If I Am Approved How Much Am I Eligible To Spend

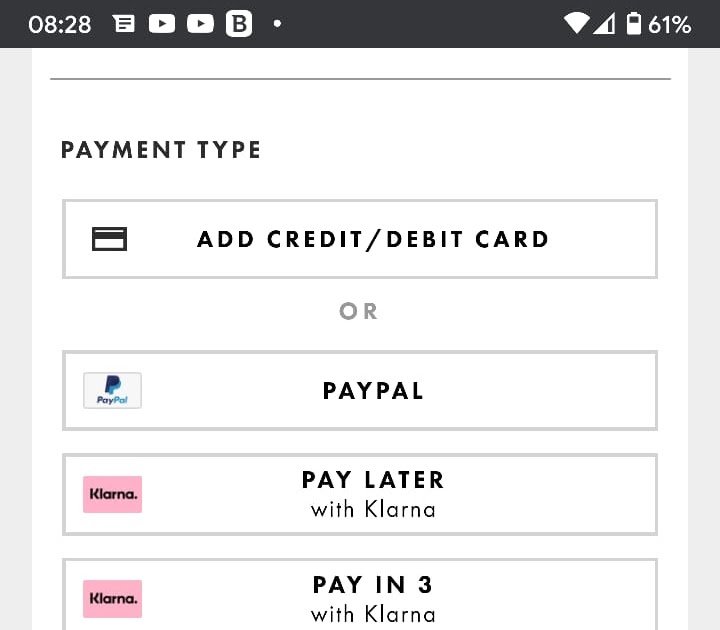

Klarna evaluates each new purchase to determine whether or not to approve.

There is no set amount. Factors include:

- Time of the day

- How long you have been a customer

- Number of purchases paid back

There are more restrictions on newer customers until Klarna can get to know you. According to their site, If you have used Klarna before, you will be able to see your;estimated;amount available to spend as your Spending Limit.

There is a minimum spend of $10, and your estimated limit may be higher or lower depending on the store and payment method.

Pay 30 Days After Purchase

This Klarna payment solution is particularly unique, as it allows users to try out their purchase before theyve paid. Among partner retailers, the ability to pay 30 days after you order your item seems to be offered less frequently than other Klarna solutions but it can be incredibly valuable if a merchant you like supports the option.

When you choose to pay later with Klarna, you wont be charged upfront for your purchase. Instead, youll have 30 days from when the item ships to make your payment or return the item. Youll receive email reminders from Klarna of your due date to ensure you dont miss it. Plus, you arent charged a fee or interest for using this feature.

Just like with installment plans, the pay-later Klarna solution charges a late fee of up to $7 if you dont pay by your due date.

How Do I Pay Klarna

Klarna offers several options for paying your debt, depending on what kind of payment plan you chose:

- Pay in 4 or Pay in 30: You’ll make payments with a credit or debit card. These payments will be automatically scheduled when you accept the loan, so you won’t have to worry about remembering to make them.;

- Financing: You can turn on autopay or remember to make payments on your own. You can use a debit card or link your bank account with Klarna to make your payments, but you won’t be able to use a credit card.;

Klarna accepts all major credit cards, although you cant use an American Express card to purchase a one-time card. You also can’t use prepaid debit cards.;

Be careful about using credit cards to make your payment. If you dont pay off your full balance each month, you’re essentially trading an interest-free loan for a loan with a much higher interest rate.;

Recommended Reading: Zzounds Financing Review

What Happens If I Dont Pay Klarna

If you’re having a hard time coming up with the money to pay back your Pay in 30 plan, Klarna allows you to postpone your payment for a fee.;

Otherwise, late or missed payments will incur fees. On a Pay in 4 plan, you’ll be charged a late fee of $7. For financing accounts, youll pay a $35 late fee, although Klarna won’t charge a fee that’s bigger than your minimum payment due.;

Other downsides of not paying include being denied future loans and potential damage to your credit score if Klarna refers your past-due account to collections.

