What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

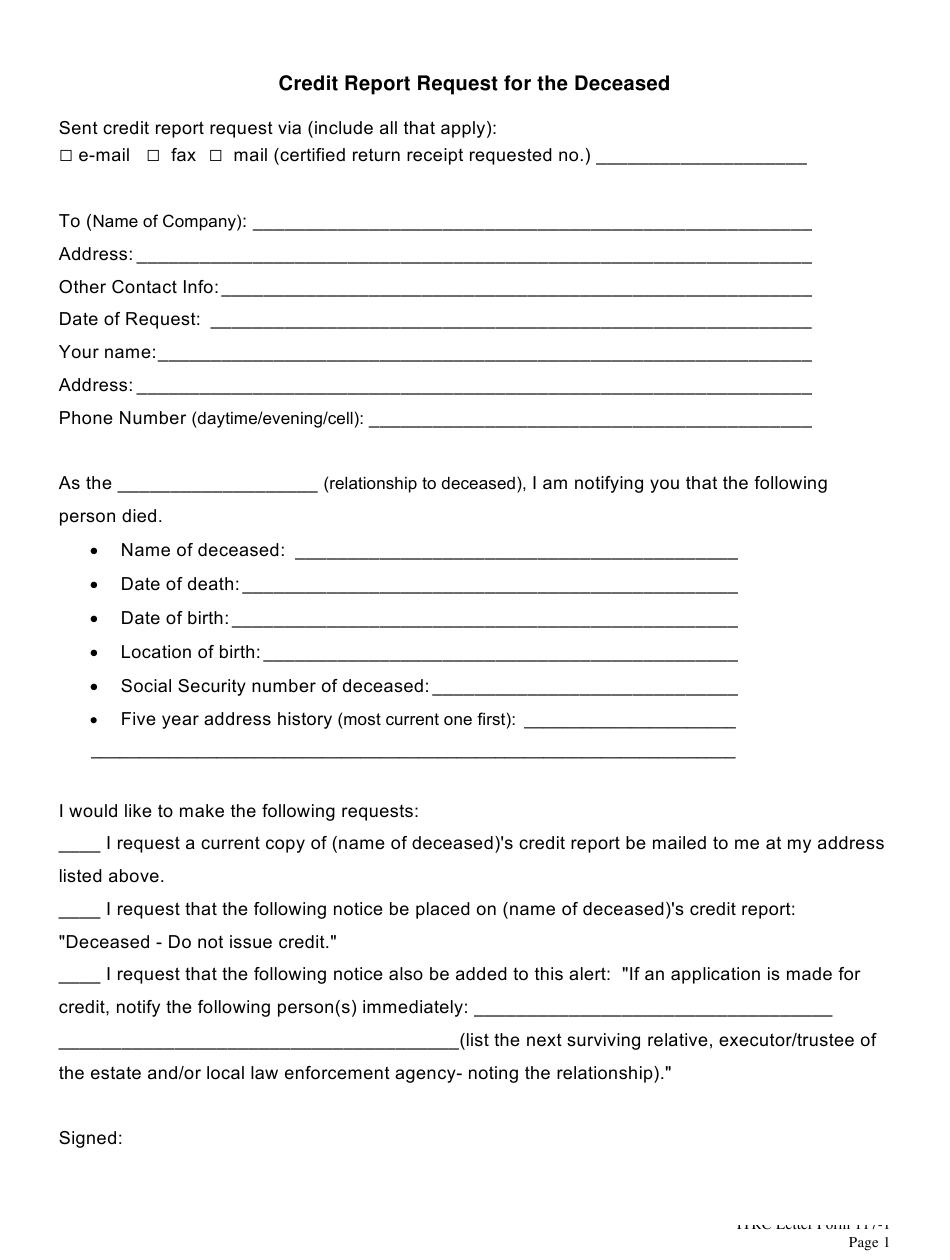

Fill Out One Online Submission Form

If you’re requesting through the website, you’ll have to fill out one submission form, regardless of whether you want one, two, or all three of your allotted credit reports. The form will ask for your name; your current address; your last address if you’ve lived at your current address for less than two years; and your Social Security number.;

Checking Your Credit Report For Free

Private companies called “credit reporting agencies” collect information related to your access to and use of credit. They make that information available to others under certain circumstances in the form of a “credit report.” Lending institutions, employers, insurance agencies, and future creditors make decisions about you from the information in your credit report. Your credit report is an important document, and the law gives you certain protections against the reporting of incorrect information. Knowing your legal rights and remedies is a first step to resolving any problems related to your credit report.

