Which Credit Score Is Used By Most Lenders

Credit agencies have a different credit bureau of choice. The above reasons arent just the only reasons why theres such a discrepancy between the Equifax and Transunion scores, which Borrowell and use, respectively.

Another more major reason that Equifax and Transunion may have very drastically different numbers is that credit agencies have a different credit bureau of choice. Not every credit agency uses Equifax and not every credit agency uses Transunion.

Is Equifax more important than Transunion? Transunion or Equifax, which is better?

Well, it depends.

Canadian KMs breaks down in a handy chart which credit bureau gets used when you apply for a new credit card. For example, did you know that American Express uses Transunion and CIBC uses Equifax?

I sure didnt!

Who uses Equifax? Here are some credit cards that use Equifax:

- BMO

- CIBC

- TD Bank

Since the banks seem to have either Equifax or Transunion equally split, it makes sense to keep track of which credit cards you open if youre wary of it affecting your Transunion score too much.

For example, Rogers Bank , MBNA, Tangerine, and American Express all use Transunion.

Create Credit History By Choosing Different Forms Of Credit

If you havent borrowed funds in the past, you wont have a credit history, and as a result, your CIBIL score will be low. So, ensure that you borrow a healthy mix of credit, both secured and unsecured loans, of a long and short tenor to build a strong credit score. This will help you access low interest rates and higher loan amounts in the future whenever you choose to apply for a personal loan.

These are some habits that you can weave into your life to improve your credit score over time. However, it is essential to note that these steps will not lead to an immediate change in your score. After implementing them, it will take around 6 months to a year for your credit score to improve.

Bajaj Finserv brings to your pre-approved offers on all of its financial products such as business loans, home loans, personal loans, etc. With pre-approved offers, not only is the process of availing a loan simplified but it helps you save on time as well. You can check your pre-approved offer by simply adding some basic details.

*Terms and conditions apply

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

You May Like: Aargon Agency Phone Number

How Does Equifax Calculate Credit Scores

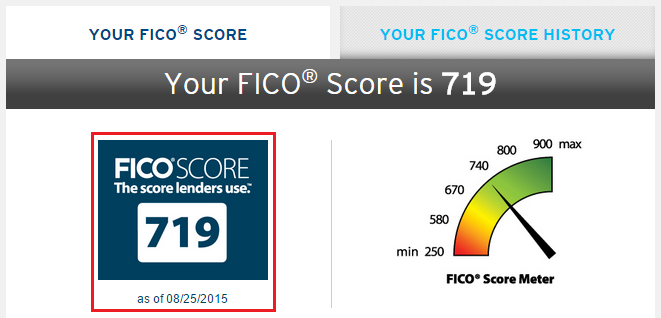

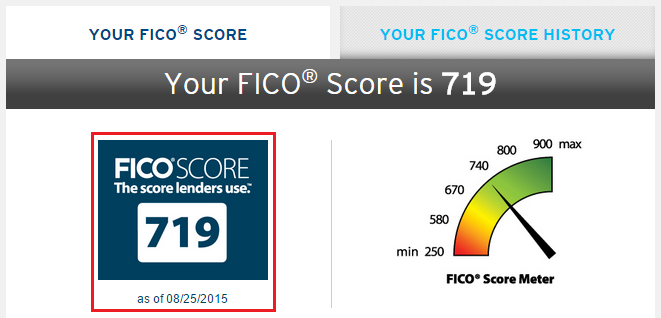

An Equifax credit score isnt used by lenders or creditors to assess a consumers creditworthiness. Instead, many lenders use FICO Scores® to help determine a potential borrowers creditworthiness. FICO uses credit scores from the three reporting agencies, including Equifax and Transunion, to determine their score. Equifax recommends aiming for a score of 739 or higher if a good score is desired.

The Equifax credit score model falls on a that starts at 280 and ends at 850. The higher a score is on this scale, the better indication that the consumer poses a lower risk to creditors.

TransUnion and Equifax calculate credit scores differently. An Equifax credit score is an educational credit score. The point of this credit score is to provide consumers with the knowledge to help them predict their general credit position.

Transunion Vs Equifax: Major Differences Explained

Reviewed by Ana Gonzalez-Ribeiro, AFC®

If you are interested in knowing your credit history, you can find out from one of the three major credit bureaus: Transunion, Equifax, and Experian. However, you may be surprised to find that the information varies from one bureau to the next.

The three major credit bureaus calculate credit scores using slightly different credit scoring models. Well cover the difference between TransUnion and Equifax in this article.