If youre facing financial hardships, reach out to Klarnas customer service team to ask for help planning your payments.

How To Use Klarna Laybuy And Clearpay Safely

If used responsibly, BNPL schemes can be quite advantageous. Here are some tips for using BNPL schemes like Klarna, Laybuy and Clearpay safely:

- Set a spending limit: with so many different schemes its easy to lose track of all the mini-loans youre taking out. Make sure you set a spending limit so these dont spiral out of control.

- Use reminders: taking out multiple loans with different providers can make it hard to know what to pay when. Use reminders to track when you need to make repayments.

- Return unwanted items promptly: if youre ordering multiple sizes or just a range of clothes to try before deciding what to keep, do your returns promptly to ensure your balance is updated before payment is due.

- Dont keep quiet: if youre going to struggle to meet the repayments, contact the company. They may be able to freeze late fees or offer an alternative arrangement.

You May Like: Minimum Credit Score For Carmax

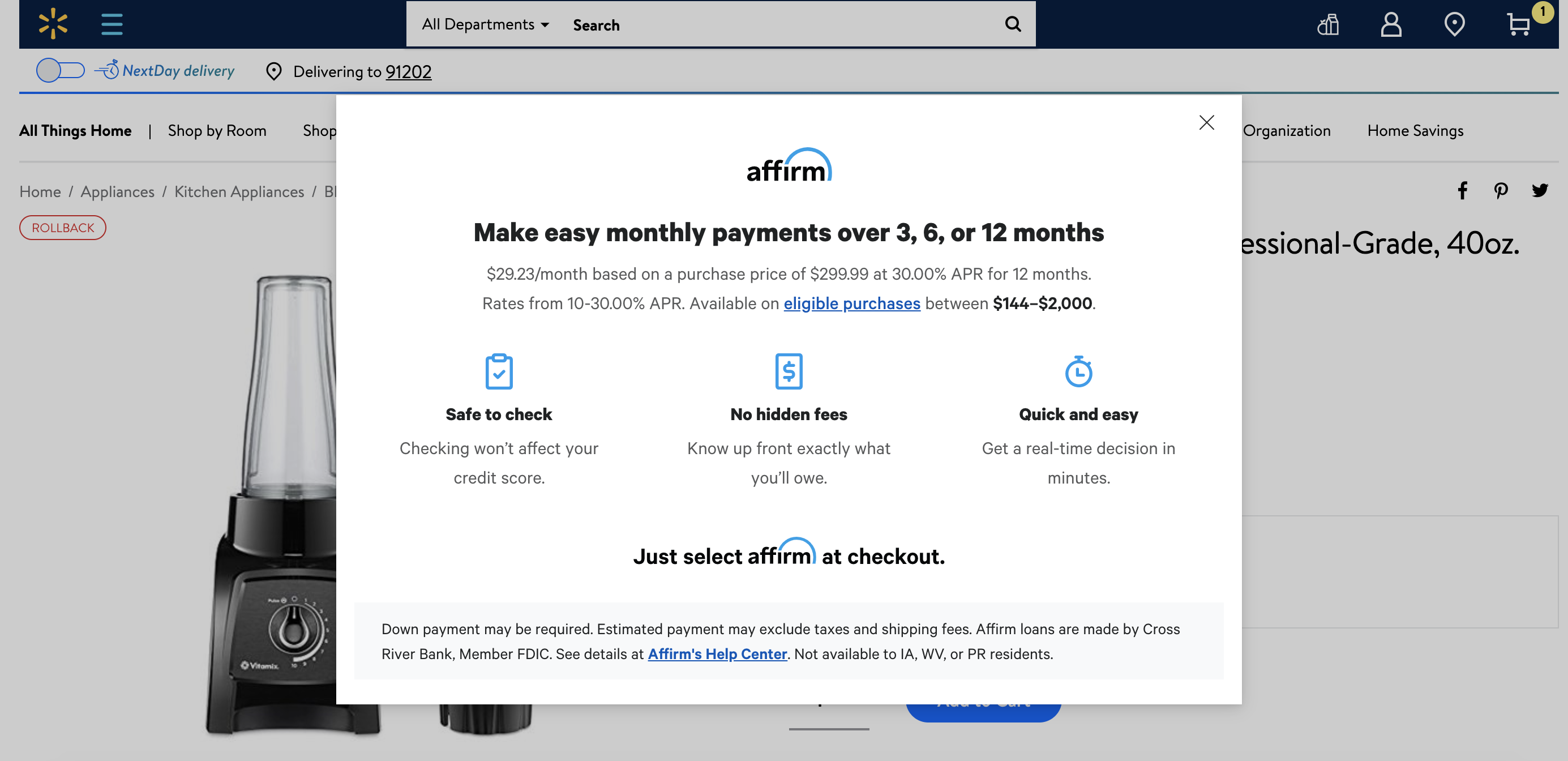

Other Installment Plan Services

- Pay over three, six or 12 months .

- Down payment may be required for some users.

- No late fees or loan limits, but your loan might be limited based on credit history.

- Pay in four equal installments, spread over six weeks.

- Zero interest and no fees when you pay on time.

- 25% of the balance is due at the time of purchase.

What Happens If I Can’t Pay On Time

Sometimes you might need more time to pay we completely understand! Depending on the payment method youve chosen when making the purchase, you might have the option to change the due date of your statement and pay later. Log in to the Klarna app or click here to select the statement you would like to pay later and see if the option is available for that purchase. If not, then it is not possible to change the date for that statement.

You May Like: Aargon Collection Agency Bbb

How Do Klarna And Affirm Work

Klarna and Affirm are point-of-sale financing companies that enable customers to buy now and pay over time, similar to how a credit card works. The major difference is that most buy-now-pay-later services perform instant credit decisions on every transaction and do not charge interest if you make your payments on time. You’ll pay 25% upfront, then be charged 25% of the original purchase amount every two weeks until your balance is paid in full six weeks later.

