Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Understanding Your Fico Score

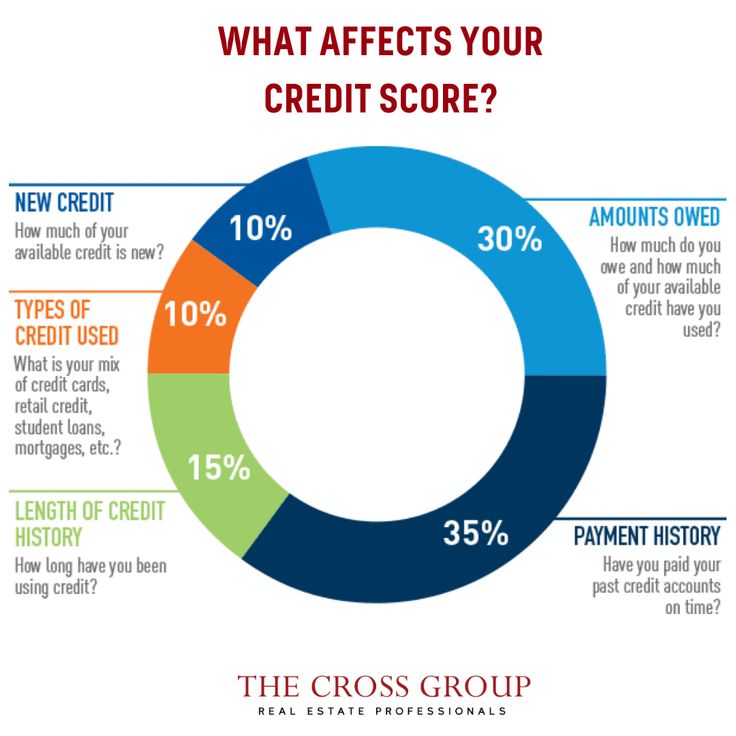

Five components comprise a FICO score: Your FICO score moves up and down with each inquiry, balance change, and as your credit history evolves.

- 35 percent of the total score is based on payment history

- 30 percent is the amount owed and the available credit, also known as credit utilization

- 15 percent is for length of credit history

- 10 percent is for types of credit used

- 10 percent is for search and acquisition of new credit and inquiries

It is also important to understand that different lenders set their own policies and tolerance for risk when making credit decisions. That means there is no universal cut-off score used by all lenders to decide when to deny or approve credit.

That said, scores under 680 often dont qualify for the lowest rates. Scores below 600 are deemed higher risk, and high-risk lenders typically charge higher interest rates.

How Can I Raise My Credit Score In 30 Days

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

What Happens If I Cant Pay Paybright

If you miss a Pay in 4 payment, PayBrights system will automatically reschedule the payment on your debit or credit card at a later date. Check your PayBright account to view the updated payment schedule.If you miss an Equal Monthly payment, PayBright will automatically reschedule the payment for the following Friday or every other Friday until the payment clears.PayBright does not charge any late fees however, missing a payment will prevent you from using PayBright in the future.

Soft And Hard Credit Checks 10%

A soft check occurs when you check your credit score, or when anyone else reviews your credit history for non-lending purposes. It does not negatively affect your credit score.

A hard check, on the other hand, occurs every time you apply for a credit card or loan. Having too many hard checks in your credit history during a short period of time can negatively affect your credit score . A large number of applications for credit products can signal financial difficulty to your creditors and make them suspect you of credit shopping.

Read Also: When Does Paypal Credit Report To Credit Bureau

Length Of Credit History 15%

Finally, the age of your credit history is also taken into account for determining your credit score If you have had a credit history for ten years, your score is likely to be higher than it would be if your credit history is only one year old.

Having a long history of credit is considered better because it shows that you have had some experience with managing credit. You are likely to do well with money in the future as well, and lenders are more willing to offer you credit.

Age of credit is determined in three parts.

When you open a new bank account, it affects your average age of credit history by reducing the age of your credit history. For example, suppose you have had a checking account for five years and get a credit card for the first time today. Since your credit card account is completely new, your average age of credit history would be 2.5 years, roughly. This is a simplified calculation, and the average age is determined with more factors under FICO.

FICO score is determined 15% by the length of credit.

Heres a snapshot of FICO factors for the determination of your credit score.