Note: Your Credit Report is Free!; Under state and federal law, you are entitled to one free copy of your credit report per calendar year from each of the three main credit reporting agencies noted above. Requesting a copy every year to ensure your report is without errors is worthwhile and recommended. If you ever apply for and are denied credit, you should immediately get a copy of your report to verify that all the information is correct. You have the right to know which credit reporting agency prepared the report that was used in the denial of your credit application. Under state law, you have the right to a free copy of your credit report within 60 days of being denied credit. Visit the annual credit report website or call 322-8228 to request your free annual credit report.

Don’t Miss: What Credit Report Does Paypal Pull

How To Order Your Free Annual Reports From Specialty Consumer Reporting Agencies

All of these reports are ordered through automated telephone systems. The system will ask you for personal information, including your Social Security number, to identify your file. In some cases, you will be sent an order form to fill out and mail in.

- CLUE Personal Property and/or Auto Report

- WorkPlace Solutions Inc. Employment History Report

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.;

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach won’t give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

Free Annual Credit Report

Review your credit report often to make sure the information is accurate.;If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

Also Check: How Accurate Is Creditwise Credit Score

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.;

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

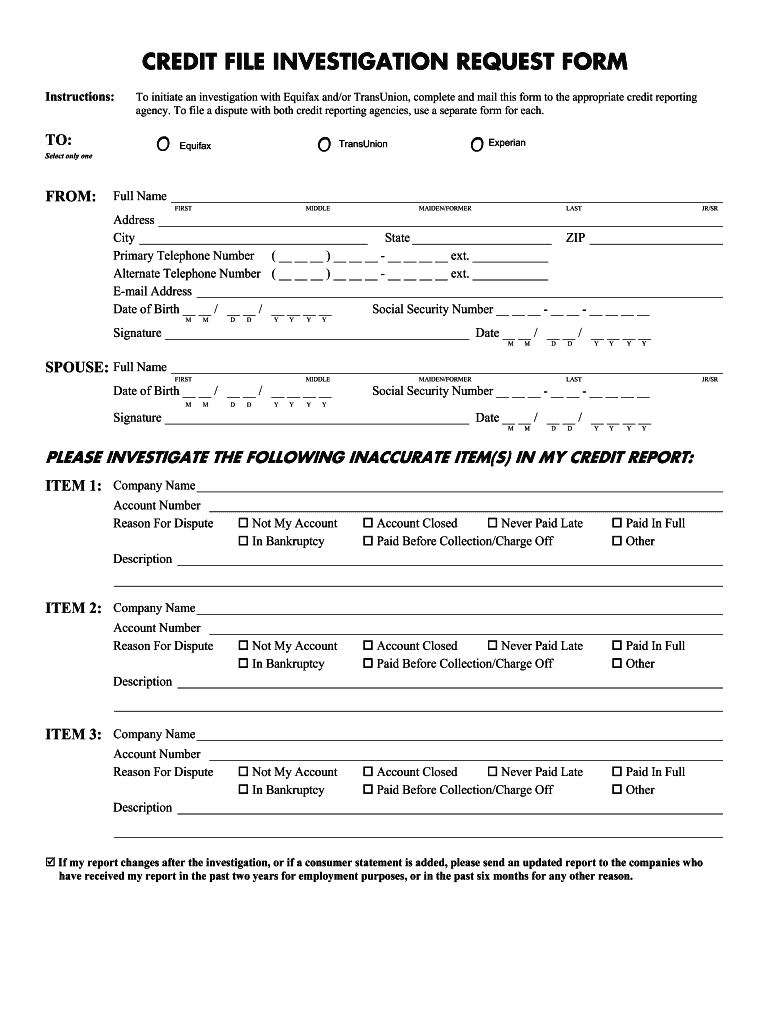

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

Read Also: What Credit Score Does Carmax Use

What Is A Credit Freeze

A credit freeze, also known as a security freeze, is a tool designed to help protect you from fraud and identity theft. It limits access to your credit report unless you lift the freeze, or “thaw” your credit. Having a freeze in place won’t affect your credit scores, but it will prevent your credit report from being accessed to calculate scores unless you first lift the freeze.