Does Klarna Affect My Credit Score

Klarna will not affect your credit score but they may perform a soft credit check. This soft credit check will verify your identity and look at your credit report to learn more about your financial behavior. This credit check does not happen when you download the app or first sign up for Klarna. They will only run the check when you are utilizing a payment plan option or applying for monthly financing.;

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How To Beat The Banker

Now youre in the know, before you next check out, check yourself and ask these three questions.

Hopefully youll save yourself some cash, keep your credit report in top shape and create good spending habits.

Have you used pay later services? Did you find them useful or did you find it too easy to overspend? Let us know in the comments section.

Does Klarna Guarantee Approval

No, Klarna does not guarantee approval. According to their website, our aim is to support responsible, ethical, and sensible spending habits.

In addition to your credit score, Klarna considers a multitude of factors before approval:

- Internal data such as past payment history

- Unpaid balances

- Length of time you have been a customer

- Total amount in your shopping cart

- Too many purchases in a short amount of time e.g., fraud prevention

Helpful Information

- Each purchase is considered a new decision, so a rejection does not mean all future purchases will be declined

- A rejection does not impact your credit score

Also Check: Can I Get A Credit Card With A 524 Credit Score

Missed Klarna Payments To Show On Credit Reports

Klarna lets shoppers buy items in monthly instalments or within 30 days time. If a customer misses a payment its not currently reported to credit reference agencies but Klarnas UK lead Alex Marsh told Radio 4s Moneybox that this will soon change.

He said: What we are looking at in terms of to protect consumers is to work with the credit reference agencies to enable reporting in the future. We work with debt collection agencies to support customers on payment plans. They do not have the ability to report back into the credit reference agencies.

According to Crediful, Klarna claims it only lends to customers it believes can pay on time and closes down the accounts of those who miss payments.

