Looking For Your Home And Finding Your Mortgage

Now that you’ve cleaned up your credit and gotten your pre-approval, you’re ready to shop for your new home. Take your time in shopping and remember to widen your search area. When you find a home that you’re interested in, talk to a realtor that represents buyers. The agent showing the home might be a seller’s agent meaning they’ll represent the seller’s interests, not yours.

Is There A Credit Blacklist

No, only a credit file. Everyone has one, and it holds all the information about the accounts and borrowings and agreements you have with any financial institution. It will show how up to date your payments have been, and record any missed payments, defaults, CCJs, Bankruptcy etc. The blacklist doesnt exist, but if you have a serious adverse history on your file, this can mean that anyone considering lending or offering financial service, may decline your application.

Preparing For Your New Home

After securing your mortgage terms and having the inspection and closing, it’s time to move in .

You need to contact:

- The moving company to negotiate a price for your move.

- A home insurance company. Use an online insurance comparison tool to lock in the best rate.

- Your postal carrier to change your address and forward your mail.

- The alarm company, the utility companies and schools in the area if you have children.

You May Like: Carmax Auto Finance Defer Payment

How Does A Mortgage Affect Your Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When it comes time to buy a house, few people can afford to pay entirely in cash.

Most opt for a mortgage, or a home loan. Like all major lines of credit, a mortgage will appear on your credit report. This is probably a good thing: A mortgage can help build your credit in the long run, provided you pay as agreed. Heres why.

Keep Unused Accounts Open

Another point of consideration in determining a consumers credit score is how long the revolving account has been open. A positive credit score is a reflection of a good, positive standing with every creditor the consumer deals with, regardless of the account activity. Simply put, the longer a positive credit history is maintained, the greater the positive influence on the score.

In essence, it is a good idea to keep old accounts that are no longer in use open. If a consumer has credit that is not currenty in use, rather than terminating the account these cards should be put away and the consumer should refrain from using them. Having several open accounts but only using a few can be a positive factor in raising a credit score, but too many cards overall can have an adverse affect.

You May Like: Does Paypal Credit Report To Credit Bureaus

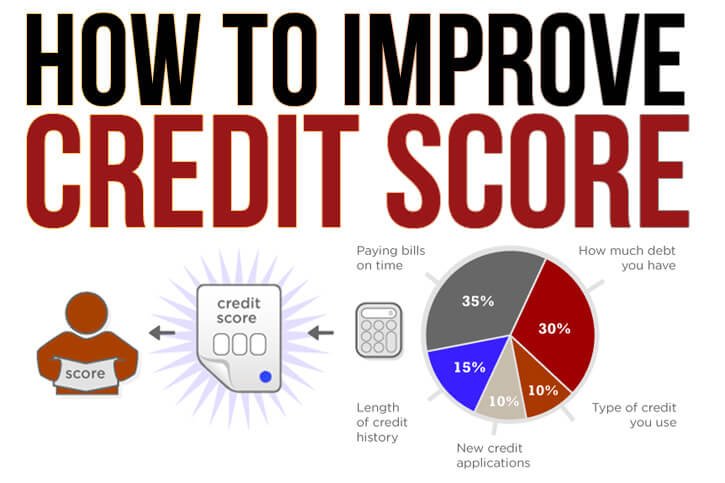

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history, and help lenders assess your financial health. Home buyers with lower credit scores are typically assigned a higher interest rate.;

Higher Fico Scores Equal Better Mortgage Rates

Youre eager to buy a home. But youre worried about getting a mortgage loan with a preferred interest rate. You fear that your credit is less than perfect. And you want to know how to raise your credit score fast.

Raise your FICO 100 points in 2018 and save big on everything

Its true that having a higher credit score will lead to better loan offers. While it can take months to overcome some derogatory events like missed payments, and years to build an excellent track record and ultra-high FICO, you can raise your score quickly with a few tricks.

Learn the facts. Being proactive early may result in you getting the loan and home you want.

Recommended Reading: Speedy Cash Change Due Date

Improving Your Mortgage Score

Despite having a lower-than-expected mortgage score, Atlanta resident Moore managed to improve it and buy a home.

First, she paid down an outstanding debt to help raise her score. Then she did intensive shopping for a loan, talking to several banks and credit unions before finally securing a mortgage that was aimed at first-time home buyers.

I found that if you get approved by a bank, you may be able to get a lower rate or better offer from another bank, says Moore, who closed on her house in December.

To help improve your mortgage score, here are four guidelines.

Controlling The Credit Checks On Your Report

There are different types of credit checks:

A hard hit is if an employer or mortgage lender looks at your credit. Or, if you apply for a credit card. These are viewable by anyone who looks at your credit.

