For Your Informationspecialty Credit Reports

Not everyone may need to check their specialty report every year. A specialty report should be ordered and checked for accuracy before looking for new homeowners insurance or auto insurance, before applying for private health insurance or for life insurance, before opening a new checking account, or before renting a home or apartment.

If you find errors in your specialty report, you have the same rights to dispute as with errors found in a credit report.

For information on specialty reports online:

Privacy Rights Clearinghouse Insurance Privacy Rights Clearinghouse Employment background Checks

Portable Document Format . Visit nh.gov for a list of free .pdf readers for a variety of operating systems.

New Hampshire Department of Justice33 Capitol Street | Concord, NH | 03301Telephone: 603-271-3658

Update Any Creditors And The Social Security Administration

The last step is to update the credit bureaus, any outstanding creditors and the Social Security Administration of the death. Until the credit bureaus are notified that a death has occurred, nothing happens to the credit report. Once the proper documentation has been submitted and the request made, the bureaus will mark the account as deceased.

This means that no further credit will be extended in the persons name and no additional accounts can be opened up, which helps protect against identity theft and credit card fraud. The death certificate should be all thats needed to complete this step.

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

Read Also: What Credit Score You Need For Care Credit

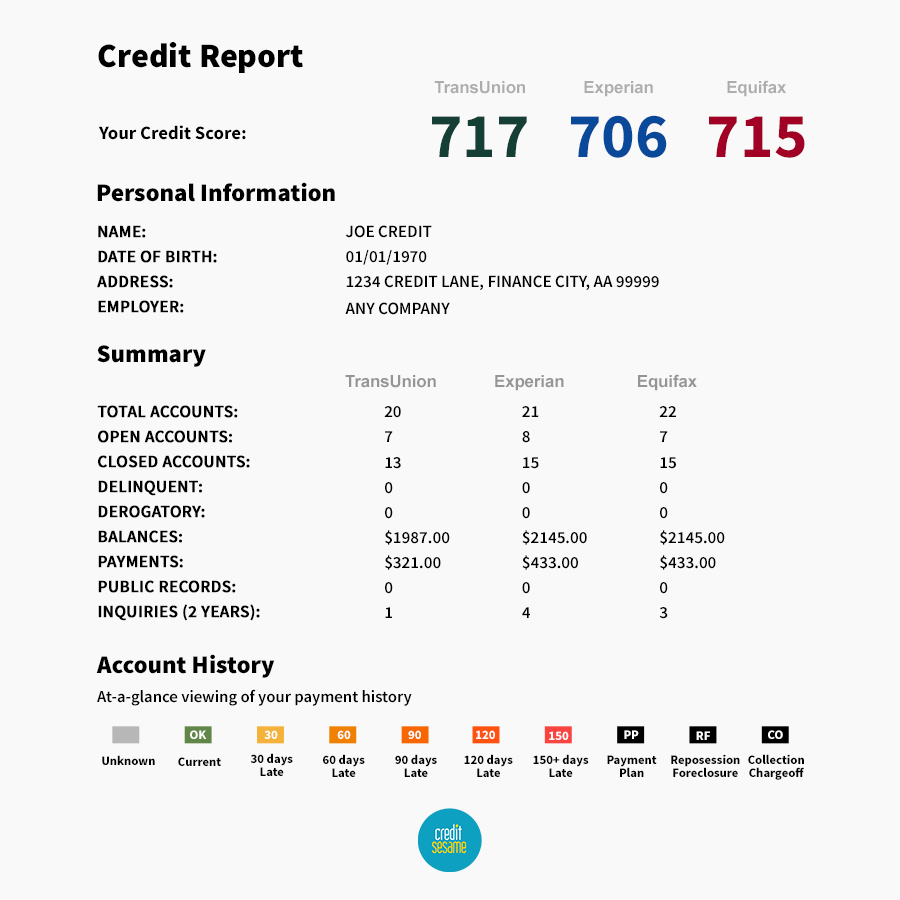

What Is On A Credit Report

The short answer to that question is: A lot!

The typical credit report will include personal identifying information: a list of credit accounts , type of account , and your payment history on those accounts.

