That said, I think the average person could still benefit from a little bit of hand-holding. I put together this short video to walk you through one example.

Note: Some of the links throughout this blog post are affiliate links that will generate a small commission for the REtipster Blog at no additional cost to you. If you feel Cozy will help achieve your goals and you decide to use these links, your support is very much appreciated!

Some Of My Credit Agreements Dont Appear On My Statutory Credit Report Why Not

There are a few reasons why this may happen:

- Recently opened opened and information has not yet been shared with TU

- Information from this provider is not shared with TU at all,

- this is a really old account and at the time of signing it was not as common for users to be notified inforamtion would be shared to CRAs and in this instance the user will need to contact their lender to share their data for CRA purposes.

Although we hold millions of accounts on our database, some lenders dont contribute information about their credit agreements to TransUnion. They may supply data to all three CRAs or only to one or two agencies.

You May Like: Credit Score Needed For Sapphire Preferred

If I Pay Accounts Will They Come Off My Credit Report

Like other credit history, paid accounts generally remain on file for seven years from the date of first delinquency if they contain any adverse information. If an account is paid and does not contain any adverse information, the account would remain on your file for 10 years from the date of last activity.

Factual Data Announces Integration With Lendingpad

LOVELAND, Colo.-Oct 31, 2018Factual Data, one of the nations premier providers of credit and data verification services to lenders nationwide, today announced an integration of its credit reporting capabilities with LendingPad , a leading provider of loan origination software headquartered in McLean, VA.

This integration allows clients to order tri-merged credit reports directly from Factual Data. Credit reports are merged in LendingPads document management system and liabilities data is updated in real time. The integration is available to all LendingPad users and will automatically populate credit information into the platform.

Factual Data is committed to providing our customers with innovative products and services to support their evolving business needs, said Factual Data President, Jay Giesen. This integration providing tier one credit reporting capabilities from Factual Data with LendingPads innovative loan origination system is another example of that commitment in action.

LendingPad is proud to be at the forefront of mortgage lending technologies working with industry leaders together to enhance origination process, said LendingPads Managing Director, Wes Yuan. Our mutual customers will immediately enjoy the convenience and benefits of Factual Data credit products inside of LendingPads platform.

About Factual Data

View source version on businesswire.com:

Read Also: Free Karmascore

Dispute Factual Datas Hard Inquiry

The first thing you need to do is dispute the error on your credit report. Under the Fair Credit Reporting Act , you are allowed to file formal disputes with all three credit bureaus.

Essentially, when you file a dispute, the credit bureau will assign a case officer to your dispute and will investigate the issue. And no, filing a dispute is not hard. We put together a series highlighting how you can file a dispute right now:

Could I Be Turned Down For Credit Because Of A Previous Occupant At My Address

When someone leaves a property, their financial details stay attached to them rather than the address. Someone else can affect your chances of getting credit but only if you have a financial association with them like a joint bank account or joint mortgage, not because you lived at the same address.

Recommended Reading: Capital One Rapid Rescore

What Is Factual Data On My Credit Report

A Factual Data inquiry may show up on your credit report if you have applied for a mortgage, are refinancing, or have applied for a rental property.

Factual Data Credit Report Services and Credit Supplements

Bureau Express Merged Credit Report When companies order a merged credit report it is so they can get credit information from all 3 credit bureaus simplified in one single report.

Third Party Services Factual Data uses to report consumer information

DataVerify DataVerify provides income and employment verification services. DataVerify also provides information on identity. Verifies OFAC, SSA, SSN, date of birth, and other watchlists. They will also check credit reports, employment and income history, property information, and debt information.

AmRent AmRent is a tenant screening service. AmRent uses its own proprietary databases along with outside information to compile data on potential tenants. AmRent reports on the following: criminal records, eviction data, identity verification, credit reports

What Is A Hard Inquiry

A hard inquiry occurs any time you apply for new credit and the lender or creditor runs a credit check. It can be for a mortgage, apartment, car loan, credit card, insurance policy, cell phone, and sometimes even a job application.

Hard inquiries will typically only drop your credit score by a few points. However, if you have too many, especially in a short period of time, they can really start to add up and do some damage.

Read Also: Hard Inquiry Fall Off

Do The Three Credit Reference Agencies Hold Identical Information About Me

No. The information CRAs obtain from public sources, such as electoral register data, bankruptcies and County Court Judgments should be similar, but information supplied by lenders may well be different. Some lenders supply data about their credit accounts to all three CRAs, while others only supply data to one or two agencies.

How To Prepare For A Mortgage Application

Applying for a home loan or taking advantage of low-interest rates by refinancing your mortgage loan will require a good credit score. Since Factual Datas hard inquiries into your credit report may lower your score a few points, its a good idea to prepare by boosting your credit score prior to filing your application. Here are a few ways to get ready.

You May Like: How Long Is A Repo On Your Credit

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

How Do I Contact The Other Two Credit Reporting Companies Experian And Equifax

TransUnion does not share credit information with any other credit reporting company. To obtain your Experian or Equifax credit report, you must contact them directly. For your convenience we have provided their addresses and telephone numbers below.

Equifax Credit Information Services, Inc

P.O. Box 740241

You May Like: Brandon Weaver Credit Repair Reviews

If I Miss A Rental Payment Will This Show On My Credit Report

Yes, if youve agreed for Property Rental data to be shared with TransUnion. Similar to the other financial account information you may see on your TransUnion Credit Report, Property Rental suppliers have the same obligations to report arrears, arrangements and defaults, where applicable, so these will be appear on your report.

Factual Data Credit Report Errors

Your credit report and credit score are crucial when applying for a mortgage or rental property. They can be the deciding factor of whether or not you are able to rent, or refinance. They will also play a large role in whether or not you qualify for a loan or what your interest rate will be.

Your Rights Under the FCRA

- Under the Fair Credit Reporting Act , credit reporting agencies like Factual Data must be sure that the information they report is accurate and up-to-date.

- Errors on your Factual Data reports cause you to be denied housing.

- If a credit report provided by Factual Data is used against you, you have the right to a free copy of the Factual Data Credit Report.

- You have the right to dispute errors on your consumer reports.

- When there are mistakes on your credit report or background check, it is important to dispute them right away.

- You have the right to sue credit reporting agencies that report false information.

How to Dispute Factual Data Credit Report Errors

To dispute errors on your Factual Data Credit Report visit the Factual Data consumer assistance webpage. Here you can download the consumer request form. Fill out the form and send it either by mail or by fax.

Factual Data Dispute Mailing Address: Factual Data Consumer Assistance

Factual Data will have 30 days to investigate your dispute and make any corrections.

Also Check: 688 Credit Score

Get Your Inquiries Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. Its so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If youre looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.