Car Loans And A 700 Credit Score

A car loan can also be relatively easy to get with a 700 credit score. In fact, some financing locations will approve you with a lower score. When it comes to taking on a car loan, the most important thing to do is to not overextend yourself. We all want to drive a nice car, but its important to choose one you can comfortably afford.

Learn how to budget for a car.

How To Build Up Your Credit Score

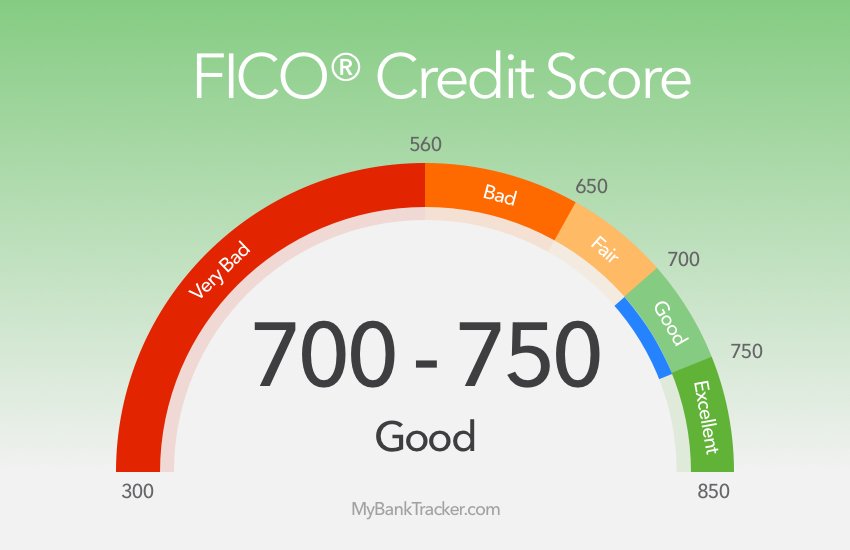

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO Score® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High , or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.7 credit card accounts.

Seek a solid credit mix. No one should take on debt they don’t need, but prudent borrowingin the form of revolving credit and installment loanscan promote good credit scores.

Here Are 10 Ways To Increase Your Credit Score By 100 Points

You May Like: How To Check Your Credit Score Chase

How Can I Raise My Credit Score From 600 To 700

Rather than repeatedly transferring debt, pay it off. While a balance transfer to pay zero interest or a lower interest rate on your debt can be beneficial, make sure you pay off the balance first before taking on further debt. According to FICO, one of the most efficient strategies to improve your credit score is to pay down your overall debt. Dont close accounts that have been paid off. Closing unused credit card accounts lowers your credit score by reducing your available credit. Keeping them open and underused demonstrates that you have good credit management skills. Also, before you close older credit card accounts, keep in mind that having a long credit history helps your credit score.

Apply For New Credit Selectively

When youre aiming for a 700 credit score, be careful about applying for new credit. While access to more revolving credit helps your score, whenever you open a new account, you lower your average credit age. Applying for a new account also results in a hard inquiry to your credit report, which temporarily dings your score.

Don’t Miss: Carmax Minimum Credit Score

Understand The Benefits Of A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 33% of people with FICO® Scores of 700.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Dont Apply For Multiple Credit Cards

This is standard advice any time you apply for credit of any type . If you put in multiple applications, you can actually hurt your chance of being approved and even catapult your score back to the bad credit range.

Each lender will have access to your credit report, which will show that youve applied elsewhere. Those applications will show up as credit inquiries. Too many inquiries can actually drop your credit score. Maybe it wont be by a lot, but it could be enough to put you into a bad credit score range.

Pick the card you want most, and apply for it. If youre turned down, or you dont like the terms, only then should you apply for another card.

Read Also: Is Opensky Safe

Keep Your Credit Utilization Rate Low

Your credit utilization rate is the percentage of your available credit that you use. The usual recommendation is to keep your credit utilization rate below 30% in other words, using less than 30% of your available credit at any given time. Generally speaking, the less available credit you use , the better.

If you check your credit reports and find that you have a credit utilization rate higher than 30%, you have options to lower it, such as paying down debt or increasing your credit limits. To increase your credit limits, youll need to ask your current lenders for a limit increase but be aware that this could result in lenders doing a hard inquiry on your credit when they make their decision.

Length Of Credit History

The longer you’ve been using credit and the longer your average age of accounts the better it tends to be for your score. Remember, credit scores are meant to estimate your risk as a customer, and a longer history gives more data to estimate with.

Avoid closing credit cards unless there’s a pressing reason, like a high annual fee. You can also look into doing a product switch to a more suitable card from the same issuer.

Don’t Miss: What Credit Bureau Does Paypal Use

Discover It Balance Transfer

The card is best for doing a balance transfer. The annual fee is zero. Again, Discover will determine all cash back earned at the end of the first year. You will be able to earn 5% cash back at different places each quarter of the year up to $1,500 max spend per quarter whereby activation for the benefit is needed.

These include gas stations, grocery stores, restaurants, and many more. Furthermore, you will be able to earn unlimited 1% cashback on all other purchases. You will also be able to know your FICO score periodically as well as receiving Social Security alerts. Try the card today, and you will never regret it. Learn more

How Your Credit Score Can Affect Your Future Mortgage Rate

Monday, 16 Oct 2017 6:35 AM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Don’t Miss: How To Get Repo Off Credit

How To Go From 700 To 750 Credit Score

Here are some essential tactics to getting your credit to increase by 50 points in a relatively short time.

