What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

How Long Does Bankruptcy Stay On Your Credit Report

According to Equifax, Canadas largest credit reporting agency, a first time bankruptcy will appear on your credit report for six years after your date of discharge. This means if you are bankrupt for the minimum period of nine months, your bankruptcy will appear on your credit report for nine months plus six years, or almost seven years in total.

A second bankruptcy appears on your credit report for 14 years.

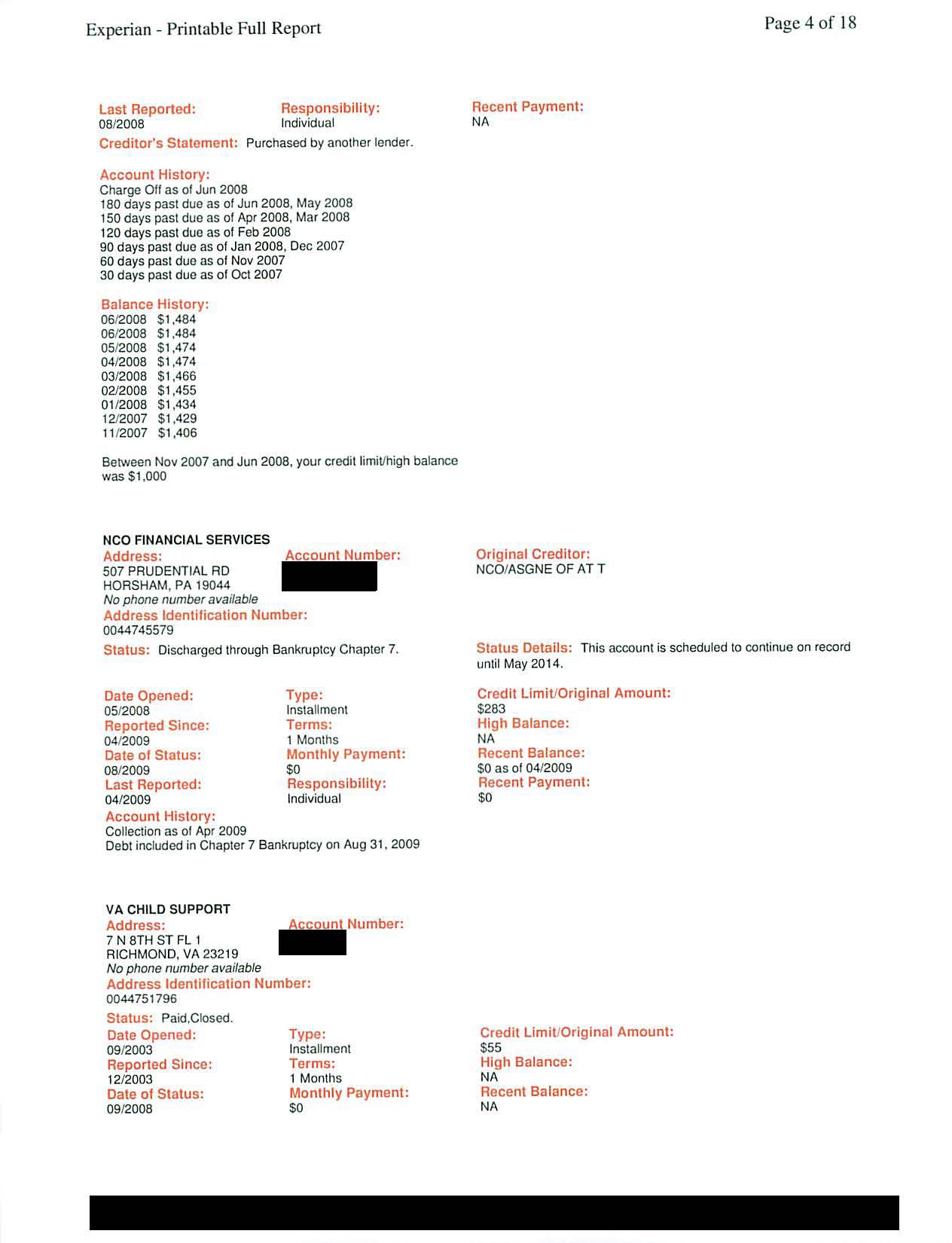

If You Discharged Debts In Bankruptcy Here’s How They Should Be Listed On Your Credit Report

Updated By Cara O’Neill, Attorney

In short, yes. Not only will a bankruptcy filing remain on your credit report for seven to ten years, but you can expect information about the debts discharged in bankruptcy to continue to appear on your credit report, too. In this article, you’ll learn what shouldand should notshow up on your credit report after you receive a bankruptcy discharge, and what to do if your credit report contains incorrect information.

