Why Would Someone Need Me To Be A Guarantor

Before learning how to be a guarantor, its perhaps more important to understand why youre being asked in the first place.

There are many reasons why someone may need you to come to the rescue when theyre looking to rent a home or apply for a mortgage etc. And one of the most common is a first-time buyer not having enough credit history on their side.

Mum and Dad will usually be the first port of call in this situation. Failing that, close relatives such as siblings or aunts and uncles.

Its also possible that someone looking to access a loan may have a new job or they dont have the desired minimum salary to meet the lenders criteria. But this should, perhaps, raise a red flag for a potential guarantor as well.

Some of the things to ask yourself before agreeing to help are:

- If they have a bad credit history, then why is this the case?

- Can you trust them to manage the repayments?

- Are they generally responsible with money?

- Is the debt essential?

- How will the repayments affect your life if the worst came to the worst?

- How would it affect your relationship?

What If My Cosigner Files Bankruptcy

If your significant other has poor credit or if you want to start a business venture and need to secure financing, you may find yourself being propelled into the role of a loan guarantor. As a loan guarantor, you basically act as the back up if a consumer or business borrower proves unwilling or unable to pay off a debt. Guaranteeing a loan does have an impact on your credit score and in some cases can be very damaging.

TL DR

When you guarantee a loan, your credit score drops some due to the new credit application and reduced account history length. If the primary borrower defaults, your credit score can suffer more if you can’t pay back the loan.

Repayment As A Last Resort

If all else fails, the lender can invoke the clause requiring you to pay off the debt. If you settle the matter without delay, then it has no impact on your credit score. However, if you cannot afford to do so, the lender can take you to court an obtain a judgment against you.

Judgments are recorded on your credit report and can cause your score to drop dramatically. Worse still, a judgment remains on your credit report for up to seven years. Therefore, your role as a guarantor could limit your access to credit for many years to come.

Read Also: What Can A 700 Credit Score Get You

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

How Becoming A Loan Guarantor Can Affect Your Credit Score

A loan guarantor is an individual who guarantees to repay a borrower’s debt if the latter fails to repay it. Lenders typically ask for a guarantor if the borrower’s income or credit rating barely meets the loan requirements, the loan amount is high, or the repayment tenure is long. If you agree to become a guarantor, the borrower’s loan approval chances may increase. However, as the guarantor, you should brace for impact if the borrower defaults on the payment. Before agreeing to be one, consider these pros and cons of being a guarantor.

Role of a Loan GuarantorAs a guarantor, you must sign a legally binding agreement a guarantee stating that the borrower will repay the loan within the stipulated tenure. The agreement further states that you, as the guarantor, would be held liable under Section 128 of the Indian Contract Act that you would repay the debt on the borrower’s behalf, including the interest and any penalties associated with the loan.

You can read more about why a credit score matters by clicking here.

Other risks of going guarantorBeing a loan guarantor is a massive responsibility you should enter into only if you know the borrower well enough to put your own financial credibility at risk. Here are some other risks of going guarantor that you should know.

Things to rememberBefore you agree to be a loan guarantor for your anyone, consider the following points:

Ready to apply? Click here to get started.

Don’t Miss: Is 623 A Good Credit Score

Does Being A Guarantor Affect Your Credit Score

Your credit report may be impaired if the borrower can no longer keep up with the repayment of the loan. The guarantor has to continue the repayment on behalf of the applicant. Being responsible for the repayment of the loan may have an impact on your credit score.

If you keep up with the repayments, your credit score will not be affected. Rather it will improve when you make all the remaining repayments on time and in full. But if you struggle to keep up with the repayments, it will damage your score. Hence, before accepting someones request to become a guarantor for them, you must assess your financial capabilities. Understand the Terms & Conditions of the loan and the responsibilities that you will have as a guarantor.

The lender may carry out a credit search to assess your profile as a guarantor. That search may remain on your profile for 12 months. It can improve if you keep making regular repayments of your debts.

