What Does Age Have To Do With Credit Score Fluctuation

Typically, the younger the age group, the lower their average credit scores are. However, this doesnt necessarily mean that young borrowers are bad with money or irresponsible with their . So, what else could be the cause of a such a low average among the younger crowd? Well, there are several key factors that cause your credit score to rise and fall in various ways.

Payment History

As we said, younger people are not necessarily more likely to make irresponsible credit transactions than older people. However, at one point or another, weve all missed a few credit card payments, especially when we were in the 18-25 age group and were still learning how to use them properly. Before we discovered the benefits of things like online banking and automatic payments, that is.

Debt Owed

Since the amount of credit debt you carry also plays a key role in the calculation of your credit score, its no wonder age becomes a factor. As we said, your payment history can be affected by how expensive and manageable your credit products are. Simply put, the more unpaid debt you carry, the lower your credit score may be. Once again, the way age becomes a factor here could be because the younger you are, the more you tend to spend and the less income youll be making to counteract it. However, it could also be because the older you get, the more significant your debts will become. After all, whats a few hundred dollars worth of credit card bills, compared to a $350,000 mortgage?

New Credit

How Long Does It Take To Get A 700 Credit Score

While getting an excellent credit score cannot happen overnight, it is possible to get a good credit score of around 700 in less than a year, provided you follow the right steps. These include:

Pay all your bills on time and never miss a payment.

Reduce your outstanding balances to bring down your credit utilization ratio .

Don’t apply for or open new credit accounts frequently.

Don’t apply for different types of credit just to improve your credit score unless youre sure of making timely payments and keeping your outstanding balances low.

Go through your credit reports every six months and dispute inaccurate information.

Keep your oldest credit card account active as it increases the length of your credit history.

If you’re looking for your first credit card with the aim of building credit, consider getting one with no annual fees. Weve reviewed over 1,600 consumer credit cards so that you can select one that suits your requirements easily.

What Doesnt Affect Your Credit Score In The Usa

Theres a lot of information that doesnt factor into your credit score or history. Companies and individuals checking your credit score in the USA wont learn:

- Your age, gender or marital status.

- Your salary or employment history.

- Your race, ethnicity, nationality or religion.

- Your savings or assets.

Most of the time, your debit cards and bank account activity wont reflect on your credit score either. This information usually isnt reported to the credit bureaus unless you repeatedly tap into your overdraft. So, it wont help you get a good credit score in the USA without credit history.

Read Also: What Credit Score You Need For Care Credit

Check Your Credit With A Secure Credit Check From Birchwood Credit

Finding out your credit score may bring on feelings of stress, but it doesnt have to. Understanding your credit situation will help you become financially independent, work towards realistic goals and empower you to feel confident with managing your finances.

Now you can get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.

What If I Have Bad Credit Or No Credit

shisuka / Shutterstock

If youre unable to get a normal credit card, one way to build your history and improve your score is to open a secured credit card, instead.

Secured credit cards require you to pay a deposit, which is held as collateral until the account is closed. If you dont pay your bills, the lender gets to keep your deposit. Secured credit cards are easy to get but may not improve your score as effectively as a regular, unsecured card.

Another option is a credit-builder loan, an unusual product solely designed to show off your ability to make regular payments. The lender actually holds on to the amount you borrow, only releasing it to you after youve paid off the balance over time. These loans still arent free, though, so make sure youre prepared for the interest rate.

Recommended Reading: Notify Credit Agencies Of Death

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Tip : Maintain A Low Credit Utilization Rate

“If your balances increase over time, your credit scores will suffer. Your is the second most important factor in scores, behind your payment history,” Griffin explains.

To calculate your utilization rate, add up the total balances on all your credit cards and divide by the total of your credit limit across all cards.

Let’s say you have two credit cards:

- Card A: $1,000 balance and $3,000 credit limit

- Card B: $3,000 balance and $5,000 credit limit

Your total balance would be $4,000 and total credit limit $8,000. That makes your utilization 50%, which is high. You should aim for a low utilization rate around 30% to improve your credit score.