Read Also: Unlock Transunion Credit

To Get Any Significant Credit You Need A Good Borrowing History

Approximately once each month every major lender in Canada sends a report about their borrowers to the credit bureaus. Also, the federal Superintendent of Bankruptcy reports a list of everyone who filed a consumer proposal or bankruptcy to the credit bureaus, as well as a list of everyone who has been discharged. The credit bureaus collect this information, summarize it, and sell it to their members, the lenders.

When you apply for credit, you normally sign an application that provides the lender consent to access your credit history. Generally, this consent allows then access not only the first time you apply, but anytime afterwards as well, as long as your account is open. It is also this consent that allows the lender to provide the bureau information on your payments etc. once you have been approved.

Reporting Accurate Negative Information

When negative information in your report is accurate, only time can make it go away. A credit reporting company can report most accurate negative information for seven years and bankruptcy information for 10 years. Information about an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. The seven-year reporting period starts from the date the event took place. There is no time limit on reporting information about criminal convictions information reported in response to your application for a job that pays more than $75,000 a year and information reported because youve applied for more than $150,000 worth of credit or life insurance.

Recommended Reading: Report A Death To Credit Agencies

Does Bankruptcy Take Care Of Any Tax Money I Owe To The Canadian Revenue Agency

Many people assume that income tax debt is not dischargeable in bankruptcy. However, in a bankruptcy, your debt to the CRA is treated the same as any other unsecured debt, such as credit cards or lines of credit. After filing for bankruptcy, all interest and collection activity by the CRA will stop. Additionally, your trustee will communicate directly with the CRA on your behalf.

How Long Does It Take To Repair Credit In Canada

The only ways you can dramatically boost your credit score within a month or two is by cleaning up the public records section of your credit report , paying down a substantial amount of debt if you are close to your credit limits , or getting a creditor or the credit bureau to stop reporting negative information that is more than 7 years old.

You May Like: Does Les Schwab Report To Credit Bureaus

Can I Get A Credit Card If I Declare Bankruptcy In Canada

No. Once you file for bankruptcy, you must hand over your credit cards to your trustee so they can be cancelled. Additionally, your credit rating will be negatively affected by your bankruptcy and Canadian credit bureaus will keep a note about your bankruptcy on your credit report for up to 7 years, depending on your province.

How Long Does Bankruptcy Affect My Credit Report

There are two main credit reporting agencies in Ontario: Equifax and Trans Union. Information about your bankruptcy or consumer proposal is reported to these agencies by the Office of The Superintendent of Bankruptcy , not your trustee. The OSB will advise these agencies when you file a bankruptcy or proposal and when you receive your discharge.

If you file ANY of a bankruptcy, consumer proposal, debt management plan or do a debt settlement, a not will appear on your credit report that can negatively impact your credit. In general:

- a first bankruptcy will remain on your credit report for six years or seven years after you are discharged

- a consumer proposal (or debt management or debt settlement plan will remain on your credit report for three years after all of your payments are completed.

Bankruptcy does not mean you cannot borrow for six or seven years. This just means that the note will remain on your report, however there are many other factors that affect your ability to get credit.

If you have a job, and if you have a down payment or security deposit, it is possible to repair your credit sooner. Many people are able to buy a car or a house in less than seven years after their bankruptcy ends, if they are able to save money and begin repairing their credit. Here are some ways you can improve your credit after filing for bankruptcy:

Read Also: Factual Data Credit Inquiry Rocket Mortgage

When To Consider Debt Settlement Or Bankruptcy

If your monthly debt payments, excluding mortgage or rent, exceed 20% of your income, you have a debt problem that requires action. The seriousness of the problem, and your ability and commitment to overcoming it, will determine whether a debt settlement plan or bankruptcy is the better option.