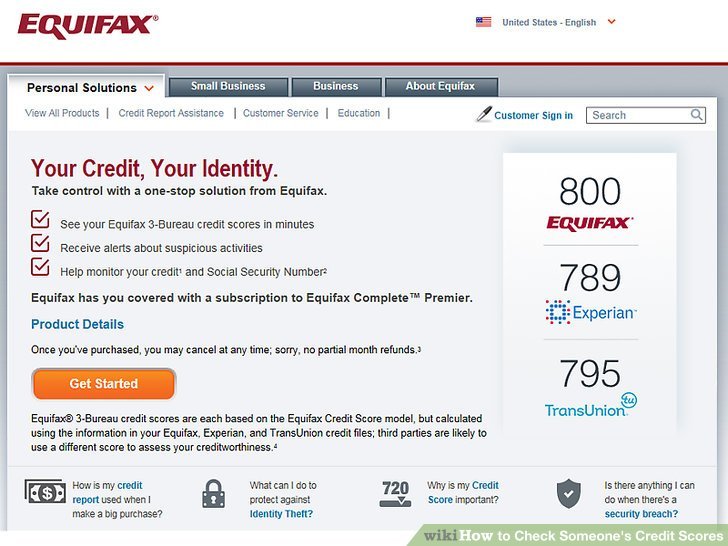

The three major credit bureaus Experian, Equifax and TransUnion compile data from sources that extend you credit. Bits and pieces of your credit history may vary slightly among the three companies because not all businesses supply information to all three agencies. However, the broad picture of your credit history should be relatively consistent.

Each credit report has four basic categories: identity, existing credit information, public records and recent inquiries.

Heres how they break down:

Learning About Credit Bureaus

Read Also: Credit Report Without Ssn Or Itin

Are You Legally Obligated To Pay A Collection Agency

If you default on a credit card, loan, or even your monthly internet or utility payments, you run the risk of having your account sent to a collection agency. These third-party companies are hired to pursue a firm’s unpaid debts. You’re still liable for your bill even after it’s sent to a collection agency.

Is Experian Safe To Give Ssn

Yes, they can. Experian doesnt match information to a persons credit history using only the Social Security number. Experian matches information using all of the identification information provided by the lender, so the account will be accurately shown in your report, even if no Social Security number is provided.

Recommended Reading: Navy Federal Mortgage Approval Odds

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Your Creditor Doesnt Report To All Three Bureaus

This could explain why you see an account on one report, but cant find it on another. John Danaher, president of consumer interactive at TransUnion, suggests consumers check their credit reports from each bureau every six to 12 months.

Ensure the information is accurate and up to date, since information from separate reports can vary, says Danaher.

You May Like: Does Amex Plan It Affect Credit Score

How Credit Is Reported For Apple Card Account Co

Each co-owner will be reported to credit bureaus as an account owner, so each person is reported in their own name. The shared Apple Card will be reflected on each account owners credit report as a jointly owned account.4 Credit reporting for each co-owner may include both positive and negative payment history on their shared Apple Card, as well as the credit line amount and credit utilization. Each individual’s personal credit history includes information that’s unique to them, so Apple Card usage and payment history can impact each person’s credit score differently.

If you combine your account with an existing Apple Card account owner

- You can only co-own an account with a member of your Family Sharing Group.

- The credit limit for each person will be combined. Both co-owners will see the combined credit limit for the shared account on their credit reports.

- Each co-owner will maintain their pre-merge Apple Card payment history on their individual credit profile.

- Each co-owner will maintain their Apple Card account origination date on their individual credit profile, which can be helpful to maintain the age of their credit history.

- After the accounts have merged, the credit profile for both account owners will include their shared payment and credit activity for Apple Card going forward.

If you want to co-own an Apple Card account with someone who doesnt have an existing Apple Card

If you want to close a co-owned Apple Card account

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Read Also: Is 586 A Good Credit Score

Send A Deceased Notice

The most official way to notify the credit bureaus of death is via certified mail. In your letter, youll need to include:

- A certified copy of the death certificate as mentioned above

- Proof that youre authorized to act on behalf of the deceased

- The deceaseds information such as their full legal name, Social Security number, birthday, and date of death

If youre the surviving spouse, you dont need proof that youre authorized to act for the deceased. Otherwise, youll need to show that youre the executor or administrator of the estate. The probate court will provide an appointment or letters testamentary after you open the estate.

