How Do I Check My Credit Score

CIBC clients can check their credit score using the CIBC Free Credit Score Service in the CIBC Mobile Banking® App.

You can also contact one of Canada’s credit bureaus to receive a copy of your credit report by mail, free of charge. For a fee, you can view your credit report online.

For more information, contact one of the credit bureaus directly at:

- Equifax Canada: www.equifax.ca

What Is Equifax Credit Score

A persons Equifax credit score is a 3-digit number between 300 to 900 that summarizes their credit history. This is calculated using information provided by credit lenders like banks and financial institutions. This information is also compiled into a more comprehensive Credit Information Report.

This report includes a summary of all the persons loans and credit cards, their repayment history, and personal identification information collected from the lenders where they have taken a credit card or a loan.

An Equifax credit score is said to represent a persons creditworthiness. Essentially, a higher score tells a potential lender that a person has a good history of repaying bills and loans, and can help to decide whether or not to approve their loan applications.

How Credit Scores Are Calculated

Each credit reporting agency has its unique scoring card. To make things even more complex, each lender will specify what type of credit profile they are looking for in prospective customers. This lack of standardization leads to scoring inconsistencies.

For example, a person could have a credit score of 680 when signing into their Equifax account, but the credit-granting establishment may only see a credit score of 650! What gives? What can you do about it? Since there are no standardized credit scoring models that are universally accepted, it truly is consumer beware. This can be problematic when a consumer has a borderline credit score and is applying for mortgages.

Real estate prices in Canada are at epic highs, and most Canadians do not have the 20% down payment needed for a mortgage. As a result, the only way a person can buy a home is by qualifying for CMHC insurance. The minimum credit score needed to qualify for a CMHC insurable mortgage is 600. You need to be sure that your credit score is correct.

Back to the lack of standardization. The majority of lenders look at credit reports from both Equifax and TransUnion. It is possible a borrower could have a 700 score with Equifax and a 600 with Transunion. These disparities are a cause for some financial anxiety because lenders make their decisions solely on these scores.

You May Like: Is 794 A Good Credit Score

By Step Instructions To Obtain Your Free Credit Reports

- If you have not lived at your current address for at least 2 years, you will also need to include your previous address.

Request Credit Reports & Answer Any Security Questions

After you fill out the form, you can request your credit reports from the three major credit bureaus. Youll likely be asked to answer some security questions to verify your identity. For example, you may be asked when you were born or information about past accounts you may have owned. In addition, you may be asked to provide your phone number to receive a one-time password.

You May Like: Syncb Ppc Card

You May Like: Is 714 A Good Credit Score

How To Get Your Annual Credit Report From Experian

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion®– once every 12 months. Every consumer should check their credit reports from each of the 3 bureaus annually. Doing so will make sure your credit is up-to-date and accurate. Each reporting agency collects and records information in different ways and may not have the same information about your credit history.

How To Check Your Credit Score In Canada

With Borrowell, you can get your credit score in Canada for free! Signing up takes less than 3 minutes, and no credit card is required. Once youve signed up for Borrowell, you can download your Equifax credit report for free AND check your credit score at any time without hurting it. Plus, youll receive weekly updates on how your score has changed. Stay on top of your credit health with Borrowell.

Recommended Reading: How To Request Credit Report

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

Read Also: How Long Does Irs Tax Lien Stay On Credit Report

What Is A Credit Score

A credit score is a numeric figure that represents your credit risk at a particular point in time. The credit-reporting agencies, Equifax and TransUnion, use a scale from 300 to 900. The higher your score, the lower the risk for the lender, so it’s easier to get approved for a new loan.

Factors that influence your credit score include:

More About Enhanced Credit Information Report

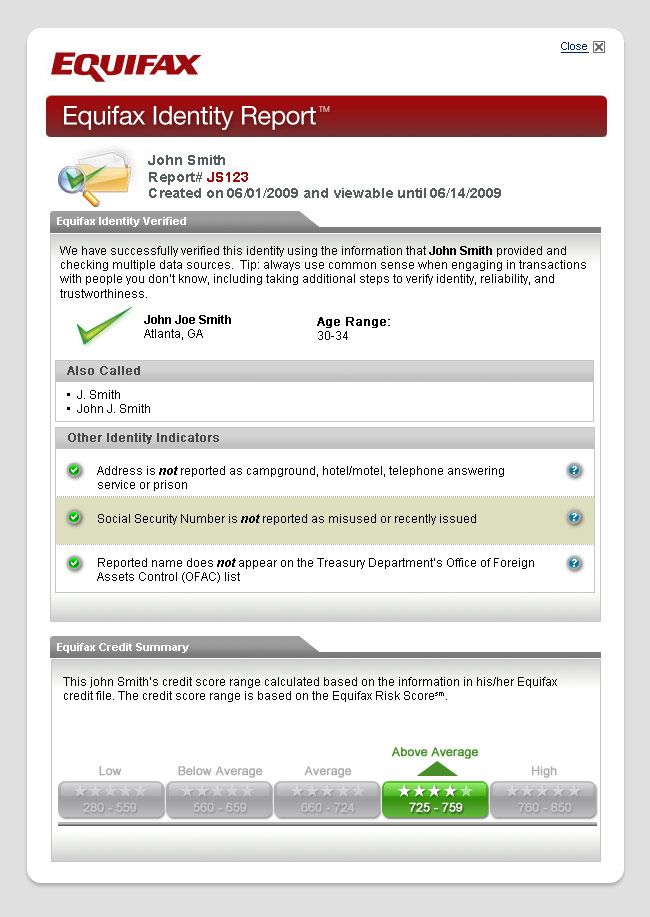

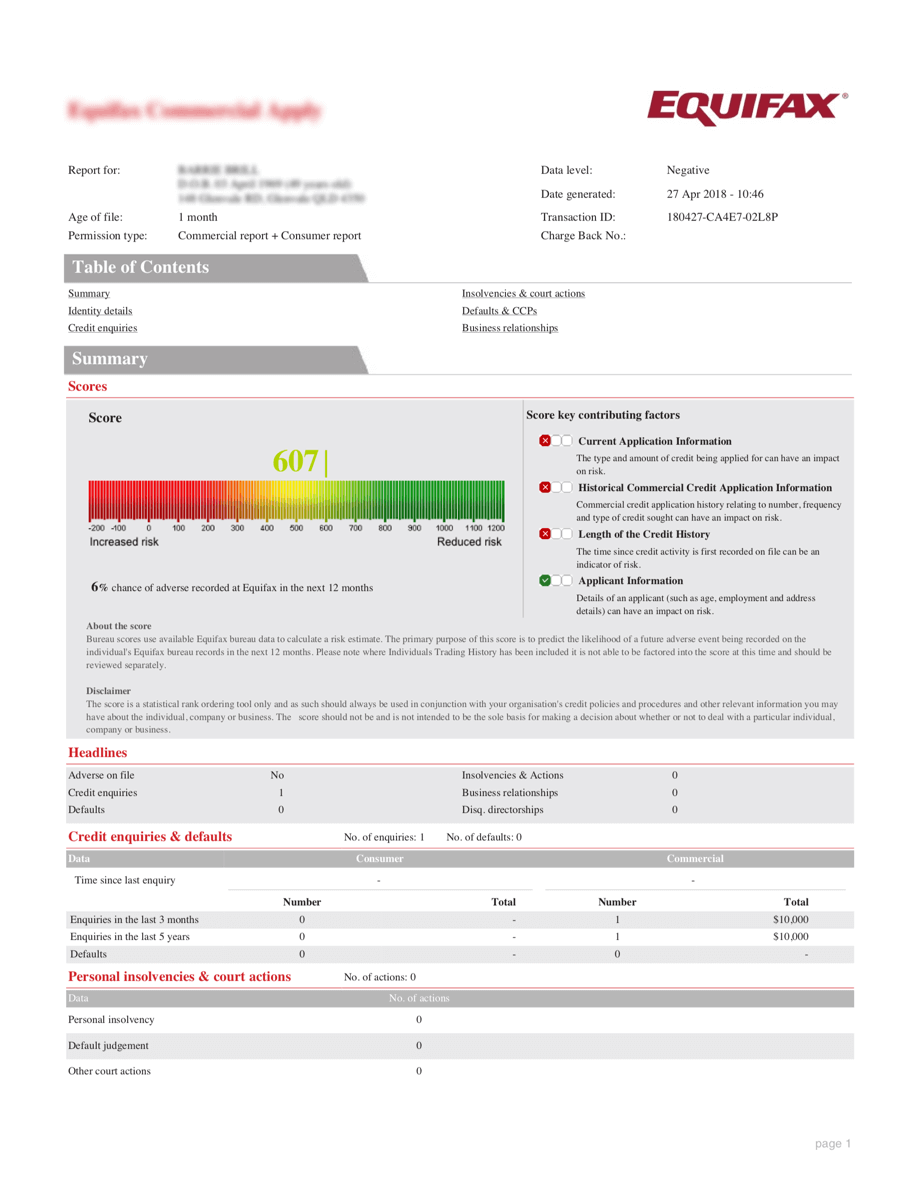

The enhanced Equifax credit information report is an advanced version of the basic credit report where all the information is shown in visual representations such as graphs and illustrations. Even the enhanced report has 5 main sections:

-

Identification section

The identification and contact section provides the name and age of the borrower, his/her date of birth, address, application number, and identification.