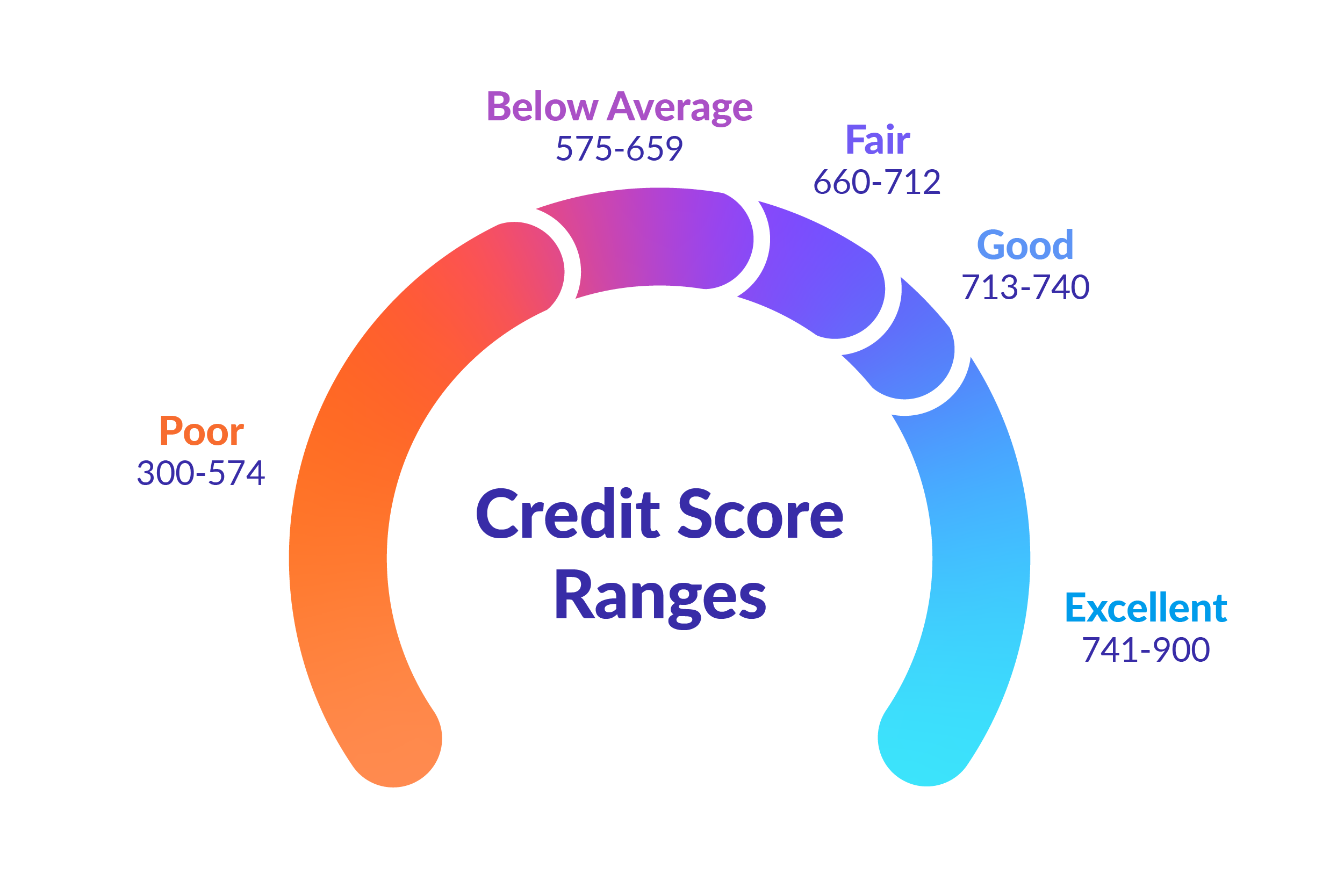

What Is A Good Credit Score

Generally, a credit score approaching 700 or above is looked at favourably by lenders, meaning you probably wont be turned down for credit or a loan, and the interest rate will likely be reasonable. If your credit score is 800 or above, youre in excellent shape.

According to FICO, for people with normal credit profiles, payment history and credit already used make up 65% of your credit score.

Recommended Reading: How Long Does Repo Stay On Your Credit

Does Owing Taxes Affect Your Credit Score In Canada

Home » Blog » Does Owing Taxes Affect Your Credit Score in Canada?

Reading time: 8 minutes

2020-07-16

Uncollected taxes in Canada are estimated to be almost $50 billion. This means many Canadians are stuck with tax debt.

Are you unable to pay your taxes right now? If this is the case, you are probably wondering about the consequences this has on your financial well-being, including whether owing taxes will affect your credit score. Well, it can but only in specific circumstances. Heres what to know and how to seek assistance.