Read Also: Credit Report Serious Delinquency

Donotpays Virtual Credit Card Doesnt Let Companies Auto

our virtual credit card, you can prevent companies such as TransUnion charge you without you being aware of it. To the company, it will look like any other credit card, but they wont be able to collect any payments from you once the trial period ends. You will avoid being trapped in an unwanted subscription and save hundreds of dollars that would otherwise drip out of your pockets unnecessarily.

Also Check: Which Business Credit Cards Do Not Report Personal Credit

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

Recommended Reading: Usaa Credit Card Approval Odds

How Credit Scores Are Determined

Information found in your credit report is used to determine your credit scores, which might include the following:

- Your history of debt payments

- Hard inquiries6 on your credit score from new credit applications

- The amount of debt you currently have on your credit accounts

- The age of your credit accounts

- The amount and type of loan accounts you have open

- The percentage of available credit youâve utilized

- If and when you had a foreclosure, declared bankruptcy, or had debt sent to collections

Itâs common to see varying credit scores when you look at different sources. Credit Karma and other services might display different credit scores, like TransUnion VantageScore, which is different from the TransUnion FICO score thatâs used for your Apple Card application. Your credit report and the timing of when your credit score is updated can affect your credit score.

For information about credit scores from TransUnion, please click here.

Also Check: What Is Syncb Ntwk On Credit Report

What’s More Important Fico Or Transunion

In short, FICO is more transparent than the three credit bureaus and, most times, the least costly for all parties involved. However, reports from the three credit bureaus are vital to monitor your progress on your journey to that ideal credit score so that you can get the best loan rates and credit cards.

You May Like: 688 Credit Score Credit Card

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

You May Like: Removing Repossession From Credit Report

What To Look For When You Review Your Credit Report

Monitoring your credit report is even more important during uncertain economic times since fraudsters like to take advantage of these situations.

You should keep an eye out for common credit report errors and signs of fraud when checking your credit report, such as:

- New accounts that you didnt open

- Identity errors

- Incorrect reporting of account status

- Data management errors

- Balance errors

If you notice any errors, dispute them as soon as possible. Check out our step-by-step guide on how to dispute a credit report error.

Learn more:

You May Like: Cbc Innovis Credit Inquiry

Keep Old Credit Alive

The length of your credit history influences your credit score. Do not cancel old credit cards in good standing even if you rarely use them now. Keep these cards and use them every now and then to show some activity on your credit profile.

Cancelling old lines of credit also lowers your total credit limit and this hurts your credit utilization ratio.

Read Also: Which Business Credit Cards Do Not Report Personal Credit

How To Start A Credit Freeze

You must freeze your credit at all three credit bureaus separately. The bureaus will provide you with a PIN that you can use to freeze and unfreeze your credit. Dont lose that number. Note, though, that Equifax no longer requires you to enter a PIN when freezing or unfreezing your credit.

Experian: You can start your Experian freeze either online or by calling the bureau at 888-397-3742.

TransUnion: Start a TransUnion freeze online or by calling 888-909-8872.

Equifax: You can freeze your credit with Equifax online or by calling 888-298-0045.

How much does a credit freeze cost? There is never a charge to freeze your credit. This is a free service.

How long does a credit freeze last? A credit freeze remains active until you ask the credit bureaus to remove it. According to the FTC, if you request that your credit be unfrozen online or by phone, the bureaus must lift your freeze within an hour. Many consumers lift freezes temporarily when they are applying for new credit or loans.

How long does it take for a freeze to go into effect? Different states have different regulations regarding security freezes. In California, the credit bureaus are required to freeze your credit no later than three days after receiving your request. In New Hampshire, the bureaus must freeze your credit within five business days of receiving your request. In New Jersey, that time limit is again three days.

Read Also: What Credit Score Do You Need For Paypal Credit

Read Also: Itin Credit Report

Why Is Knowing Both Equifax And Transunion Score Necessary

Is TransUnion more important than Equifax? I wouldnt say so. Same question goes for is Equifax more important than Transunion.

Which credit score matters more Transunion or Equifax?

Since they can vary so much, if youre applying for credit sometime soon , you might wonder if knowing but your Transunion vs Equifax score is necessary or would it be considered overkill. Personally, it would be good to know both your Equifax and Transunion score.

So to answer the question, Transunion or Equifax which is better

At least you should check both Transunion and Equifax credit reports periodically, in case you need to check with the particular credit card bureau to fix something between the landlord and tenant. For me, I check about every 6 months or more frequently, when I apply for a new credit card .

If youre not applying for credit any time soon, its still nice to know because knowing your credit score is like a vanity metric LOL. This is somewhat reminiscent of the days when you want to get as high a grade as possible in school, right?