Its a fair enough question and it is more realistic than how to boost your credit score by 200 points in 30 days.

The time frame is the issue in that question, yet you can set put to boost your credit score by 200 points. how to go from 700 to 750 credit score, quickly, is a better sought after goal.

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

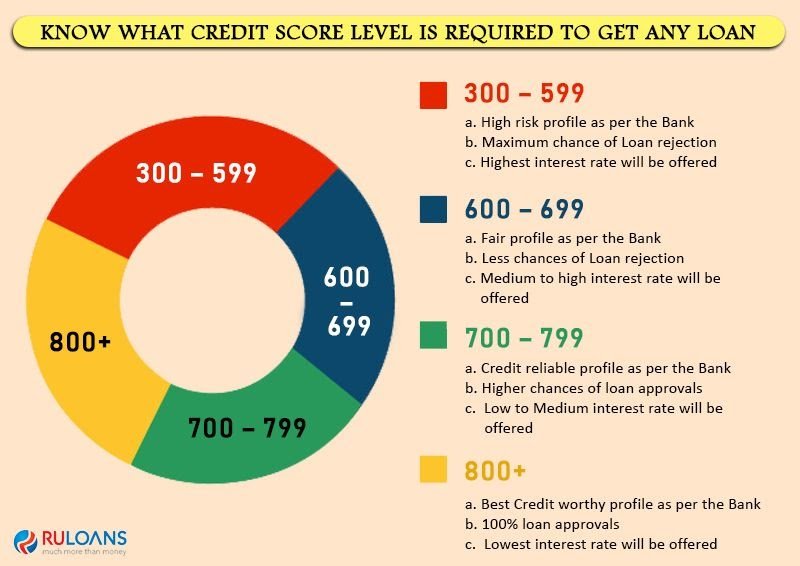

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Don’t Miss: Notify Credit Bureau Of Death

How Much Excellent Credit Can Save You

Using the same FICO loan savings calculator in the example above, heres how much the calculator estimated youd spend on interest based on credit score:

- 760850 score $84,000

- 680699 $99,200

- 660679 $107,500

Theres big money to be saved if you have a higher credit score. Thats why many people try to improve their credit before buying a house.

However, with a 700 score, youre already paying less in interest than many home buyers.

And you can always refinance into a lower rate if you improve your scores over time. In fact, your payment history matters and faithfully making ontime mortgage payments is one of the best ways to increase your credit score.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Does Paypal Credit Report To The Credit Bureaus 2019

Lower Your Credit Utilization Ratio

Reducing your will raise your score. That means paying down your credit card balances so they make up a small percentage of your overall available credit. To quickly determine your current ratio, check out Bankrates credit utilization ratio calculator.

Just because a lender says you can borrow a certain amount, does not mean that you should, Sechrist said. You should keep your utilization rates under 35 percent. For example, if your monthly credit card limit is $10,000, then youd want your balance to be under $3,500 at all times.

Another way to lower your credit utilization ratio, even if you pay your entire balance every month, is to make your payment early or make an extra payment in the middle of the month, Rossman said.

Even if you pay your bills in full, you still might have a high credit ratio, Rossman said. Your balance is reported on the statement date, so bring your balance down before the statement comes out.

While it may be tempting to close credit cards youre not using, think twiceespecially if theres no annual fee, Sechrist said. Those cards can help keep your credit utilization ratio low, and if youve had them a long time, help you maintain a long length of credit history.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Don’t Miss: How Long Do Repo Stay On Your Credit

Charge No More Than You Can Easily Repay When The Bill Comes In

This really gets to the mechanics of paying off your balance each month. If you have room in your budget to pay $500 per month toward your credit card bill, then thats as much as you should charge on it. It makes it less likely youll need to carry a balance.

Remember, using a credit card responsibly does not mean maxing out your available credit every month!

Avoid Applying For Too Much New Credit

When a lender pulls your credit as part of a loan or credit card application, thereâs a chance it could hurt your credit score. If any damage happens , itâs usually only a little and will only last for up to 12 months.

Still, itâs wise to make a habit of applying for new credit only when you need it and probably not because youâre trying to get 20% off your purchase at the mall.

Recommended Reading: Will Carmax Approve You With Bad Credit

What To Do Before Applying For A Credit Card If Your Fico Score Is 700 To 749

Even if youve been in the 700 to 749 credit score range for a long time, never assume thats still the case. Credit scores are a moving target! The score you have today will be different a month from now, and again a year from now.

For that reason, there are a few steps you should take before you even make application for a credit card.

Increase The Length Of Your Credit History: 15%

This aspect of your credit score is broken down into two subcategories: the actual length of your credit history, and the average age of your credit accounts and loans.

The longer you have had credit accounts, the more information that FICO has on your credit habits. This gives a small boost to your credit score because it shows that you have a lot of experience with handling debts and bills.

A short credit history will not harm you, but you wont score many points in this category.

Read Also: Letter To Remove Repossession From Credit Report

Make Payments On Time

In order to reach your ideal credit score range, making payments on time is crucial. Missing payments even if its just by a few days can wreak havoc on your credit score. Setting up automatic payments removes the need to remember to pay your recurring bills.

Read More: Why Its a Bad Move To Use the Same Credit Cards Indefinitely