Here are some scenarios in which debt settlement may provide the better path out of debt:

- Youre able and willing to negotiate with creditors or debt collectors on a settlement plan that you can afford.

- Your creditors will agree to greatly reduce your debt burden in exchange for your commitment to make a lump-sum payment.

- Your income is stable enough that you can continue to pay your mortgage or rent and other essential bills in addition to the payments required under a debt settlement, while still saving some money for emergency expenses.

Here are some scenarios in which bankruptcy is the better option:

Its important to remember these are general guidelines. Anyone weighing the pros and cons of debt settlement vs. bankruptcy should consult with a nonprofit credit counselor. Counselors from National Foundation for Credit Counseling member agencies such as InCharge Debt Solutions can help evaluate your current financial situation and the various debt relief options available to you.

How Long Does Bankruptcy Or A Proposal Remain On Your Credit Report

TransUnion is very transparent about how long they maintain information on your credit report. According to their website, a record of your filing is retained on your report as follows:

Bankruptcy: TransUnion maintains this information for the maximum length of time permitted by provincial law. For a first time bankruptcy that means:

BC, YK, NWT, NU, AB, SK, MB, NS- six years from the date of dischargeON, PQ, NB, PEI & NL- seven years from the date of discharge.

If you declare bankruptcy more than once, each bankruptcy will remain on your report for fourteen years from the date of discharge.

When your bankruptcy is removed, all of the debts included in your bankruptcy will be removed from your file as well.

Consumer Proposal: A consumer proposal and all accounts satisfied through the proposal will be removed from your file three years from the date you completed the proposal or years after the date you defaulted on the account, whichever date comes first.

Other Debt Repayment Programs: Debts satisfied through the filing of an Orderly Payment of Debts or a Debt Management Plan will be removed from your file two years from the date you completed the program or years after the date you defaulted on the account, whichever date comes first.

Don’t Miss: Cbna Stands For

Bankruptcy Information Can Be Wrong

You may want to hire a credit repair attorney if your record shows inaccurate financial or bankruptcy information. They can speak with credit reporting agencies, credit card companies, or credit card issuers if you are having personal finance trouble. An attorney can also step in if a company does not discharge your debt correctly or you fall into a credit counseling scam.

Remember: A bankruptcy discharge legally stops creditors from harassing you. You have rights if a company is not following the process or respecting your bankruptcy filing.

Establish A Good Payment Credit History

Without question, the very best way to bring about the restoration of your credit is by always paying your bills on time and establishing a solid payment history with no late payments. This takes time, and thats often what people with bad credit dont like to hear. But thats the way the credit system is built. Its built to recognize good payment credit history over time. If you have had a particular credit card or line of credit for a long time, you can use this aspect of the credit reporting system to your advantage. The credit scoring system likes to see a lot of history. If you can clean up a credit card that was opened many years ago and establish a new history of no late payments, the age of the account can help restore your credit as the old late payment history falls off over time.

Also Check: Does Carmax Do Credit Checks

How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act. But heres the good news: As those items age, negative items have less of an impact on your credit scores.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries |

| 10 years |

Debt Relief Alternatives To Bankruptcy

Bankruptcy has serious consequences. A Chapter 7 bankruptcy will remain on your for 10 years, and a Chapter 13 will remain for seven years. That can make it more expensive or even impossible to borrow money in the future, such as for a mortgage or car loan, or to obtain a credit card. It can also affect your insurance rates.

So itâs worth exploring other types of debt relief before filing for bankruptcy. Debt relief typically involves negotiating with your creditors to make your debts more manageable, such as reducing the interest rates, canceling some portion of the debt, or giving you longer to repay. Debt relief often works to the creditorâs advantage, too, as they are likely to get more money out of the arrangement than if you were to declare bankruptcy.

You can negotiate on your own or hire a reputable debt relief company to help you. As with , there are scam artists who pose as debt relief experts, so be sure to check out any company that youâre considering. Investopedia publishes a regularly updated list of the best debt relief companies.