-

This section presents a graphical illustration of the credit profile of the customer.

-

Recent Activities

In this section, the recent activities of the customer can be reviewed which includes the new credit accounts, delinquent accounts if any, etc.

-

Account Details

The account details show the comprehensive details of all the accounts. This includes the repayment history of the account, the amount outstanding, the types of accounts, and more.

-

The credit inquiry section shows the credit inquiries made by the customer.

Recommended Reading: What Is A Subprime Credit Score

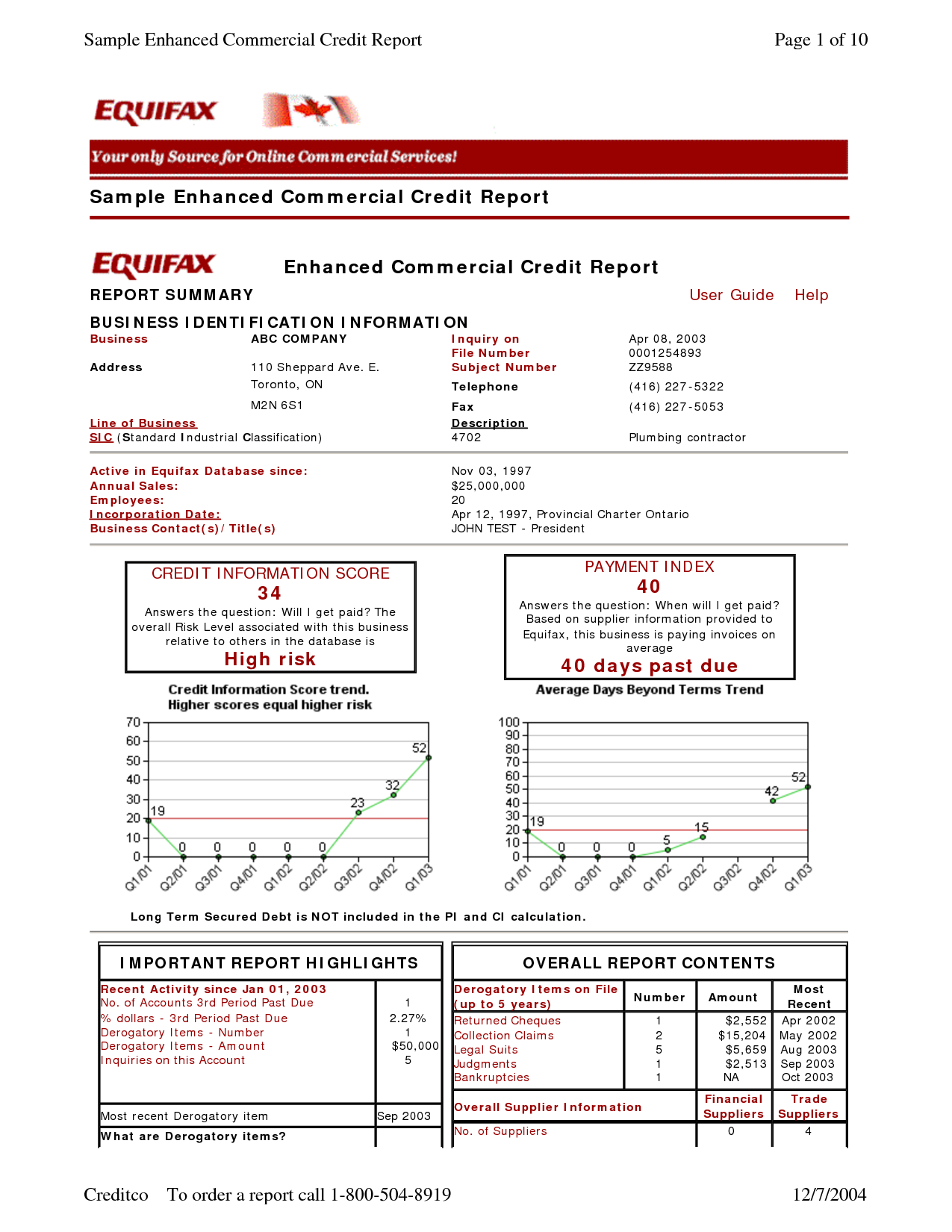

What Else Is On The Equifax Business Credit Report

Along with the above credit scores, the Equifax business credit report includes other information, such as:

- : How much credit is available to your company, how much youve used, and your current credit utilization ratio.