Your letter should have all of the required information. It should be sent via certified mail to ensure its delivered safely. From there, wait for approval from the credit agency. This could take several weeks.

For some credit agencies, there is an online submission form for death notifications. Experian has an online portal for uploading death certificates and other related documents. No matter what method you choose, make sure you provide all the required documents.

How To Fix Errors On Your Credit Reports And How They Occur

To err may be human, but if that human error negatively affects your credit worthiness, you’re not alone. The number one complaint received by the Consumer Financial Protection Bureau involved incorrect information listed on consumers’ credit reports. Of those complaints, errors on a credit report were at the top of the list.

Worse yet, 26% of participants in a study by the Federal Trade Commission identified at least one error on their credit report that could make them appear riskier to lenders. The potential negative impacts those errors can have on your credit report can be catastrophic on your ability to get loans, new lines of credits, or better lending terms and interest rates.

That’s why staying on top of the content of your credit reports is so important. In this section, we’ll reveal some of the most common mistakes found in credit reports, how to fix them, and what to do if you disagree with any of the information in your report.

You May Like: Cricket Affirm

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

How To Get A Credit Report

The Fair Credit Reporting Act requires Experian, Equifax and TransUnion to provide you a free copy of your credit report once, every 12 months.

There is a charge for credit scores, but the credit report is free.

To get a free credit report, go online to www.annualcreditreport.com or call 1-877-322-8228 and request it. This is the only website authorized to fill orders for free credit reports. Once there, each agency must supply you one credit report every 12 months. You could receive all three reports at once, or spread them out over 12 months depending on the purpose you have.

If you want to examine the three together and compare all the information contained in each report to be sure its accurate , you should request all three at the same time.

Since the information on all three should essentially be the same, you may want to ask for one report every four months and verify each time that the information remains accurate.

If you already received a free report from each of the bureaus and want to check your credit report again, you can contact any of the three reporting agencies and order one for a small charge, usually under $10.

Don’t Miss: How To Remove Car Repossession From Credit Report

Any Entity With A Court Order

There is an exception to the “needing a legitimate business reason to pull your credit” rule. If an entity gets a court order to access your credit, it may do so. However, court orders arent easy to obtain, so its unlikely that your report will be given to someone who doesnt have a good reason to see it.

What Is The Best Reason To Dispute A Collection

Normally, collections are disputed because the debtor believes they are incorrect for some reason. For example, if you review a copy of your credit report and you see a collection account that you believe belongs to another person, has an incorrect balance or is greater than seven years old, you can file a dispute.

You May Like: Transunion Credit Unlock

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

What Do Creditors Have To Report To Credit Bureaus

Creditors and lenders are not required by law to report anything to . However, many businesses choose to report on-time payments, late payments, purchases, loan terms, credit limits, and balances owed. Credit bureaus collect this data, and it helps create a person’s credit report, and often this information can impact credit scores.

Businesses usually also report significant events such as account closures or charge-offs. For example, if a mortgage is paid off, this information is reported.

Governmental organizations that maintain public records don’t report to the credit bureaus, but the bureaus usually obtain the documents on their own. For this reason, bankruptcy filings also typically show up on credit reports.

Another example, if a person owes the IRS money, chances are, a public record of a tax lien may find its way onto their credit report, and that can impact your .

Recommended Reading: Does Aarons Do A Credit Check

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

What Happens To Credit Reports After Death

When someone passes away, his or her credit reports aren’t closed automatically. However, once the three nationwide credit bureaus Equifax, Experian and TransUnion are notified someone has died, their credit reports are sealed and a death notice is placed on them.

That notification can happen one of two ways from the executor of the person’s estate or from the Social Security Administration. Estate executors or court-appointed designees, however, are encouraged to contact at least one of the three nationwide credit bureaus so that the deceased’s credit report can be flagged, appropriately.

Read Also: Can Lexington Law Remove Repossessions

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.