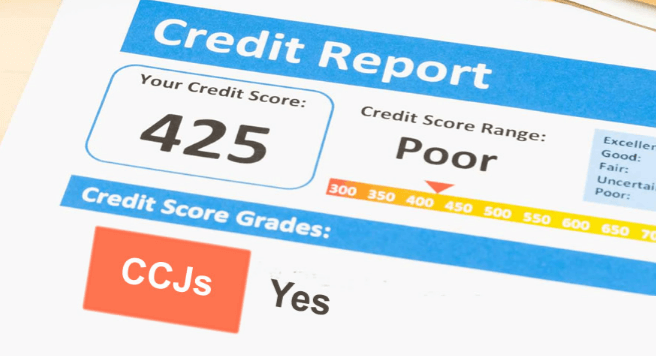

Debt Recovery And Ccjs

As a guarantor, and fully responsible for the loan, should you fail to fulfil your legal obligations you will be subject to the loan providers debt recovery policies which could, further down the line, mean a County Court Judgement . This will make it difficult to obtain credit in any form in the future.

If you are also unable to make the repayments then you could even lose your home if you used this as security for the loan when signing as a guarantor. Even if your house isnt used to secure the loan, if a County Court Judgement is issued for the repayment of the loan then the lender could request a charging order against any proceeds if the guarantor wanted to sell or remortgage their home.

Acting as a guarantor can help someone close to you to secure credit when they need it most, but its important that you ensure you are comfortable with the level of responsibility that this entails. It is also good to keep in mind that any repayment issues could cause personal problems between you and the borrower.

You May Like: How Do You Get A Good Credit Score

Hold Up What Is A Guarantor

If youre unsure what a guarantor is, heres the lowdown:

Banks and Credit Unions offer lower interest – and higher approval – rates to applicants who have a third party – thats you! – act as additional security.

Think of it as a safety net for the lender, and a vote of confidence for the applicant.

In fact, its a great way to get a loan if the applicant:

- Has a large amount of debt or a low credit score.

- Doesnt meet the requirements for a secured loan.

- Wants to access a lower interest rate or higher loan amount.

Alright, enough about the benefits for everyone else…whats in it for you?

A pat on the back and the eternal gratitude of your friends or family is one thing, but being a guarantor could also leave you at risk.

Chief among these, you could be saddled with the repayments if the borrower falls behind.

So what should your response be? Are your concerns justified? And how risky is it really?

To start, were looking at the pitfalls of unlimited guarantees

Impact On The Guarantors Credit Score

Serving as a guarantor may also have a negative impact on your credit score. If the principal borrower has defaulted on the loan, the legal liability will affect the credit score of the guarantor as well. Even if you are prompt in making payments for your other loans, your credit score can be negatively impacted by the loan for which you are serving as the guarantor. In the long run, this could also affect your eligibility for other credits. This is mainly because credit information companies like CIBIL record information about the guarantors of a loan as well.

You May Like: How Long Does Negative Information Stay On Your Credit Report

Concerned About The Effects Being A Guarantor Will Have On Your Credit History The Answer To This Is Quite Simple

Who is a guarantor?

A guarantor is someone who helps another person get some credit, usually in the form of mortgages or loans. As a guarantor, you stand-in for the person borrowing money with a guarantee that you will pay back such a loan or lease if the borrower is unable to repay or the loan falls into default.

Guarantor loans and mortgages are most often the options when a person is having a hard time getting credit from lenders as a result of bad credit history. Some online platforms such as Nowloan also have a loan for bad credit specially designed for persons with bad credit scores.

Who can be a guarantor?

There are a few requirements to meet before a person can act as a guarantor in the UK. You have to:

Be older than 21 years old

Be financially stable

Have a good credit history

In addition to this, a guarantor who is a homeowner increases the chances of the borrower getting credit. Usually, guarantors are people close to the borrower, such as a family member, friend, or close relative.

How does being a guarantor affect credit rating?

A lot of individuals show concern about the effects that being a guarantor will have on their credit history. One will find prospective guarantors asking the question, how does being a guarantor affect my credit rating? The answer to this is quite simple.

As long as the borrower keeps up with making their repayment at the right time, being a guarantor will not necessarily have a negative effect on your credit rating.

Everything You Need To Know Before Signing On The Dotted Line

Theres no denying Kiwis are a helpful bunch!

But what would you say if a friend or relative asked you to act as guarantor on their next personal loan?

- Yes?

- No?

- Maybe?

Facing mounting debts and skyrocketing house prices, guarantor loans are an increasingly popular option among parents looking to help their kids break into the property market.

But would you even know what youre signing up for?

Today were helping to answer this question, filling you in on all things guarantor so you can make an informed decision thats right for you and your financial future. This includes:

- How unlimited guarantees could trip you up.

- The difference between being a co-borrower and a guarantor.

- The ways things can – and do – go wrong.

