What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

Why You Have Three Different Credit Scores

Given the above components for your credit score, why do consumers have three different scores? This is because there are three different credit bureaus that independently calculate your score: Experian, Equifax and Transunion. While the three companies use very similar processes for determining your credit score, they there are small differences in how they’re done. Another complication is that the three bureaus may not all have the same information on you in their systems when making these determinations. This often occurs when an account in your credit history has been reported to one bureau but not another.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

Does The Fico Score Im Seeing Reflect My Most Recent Payments

Scores reflect data from your Experian® credit report at the time it was calculated and may be from a previous period. All lenders have their own reporting schedule, so you should allow 30-60 days from the time of any payments or other activity for that activity to be reported in your credit report and then reflected in your FICO® Score. If you believe your FICO® Score is incorrect or doesnt reflect your most current activity, the first thing you should do is check your credit report. You can check your credit report from each of the three consumer reporting bureaus once per year for free at annualcreditreport.com. If you see an error or a particular lender has not reported your latest activity to the credit bureau, follow each bureaus instructions on how to dispute the information or contact the lender directly. If you see an error associated with a Wells Fargo account, call us at 1-855-329-9605, Mon Fri, 7:00 a.m. 7:00 p.m. Central Time.

Also Check: Sample Notification Of Death Letter To Credit Reporting Agencies

Faqs About The Accuracy Of Credit Scores

What is the most accurate credit score site?

There is no one credit score site that is more accurate than others. Your credit scores may vary depending on the credit score version you are checking, the day you check the score, and which credit bureaus data is used to generate the score.

Is Experian more accurate than Credit Karma?

Neither provider is more accurate than the other. They provide different things.Credit Karma provides free VantageScore 3.0 scores from TransUnion and Equifax, but not from Experian. Experian provides FICO Score 8 Credit Karma does not. Credit Karma provides free credit reports from Equifax and TransUnion, updated weekly. Experian CreditWorks provides an Experian credit report, and FICO Score monthly the Premium version provides access to FICO Scores and credit reports from all three credit bureaus monthly and Experian FICO Scores and credit reports daily.

How can I check my credit score accurately?Which credit score matters most?What is considered a good FICO score?

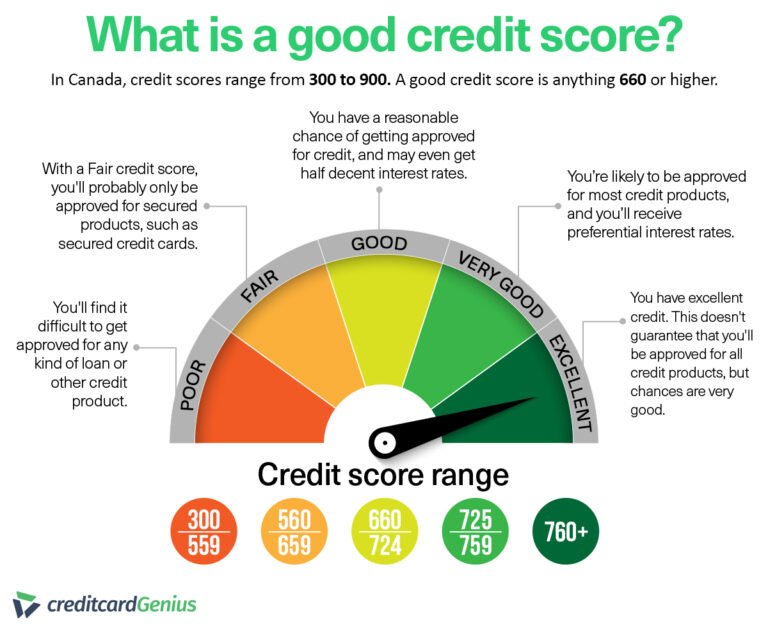

The FICO score credit scoring model uses a range of 300 to 850. A good FICO Score is between 670 to 739 a score between 740 to 799 is considered very good.

Why Isnt My Fico Score Available

There are several reasons why you might not see a FICO® Score, such as:

- Your account is new , and the FICO® Score service is not yet available.

- Your credit history is too new or limited to allow a FICO score to be calculated.

- You are not the owner on a Regions consumer credit product .

- Your loan/credit card is set up with an ITIN .

- Your loan/credit card is a business account.

- Your loan/credit card has been inactive for over 10 years.

- You filed a dispute and your credit report still reflects the dispute. If you filed a credit card dispute with Regions and have further questions, please call 1-800-253-2265.

Also Check: Does Qvc Easy Pay Report To Credit Bureaus

Is Fico Scores The Bestfico Score Vs Credit Score

Now that we know a little about FICO scores, is it one of the best options? Now, this is a personal choice but makes a significant difference when doing a credit lending or borrowing activity.

FICO score comprises several factors: timely payments, percentage of credit used, age of credit, type of credit, and inquiries. However, it is not a single credit score and instead more diverse to make accurate credit decisions.

As we know, there are more than 30+ FICO credit scores for various purposes. So, if you want to check the FICO score for lending money, FICO 8 and FICO 9 are the best choices, while FICO 10 is best for assessing the credit risk. Such a diverse scoring mechanism specific to needs makes it one of the best choices over other credit rating models.

Vantage Score is also one of the best options and range similar to the FICO score . However, FICO is still considerable as it offers more choices.