A soft hit is when you pull your report or a business pulls it to update your record.

To keep your inquiries from damaging your credit:

- Limit how often you apply for credit. Dont keep applying as this can bring your score down. Repeated credit checks can look like you urgently need money or youre living beyond your means.

- Only get quotes from lenders over a short period like a week or two.

- Only open and lines of credit if you need to. For example, you might want to open a home equity line of credit loan to make upgrades or repairs to your new home.

Recommended Reading: Carmax Credit Score Requirements

How Do Multiple Credit Checks Work

The good news is that if you are shopping around with different lenders, credit bureaus will typically only dock your score once within a 45 day period, no matter how many mortgage lenders do a hard credit check. Thats great if you think youll close on a mortgage within 45 days, but if youre early on in your homebuying process, the clock will start ticking earlier than you may want. Luckily, a Better Mortgage pre-approval doesnt require a hard credit pull.

You can start your home search with your pre-approved amount, then shop multiple lenders for rates when youre ready to buy. And if you decide to finance your home with Better Mortgage , well only perform a hard credit check once, even if you were pre-approved months before.

This is a great have your cake and eat it too strategy when it comes to house hunting. A pre-approval means youll start your house hunt with useful information like a budget to work with and a pre-approval letter to show sellers youre serious. And by waiting until youre ready to buy to compare mortgages with different lenders, you wont impact your credit score with a hard credit inquiry or prematurely trigger the 45 day mortgage shopping window.

How To Increase Credit Score Immediately

How to improve credit score fast, try these tips:

Check your credit report. Request a free copy at AnnualCreditReport.com. Correct errors that are lowering your score.;Alert the three credit bureaus about any errors you find. Its important to immediately dispute all claims made against you that are false on your credit report, says Steven Millstein, a certified credit counselor with .

If you need errors corrected quickly, ask your lender about a rapid re-score service. Only your mortgage lender can get this for you because rapid re-scorers dont deal directly with consumers.

Reduce your debt. The most effective way to improve your credit score is to pay down your revolving debt, suggests Gardner. Apply your tax refund to pay down your debt. You may be able to improve your score simply by replacing credit card with a personal loan .

Recommended Reading: Does Barclaycard Report To Credit Bureaus

How To Check Your Credit Score

To find out your credit score, contact Canadas two credit-reporting agencies: Equifax Canada at www.equifax.ca and TransUnion Canada at www.transunion.ca.

For a fee, these agencies will provide you with an online copy of your credit score as well as a a detailed summary of your credit history, employment history and personal financial information on file. You can also obtain a free copy of your credit report by mail. If you find any errors in your report, notify the credit-reporting agency and the organization responsible for the inaccuracy immediately.

Pay More Than Monthly Minimums

If youve maxed out your credit card in the past, now is the time to take control of the situation. Make more than the minimum payment due each month, says Lisa Torelli-Sauer, editor at Sensible Digs, a website specializing in budgeting home investments. Even if its only a few dollars more than the minimum payment, it will show the credit reporting agencies you are making a greater effort to pay down your debt and will improve your score.;

Don’t Miss: Can You Have A Credit Score Without A Social Security Number

The Mortgage Stress Test

When you hear stress test, you might think, Uh, oh. But, the mortgage stress test is helpful. It lets the bank know if you can afford your mortgage payments if a rate change occurs. Federally regulated lenders arent required to use this test.

If your lender states you will need mortgage loan insurance, they will use the higher interest rate from:

- Bank of Canadas five-year mortgage rate for conventional loans. Or,

- The rate you set up with your mortgage lender.

If your lender states you will not need mortgage loan insurance, they will use the higher interest rate from:

- Bank of Canadas five-year mortgage rate for conventional loans. Or,

- The rate you set up with your mortgage lender plus an additional two percent.

Lets look at an example…

Youre applying for a mortgage with five percent down. You have to take out mortgage loan insurance because youre putting down less than twenty percent. And, lets say your interest rate is three percent while the Bank of Canadas rate is five percent. You have to qualify at a higher rate even though youre going with the lower rate.

How To Improve Your Credit Score To Qualify For A Mortgage

When youre planning to buy a home, getting a mortgage requires special attention. The mortgage you end up with might be the biggest debt transaction of your life, and getting the best interest rate possible can save you some serious money over the years.

For example, if you take a $300,000 mortgage at 4.0% for 30 years, youll make $515,610 in total payments. But if that rate goes up to 4.25%, your total payment ends up being $531,295.20. Thats an extra $15,685.20 over the life of the mortgage, just by raising the interest rate by a quarter of a percent.