- Why you could have a harder time getting a loan of your own.

- The many ways you could put your credit score at risk.

But first, lets get you up to speed on what a guarantor is…

Don’t Miss: How To Make My Credit Score Go Up

Can Anyone Be A Guarantor

When mulling over the decision to act as a guarantor, its natural that youll have many questions. And wondering if you are even eligible is probably right up there at the top of the list.

Well, the good news is that almost anybody can potentially act in this capacity.

The first thing to tick off the list is that youre over 18or over 21 in some cases. The UK laws simply wont allow for anyone younger than this to step forward and undertake such a responsibility. The lender will also enforce an upper age limit of around 75 years of age.

The other main requirement is that you have a good credit history and that you can prove that you are financially stable.

You must also have a separate bank account from the borrower. But this is usually the case anyway.

What Can You Do To Protect Yourself As A Guarantor

Before agreeing to act as a guarantor, consider whether the loan is a sensible option for that individual and whether theyre likely to struggle making the repayments.

If you decide to go ahead, make sure proper affordability checks are carried out and make sure you get a copy of the borrowers credit agreement. That way, youll know what their payment schedule is and the terms of borrowing.

Go through this and all documents you get with a fine-tooth comb.

You may want to seek independent legal advice on how else you can keep yourself protected. This could involve getting a written agreement between you and the borrower, for example, stating they must keep you up to date with their financial position and decisions.

For your own peace of mind, you could put some extra funds aside just in case.

Another good way to protect yourself is by keeping a close eye on your credit report. That way, you can see if anything is registered against you, and you can act as soon as any issues arise.

You can see your credit report from sites like TotallyMoney for free.

And, if you are looking to take out new credit at any stage either while acting as guarantor, or at a later date, it is worth checking your eligibility before deciding what products to apply for, as this will give you an idea of what youre likely to be accepted for.

You May Like: Which Credit Score Is Correct

What Is A Loan Guarantor

When youre a loan guarantor what youre doing is offering to guarantee to cover and pay off the debt of the loan if the borrower is unable to do so.

In most instances youll just be expected to make the repayments for them, but with some lenders you may also need to put forward some collateral as well for example your home or vehicle to secure the loan.

Things To Consider When Becoming A Guarantor

Becoming a guarantor is a huge undertaking that comes with significant financial responsibilities. Before you agree to become a guarantor, consider the following:

Youll Be Responsible For Payments

You must be entirely comfortable taking over loan payments if the borrower defaults. If you are not comfortable with the possibility that youll have additional loan payments to make, then you may want to rethink the notion of becoming a guarantor.

Your Credit Could Be Affected

Establishing good credit takes time and effort. You dont want to do anything that could sabotage your credit scores, as this could affect your ability to secure future loans or credit.

If the borrower defaults on the loan, your credit profile could be negatively impacted. Thats because youll be taking over the responsibility for the loan. And if you fail to cover the payments, your credit scores may be negatively affected.

Ask The Borrower To Get Insurance

An insurance policy can cover the loan amount in case the borrower suffers a disability that renders them unable to work, or passes away.

Additional Reading

You May Like: What Credit Score For Car Loan

Does Being A Guarantor Affect Your Credit Rating

There are many reasons why someone might need you to be their guarantor, but does being a guarantor affect your credit rating, and if so, can it also affect your creditworthiness for things like mortgages and personal loans? Find out the answers to these and a number of other important questions in this guide.

A guarantor loan can be a way for people who might be struggling to be approved by lenders due to factors such as having bad credit to borrow money.

However, while theres the positive that being a loan guarantor can allow others to become borrowers, if youve been asked to be one you should have a thorough understanding of what your responsibilities are before you agree.

This is because being a loan guarantor can come with risks for you and the borrower and potentially impact your finances and your ability to borrow in the future. So to help you avoid such issues, this guide breaks down what you need to know, so you can make an informed decision.

Why Might I Be Asked To Be A Guarantor

As we mentioned earlier, one of the main reasons someone may ask you to be their guarantor is that they arent able to secure a loan themselves most likely due to having a poor credit score or no credit history. Lenders will invariably view individuals like this as being a higher credit risk, subsequently limiting their chances of approval.

In addition to being someone the borrower can trust, you may also be asked to be a guarantor because you have a good credit rating. This is because your good credit can show lenders youre the more financially stable party in the agreement and can improve the chances of the guarantor loan being approved.

Don’t Miss: What Goes Into A Credit Score