Justin Basini, CEO and co-founder of ClearScore, said: Klarnas recent announcement that they plan to now report missed payments is a welcome step, however it is too little, too late. Although its great that theyre starting to take their responsibilities to consumers seriously in reporting missed payments to credit reference agencies, this move doesnt go far enough in protecting consumers before they fall into debt.

Klarna currently only perform soft searches on a persons credit report before they take out a BNPL product, rather than the usual hard search that most credit providers use to assess whether a person can afford to take on debt.

How Is Klarna Different From Traditional Financing Options

Klarnas BNPL model claims to be a better option for consumers than credit cards because it prevents people from getting into deep debt. Sebastian Siemitkowski, CEO of Klarna says that Klarna offers an alternative to credit cards with fees and high interest rates through their in-shopping feature.

Another key differentiator is the way Klarna gives credit on a per-purchase basis, as opposed to credit card companies that offer big borrowing limits. Companies like Klarna also perform soft affordability checks, which means that these checks do not affect a persons credit score.

This is also not visible to other lenders. The consequence for failing to pay in BNPL models is that companies like Klarna can reject a delinquent payer in future transactions.

However, there are rising concerns over the lack of regulation of BNPL models. Some are also concerned that the ease of payment selling point may eventually cause shoppers to unwittingly fall into debt.

Also Check: Carmax Auto Finance Defer Payment

How To Get Approved For Klarna

You must be at least 18 years old and shop with a retailer that offers Klarna to sign up for an account.

If your purchase is eligible, you’ll see Klarna listed as a payment option at checkout. Select Klarna and complete the short application on the next page. You’ll know instantly if you’re approved for financing.

To use Klarna’s app, create an account online with your email or download the app on your mobile device.

What credit score do I need for Klarna?

There isn’t a minimum credit score required for Klarna. In fact, it’s possible to get approved for Klarna even without a credit history since it only performs a soft credit pull when you apply for its payment plan.

Does Klarna Perform A Credit Check On Me And Will This Affect My Credit Score

As a responsible lender, we want to make sure were helping our customers make the right financial decisions for their circumstances. When a credit check is performed, we verify your identity using the details you provided and we look at information from your credit report to understand your financial behaviour and evaluate your creditworthiness.

Depending on the payment method or service you choose, we may perform different types of searches to check your financial standing. You can find an overview of the credit checks we run for our payment options and services and whether they impact your credit score below.

- Creating a One-time card

- Taking out a Covid-19 related payment holiday.

For the above mentioned, we will perform a credit check will not be visible to other lenders and therefore wont impact your credit score in any way.

Using Klarna might affect your credit score when:

- Applying for one of our Financing options.

- Taking out a standard payment holiday for our Financing options.

If you decide to use Financing, we might perform a credit check with credit reference agencies to complete your credit assessment. This credit check will show up as an inquiry on your credit report, will be visible to other lenders and might impact your credit score.

These checks are performed in accordance with Klarnas Terms & Conditions.

Was this article helpful?

Read Also: Is Credit Wise Accurate

How Does Klarna Work

Online shopping has made the BNPL model more popular because of the ease it offers users in their shopping experience. Its also easy to get started with Klarna as there is no account sign-up required, just a credit or debit card and information so that Klarna can perform a credit check.

Various studies show that 70% of online shoppers abandon their carts and do not proceed to check out. Options like Klarna make it easier for shoppers to push through with their purchases with flexible payment plans.

Klarna financing is provided in concurrence with WebBank. Fees and charges are:

- Minimum interest charge is $2

- The charge for late payments is $35

- Late fee is up to $7 for installment purchases

Tips For Getting The Most Out Of Klarna

To maximize your Klarna usage, here are some things to keep in mind:

- Shop Through the App: Use it to split large purchases so you can pay via an installment plan.

- Use a Rewards Card: Klarna accepts all major credit cards, so use a rewards card with cashback or miles so you can maximize each purchase.

- Join Vibe: Join Klarnas loyalty program, Vibe, which will allow you to earn rewards when using Klarna. Its free, too.

- Pay on Time: As much as possible, keep track of payment schedules to avoid fees and penalties.