If you find it hard to keep track of the percentage of credit you use, take advantage of various alerts card issuers set, such as when your balance exceeds a certain amount or when you’re approaching your credit limit. If you have no problem paying your balance in full each month, you can also call your card issuer and ask them to increase your credit limit.

Don’t Miss: What Is A Tri Merge

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

Who Tracks Your Credit History In The Us

In the United States, there are three major credit bureaus:

- Equifax

- Experian

- TransUnion

Even if one or more of these agencies operate in your home country, your financial history and credit-building activities wont reflect on your US credit report.

These bureaus operate under national regulations in every territory they work in and different countries work with different scales for scoring and require different reporting metrics.

In the US, credit bureaus are regulated by the national Fair Credit Reporting Act, but theyre not operated by the government each one is an independent, for-profit business.

While some creditors report to all three major US credit bureaus, others report to just one or none at all.

Prodigy Finance reports payments made by US residents to Experian and UK residents to TransUnion.

Why you should care about credit reporting as an international student?

If youre actively working to build a positive credit profile in the US, you want all your credit and contract payments to reflect on the reports compiled by one of the major agencies .

Check with every provider who theyre reporting to and, if you have a choice, you may want to go with the provider that routinely or frequently submits reports.

Your credit history will show:

- How much credit you have available.

- How much credit youre using.

- How long youve had each reporting account.

- How many new creditors youve approached recently.

- Your payment history .

