How We Rank Credit Cards Approved For Fair Credit Scores

We compile and rank our lists of suggested credit cards based on publicly available data from card issuers and other reputable sources like the Consumer Finance Protection Bureau. We analyze and compare over 55 data points such as annual fees, interest rates, rewards, benefits, and more for approximately 2,500 cards to assign a rating for each card feature.

The ratings are then stack ranked and weighted based on the most relevant features for each card category . These determine the top suggestions for each type of user or card category. Because card details and welcome offers change regularly, we revisit this list at least once a month to update our ratings and recommendations as needed. Learn more about our data collection and ranking process.

Think Carefully Before Closing Old Credit Card Accounts

If you dont use an old credit card much anymore, you might be tempted to close it.

To this we say: Not so fast. Keeping an old credit card account open can increase your age of credit history as well as your credit mix, which could help you build credit.

You might be better off keeping that old account open, assuming you dont have to pay an annual fee. You may even consider putting a small recurring charge like a monthly subscription on the card to ensure the account stays active and the credit card company doesnt close it for you.

Best Credit Cards For A 600 Credit Score

When growing your hair from short to long, theres often a transitional stage in the middle when its long enough to get in your eyes, but not so long it can be tied back.

A credit score of 600 to 650 is the financial equivalent of that follicular midpoint its probably not good enough for a prime rewards card, but it may be too good to settle for expensive subprime cards.

In many ways, the cards you can get with a 600 credit score will depend on the nature of your score if youre building credit for the first time, a student or no annual fee card may be the right pick. If youre rebuilding credit after some mistakes, a secured card may provide the best value. Keep reading for our experts selections for the best credit cards for 600 credit score ranges, including the overall best cards, unsecured, secured, no annual fee cards, and student cards.

| | | | |

Also Check: Syw Mc/cbna

Easiest Credit Cards To Get For Limited Or No Credit History

If youre just starting out and havent yet established a credit history, choosing the right card for building credit may seem like a challenge. But there are still quite a few cards available to you.

The easiest cards to get are typically secured credit cards, which require refundable security deposits to fund their credit limits. There are unsecured cards designed for no credit history, which you should check out first, but generally speaking youll have an easier time qualifying for secured cards, as they typically have low credit score requirements.

Certain card issuers will even conduct periodic automatic reviews that qualify cardholders for card upgrades if theyve shown consistent responsible use with a secured credit account.

Some issuers, like Deserve, provide unsecured cards specifically for people with limited or no credit. Deserve will check more than the usual factors to determine your creditworthiness, like your education and career path.

When applying for cards like these youll have a better chance of approval if youre well-paid and have good job prospects. This can show the issuer that youll be more likely to pay back your debts on time, even if you dont yet have a credit history.

Insider tip

Take note that Deserve will need to connect to your bank account to verify your balance. If you have privacy or security concerns this might worry you, but it seems logical because Deserve bases its decision on more than just an applicants credit history.

What Does It Take To Qualify For A Business Credit Card With Bad Credit

There are two primary qualifications most business credit cardissuers consider:

: In most cases, a personal credit check will be required even for business credit cards. Its a good idea to check your credit reports and scores from the major consumer credit bureaus Equifax, Experian and TransUnion so you understand your creditworthiness. This can also help you identify problem areas in your credit history where your credit can be improved. For example, high debt utilization is often a problem for consumers and business owners. If your debt ratio is too high, it could be weighing on your scores, and youll want to focus on paying down those balances.

In addition to minimum credit score requirements, some issuers will not approve your application if you have too many recent inquiries, high balances on other credit cards or no credit history.

Income: Issuers will often have minimum income requirements but the good news is that most will allow you to include income from all sources and not just the business. That means these cards may be available to startups as well as more established businesses.

Also Check: What Is A Good Leasingdesk Score

Journey Student Rewards From Capital One

Our pick for: College students and young adults

The Journey Student Rewards from Capital One gives newcomers to credit a powerful incentive to develop responsible habits. You earn cash back on every purchase, but when you pay your bill on time, the cash-back rate for that month gets a boost. Read our review.

How To Apply For A Business Credit Card With Bad Credit

Unless you get appealing credit card offers in the mail, youll most likely shop for a credit card online. Most issuers make it easy to apply online and get a decision very quickly. Youll want to have the following information handy when you apply:

- Your Social Security Number

- Employer Identification Number or Taxpayer Identification Number

- Business information: address and phone number

Note while a few issuers require you to have a formal business entity to apply for most business credit cards, in most cases these cards are also available to sole proprietors, independent contractors and freelancers.