Also read: How to Write a Dispute Letter to Creditor.

How To Find Your Score

In order to accurately record your credit history and analyze your information to create a FICO score, you need one account thats been open and actively reported to a credit bureau within the last six months.

Otherwise, there wont be enough information to calculate your FICO score.

You do not need to borrow a large amount of debt in order to have a FICO score.

You can simply have a statement balance that shows up on your account. This can be in the form of charging money to a credit card and paying off the entire balance at the end of each month.

To check your own credit score, you have many options. Generally, you can pay for a one-time credit score or a subscription service directly through FICO.

However, that can get expensive. Banks and credit card companies may offer free monthly FICO credit scores.

You May Like: How Long Do Repos Stay On Credit

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

You May Like: Usaa Credit Monitoring Service

Does Your Fico Score Matter

If youre applying for a credit card, yes. Need to get a car loan? Sure, youll want a credit score.

But hold on to your seats. Were about to make a really bold statement: You dont need a credit score.

Cue the shock, the awe and the horror! People who need a credit score are people who plan to take on more debt. Thats not what we want for you! The goal here is to become completely debt-free, and debt-free people dont need a credit score. Why? Because they arent taking on more debt!

Around here, we like to say a credit score is just an I love debt score. Think about it. A credit score doesnt reflect your salary increases, the amount of money in your savings account, or how well you budget each month.

If someone in your family was to pass away and leave you a million dollars, your credit score wouldnt change one single point. Your net worth would skyrocket, but your credit score wouldnt budge. Seems fishy, doesnt it?

In other words, a credit score has nothing to do with how well you handle your money. But it does show how well you play around with debt. Your credit score is solely built on how much debt you have, what kind of debt you have, how long youve had it, and how youve paid on it.

Thats all.

But waitdont you need a credit score to buy a house? Nope.

What Is A Fico Score

A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. This, in turn, affects how much you can borrow, how many months you have to repay, and how much it will cost .

When you apply for credit, lenders need a fast and consistent way to decide whether or not to loan you money. In most cases, they’ll look at your FICO Scores.

You can think of a FICO Score as a summary of your credit report. It measures how long you’ve had credit, how much credit you have, how much of your available credit is being used and if you’ve paid on time.

Not only does a FICO Score help lenders make smarter, quicker decisions about who they loan money to, it also helps people like you get fair and fast access to credit when you need it. Because FICO Scores are calculated based on your credit information, you have the ability to influence your score by paying bills on time, not carrying too much debt and making smart credit choices.

Thirty years ago, the Fair Isaac Corporation debuted FICO Scores to provide an industry-standard for scoring creditworthiness that was fair to both lenders and consumers. Before the first FICO Score, there were many different scores, all with different ways of being calculated .

You May Like: Which Credit Score Does Carmax Use

More Accurately Assess Consumer Credit Risk

The FICO® Score is used by lenders to help make accurate, reliable, and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used broad-based risk score, the FICO Score plays a critical role in billions of decisions each year.

What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

You May Like: Experian Credit Unlock

What Is A Fico Score Fico Score Vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.

Your Fico Score May Differ

On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Using Credit Karma won’t hurt your credit score. Your search is a self-initiated inquiry, which is a “soft” credit inquiry, not a “hard” inquiry.

You May Like: 1-877-795-9819

Understanding How A Fico Credit Score Is Determined

This video from the Continuing Feducation series provides a short overview of credit scoreshow they are determined and why they are important.

To provide students with online questions following each video, register your class through the Econ Lowdown Teacher Portal.

This video is included in an online booklet for Boy Scouts to earn the Personal Management merit badge, one of the requirements to become an Eagle Scout. Learn more about the badge and other videos featured in the booklet »

Is Your Fico Score Really Free

There is a multitude of websites that claim to offer your credit score at no cost, but in most cases, theyre not actually free. When you sign up for these supposedly free credit scores, some websites will enroll you into a credit monitoring service that charges a monthly fee without any warning to you.

Another common issue with providers advertising free credit scores is while they may provide you a monthly update of your credit score for free, they may also make you apply for a credit card with high interest rates and costly monthly fees.

Read Also: Does Paypal Report To The Credit Bureaus

Make Payments On Time

Payment history, which includes paying your bills on time and not missing a payment, is the most important factor in your credit score it makes up 35% of your FICO Score.

Whats more, paying your bills in full can help you build credit while also avoiding high-interest debt. Paying your credit card bills in full and on time each month will help avoid costly fees and interest that can snowball over time when you carry balances month-to-month.

Your payment history is the single biggest factor determining your credit score, says Bruce McClary, vice president of communications for the National Foundation for Credit Counseling . So if youre focusing on that, youre doing yourself a big favor.

A smart way to avoid missing a loan or credit card payment is by putting your bills on autopay, so theyre automatically deducted from your linked account by the due date. Just make sure you have enough money in your bank account each month to cover each bill to avoid an overdraft.

Vantagescore And Fico Scoring Factors

Both FICO Scores and VantageScores weigh the same five general factors.

However, FICO Scores and VantageScores weigh these factors somewhat differently. VantageScore 4.0 weighs credit usage and available credit most heavily, followed by credit mix, with payment history only moderately influential. For FICO Scores, your payment history is the most important factor, accounting for 35% of your credit score, followed by credit usage, which accounts for 30% of your score.

Recommended Reading: Aoc’s Credit Score