Also Check: How To Remove A Public Record From Your Credit Report

Understand What Goes Into Your Score

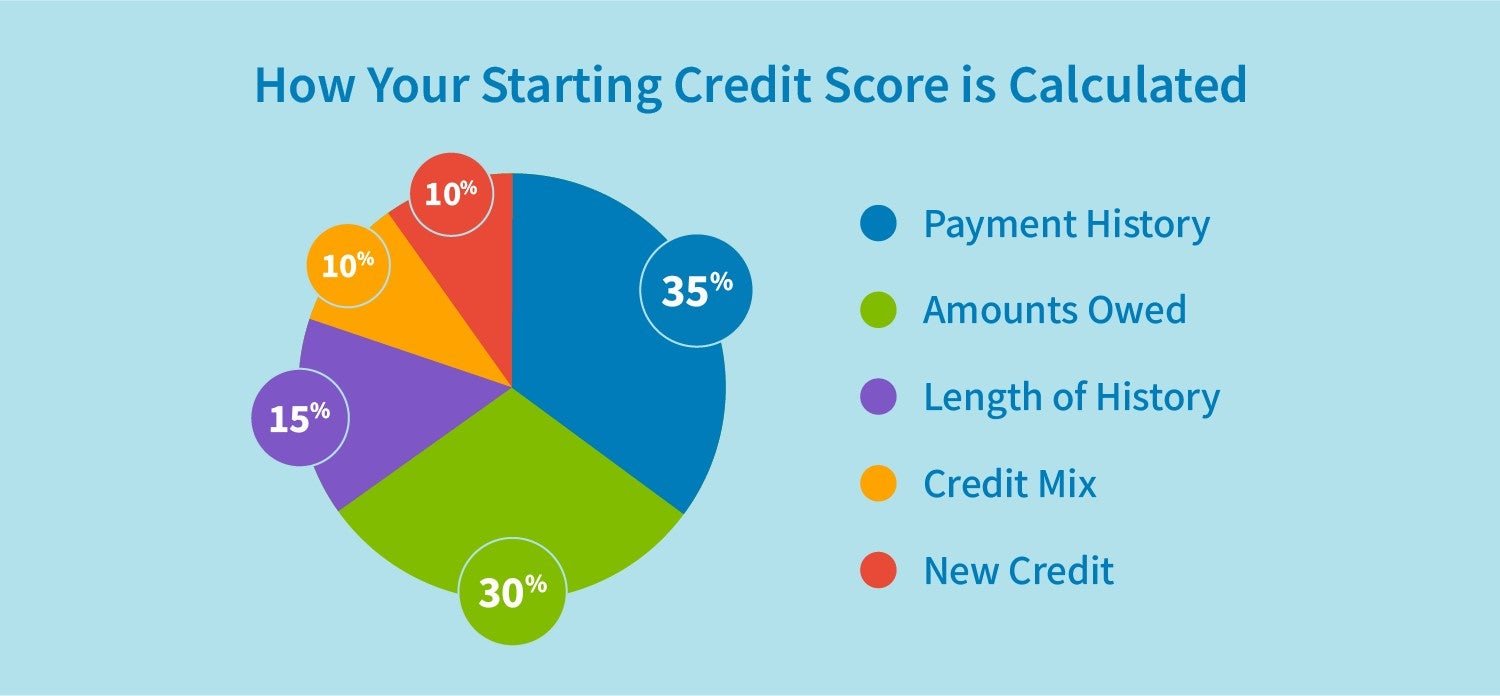

Five factors contribute to your FICO score, though some carry more weight than others:

Payment history

This is the single most important factor, making up over a third of your score. It shows lenders whether you have a history of late or missed payments on loans, credit cards and sometimes other bills.

While youre building your credit score, its essential that you make all of your payments on time.

Even one late payment can cause your score to drop. And if you fail to make up for a missed payment within 30 days, your account could be labelled delinquent, a stain that will stay in your credit history for up to nine years.

Your utilization ratio is the amount of credit youre currently using divided by the total amount of credit you have available to you, expressed as a percentage.

Ideally, you want to keep your utilization ratio below 30%. So if youve only got one credit card and it has a $1,500 limit, you should aim to have less than $500 in debt on it at any given time.

If possible, try to pay off all your balances in full each month. That way, your credit utilization will be 0%.

The amount of time youve had credit also plays a role. If youre a new user, the length of your credit history will be quite short, and there isnt much you can do about it but wait.

Once youre a bit further along, make an effort not to cancel old credit cards even if you dont use them very often. All active cards count toward your credit length.

Hard inquiries

What Is Your Credit Score If You Have No Credit

If you have no credit history, you are credit invisible. That means none of the three major credit bureaus have a credit history on you. That might be because youve never applied for credit or youve paid for everything in cash. If youve never used credit or applied for a loan, youre credit unscorable. That means that you may have a credit file at the major credit bureaus, but theres not enough history to calculate a credit history.

Don’t Miss: Zebit Reviews Bbb

What Is The Average Credit Score In Canada By Age

Home \ \ What is The Average Credit Score in Canada by Age?

Join millions of Canadians who have already trusted Loans Canada

A good credit score is a valuable tool for anyone trying to navigate their financial life. True, making a decent income and saving money are also healthy practices, but a solid credit score is one of the key factors that can put you in the position to get approved for loans and other types of credit products. You can use those products to pay for your childrens education, get married, even buy a car or a house. While everyones financial goals are different, one thing is certain. Its important to learn about your own credit score so you can always keep it in the best shape possible.

It can be tough to predict what your own will look like in the years to come. You could experience debt issues, job loss, or get your finances back on track, no one can predict the future. While its never a good idea to compare your finances to someone elses, it can be beneficial to understand where your credit score should be during different times in your life as well as how that can affect the overall health of your credit.

Apply For A Secured Or Credit Builder Card

Secured credit cards are designed for people with bad credit or no credit at all. These cards typically require a cash deposit to open, which doubles as your credit line. As you make purchases, your credit limit is reduced. As you pay your bill each month, you can free up available credit.

If you want to build credit with a secured card quickly, the easiest way to do it is to pay on time. Remember that with FICO credit scoring, payment history carries the most weight. You could begin to see a positive movement in your credit score after just a few months if you pay on time consistently.