One of the biggest factors that will determine the interest rate on your mortgage is your credit score.;To that end, it’s recommended to;improve your score in the years before you want to purchase a house.;But even if youre just a couple of months away from homeownership, theres still time to get your credit up.

To boost your credit score legitimately, it is best to begin by addressing the five criteria of what makes a good score.

Focus on the five credit score categoriesYour credit score is calculated based on five categories, each of which makes up a specific percentage of your score. If you have limited time or resources, focus on the biggest categories. That said, all categories earn you credit score points, which will get you closer to your best mortgage interest rate.

Unless you make it happen yourself, you will not get credit for these monthly payments.

Make sure your credit report is accurate

Read Also: Innovis Consumer Assistance Letter

No : Pay Bills On Time

Late payments and collections leave major blemishes on your credit report, according to myFICO.com. And once you have a delinquent payment, there’s not much you can do about it.

Paying your bills on time and avoiding late payment is the only way to keep a positive payment history. And the only way to improve upon a payment history is by annually reviewing your report to keep a look out for, and correct, possible errors, says McNamara.

“Credit scores are slow to improve, but very quick to drop if late payments are recorded,” says Arzaga.

Johansson says that in addition to bankruptcy, foreclosure and judgments, collections and habitual late payments are the worst things to see on a credit report.

What Credit Score Do You Need To Buy A House In 2021

A lot of first-time home buyers worry that their credit scores are too low to buy a home. First, know that whether your credit score is good or bad is subjective and wont affect your home-buying. Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type.;

Conventional loans are the most common loan type. On the credit score scale, which ranges from 350-850, conventional loans require a credit score of at least 620. Other loan types allow for lower credit score minimums, and some mortgage programs have no credit score requirement whatsoever.;

Read on for details by loan type, or jump to learn more about your credit score:

Also Check: Does Les Schwab Report To Credit Bureaus

Have A Mix Of Credit And Loan Account Types

A mix of Credit Accounts = 10% of your FICO Score

10% of your credit score is made up of the mix of account types you have. If all you have are credit cards, your credit rating will be lower than if you had a deathly mix of credit.

Auto loans, mortgage loans, credit cards, store cards, personal loans. Its good to have a few different types of credit and loan accounts to really maximize your credit score.

Dont Hit Credit Card Limits

If lenders frequently see you hitting your credit card limit which is information they may well be able to access then they wont think youre financially responsible, and youll definitely be less eligible for loans or other credit boons. If you have a credit card, try as hard as you possibly can to avoid hitting the limit. You absolutely should never exceed the limit of the card, as this is a huge red flag for lenders that youre too dependent on credit and that you shouldnt be given a loan. Spend responsibly when youre using a credit card and you should be fine.

Don’t Miss: Speedy Cash Payment Plan

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

What Is A Credit Score And Why Does A Higher Score Mean More Favorable Rates

If you took your entire relationship with debt and boiled it down to a number between 300 and 850, youd have your credit score. Equifax, TransUnion, and Experian are the three major credit bureaus, but they all use similar criteria to create a credit score. Your FICO score, created by Equifax, is most lenders preferred credit score, but all of these scores may be considered when evaluating creditworthiness. When generating your score, credit bureaus weigh payment history, debt volume, the age of your credit, credit diversity , and credit inquiries. So if youre monitoring your credit, paying on time, and using less than 30% of your total credit, you should be well on your way to a high score.

Lenders then use that score as a guide to offer interest rates and terms for each borrower. If you think of a loan as a bet, the credit score is the odds of the lender being paid back in full. Rather than denying a mortgage application, lenders adjust the rates and terms to make sure their bet is safe. If a borrower has a high credit score, they can offer more favorable rates and terms because its a relatively safe investment. If a borrower has a fair to good credit score, lenders may raise the rates they offer by fractions of a percentage as a way to hedge against a possible default.

For example: Take a homebuyer with a 20% down payment applying for a 30-year-fixed loan to purchase a $200,000 home in New Jersey.

You May Like: 586 Fico Score

How Do I Check My Credit

Before considering a home purchase, everyone should check to see if they have a good credit score. By law, a person is entitled to one free copy of their report from the three major credit reporting companies every 12 months. The only place to get a free report is from annualcreditreport.com.

Note that this will just be a report, not score. There are many companies out there that sell credit scores, and most large banks even provide this as a free service. However, these may just be estimates as their scores may only reflect results from one sources reports or they use a different scoring model.

Related: 5 Credit Card Mistakes That Could Prevent You From Getting a Mortgage