Where Rentreporters Falls Short

Because the company reports only to TransUnion and Equifax, its reach is limited. The company says it also plans to add a customer portal, but for now, clients receive status updates via emails or by calling the company.

Also note that the companys user satisfaction guarantee about your initial score bump has a time limit. Once RentReporters adds rent payments to your credit report and emails your new score, you have only 48 hours to cancel the service and get a refund. RentReporters then removes the rental history, which in turn shifts your credit score back to what it would have been without the service.

Read RentReporters educational materials and advice with the understanding that it wants you to buy its services. It sometimes overemphasizes the role of rent reporting in a broader credit-building strategy.

How To Get Your Rental Payments On Your Credit Reports

Depending on if you are renting from a large apartment complex or a private party, it may take a little initial legwork to get the reporting process started. But after that, your rental payments can be reported to the credit reporting agencies every month. A few tips are below, and this helpful FAQ can provide more details.

The first step in getting your rental account reported to the credit-reporting agencies is to ask your landlord or property management company since not all landlords “automatically” report rental payments. If you rent from an individual landlord or property management company that does not yet report data, sign up through a rent payment service such as:

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Also Check: Report A Death To Credit Bureaus

Why Does Credit Matter When Renting An Apartment

Any landlord or leasing agent has to be careful with who they let live in their residential properties. To ensure that they get stable tenants whom they can rely on to pay their rent on time every month, they check a variety of financial metrics. One of these is your credit score.

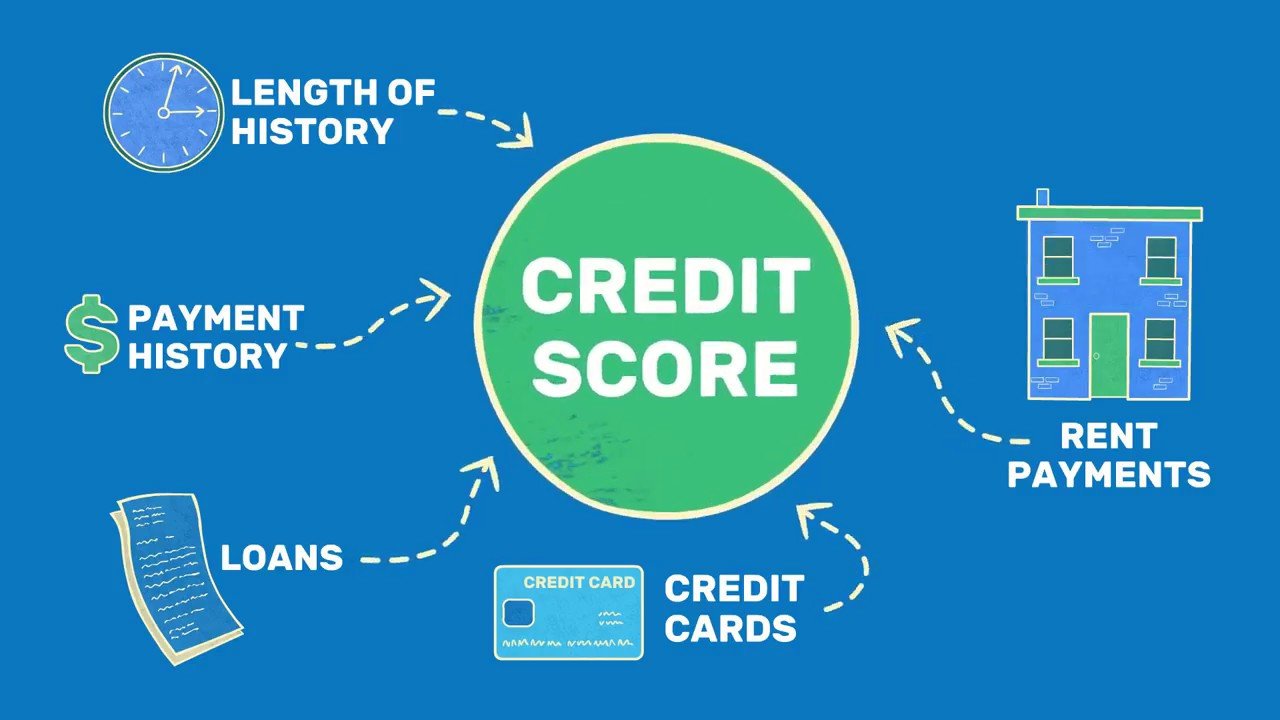

Your credit score is a basic summary of your financial creditworthiness. The number stands in as a general rating for how trustworthy you are regarding loans or long-term financial commitments.

