How Does A Credit Score Of 700 Really Stack Up

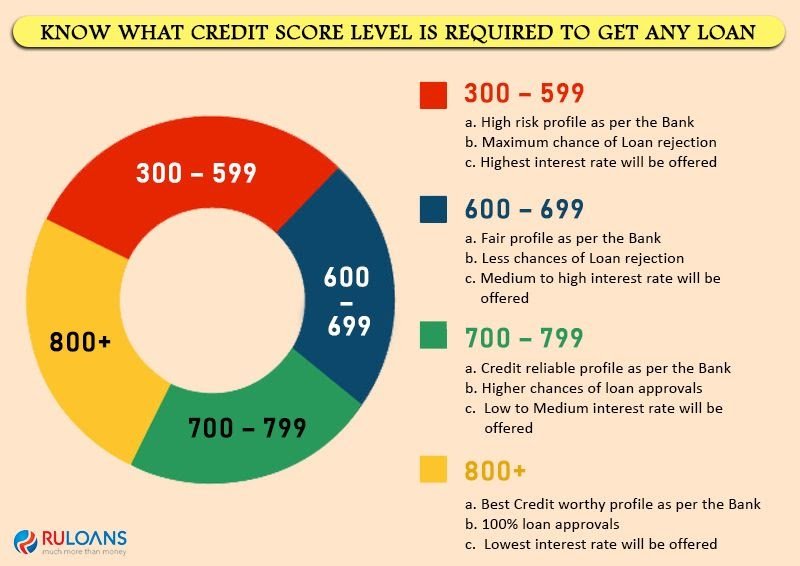

Achieving a credit score of 700 officially places you in the good credit score category, although it does fall slightly below the average. In , the average FICO score was listed as 716 following a generally upward trend in average credit scores over the past 10 years. According to Experian, 40% of consumers have FICO scores lower than 700.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, told Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

In other words, a 700 credit score will still qualify you for better deals on credit cards, personal loans, mortgages and other types of credit, but it won’t give you access to the same types of terms someone with very good credit, or a credit score above 740, would have.

Furthermore, credit scores are often just one of the many factors lenders look at to determine creditworthiness, and your income and employment status may also play a role in the interest rate you receive.

You can check and monitor your credit score with a free like and Experian. And using a service like Experian Boost can you help you quickly raise your credit score* if you’re trying to achieve a fair, good or excellent score.

Learn more about eligible payments and how Experian Boost works.

What Can I Get With A Credit Score Of 700

In a broader economic sense, having a good credit score means you wont be turned down for important milestones like financing for a car or a home, a job, or when a landlord checks your credit in order to assess if they should rent an apartment to you.

Having a 700 score also offers the following benefits:

The 9 Best Credit Cards For 700 Credit Score

What comes to your mind when you hear the phrase credit score? Maybe you have your own understanding of what a credit score is. In general, a credit score is the creditworthiness of an individual that is expressed in numerals. Each credit score range has suitable credit cards. For instance, the best credit cards for 700 credit score will give you a higher credit limit accompanied by various rewards to make your card usage exciting.

A crucial thing to note is that even people with bad credit scores can get credit cards for bad credit. Various financial institutions can give to help you improve your credit score. The only problem with bad credit cards is that they charge high-interest rates. Moreover, most bad credit cards have low limits. These are the unsecured credit cards. Secured credit cards give you a limit depending on your deposit amount.

Also Check: Rental Kharma Complaints

Improve Your Credit Mix: 10%

Your credit mix has a small effect on your overall credit score but it is one of the easiest to change to improve your score. Lenders like to see that you are a savvy consumer and capable of handling different types of loans with different terms and requirements.

The different types of credit that the Fair Isaac Corporation track are credit cards, retail accounts, installment loans, finance company accounts, and mortgages.

The more different types of credit you have, the better it is for your score. This means that having a car loan, a credit card, and a mortgage is better for your score than simply having three credit cards.

If you have ever asked how can I raise my credit score fast? improving your credit mix is one strategy.