If you get rejected for a card you want, you may want to reach out to the card issuer. Some have a reconsideration department that will review your application to determine whether there are other factors that may help you qualify.

Don’t Miss: Remove Syncb Ppc From Credit Report

Annual Percentage Rate Apr

Do you know how credit cards typically advertise wide interest rate spreads, like 14.99% to 24.99%? With a credit score between 600 and 649, youre much more likely to pay 24.99%.

This is a primary reason why we recommend throughout this guide that you keep your credit card balance to an absolute minimum. Its possible to use a credit card to increase your credit score and to do so at a very low cost. But if you carry a balance, the interest cost will be substantial.

Conventional Loan Rates With Low Credit

With a conventional loan unlike with an FHA loan your mortgage rate is directly tied to your credit score.

Thats because conventional loans use loanlevel price adjustments .

LLPAs are riskbased fees that lenders charge to borrowers with lower credit and/or smaller down payments. Instead of being paid upfront, LLPAs are typically paid via higher interest rates.

For example, say 30year conventional rates are 3.00%.

- A borrower has 620 credit and a 5% down payment

- Their LLPA fee is 3.25% of the loan amount

- Thats equal to $9,750 on a $300,000 loan

- Instead of paying $9,750 out of pocket, most borrowers will cover the fee with a higher rate

- A 3.25% fee would likely raise rates by about 0.5% to 0.75%

- So instead of the 3.0% base rate, your mortgage rate could be as high as 3.75%

These fees are the reason many borrowers with lower credit even those who might qualify for a conventional loan opt for FHA loans instead.

However, there are benefits to conventional mortgages for those with credit of 620 or higher. A big one is the ability to remove mortgage insurance without refinancing.

Thus, a conventional loan might be cheaper in the long run if you plan to stay in the house for many years.

The right choice will vary by person, so its important to compare all your loan options before buying.

Read Also: Syncb Ppc

Have Your Application Reconsidered

Its no surefire solution, but you should contact the card issuer to see if theyd review your application again. If youre able to argue your case, you might be able to get your foot in the door. Some card providers might be more willing to accept you as a cardholder after youve shown extra initiative.