Don’t Miss: Does Eviction Notice Go On Credit Report

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

Don’t Miss: How To Check Hard Inquiries Credit Karma

How Are Credit Scores Calculated

FICO and VantageScore credit-scoring models rely on data retrieved from credit reports to come up with credit scores. Both assign varying levels of importance to different aspects that go into generating your credit score.

FICO relies on five categories, and each is assigned a fixed percentage value.

- Payment history: 35%

- Amounts you owe : 30%

- Length of credit history: 15%

- New credit: 10%

VantageScore does not assign fixed percentages but relies on varying levels of influence.

- Payment history: Extremely influential

- Duration of credit history and mix of credit: Highly influential

- Percentage of available credit youve used : Highly influential

- Total balances you owe: Moderately influential

- Recent credit inquiries and behavior: Less influential

- Available credit: Less influential

What Is Your Credit Score When You Have No Credit

You do not have a credit score when you have no credit history. Each equation has minimum requirements for information on a consumer report.The algorithms will not output a valid number until your credit report meets these three standards: one or more accounts open for six months, at least one account updated in the last six months, and the file does not flag the account holder as deceased.

Also Check: Does Usaa Report Authorized Users

What Your First Credit Score Means

Simply having a credit score to begin with tells you a lot. For starters, it indicates that you have enough credit history to actually generate a score. Your first credit score will also clue you in to the following:

- The nature of your initial performance as a borrower, considering that mistakes are magnified in a thin file. So if you start with a bad score, it will be obvious that some measure of habit change is in order.

- The types of financial products youre likely to garner approval for as well as which are best left alone. For instance, if your first credit score is 650, then youll have a good chance at getting a limited-credit credit card but not an offer that requires good or excellent credit for approval.

- The possibility of identity theft. If youve yet to intentionally kick off your credit career, the mere presence of a credit score could be an indication that someone applied for credit in your name. Dont jump to any conclusions, though, as you could have built a bit of credit as an on a parents account, for instance.

You can sign up for WalletHub to get your free credit score and learn more about what it means. We update our scores on a daily basis, provide in-depth analysis of your credit standing and offer customized credit-improvement advice.

Try A Store Credit Card

Most store credit cards offer charging privileges only at the issuing store and its brands or partners and work the same as other credit cards, though they may be easier to get approved for compared with traditional credit cards. Some may even offer rewards on purchases.

What you have to watch out for, however, are the annual percentage rate and the credit limit. Because store credit cards may have lower credit requirements for approval, they may charge a higher APR, which means that carrying a balance on one of these cards month to month could cost you more money. And a low credit limit means that you could max your card out quickly, leading to a higher , which can lower your credit score.

Don’t Miss: What Credit Score Do You Need For Chase Sapphire Reserve

Understanding Good Credit Score In Australia

What is a credit score?How is a credit score calculated?

- Your repayment history for any loans or credit cards

- A summary of how much you have borrowed in the past

- An estimate of your ability to pay bills on time

- Any credit limits currently in place

- The number and frequency of credit applications youve made in the past

- Any bankruptcies, defaults or court judgments in your name

How do you view your credit report? There are a number of reputable agencies that offer credit reports and credit score summaries. The most popular ones in Australia are Equifax, Experian and Illion, and to get your report youll need to prove your identity using official documents such as your drivers licence, passport or Medicare card. Its worth noting that these agencies sometimes offer slightly different scores to each other because different credit reporting bodies may hold different information about you.

H& R Block have partnered with the leading independent provider illion to create our MoneyHub platform. MoneyHub is a free score and credit reporting platform that allows clients to take control of their finances. Once registered, users can see their report at any time, track their spending with inbuilt spend tracker tool and gain access to a range of exclusive client offers. How do you interpret your credit score? Fortunately, its easy to understand your credit score as it is graded with simple categories: Excellent, Very good, Good, Average and Below average.