Freezing your credit can help prevent identity thieves and other criminals from using stolen personal information to apply for new credit in your name. Since checking your credit report and credit scores are typically the first steps in processing any credit application, freezing your credit at the national credit bureaus can help stop unauthorized credit accounts from being opened.

The major drawback of credit freezes is that, along with preventing unauthorized credit applications, they also block authorized checks. This can complicate legitimate applications for loans, credit cards and other things because you’ll need to unfreeze your reports before the process can move forward.

You must contact each national credit bureaus individually to freeze your credit reports. They’ll do so for free upon request.

What Are Credit Monitoring Services

If you spot entries in your credit report that don’t seem to relate to you , you may be a victim of the rapidly-growing crime of identity theft. You should notify the credit reporting company immediately.

There are companies that will take the effort of checking your credit report off your hands;;for a price. The credit reporting bureaus are, not surprisingly, very active in this area. At TransUnion, their credit monitoring service costs $14.95 a month and includes unlimited access to your credit profile and credit score. At Equifax, credit monitoring and identity theft protection starts at $16.95 a month.

There are several other companies offering similar services for similar prices. They usually include features like e-mail alerts when there’s a change to your credit report.

It’s a personal decision whether you feel these services are worth the money. The bottom line is you can always check your credit report for free by mail. Or, you can pay to get it online whenever you want. People who have been the victims of identity theft or people who are worried that they may be susceptible to ID theft may consider the expense worthwhile.

You May Like: Paypal Credit Soft Pull

How Can I Get A Copy Of My Credit Report And Credit Score

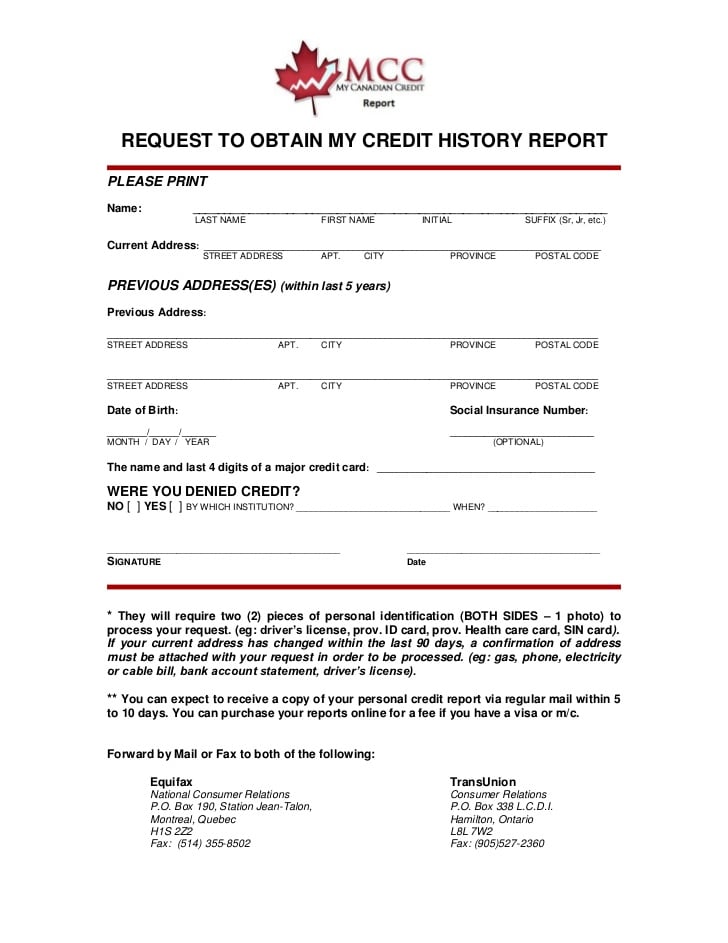

You can ask for a free copy of your credit file by mail. There are two national credit bureaus in Canada: Equifax Canada and TransUnion Canada. You should check with;both bureaus.

Complete details on how to order credit reports are available online. Basically, you have to send in photocopies of two pieces of identification, along with some basic background information. The reports will come back in two to three weeks.

The “free-report-by-mail” links are not prominently displayed;;the credit bureaus are anxious to sell you instant access to your report and credit score online.