You can take advantage of this by financing large purchases at stores, taking out a loan when you buy a car, or consolidating credit debt with a personal loan. Your score will improve with each new type of loan you open.

Tldr Should You Aim To Get To A Credit Score Of 700 And Higher

In conclusion, yes a credit score of 700 is a Good score. Whats more, having a Good credit score can help you get better interest rates, save on down payments, and overall have a better experience when applying for credit.

Now that you know a 700 credit score is Good, what steps will you take to achieve it?

Don’t Miss: Credit Score Needed For Care Credit

How To Fix A 700 Credit Score

In summary your credit score determines your ability to borrow. Its important that you manage it. If you have 700 credit score then your focus should be on driving it higher. To do this follow these simple tips:

- Pay down your debt If you have debts but also have savings then you need to ask yourself do you need all that cash in the short term? Could it be used better if it was spent on paying down debt? This would be an excellent use of your funds in a low interest rate environment and would have the beneficial affect of moving your 700 credit score even higher.

- Get a credit report Like everything else in life mistakes can happen in any area and that includes the record of your debt repayments. Its possible to get a credit report to see if all the information that lenders have on you is correct. If it is not and there are records which indicate that you missed a payment which you never missed, or you applied for finance at an institution you have never even heard of then you need to correct that. Correcting those errors will also drive that score towards excellent.

- Avoid short term debt Before you take on short term debt do a simple mental exercise. Consider an item you wish to buy, look at the price, now ask yourself what the real price is if you use short term finance given the high interest rates that can apply. In some cases, this can mean that the item will cost you twice as much as the list price. At that price is it still something that you wish to buy?

How Does My Credit Score Affect My Credit Limit

Your credit score can also impact your on revolving credit accounts, such as credit cards. Generally, a higher score can help you qualify for a higher credit limit.

But similar to installment loans, creditors will consider more than just your credit score when setting your credit limit. Your income, DTI, history with the creditor, current economic conditions and the company’s goals can all play into the decision.

Your credit score can continue to impact your credit limit on your revolving account after you open an account. If your credit have improved since you got a credit card, you may be able to request a credit limit increase. Conversely, if your score or income drops, the credit card issuer may lower your card’s credit limit.

Recommended Reading: Bestbuy/cbna

Monitor Your Credit Regularly To Avoid Major Issues

Many things can hurt your credit score, including how much of your available credit youre using. In most cases, though, you can address potential issues before they inflict significant damage on your credit profile.

Experians free credit monitoring service allows you to view your Experian credit report and your FICO® Scoreâ powered by Experian data whenever you want. Youll also get real-time alerts when changes to your credit are made, such as new accounts, credit inquiries and more.

As you monitor your credit score and reports regularly, youll have the information you need to build and maintain an exceptional credit history.

Dont Miss: 524 Credit Score Good Or Bad

Have A Good Payment History: 35%

Your payment history is the most important aspect of your credit score. It is the easiest to use in your favor, but also the most difficult to repair if it begins dragging your score down.

Lenders are primarily concerned with whether they will get their money back from the people they lend it to.

Having a track record of making payments on time is the best way to boost their confidence in you. It isnt fast or glamorous, but paying your loans over the course of a couple of years has a massive impact on raising your credit score.

If you miss a payment, how much you miss it by can affect the ding it puts in your credit score. The good news is that many lenders will work with you if you have a history of on-time payments and will forgive the first offense.

If you ever miss a payment or send one in late, contact the lender, explain the situation, and ask if they can work with you to avoid the black mark on your credit report.

Read Also: How To Fix Delinquency On Credit Report

How To Get A Credit Score Of 700 Or 800

5-minute readDecember 21, 2021

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

A credit score is a three-digit number that can have a big impact on your life. While a good credit score can open many doors, a bad credit score could leave you in a lurch.

Luckily, credit scores arent static numbers, and if you can figure out how to get a credit score of 700 or 800, you can enjoy some of the best rates and terms on financial products like mortgages, car loans, credit cards and personal loans.

If you dont know where to start, were here to help. Read on to learn more about the benefits of knowing how to increase your credit score and the best tips for doing so.