Where Can I Get Debt Advice If I’m Struggling With Missed Payments

If youre looking for ways to improve your credit profile, or youre worried about your ability to repay the debt you owe, A. Fisher & Associates is here to support you.

For free advice and guidance tailored to your financial situation, you can talk to one of our debt experts today. Give us a call for free on 416-842-0040

You May Like: Tri-merge

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Why Are Your Credit Scores Important

There are a number of reasons why your credit scores are important.

- Your credit scores often have a significant influence over your lenders and creditors decision to lend you money.

- Interest Rates Your credit scores can also influence the interest rate your lender charges you. Generally, the better your score, the lower your interest rates.

Surprisingly, other people can see your credit report too. If you are looking for a new job or trying to rent an apartment, your credit could impact your ability to get either.

- To Get A Job You should know that employers can request your credit information and use it in their hiring decisions. However, this is not the case for all jobs in all industries.

- To Rent Landlords also request credit reports for potential tenants, using the information to predict whether you will pay your rent consistently. Insurance companies may also request access to your credit file before providing you with a policy.

Recommended Reading: Does Affirm Affect Credit Score

How Does The Money You Owe Affect Your Credit Scores

While using credit is a part of building credit, owing money can also negatively affect it. Find out how owning money on different accounts may affect your credit.

How Does Owing Money On A Credit Card Account Affect Your Credit?

Your debt-to-credit ratio usually accounts for around 30% of your credit scores. As such, the amount of debt you on your credit card can impact your credit scores. When it comes to using your credit card, its recommended that you use no more than 30% of your available credit limit.

For example, if you have several credit cards, with a total limit of $10,000, you want to try to use less than $3,000 at any given time. If you are regularly carrying a higher amount, it could have a negative impact on your scores.

Can Owing Money On A Credit Card Positively Affect Your Credit?

On the other hand, debt can also be a good thing for your credit scores. If you owe money, but you are making your payments on time and adhering to the terms of your agreement, your credit scores may improve over time.

What Are Credit Scores

In Canada, there are two main credit bureaus, Equifax and TransUnion. They collect information about your credit activity which is reported by your lenders, creditors and other financial institutions. This information is compiled into a file called a credit report. The information in your report is used to calculate your credit scores, which ranges from 300 to 900. Your credit scores are a tool used by lenders, creditors and other third parties to evaluate your likelihood to pay your bills on time.

Don’t Miss: Itin Number Credit Score

Failing To Pay Back An Overdraft In Your Bank Account

This is why its so important to make sure any automated payments coming out of a bank account you plan to close are switched to your new account. You can easily overlook one payment and it can send your old account into overdraft. If youre no longer using that account, you might not be paying attention to it, and your overdraft can eventually be sent to collections.

How Long Is Information Kept On My Credit File

| Actual inquiries made by credit grantors | minimum of 3 years |

| 6 years from the last activity date | |

| Bankruptcies | 6 years from the date of discharge |

| Judgments, foreclosures, garnishments | 6 years from the date filed |

| Collections | 6 years from the date of last activity |

| Secured loans | 6 years from the date filed |

| 3 years from the date settled or completed |

Don’t Miss: Usaa Credit Card Approval Score

Installment Credit Affect On Credit Score

This is the traditional type of credit that has been in use for centuries. With installment credit, you get a set amount of money with a fixed interest and payment term period. Both the term of the credit and interest rate are determined at the time you agree to take on the loan.

Installment loans have several subcategories: mortgages, auto loans, student loans, personal loans, asset leases, etc. This type of credit facility is quite common.

Major Factors That Impact Your Credit Score In Canada

Your credit score is a significant number that will have a strong influence on your financial stability. A good credit score allows you to get loans and credit more quickly. You can even get more favorable credit terms if your score is high enough. A bad credit score can increase your cost of raising finances and also close the door on many opportunities in the market.

This is why it makes sense to ask, what affects your credit score? Once you understand the factors that can increase or decrease your score, you can take action to keep your credit high.

Five major factors affect your credit score:

Also Check: What Is Aoc Credit Score

Switching Credit Cards With The Same Bank

Switching to a new credit card with the same bank may be the easier way to go. The new credit card will be under the same bank account, so there will likely be no need to re-apply for a credit card or have a credit check performed. You may even be pre-approved for certain credit cards.

That said, you probably wont be able to take advantage of any introductory welcome bonuses that new clients would have available to them.

How Much Do Late Payments Hurt Your Credit Score

The concept is simple enough: pay your bills before theyâre due. This isnât a suggestion payment history is one of the largest components of how your is calculated.