- Track Your Spending: Keep track of your installments, especially if you plan to take on several plans at once.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Be Wary Of Missed And Late Payments

âBuy now, pay laterâ can work well if you need something urgently but donât have the cash to hand, as long as youâre confident you can make your repayments on time.

Klarna will send you an email telling you when and how to pay, as well as text reminders when your payment is due. PayPal also send you monthly reminders of when your payment is due, and you can set up a direct debit with them if youâd rather be safe.

The trouble starts if you miss a payment, or don’t have enough money in your account for the payment to be taken.

When this happens with Klarna’s ‘Financing’ option, any promotional interest rates will be cancelled, and youâll start being charged interest on repayments. Youâll be charged interest at up to 18.9% APR which means your purchase could turn out to be a lot pricier than you first thought.

If you use financing and forget your payment date and make a payment late, you could also be charged a fee. Likewise, PayPal will charge you a fee of £12 if you make a late payment .

If youâve ordered something and are worried about missing your payment, get in touch with Klarnaâs customer service team or PayPalâs team on 0800 368 7155 to see if you can postpone it.

Klarna: ‘buy Now Pay Later’ System That Is Seducing Millennials

It lets you try before you commit at Asos and other online retailers but is it a debt trap?

Swedish firm Klarna has taken online shopping by storm over the past couple of years. Millennials no longer pay for clothes and gadgets with old-fashioned money they Klarna it.

If youre over 30, youve probably never heard of Klarna. Its a new form of digital payment pitched at people who wanna cop some new gear but cant wait until payday, as JD Sports puts it.

At Asos, when buyers reach the checkout, they are asked to pay with a debit or credit card, PayPal, or pay later with Klarna. It says Klarna lets you sit back and relax. Klarna will notify you when payment is due.

Klarna was set up in 2005 by Swedish entrepreneur Sebastian Siemiatkowski, 37, and is currently valued at about $2.5bn . Last year its profits tripled to £29m. It launched in the UK in 2017 and recently announced a $20m partnership with H&M.

Klarna allows people who shop online at Asos, Schuh, JD Sports, Topshop, and hundreds of other online stores, to try before you buy. Shoppers accepted for Klarnas pay later service have 14 or 30 days to pay for their online order. This means you could get a pile of clothes delivered, try them on and return any you dont like, then only pay for what you keep. For cash-strapped millennials, this removes one of the biggest obstacles to online shopping waiting for returns to be credited.

You May Like: Does Klarna Report To Credit

Klarna Credit Review: Retail Financing Even With No Credit

Online shopping isnt only convenient. It makes comparison shopping easier and theres the ability to use various methods of payments.

Theres the option of paying for goods with a credit card, gift card, and debit card, which many consumers do. But these arent the only options available to you. You can also use Klarna as a payment method.;

This company offers point-of-sale financing when shopping with retailers.

Its an alternative to a credit card or cash.

If shopping through the Klarna app, you can use this solution with any retailer.

Or, select this payment method when shopping with select retailers online.

Klarna Review: Is It Safe And Does It Affect My Credit Score

Klarna is at the forefront of “buy-now-pay-later” and is the current market leader in the UK. It offers point-of-sale credit to consumers, allowing them to spread the cost of purchases. For most of its services, the short-term debt is interest free and won’t feature on your credit file. It also has a longer-term Klarna Financing option, which is more akin to a standard credit card and allows buyers to pay in instalments over 6-36 months, although interest is payable and it necessitates a full credit check.

Klarna stands out from its competitors due to its slick marketing, easy-to-use app and market share – if you shop online, it is very likely you will have encountered it as an option at checkout for many of the retailers you use. It positions itself as a ‘safe’ option and claims that using its services won’t damage your credit rating and that you won’t be charged fees, even if you are late making payments. However, as we will discuss later in this review, users do still need to exercise caution when using any buy-now-pay-later provider, Klarna included.

You May Like: Is 611 A Good Credit Score