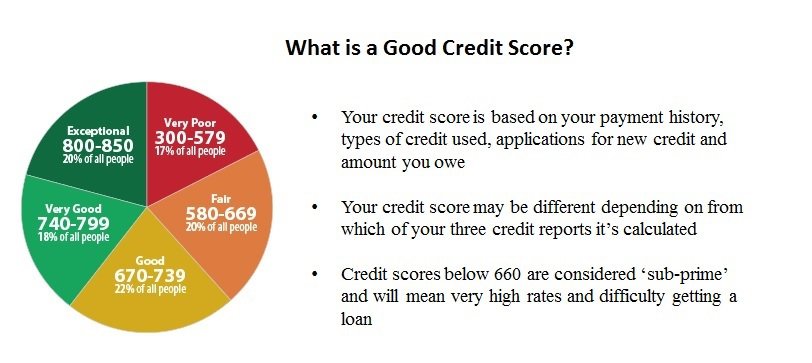

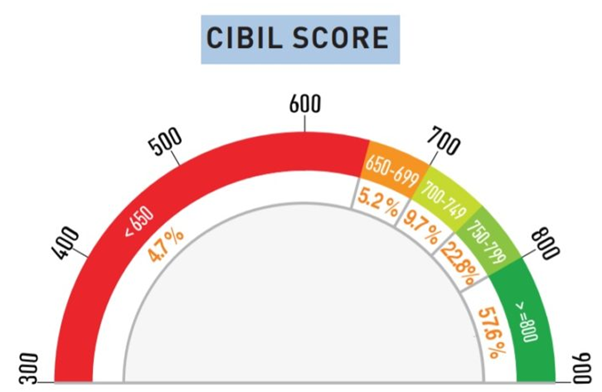

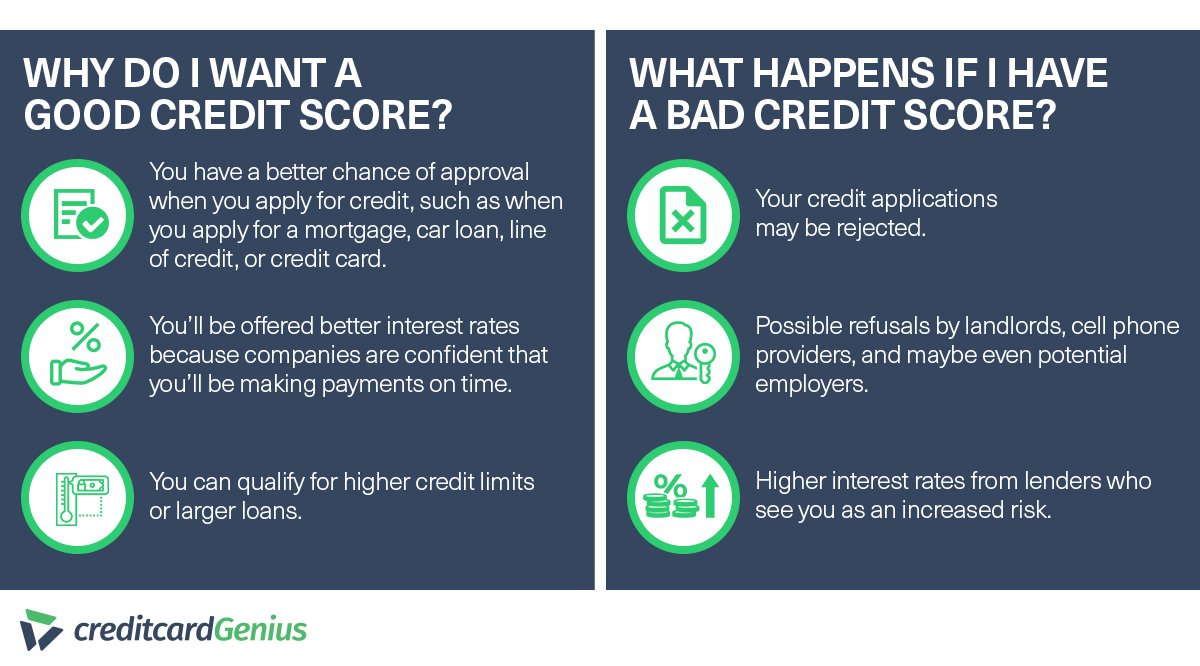

What Is A Good Credit Score

Once you achieve a 700 credit score or higher after following these steps, youre in the good credit range, which runs between 670 and 739. A score of 740 to 799 is very good, qualifying you for better than average terms and interest rates. An 800 credit score or above is considered exceptional, qualifying you for the best available terms, like interest-free auto loans or top-tier rewards credit cards.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

Mortgage Loan Options For Slightly Higher Credit Scores

You dont need perfect credit to purchase a home.

But a higher credit score can make the approval process easier, and it can definitely save you money.

If you have a 600 credit score, bumping your score up to 620 , can help you qualify for a conventional loan.

- Conventional home loans might be an option, but youll need a minimum credit score of 620. Keep in mind if you finance a property with a conventional loan with less than a 20% down payment, youre on the hook for paying private mortgage insurance . But homeowners can remove PMI with a refinance once they build 20% equity

- The Fannie Mae HomeReady program is available to home buyers with a 620 score. It features a 3% minimum down payment requirement, and you can include income from other household members to qualify regardless of credit history.

- USDA loans are backed by the U.S. Department of Agriculture, and theyre popular loan options because there is no down payment requirement. However, USDA loans do require that properties are located in an eligible rural area. Youll need a score of 640 or more

- The Freddie Mac Home Possible loan features a low 3% minimum down payment requirement and a minimum score of 660. But this loan program is only available to firsttime home buyers

What Is Your Fico Credit Score

A FICO credit score is the credit score used by the majority of U.S. lenders. It is an important part of your finances that they review to determine if you are trustworthy enough for a credit card, loan, or any other type of credit line.

FICO stands for the Fair Isaac Corporation, the company that created the formula behind the FICO credit score.

Each credit score is calculated based on the data that is in your credit reports. Your FICO scores may be different depending on the credit reports pulled.

For instance, there are three major U.S. credit bureaus — Equifax, Experian, and TransUnion. You might get a different credit score from each one.

FICO doesnt reveal the top-secret formula for your credit score. However, the factors that make up your score are available to the public.