Don’t Miss: What Score Do I Need For Care Credit

What Happens To My Regular Income If I Declare Bankruptcy In Canada

Your wages are not affected by your bankruptcy, but part of your duties during bankruptcy includes providing your trustee with your household monthly earnings and expenditures. Additionally, if your income changes or you gain or lose a dependent, you must inform your trustee.

You may be required to make monthly payments to your trustee. These are called surplus income payments. Your trustee determines whether you have to make surplus income payments based on your average earnings over the bankruptcy and the number of people in your household.

Watch the video below to learn more about surplus income payments.

Video transcript: Meet Stephanie, the mother of a young son, James, who is just about to enter Primary School. Recently, Stephanie has overextended her credit and, despite her best efforts, is unable to pay her bills. Realizing that she needed to speak to an expert, Stephanie found a Licensed Insolvency Trustee located in her area and has gone to meet with her. After speaking to the trustee, Stephanie has determined bankruptcy was the most appropriate option for her.

Why Does Information Show Up On Your Credit Report For Years

Both good and bad credit information stays on your record for several years because it helps lenders determine your risk level when they consider approving you a loan.

Positive credit information, such as making your payments on time and in full, usually stays on your credit report for up to 10 years with Equifax and 20 years with TransUnion Canada.

Negative credit information, such as missed or late payments, accounts sent to collections, bad cheques, and so on, will show up on your credit for several years as well.

Equifax Canada starts counting the time from the date our debt was assigned to a collection agency and keeps the negative information on record for 7 years. TransUnion Canada starts counting from the date of your accounts first delinquency and keeps the negative information on record for 6 years.

However, different types of information stay on your credit report for different lengths of time. Heres a breakdown of how long different items show up on your credit report.

Also Check: Sywmc Cbna On Credit Report

How Does Bankruptcy Work

In plain language, this is what happens in personal bankruptcy in Canada: you assign your non-exempt assets to a Licensed Insolvency Trustee in exchange for the elimination of your debts. Certain exemptions that vary by province may allow you to keep some assets such as your home , car, RRSPs, pension plans, furnishings and effects, etc.

As soon as your bankruptcy papers are filed, your creditors are barred from attempting to contact you, and most legal proceedings and garnishments related to your debts will cease. Once you are released from bankruptcy , the debts included in the bankruptcy will be extinguished. Those creditors are legally blocked from approaching you for any further payments.

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit report’s negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

Read Also: Trueidentity Credit Freeze

Why You Should Not Be Embarrassed By Bankruptcy

According to the Office of the Superintendent of Bankruptcy, approximately 100,000 Canadians every year turn to bankruptcy or consumer proposal as a way to deal with their debt problems.

It is important to recognize that there should be no shame associated with declaring personal bankruptcy. People find themselves in this stressful position for a wide variety of reasons, from a sudden loss of employment to large, unexpected bills.When your bankruptcy is completed , the debts included in your bankruptcy will be extinguished and you can begin to improve your right away.

Myth #: Each Person Only Has One Credit Score

There are two credit bureaus in Canada: Equifax and TransUnion. Some creditors report to one bureau and not the other, so each bureau may have different information on any one individual. Each bureau also uses their own calculations and algorithms to calculate a credit score. As a result, the same individual may have a different credit score at each credit bureau.

Also Check: Will Paypal Credit Affect Credit Score

Impact Of Bankruptcy And Debt Settlement On Credit

Both bankruptcy and debt settlement can reduce your creditworthiness and lower your credit, or FICO, score for years. Debt Settlement will stay on your credit report for seven years. Bankruptcy, no matter which chapter you file under, is certain to bring down your score. The higher your score is to begin with, the more it will drop.

How Long Will I Be Bankrupt

The length of time you will be bankrupt and are required to make bankruptcy payments is determined by your income and if you have declared bankruptcy before.

- A first bankruptcy with no surplus income lasts 9 months. Surplus income will extend your bankruptcy to 21 months.

- A second bankruptcy with no surplus income lasts 24 months. This is extended to 36 months if you have surplus income.

- A third bankruptcy can only be discharged after a court hearing.

Most personal bankruptcies in Canada involve no surplus income and last for nine months. This is because someone with high surplus income would find it more advantageous to file a consumer proposal as an alternative to making high monthly bankruptcy payments.

You May Like: Does Child Support Help Credit Score