Your credit score goes up when you pay bills on time- and take-out credit responsibly, then pay any existing loans back quickly. Your credit score goes down when you fail to pay your bills and use loans irresponsibly.

Landlords and leasing agents will use your credit score to determine whether youll likely be a good tenant over the next year.

What Can You Do To Work On Your Credit While Renting

If youre a renter looking to improve yourcredit but your landlord doesnt report your payments, you have some options.

- Ask your landlord or rental company to begin reporting your payment history.

- For a small monthly fee, there are services that can report your rent payments to the three major credit bureaus. Of course, you may see a benefit from this only if your rent payments are on time.

- For a free approach, you can try Experian Boost, a service that links to your bank account to report utility and phone service payments. While this service reports only to Experian, it could be a way to work on your Experian FICO® 8 credit score.

One no-cost option is to sign up for CreditKarma, where you can check your VantageScore 3.0® credit scores from TransUnionand Equifax on Credit Karma along with your credit reports from Equifax andTransUnion any time.

About the author:

Read More

Also Check: Care Credit Hard Inquiry

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and, if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

What Credit Score Is Needed To Rent An Apartment

- 580 or below is poor

- 580 to 669 is fair

- 670 to 739 is good

- 740 to 799 is very good

- 800 and above is excellent

Most apartment landlords or leasing agents will want you to have at least a fair credit score of around 620 or so.

Some landlords may go below this amount, but they may also compromise other factors like apartment quality or maintenance response time.

Try to aim for a credit score of 620 or higher to get into a decent apartment.

Read Also: Does Affirm Report To Credit

Why Landlords Should Report Rent Payments To Credit Bureaus

Rent Reporting Benefits Both Landlords and Tenants

Rent reporting to credit bureaus is one of the easiest ways for Landlords to reduce income loss and reward their responsible Tenants with good credit. Landlords can lower payment delinquencies by 36%, while Tenants have reported bumps of more than 40 points in their credit score in a matter of months.

Let us look at why Tenants value good credit and how Landlords can help their renters boost credit. At the same time, Landlords can improve their ability to run profitable rental businesses.

Does Paying Rent Affect Your Credit Score

Your rent payments generally wont affect your credit score. Thats because they arent usually reported to the three main credit bureaus . This means they arent included in the information on your credit report, which is used to calculate your credit score.

However, there are exceptions. Your rent payments can affect your credit score under the following circumstances:

- Your landlord uses a rent-reporting service: Although most landlords dont report rental payments to the credit bureaus, a few dogenerally by using a special rent-reporting service, such as Experian RentBureau. The effect on your score from this can be either positive or negative, depending on whether you typically pay on time or not.

- You pay your rent through a rent-reporting company: If your landlord doesnt report your rent and youd like to add it to your credit report to build your credit, you can sign up for a similar service on your own. We cover the ins and outs of this process in more detail below.

- You have severely overdue rent payments: If you go long enough without paying your rent, theres a chance your landlord will transfer your overdue rent to a debt collection agency. A collection account will then be added to your credit reports, which will badly damage your credit. Unlike the first two scenarios, this cant build your scorethe effect is always negative.

Also Check: Does Usaa Do A Hard Pull For Credit Increase

Which Bureaus Account For Rent Payments

All three credit bureaus will include rent payment information in your credit report if they receive it.

However, credit bureaus dont automatically receive your rental payment history. And despite services that simplify rent payment data reporting, that information wont automatically translate into changes in the credit score potential lenders see when you apply for a loan or new credit card.

Commonly-used versions of FICOs scoring model do not include rental payment data when calculating your credit score, though VantageScore models do consider rent payments when calculating your credit score.

Become An Authorized User

Becoming an on a family member or friends credit card can improve your credit score and increase the length of your credit history. When you become an authorized user, youll receive your own card and have access to the same credit line as the primary cardholder.

All of the cardholders account information will be added to your credit report, which will instantly boost your own credit scoreassuming theyve managed the account responsibly in the past. Be sure to check that the primary cardholder has a good payment history before committing.

You May Like: Thd Cbna Bank

How Do Rent Payments Appear On My Credit Report

Rent payments are considered alternative credit data, which are non-traditional forms of credit that can determine your creditworthiness. Although these payments wont show up on your main FICO® credit score, this is a great way to build credit if you currently have little to none on your report.

Popular scoring models FICO 9, FICO XD, and VantageScore consider rent payments and other utilities when determining whether or not someone is a reliable borrower. In order to contribute to those credit scores, youll need to utilize a rent reporting platform to start building your credit health as a renter.