- Days Beyond Terms: How long, on average, youve been past due on invoices to your creditors.

- Inquiries: Any recent credit inquiries that have been recorded for your business.

- Bureau Messages: Notes from the credit bureau about miscellaneous topics related to your business such as having multiple locations.

- Bureau Summary Data: An overview of all the data the credit bureau has about your business such as the number of accounts you have, how long your credit has been active, any charge-offs, any delinquent accounts, and any credit inquiries youve allowed.

- Public Records: Any liens, judgments, or bankruptcies on file, the dollar amount associated with them, and the date they were filed.

- Additional Information: Owner names, guarantor names, alternate company names, and DBAs.

If youd like to see an example, take a look at this sample Equifax business credit report.

Whats A Good Credit Score In Canada

A good credit score in Canada is any score between 713 and 900. Credit scores in Canada range between 300 and 900. There are five distinct categories that your credit score could fall into, ranging from poor to excellent. Having a good credit score can help you qualify for financial products at lower interest rates. Not sure where you stand? Check your credit score with Borrowell!

Also Check: What Is Considered A High Credit Score

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

- Most negative information generally stays on credit reports for 7 years

- Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type

- Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax ? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report :

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account can stay on your Equifax credit report for up to 10 years from the date it was reported by the lender to Equifax.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report Is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Read Also: How Long Does Payment History Stay On Credit Report

Is Everyone Eligible To Get Their Free Statutory Annual Credit File Disclosure

Yes. As of Dec. 1, 2005 all consumers are eligible to request their statutory annual credit file disclosure once every twelve months.

Monitor your Experian credit report for free

No credit card required.

- Access to your free Experian credit report and FICO® Score

- Get real-time alerts to help you detect possible identity fraud sooner

- Monitor your spending and know when your account balances change

How To Get A Free Equifax Credit Score

Equifax does not provide your credit score free of charge. To access your score, the fee is $23.95 each time you check it.

You can also check your Equifax credit score by signing up for one of their monthly packages including:

- Equifax Complete Advantage: $16.95 per month

- Equifax Complete Premier: $19.95 per month

- Equifax Complete Friends and Family: $29.95 per month

So, how can you get your free Equifax score? These two financial technology companies below offer them for free:

Don’t Miss: How Do You Remove Closed Accounts On Your Credit Report

Public Records And Other Information

The following information was reported to your file on the date indicated.

A collection was reported in 06/07 by ABC COLLECTION AGENCY in the amount of $550. Balance outstanding: $350. Creditor industry classification: BANKING. Collection Status: Unknown. Reference: ABC BANK. Date of last Payment: 04/07. Collection agency reference number: 999999.

A judgment was filed in 01/07 in C QUE MTL. Plaintiff and/or case number: ACME CO 9999123456789012345. Defendant / Other info: SUBJECT. The status is reported as Satisfied. Date satisfied: 02/10. Information verified in 08/08. Name of Lawyer: MCOURT & MCOURT.

A voluntary bankruptcy was filed in 03/06 in FED COURT. Case number and/or Trustee: 123454567 MCOURT & MCOURT. Liabilities: $80,000. Assets: $23,500. Item classification: Individual. The information is reported on the subject only. Date Discharged 12/2008.

A report was received in 10/10 by LAKE STORE for returned cheques DOLLARS CHEQUE NUMBER 123456789). Reason: NSF was due to financial issues.

A secured loan/Chattel mortgage was filed in 08/08 in Ministry. Company name and/or amount: 555512345 DCE INC 780,000 DOLLARS. Creditor industry classification BANK.

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

Read Also: What Is An Excellent Credit Score Range

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Variables That Influence Credit Scores

Equifax has a scoring range of 300-850, where 300 is terrible, and 850 would be someone with perfect credit. However, the average Canadian has a score in the 660s, so you should keep tabs on your credit score. Arguably, the most influential variable that impacts credit scores is the repayment history.

The rationale is that past behaviour is an excellent indicator of future behaviour. Therefore a person who has always paid their debts on time will most likely continue to do so in the future. It is an assumption that lenders will make.

Another variable that impacts a credit score is the type of credit. There are two types of credit accounts:

- and lines of credit are commonly referred to as revolving accounts or revolving lines of credit. A consumer would use these facilities then pay the balance when due. When the balance has been repaid, the consumer can use the funds again. This revolving is what gives the account this classification.

- Installment payments or installment accounts are car loans, furniture purchases, etc. The borrower makes regular payments at predetermined intervals, and with each payment, the balance outstanding is reduced.

Consumers who do not have both of these types of accounts will not have a high .

Recommended Reading: Does Monroe And Main Report To Credit Bureaus