How To Build Up Your Credit Score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO Score® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High , or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.7 credit card accounts.

Seek a solid credit mix. No one should take on debt they dont need, but prudent borrowingin the form of revolving credit and installment loanscan promote good credit scores.

Recommended Reading: Sync/ppc On Credit Report

Cash In With A Credit Card

If you don’t plan to get a mortgage or refinance any existing debt, at least consider getting a rewards credit card. Thanks to robust competition for credit card customers, banks are offering friendly terms to borrowers who have credit scores over 700. Some particularly good offers can be found in cash-back rewards cards and travel credit cards.

How To Raise Your Credit Score

While a 700 credit score can help you qualify for a mortgage, you might get better loan terms by boosting your score which could save you thousands of dollars over the life of the loan.

If youve been monitoring your credit, you have a good idea of where your credit score stands.

Here are some ways you can improve your credit scores:

- Pay down your debt balances.

- Always make payments on time. Automatic payments or monthly alerts can help.

- Become an authorized user on someone elses credit card account.

- Only open credit accounts that you need.

- If some of your accounts are delinquent or you have a large amount of debt, consider contacting a credit counseling agency.

Read Also: Whats A Good Dun And Bradstreet Score

Avoid Paying Interest To Improve Your Credit Score

One thing that is important to note is that you should never feel the need to pay interest to improve your credit score.

One of the benefits of a high credit score is saving money on interest payments, so paying unnecessary interest to achieve a high score is self-defeating.

The good news is that just opening the account will be enough to get a bump in your score, so long as the lender reports the loan to FICO.

If you have the money to make a purchase in full, you can finance it to get the new type of loan listed in your credit history, then pay it in full once the loan has appeared on your credit report. This lets you avoid interest while reaping the benefits of an improved score.

Lenders Might See A Lower Credit Score Than You Do

Perhaps you monitor your credit with free credit score apps from the major credit bureaus, so you know exactly what youre working with when you apply for a mortgage.

But then you talk to a mortgage loan officer, and they tell you theyre seeing a lower score than you thought you had.

In fact, this happens pretty often.

Most people arent aware that they have dozens of credit scores. And the score you see from your bank or credit reporting service is just one of them.

Its common for your mortgage credit score to be lower than the score you see on other platforms. This is because lenders use a tougher scoring model.

Its also pretty common for your mortgage credit score to be lower than the score you see on other platforms.

Thats because mortgage lenders often use a tougher credit scoring model. A home loan is a lot of money, and lenders want to be extra sure youll be able to pay it back.

So, if your score is a little lower than you thought, dont be surprised.

Also, dont be discouraged! Youre still likely to qualify for most loans with a score slightly below 700. And there are plenty of ways to raise your score a few points, then try for a mortgage again.

Recommended Reading: What Is A Good Leasingdesk Score

Dealing With Negative Information Which Impacts Your 700 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 700 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 700 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

Strategies To Raise Your Score Above 700

Whether you have bad credit or a 700 score, improving your credit score is always a worthwhile endeavor.

The single biggest element in the calculation of your FICO score is the timely payment of bills. Payment history makes up 35% of your score.

But, with your 700 FICO score, you probably already know that. So lets assume youll continue doing so.

What else can you do? Well, here are some dos and donts.

Read Also: Factual Data Credit Inquiry Rocket Mortgage

How Long Does It Take To Go From A 700 To 800 Credit Score

The amount of time it takes to go from a 700 to 800 credit score could take as little as a few months to several years. While your financial habits and credit history will play a role in how long it takes, there are some factors that have specific timelines. For example, it takes up to 2 years for a hard inquiry to go off your credit report. As hard inquiries are removed, your score can go up. Your score also goes up the longer youve had credit. Each year you have your credit, your credit history gets longer, helping your score improve.

Both of these examples show why its important to consider opening new accounts when building your score. When you open a new account, you put a new hard inquiry on your report and you bring down the average age of your credit. Youll also want to consider the impact closing an account can have on your score, too. Closing an older account can lower the average age of your credit history.