Landlord Credit Check: What To Expect

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Because many landlords check applicants’ credit, your credit history could make a big difference in your next apartment search.

For would-be renters, the credit-check process may seem mysterious. If you’re wondering what landlords scrutinize when they check your credit, here’s an insider’s look, along with strategies for landing a place to live.

Read Also: Does Amex Plan It Affect Credit Score

How To Quickly Improve Your Credit Score

The Benefits Of Having A Good Credit Score

Having a credit score higher than 629 can make it easier to qualify for lower interest rates on different types of loans, a mortgage, and credit cards. Plus, youll have an easier time getting approved for an apartment down the line.

Exploring various ways to build your credit can make it easier to not only improve a low credit score, but get as much value as possible from all of your monthly bills. In the past, only homeowners were able to build credit through their monthly mortgage payments, but the same is now possible for renters to prove their credit worthiness.

Having a good credit score affects many areas of life, from necessities like housing and transportation to opportunities for leisure and travel. The quicker you begin reporting your on-time rent payments to a credit bureau like TransUnion, the easier itll be to have a stellar credit history.

Also Check: How To Remove A Repo From Credit

Minimum Credit Score To Rent An Apartment: Is There One

SimpleMoneyLyfe » Minimum Credit Score to Rent an Apartment: Is There One?

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Read our Disclaimer Policy for more information.

Everyone needs a place to live, but it can be tough to qualify for apartment rental if your is particularly low.

Since apartment rental requirements vary from place to place, it may be wise to learn whether theres a minimum credit score to rent an apartment. Lets break this topic down in detail.

On Credit Scores And The Fico Scoring Model

The FICO Score helps lenders make accurate, reliable and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used, broad-based risk score the FICO Score plays a critical role in billions of decisions each year.

For example, it’s only been within the last five years or so that the most widely used FICO model FICO 8 achieved that distinction. There have been older models, such as the FICO NextGen score, that have never gained a wide following, Paperno said.

Recommended Reading: Does Student Loans Fall Off Your Credit

Canadians Now Have The Option To Build Their Credit Scores Via Rent Payments

Landlord Credit Bureau CEO says move could significantly benefit some who have struggled to build credit scores

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

What Information Is Needed For A Credit Check

Before you can run a credit check on rental applicants, each applicant over the age of 18 must submit a completed rental application and give the landlord permission to check their credit. As the landlord, you must follow all Fair Credit Reporting Act guidelines and be able to verify that youre the actual landlord. Heres what youll need to prepare for the rental credit check:

Don’t Miss: Credit Inquiries Fall Off

Which Credit Scores Do On

While VantageScore®3.0 and 4.0 and FICO® Score 9 use rental payments in their evaluation of a borrower’s credit history when generating their most widely available credit score, they also provide lenders different types of scores. For example, if you are looking for an auto loan, FICO® Scores will use the factors of your credit history that typically suggest that you can fully repay an auto loan: and rent may not be one of those factors.

Likewise, those requesting the credit scores pay to receive your credit score as they evaluate your application. But they may not be requesting VantageScore® 3.0/4.0 or FICO® 9: so even if you are enrolled with a rent-reporting service, the requester won’t see rental payments on your credit report, minimizing the benefit of your reported rental payments.

Strategies That Will Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to improve your credit score, there are a number of simple things that you can do. It takes a bit of effort and, of course, some time. Heres a step-by-step guide to achieving a better credit score.

You May Like: Unlock Transunion Credit Report

How Rentreporters Is Different

RentReporters doesnt require its clients to pay rent online or change the way they pay their rent, as is the case with some competitors, such as RentTrack.

Simpson says the companys educational resources set it apart, because many customers dont understand how credit works. “We want to help people and educate them, he says. RentReporters has a blog, newsletter and Facebook Live sessions to help clients build credit and avoid missteps. We dont want people to go get a card and charge it to the limit,” which would damage their scores.

How Does Rent Reporting Work

While Canadians have always earned points for paying their credit card bills and other financial obligations, their record of paying rent has historically been excluded from their .

There are many renters with poor credit scores who actually have a good record of paying their rent on time, and they have a harder time getting housing because landlords check credit scores, said CEO Zachary Killam in a recent interview with HuffPost Canada.

We should be giving credit to consumers for paying their rent on time.

To do so, the LCB has inked a deal with Equifax, one of Canadas two main credit bureaus. Landlords can now report their tenants payments to the LCB, which will go to Equifax and end up on their credit report.

The service is now available in all provinces except Quebec.

Don’t Miss: Does Speedy Cash Check Your Credit