Getting an 800+ credit score is not hard to do and its nice to have.

Its also good to check your credit score for both credit bureaus because when you close a credit card that you have applied for recently you will want to double check and make sure the account is closed. This happened recently to me.

Equifax Vs Transunion Credit Score

Transunion and Equifax credit scores are often not the same. Here are some reasons why your credit scores from these Canadian credit bureaus may be different.

Different algorithms: They use different models to calculate your score.

Reporting by lenders: Some lenders report to both credit bureaus, some report to only one and some do not report at all.

Different dates: Credit scores are always evolving. If you are comparing credit scores processed on different dates, chances are they will be different.

Read Also: How To Check Credit Score Without Social Security Number

Different Credit Score Models

While its impossible to keep track of all of your credit scores, there are some that are used by most lenders that are important to at least be aware of.

The good news for those hoping to borrow is that most agencies look at similar factors when calculating credit scores.

FICO

FICO is the most commonly used credit score used when applying for new credit or a loan. FICO scores range from 300-850 and are based on the following factors:

- Your payment history

- New credit/inquiries

- Types of credit you have

Though the formula may seem simple, FICO often makes changes to its model to produce a better reflection of your trustworthiness as a borrower.

To go into further detail the Fair Isaac Corporation stated, You have more than one FICO Scoredepending on what type of credit youre seeking, your lenders may evaluate your credit risk using different FICO Score versions. Auto lenders, for instance, often use FICO® Auto Scores, an industry-specific FICO Score version thats been tailored to their needs. Most credit card issuers, on the other hand, use FICO® Bankcard Scores or FICO® Score 8.

Though it may seem confusing at first, these updates can be to the borrowers benefit. For example, the FICO 9 update allows unpaid medical bills to carry a lower weight than other unpaid debts, as medical debt may not be an indicator of financial health.

VantageScore

The VantageScore model is based on the following:

- Age and type of credit

- Recent credit behavior

- Available credit

How Can I Access My Credit Score

To access your credit score for a fee, you can contact the credit reporting agencies. There are also websites that offer a free Vantage Score. A Vantage Score is not the same as a FICO® Credit Score, and there are differences in how they are calculated. Some banks and credit card companies also provide credit scores to their eligible customers. Wells Fargo now provides access to FICO Credit Scores to eligible customers through Wells Fargo Online®. When comparing scores, be sure to understand what kind of credit score you are looking at , what score version it is, and when it was last updated. For more information, view: understanding the difference between credit scores.

Recommended Reading: Repo Removal Letter

Improving Your Transunion Credit Score

Your TransUnion credit score affects your ability to obtain credit. This score represents your ability to pay back your creditors and your credit history. For instance, when you are late paying your payments on a credit card, this credit score drops.

Your best option for improving your TransUnion credit score is to review your TransUnion credit report. During this review, establish which debts belong to you. Establish which debts are older than seven years and are not included in a bankruptcy. Establish whether any of your debts possesses incorrect information. Once you have gathered all of the required information, create reports for each of these debts. TransUnion investigates all debts for which you create a discrepancy report. Once the credit reporting agency establishes that these debts do not belong to you, are too old to list, and/or contain incorrect information, the listing is updated.

Evaluate all debts that are negatively affecting your TransUnion credit score. Collection accounts, as well as, the original debt affect your TransUnion credit score. All debts for which you have multiple late payments also lower your TransUnion credit score. Create a list of these debts with contact information for each creditor.

Consult your budget and determine the amount of money you have available to payoff collection accounts. Establish the amount of money you could pay extra on debts that are behind. Use this amount to establish a budget for paying off these debts.

The Credit Scoring Model

Your credit scores are numeric representations of the risk you could pose to a lender when you borrow money. Your credit scores are intended to reflect the level of risk a lender takes when considering you for a loan. The scores typically range from 300 to 850, with higher scores indicating better credit than lower scores.To calculate your score, the positive and negative information in your credit report is broken down into five scoring categories. Your payment history and the amount of money you owe are weighted most heavily. The length of your credit history carries some weight, as does your mix of credit and the amount of new credit you have applied for or opened.

Also Check: Does Removing Hard Inquiries Increase Credit Score

Customise Your Credit Limit

Your credit utilisation ratio has a significant impact on your credit score. The more you are able to restrict your credit usage as per the allotted limit, the better it is for your credit score. Reaching the limit has the opposite effect as it lowers your credit score. One way of tackling this is to get in touch with your lender and customise your credit limit based on your expenses.

Donât Miss: Does Paypal Credit Help Credit Score