Read Also: How To Get A Public Record Removed

Can You Get A Business Credit Card With Bad Credit

If your credit scores are low it will be harder to qualify for a business credit card. You may need to start with a card with a smaller credit limit, and in some cases you may need to work on your personal credit scores before you can qualify. If your credit scores are low, you may need to stick with personal cards while you rebuild your credit.

What Credit Score Is Considered Fair

According to Experian, a credit score that hovers between a 580 to 669 FICO score is considered “fair.” This sits between what’s considered a “poor” score, which ranges from 300 to 579, and a “good” score, which is anything from 670 and 739. Once you hit the threshold for a good credit score on your credit report, you’ll gain access to more credit card options with better rates and terms.

You May Like: Remove Transferred Student Loans From Credit Report

Capital One Quicksilverone Cash Rewards Credit Card

You may be able to qualify for this card if you’ve defaulted on a loan in the past five years or you’ve been building credit for fewer than three years, according to Capital One.

The Capital One QuicksilverOne Cash Rewards Credit Card charges a $39 annual fee, but also offers 1.5% cash back on every purchase you make. That’s a common rewards rate for credit card users with good credit, and it’s one of the best offers for fair-credit borrowers.

The card is unsecured but charges a relatively high APR, so make it a goal to pay off your balance in full every month. The minimum credit limit is $300, and you may be considered for a higher limit in as little as six months.

What Is Considered A Bad Or Poor Credit Score

The exact meaning of a bad credit score will vary depending on who you ask, but generally speaking, a score below 580 can be considered bad or poor. People with bad credit have much higher loan costs, and they are often only considered for very risky loans with higher interest rates.

While it can still be possible to improve your credit score, it will take some effort, financial discipline, and a little bit of help.

You May Like: What Mortgage Company Uses Factual Data

Determine How Much Youre Planning To Spend

This will directly influence which card you get due to the inherent credit limits of each provider. A recent study has shown that the average American has a total credit limit of $22,751 across different cards.

High limit credit cards for fair credit like Petal 2 Visa are quite rare. Statistics show that bank-based credit cards for first-time users generally hold a limit of $5,000. Cards issued by private agencies have a first-time average limit of $2,000. Your actual number will depend on your credit history, current credit score, and monthly income.

Dont Apply For Multiple Credit Cards

This is standard advice any time you apply for credit of any type . If you put in multiple applications, you can actually hurt your chance of being approved and even catapult your score back to the bad credit range.

Each lender will have access to your credit report, which will show that youve applied elsewhere. Those applications will show up as credit inquiries. Too many inquiries can actually drop your credit score. Maybe it wont be by a lot, but it could be enough to put you into a bad credit score range.

Pick the card you want most, and apply for it. If youre turned down, or you dont like the terms, only then should you apply for another card.

Read Also: How Long Does Carmax Pre Approval Take

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

What To Do Before Applying For A Credit Card If Your Fico Score Is 700 To 749

Even if youve been in the 700 to 749 credit score range for a long time, never assume thats still the case. Credit scores are a moving target! The score you have today will be different a month from now, and again a year from now.

For that reason, there are a few steps you should take before you even make application for a credit card.

Don’t Miss: How Long Do Evictions Stay On Credit Report

Check Your Credit Score

You should be checking your credit report at least annually. Even the credit bureaus make mistakes, and theres always a chance that your score could be a result of those mistakes or possibly identity fraud. Keeping track of your credit report and history will help you dispute mistakes and stay on track with good credit management.

Auto Loan Rates For Poor Credit

Theres no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, it could be difficult to get approved for a car loan. Even with the best auto loans for poor credit, watch out for high interest rates, which can make it very expensive to borrow money.

If you have time to build your credit before you apply for a car loan, you may be able to eventually get better rates. But if you dont have time to wait, there are some strategies that can help you get a car loan with bad credit.

- Consider a co-signer if you have a trusted family member or friend with good credit who is willing to share the responsibility of a car loan with you.

- Seek out alternative lenders, such as a credit union or an online lender.

- Ask the dealership if theres a financing department dedicated to working with people with poor credit.

- Use buy-here, pay-here financing only as a last resort.

If your credit could use some work, its especially important to shop around to find the best deal for you. Our auto loan calculator can help you estimate your monthly auto loan payment and understand how much interest you might pay based on the rates, terms and loan amount.

Compare car loans on Credit Karma.

You May Like: What Does Thd Cbna Stand For