Lenders use your credit report as a measure of financial trustworthiness, and a track record of on-time payments is the single easiest way to prove youâre a reliable borrower. Ideally, you should be paying off your balance in full each month on all your bills: credit cards, line of credit, car loan, mortgage payment, cell phone and internet bill, etc.

Of course, if everyone neatly complied, I wouldnât be writing this. Maybe a financial emergency cleaned out your savings, or you lost your job. Perhaps youâre disorganized and simply forgot to pay on time.

Unfortunately, the reason doesnât matter: late payments shave precious points off your credit score. This has can knock you down into a lesser tier and potentially prevent you from qualifying for the best credit cards and mortgage rates. The later the payment, the greater the damage to your score.

What counts as âlateâ?

On your credit report, payments are categorized as 30, 60, 90, or 120 days late. This is rated on a scale of 1 to 9, with a letter in front indicating what type of credit you hold:

How long do late payments stay on a credit report?

What should you do if you miss a payment?

Never again

Also read:

You May Like: When Do Late Payments Fall Off Credit Report

Myth #: Each Person Only Has One Credit Score

There are two credit bureaus in Canada: Equifax and TransUnion. Some creditors report to one bureau and not the other, so each bureau may have different information on any one individual. Each bureau also uses their own calculations and algorithms to calculate a credit score. As a result, the same individual may have a different credit score at each credit bureau.

The Top 5 Factors That Could Affect Your Credit Score

1. Payment History

Pay your bills on time! Paying bills on time is one of the best ways to contribute to your credit health.

The percentage of paying bills on time is very important. Even missing a couple payments could affect your credit score. All bills are important to pay on time. This includes utility bills, loans and even cell phone bills.

2. Credit History

This is information about how you have maintained your credit over time.

How many hard inquiries are on your report? Some hard inquiries include loans, mortgages, credit cards, student loans and more.

Multiple hard inquiries can generally affect your credit score. Other things that will show in your credit history and can affect your credit score are collections, foreclosures, liens, and insolvencies.

Soft inquiries do not affect your credit score. Examples would be soft inquiries by insurance companies, employment, and companies that are checking to give you promotions.

3. Outstanding Debts and Credit Utilization

Having too much outstanding debt and high credit utilization are factors that can hurt your credit score.

Try not to run your balances up to your credit limit. Your open credit amount available compared to how much of your credit you have used can be calculated to a utilization percentage.

If your percentage is high and you have many outstanding debts, a lender may think you are spending more than you can afford. A good target percentage would be 30% or less.

4. Types of Credit

Don’t Miss: Ccb Mprcc On Credit Report

Why Your Credit Score Matters

When you understand your credit score, how its calculated and how you can improve it, you start to think a little more deeply about the debt you might be considering. Not only that, but working to improve your credit score develops strong financial habits. It’s building a foundation will help you as you continue your journey towards financial well-being.

When it comes to credit, the most important rule is this: dont bite off more than you can chew. If you’re worried about taking on more debt or if you’re aware that you struggle to pay down your credit cards and you’re concerned a higher credit limit might be more harmful than beneficial these are valuable flags to pay attention to.

If you are struggling with debt and are concerned that your only options to dig your way out seem to be to take on more debt, talk to an expert. We are here to help you find the best option available to you and give you peace of mind.

We want to help you make the best decision for you and your family and to make a plan to become debt-free.

Types Of Paybright Payment Plans

PayBright offers two payment plans:

Pay in 4 for purchases under $1,000, customers can pay in 4 bi-weekly payments. This plan has 0% interest and no processing fees.

Equal monthly payments this plan has a term length from 3 up to 60 months. PayBright interest rates range from 0% to 29.95% APR.

Some PayBright plans include a small monthly processing fee.

To find out the available plans for PayBright retailers in Canada, contact each merchant directly or check their website.

Also Check: Does Affirm Build Credit

What Information Is Kept In My Credit File

Your credit file contains information on all of your credit accounts submitted to the credit bureaus, including balances, limits, payment history, etc, as well as identification information such as your name, address, age, social insurance number, marital status, spouses name and age, number of dependents, occupation, and employment history.

The Ultimate Guide To Credit Scores In Canada

What is a credit score? A credit score is a 3-digit number that allows lenders to determine a potential borrowers credit riskthe risk they run of not paying back their credit cards or loans. Canadians typically cannot borrow money or receive credit of any kind unless they have a solid credit score. Canadas two national credit bureaus, Equifax and TransUnion, create credit scores and credit reports based on the information they receive about each borrower from their lenders.

In This Article:

You May Like: Whats A Good Dun And Bradstreet Score