For TransUnion, the instructions to get a free credit report by mail are available;here.;For Equifax, the instructions are;here.;

If you can’t wait for a free report by mail, you can always get an instant credit report online. TransUnion charges $14.95. Equifax’s rate is $15.50.

To get your all-important credit score, you’ll have to spend a bit more. Both Equifax and TransUnion offer consumers real-time online access to their credit score . Equifax charges $23.95, while TransUnion’s fee is $22.90. There is no free service to access your credit score.

You can always try asking;the lender you’re trying to do business with, but they’re not supposed to give credit score information to you.;

Getting Your Credit Reports

You can get a free report once every 12 months from each of the three nationwide consumer credit reporting companies through AnnualCreditReport.com. You can request all three of your reports at once, or you can space them out over the course of the year. That means if you order a report from one of the companies on March 1, you can’t get another free annual credit report from the same company until March 2 next year.

Please note, that there may be situations where you can obtain additional copies of your credit report for free such as the application of certain state laws, when you have been denied credit or in certain situations involving fraud.

You can visit the Consumer Financial Protection Bureau’s website for more information on how you can obtain your credit report for free.

Also Check: How To Get Credit Report Without Social Security Number

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone:; 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Transunion Credit Score Range

Lenders and financial institutions place prospective borrowers on a credit score range to determine whether they qualify for a loan or other transaction, as well as the specific terms theyll offer if you do qualify.;;

The range you fall into depends on the credit scoring system the credit reporting company uses. Since TransUnion uses the VantageScore credit scoring system, your score will fall into one of the following ranges:

- Excellent: 750 to 850;

- Poor: 550 to 649;

- Very poor: 300 to 549.

When you have a poor credit score, youre considered a higher risk for lenders and financial institutions. If you qualify for a loan, youre likely to be offered unfavorable terms, such as a large deposit or down-payment requirement and a high interest rate. On the other hand, individuals with excellent credit scores may qualify for exclusive terms or benefits.;

Don’t Miss: Carmax Credit Score Requirements

When Should I Add A Fraud Alert

You should learn more about fraud alerts and consider adding one if you:

- Are a victim of fraud or identity theft, or suspect you are a victim.

- Find information in your credit report that doesn’t belong to you.

- Discover unexplained transactions or withdrawals from your bank account.

- Receive notice that your personal data was exposed in a security breach.

- Get notices you don’t understand from collection agencies or the IRS.

Transunion: Vantagescore Vs Fico

Experian, Equifax, and TransUnion all use one of two types of scoring methods when they generate your credit report either FICO or VantageScore. FICO and VantageScore use similar metrics when calculating scores, however, they weigh different aspects of your score differently, which can cause discrepancies between them.

TransUnion uses the VantageScore 3.0 model both for their annual scores and their member scores. Because TransUnion uses the VantageScore model, they weigh things like credit inquiries and active debt less heavily than the FICO model, while payment history and age of your accounts are weighted more heavily.;

Read Also: How To Get Bankruptcy Off Credit Report Early

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.;

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .;

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

You Have A Right To A Copy Of Your Lexisnexis Credit Report

The federal Fair Credit Reporting Act gives consumers the right to receive free copies of their LexisNexis consumer reports and to dispute any inaccuracies. LexisNexis is a “consumer reporting agency” under the FCRA and is required to give a free copy of your report every year. You have the right to receive that credit report on an annual basis and to dispute any errors that you find that LexisNexis made.; There are a number of reasons allowing your to get a free copy of your credit report.; If you don’t know whether your are entitled to a free copy, you can email us through this site or call 400-CREDIT | 400-2733 to get help

Read Also: When Do Companies Report To Credit Bureaus

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to;file a dispute with Equifax Canada. You will need to complete the;;enclosed with your package. You can also review;how to dispute information on your credit report;for additional details on the Equifax dispute process.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a;free credit report;summary and a;free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Don’t Miss: Does Paypal Credit Affect Your Credit

What Is A Credit Report

Your personal credit report contains details about your financial behavior and identification information. Experian® collects and organizes data about your credit history from your creditor’s and public records. We make your credit report available to current and prospective creditors, employers and others as permitted by law, which may speed up your ability to get credit. Getting a copy of your credit report makes it easy for you to understand what lenders see when they check your credit history. Learn more.

Generate Your Credit Report Online

You can save;reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a;request form;to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Also Check: Paypal Credit Soft Or Hard Pull